Washington

The New York Times: Wisconsin’s Lavish Lure for Foxconn: $3 Billion in Tax Subsidies

July 28, 2017

Big companies like Foxconn possess leverage to extract concessions from state governments that smaller firms cannot, said Carl Davis, research director at the nonpartisan Institute on Taxation and Economic Policy in Washington. “This is not a comprehensive strategy for economic development,” he said. “If Wisconsin were going to offer this kind of subsidy for every […]

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.

GOP Will Have to Radically Depart from Previous Proposals to Meet Its Tax Reform Goals

July 27, 2017 • By ITEP Staff

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding GOP leadership’s tax reform goals released today. The tax reform goals outlined in the letter will not be achieved if the GOP pursues pending Trump Administration and House tax proposals. “First was a so-called health reform bill […]

Bloomberg: Americans Say They Back Gas Tax to Fix Crumbling Roads

July 20, 2017

Twenty-six states have raised or updated their gas taxes since 2013, including eight so far this year, according to the Institute on Taxation and Economic Policy, a non-profit research organization in Washington. Read more

Trump Tax Proposals Would Provide Richest One Percent in Washington with 53.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Washington would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,983,800 in 2018.

State Rundown 7/19: Handful of States Still Have Their Hands Full with Tax and Budget Debates

July 19, 2017 • By ITEP Staff

Tax and budget debates drag on in several states this week, as lawmakers continue to work in Alaska, Connecticut, Rhode Island, Pennsylvania, Texas, and Wisconsin. And a showdown is brewing in Kentucky between a regressive tax shift effort and a progressive tax reform plan. Be sure to also check out our "What We're Reading" section for a historical perspective on federal tax reform, a podcast on lessons learned from Kansas and California, and more!

The American Prospect: As Trump Gears Up for Big Tax Cuts, Seattle Opts to Tax Wealthy

July 12, 2017

Currently, Washington is one of the few states that don’t levy a personal or corporate income tax. No cities in Washington levy a tax on income, either. That’s partially why the Institute on Taxation and Economic Policy found in 2015 that the state has most regressive taxation system in the entire country, with low- and […]

Governing: In an Income-Tax Free State, Seattle Hopes to Tax the Rich

July 12, 2017

There were about 11,000 individuals in Seattle with earned annual incomes of at least $250,000 in 2015, according to U.S. Census Bureau data. The Seattle tax would cover both earned and unearned income. “Washington has among the most regressive tax systems in the United States,” the legislation states, citing research by the Institute on Taxation […]

State Rundown 7/11: Some Legislatures Get Long Holiday Weekends, Others Work Overtime

July 11, 2017 • By ITEP Staff

Illinois and New Jersey made national news earlier this month after resolving their contentious budget stalemates. But they weren’t the only states working through (and in some cases after) the holiday weekend to resolve budget issues.

Seattle Times: Seattle Council to Vote Today on Income Tax on the Wealthy

July 10, 2017

There were about 11,000 individuals in Seattle with earned annual incomes of at least $250,000 in 2015, according to U.S. Census Bureau data. The Seattle tax would cover both earned and unearned income. “Washington has among the most regressive tax systems in the United States,” the legislation says, citing research by the Institute on Taxation […]

What do terrorists, opioid and human traffickers, corrupt government officials and tax evaders have in common? They all depend on the secrecy provided by anonymous shell corporations to allow them to finance and profit from their crimes. Momentum is building in the House and Senate to pass legislation that would strike against illicit finance in the United States and around the world by bringing an end to the anonymity provided by U.S. incorporation.

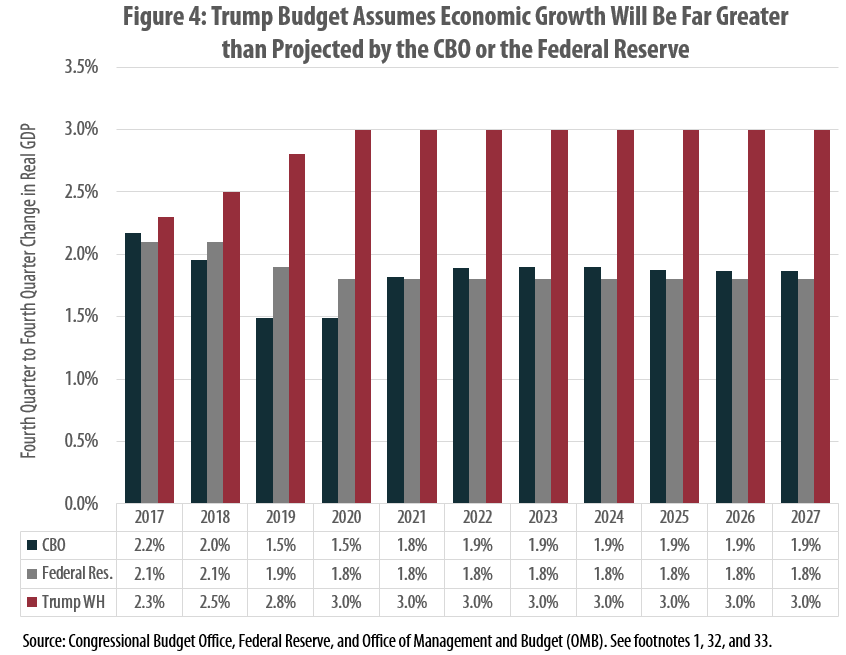

Trump Budget Uses Unrealistic Economic Forecast to Tee Up Tax Cuts

June 29, 2017 • By Carl Davis

The Trump Administration recently released its proposed budget for Fiscal Year 2018. The administration claims that its proposals would reduce the deficit in nearly every year over the next decade before eventually achieving a balanced budget in 2027, but the assumptions it uses to reach this conclusion are deeply flawed. This report explains these flaws and their consequences for the debate over major federal tax changes.

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

Explaining our Analysis of Washington State’s Highly Regressive Tax Code

June 22, 2017 • By Carl Davis

Supporters of creating a local personal income tax in Seattle are rightly concerned about the lopsided nature of their state’s tax code. In a 50-state study titled Who Pays?, produced using our microsimulation tax model, we found that Washington State’s tax system is the most regressive in the nation.

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

State Rundown 5/3: Lawmakers See Value in State EITCs, Danger in Tax Cut Triggers

May 3, 2017 • By ITEP Staff

This week, Kansas lawmakers found that they’ll have to roll back Gov. Brownback’s tax cuts and then some to adequately fund state needs. Nebraska legislators took notice of their southern neighbors’ predicament and rejected a major tax cut. Both Hawaii and Montana‘s legislatures sent new state EITCs to their governors, and West Virginia began an […]

Bloomberg: Trump Study of Gas Tax Could Run Afoul of GOP, Rural Voters

May 1, 2017

Voters in rural areas overwhelmingly chose Trump over Democrat Hillary Clinton in the 2016 presidential election, and a higher gas tax also may indeed affect those areas disproportionately, said Carl Davis, research director for the Institute on Taxation and Economic Policy, a non-profit research organization in Washington. The gas tax is regressive, meaning it puts […]

The Minneapolis Star-Tribune: Tax the Rich? Done. Tax Fairness, Well …

April 29, 2017

A broader comparison of all state and local taxes comes from the Institute on Taxation and Economic Policy, a progressive Washington research group. It, too, ranks Minnesota’s tax system today among the country’s most progressive — or, as ITEP says, among the “least regressive.” “Virtually every state tax system is fundamentally unfair,” the report declares, […]

PBS News Hour: Corporations Go Overseas to Avoid U.S. Taxes

April 29, 2017

PATRICIA SABGA: From the White House to Capitol Hill, Republicans are determined to lower the 35 percent corporate tax rate — the highest of any developed economy. Matt Gardner is a Senior Fellow with the Institute on Taxation and Economic Policy, a liberal, Washington-based think tank. MATT GARDNER: The biggest, most profitable corporations are now […]

If lawmakers truly want to create an environment in which economic mobility is possible for more working people, budget-busting tax cuts are the wrong way to achieve this goal. Dramatic tax giveaways would force cuts to programs that provide early education, health care, job training, affordable housing, nutrition assistance, and other vital services that promote economic mobility. Further, current tax proposals from Congress and the Trump Administration defy what most Americans would consider true reform and, instead, embrace supply-side economic theories. This policy brief outlines two sensible, broad objectives for meaningful federal tax reform and discusses six tax policies that…

State Rundown 4/27: States Finally Reaching Resolution on Gas Taxes

April 27, 2017 • By ITEP Staff

This week, transportation funding debates finally concluded with gas tax updates in Indiana, Montana, and Tennessee, and appear to be nearing an end in South Carolina. Meanwhile, Louisiana and Oregon lawmakers debated new Gross Receipts Taxes, and Texas legislators considered eliminating the state’s franchise tax. — Meg Wiehe, ITEP Deputy Director, @megwiehe Louisiana Gov. Bel Edward’s Commercial Activities Tax (CAT) was pulled from committee early this week without a vote due to opposition, […]

The Seattle Times: Washington State Relies on a Rotten Tax System

April 24, 2017

Poor people across the country pay a higher percentage of their income in state and local taxes than do wealthier people, but Washington is the worst offender in that regard. A report by the nonpartisan Institute on Taxation and Economic Policy found that in our state the 20 percent of households with the lowest income […]

Carl Davis

April 21, 2017 • By ITEP Staff

Carl is the research director at ITEP, where he has worked since 2008. As ITEP’s research director, Carl is responsible for exploring new and emerging trends in tax policy. In this role, he has authored reports on proposals to legalize and tax cannabis sales, to implement vehicle-miles-traveled taxes, to update the tax treatment of the “gig economy,” and to improve the enforcement of sales taxes as they relate to online shopping. Carl has also conducted extensive research into private school tax credits. That research helped reveal the profitable tax shelters that these credits created for some upper-income donors to private…

Charleston Gazette-Mail: Cutting WV Income Tax Likely to Backfire

April 11, 2017

There are nine states with no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire and Tennessee. Only Texas has seen job growth — as a result of being the center of the oil industry. The others have not; job growth has trailed population growth in the other eight. This is based […]