Utah

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

April 11, 2024 • By ITEP Staff

State and local tax codes can do a lot to reduce inequality. But they add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. These regressive tax codes also result in higher tax rates on communities of color, further worsening racial income and wealth divides.

Money: These States Are Using Their Budget Surpluses to Give Tax Breaks to Residents

April 8, 2024

The most impactful changes in state taxes this year have come in the form of new or expanded tax credits targeted at families with children, according to Aidan Davis, state policy director at the Institute of Taxation and Economic Policy (ITEP), a nonprofit, nonpartisan tax policy organization. “The first really incredible — and, I would say, positive — trend was that 18 states created or enhanced child tax credits or income tax credits in their states,” Davis says. Three of those states (Minnesota, Oregon and Utah) launched brand-new child tax credits, she says, with the remainder altering, and usually improving, existing credits.

Over the past week Utah continued its slow march toward a more inequitable tax code...

Governors and legislative leaders in a dozen states have made calls to fully eliminate their taxes on personal or corporate income, after many states already deeply slashed them over the past few years. The public deserves to know the true impact of these plans, which would inevitably result in an outsized windfall to states’ richest taxpayers, more power in the hands of wealthy households and corporations, extreme cuts to basic public services, and more deeply inequitable state tax codes.

Deseret News: The Utah Legislature Approved Another Tax Cut. Here’s What Taxpayers Need to Know

March 4, 2024

Utah lawmakers dropped the state’s income tax rate again this year. The reduction in the individual and corporate state income tax rate from 4.65% to 4.55% adds up to nearly $170 million, slightly more than the amount set aside in December for an unspecified tax cut by the powerful Executive Appropriations Committee made up of legislative leadership. The higher price tag is due to updated revenue forecasts showing an anticipated increase in income tax collections and the Legislature’s longtime Republican supermajority left little doubt they intended to continue to lower the state income tax rate. A tax cut was announced as a top…

State legislative sessions are in full swing with New Jersey and Oklahoma both particularly active this week...

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

State Rundown 1/11: Sounding the Alarm on Regressive State & Local Tax Codes

January 11, 2024 • By ITEP Staff

States got a wake-up call this week as ITEP released the latest edition of our flagship Who Pays? report...

Utah: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Utah Download PDF All figures and charts show 2024 tax law in Utah, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Utah. State and local tax shares of family income Top 20% Income Group […]

ProPublica: Utah Bills Itself as “Family-Friendly” Even as Lawmakers Have Long Neglected Child Care

January 5, 2024

Federal relief had improved access to child care. But when funding expired, the state rejected proposals to replace it. Some advocates say the historical influence of the LDS church has added to the resistance. Read more.

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

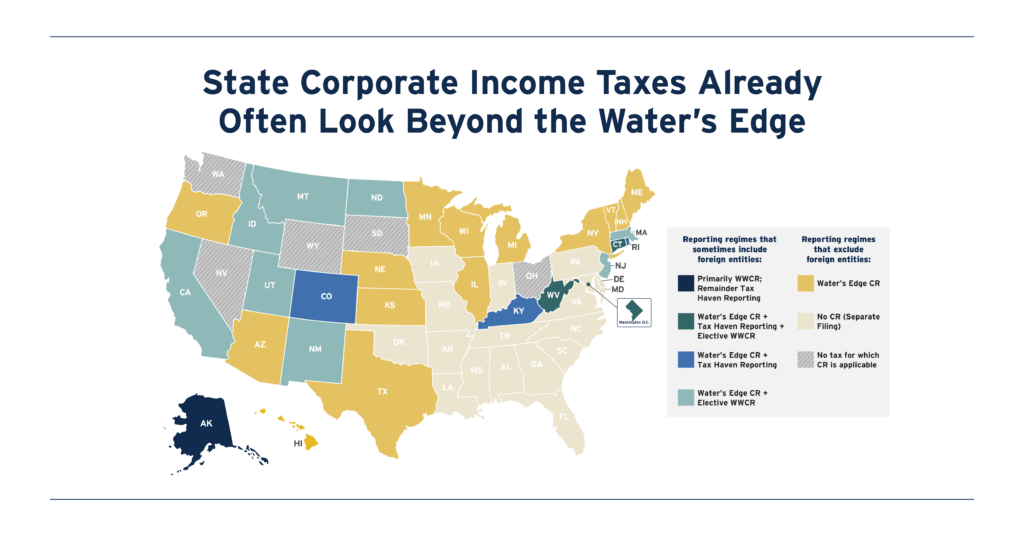

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

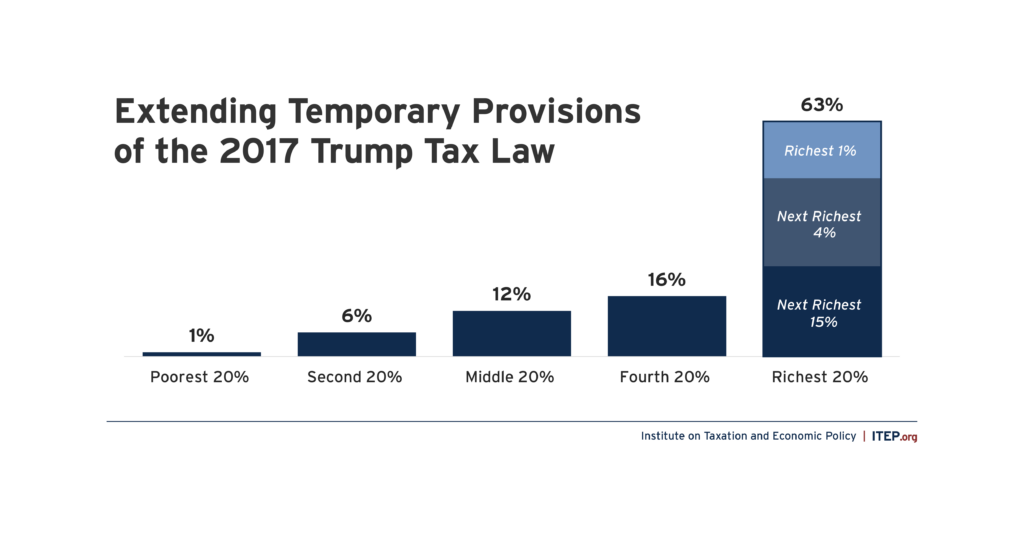

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

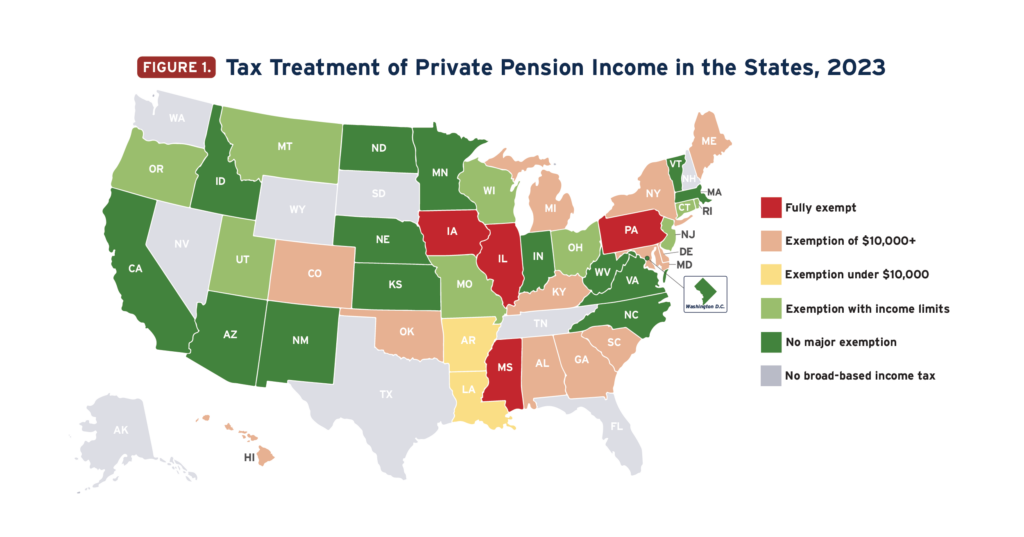

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities

March 22, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities State lawmakers should focus on improving overall tax fairness, not creating special carveouts based on age Lawmakers in several states are currently considering tax subsidies for senior citizens, even though these breaks are costly and poorly targeted. […]

This week, several big tax proposals took strides on the march toward becoming law...