Washington

Washington Post: Tax-cut Guru Still Says He’s Right About Trump, Truss and Trickle-down

November 2, 2022

The mess in England doesn’t mean he’s wrong. Arthur Laffer, the chief cheerleader for supply-side economics since the days of Ronald Reagan, wants to make that clear. Read more.

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

Editor’s note: This originally ran as an opinion piece in The Hill. Though the Inflation Reduction Act is enormously popular, some politicians and pundits are trying to generate hysteria about one feature: Funding for the IRS. All the false claims are distracting us from two important things: how necessary the funding increase is to reverse […]

Washington Post: With Sinema’s Help, Private Equity Firms Win Relief from Proposed Tax Hikes

August 11, 2022

Senate Democrats agreed Sunday to protect firms owned by the private equity industry from a new minimum tax on billion-dollar corporations, bowing to pressure from Sen. Kyrsten Sinema (D-Ariz.), who insisted on making the change to the Democrats’ sprawling climate, health-care and tax package. Read more.

Washington Post: The Corporate Minimum Tax Could Hit These Ultra-Profitable Companies

August 11, 2022

The House is expected to approve the Inflation Reduction Act on Friday that includes a minimum tax rate of 15 percent on highly profitable companies — a levy that could hit Amazon, Verizon and others. The tax would help pay for large investments across climate and health care. Read more.

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...

The Washington Post: How the Schumer-Manchin Climate Bill Might Impact You and Change the U.S.

July 28, 2022

“This would certainly be the biggest corporate tax increase in decades,” said Steve Wamhoff, a tax expert at Institute on Taxation and Economic Policy. “We’ve had decades of tax policy benefiting the rich, but this is really the first attempt to raise revenue in a progressive way that would begin to combat wealth and income […]

State Rundown 7/27: It’s (Sales Tax) Holiday Season, But Who’s Really Celebrating?

July 27, 2022 • By ITEP Staff

It’s the holiday season – well, the sales tax holiday season, that is. But after taking a closer look, you may notice that there is little to celebrate...

With many state legislative sessions wrapped or wrapping up, we at ITEP want to take a moment to direct your attention south, and specifically, to the American South...

With inflation dominating headlines both nationally and locally, state lawmakers around the U.S. are searching for ways to put their revenues to good use, and not surprisingly, some options are better than others...

Washington Post: Corporate America takes first battle over future of Trump tax cuts

May 10, 2022

“That’s a fair trade,” said Frank Clemente, executive director of Americans for Tax Fairness, a left-leaning group that has along with the Institute on Taxation and Economic Policy voiced opposition to the incentive being restored. “It’s a deal, whereas this is not a deal.” Read more

The Center Square: States That Legalized Marijuana Are Bringing in More Tax Revenue on Marijuana Sales than Alcoho

May 10, 2022

A majority of the states that legalized recreational marijuana for recreational use are collecting more tax revenue from pot sales than alcohol sales. The first two states to legalize pot are profiting the most, Colorado and Washington. Across the country, the total revenue for taxes on weed amounted to nearly $3 billion, according to a report on […]

This Spring looks to be bringing a mix of showers and flowers as states around the nation continue to act on a range of tax proposals...

Cannabis Taxes Outraised Alcohol by 20 Percent in States with Legal Sales Last Year

April 19, 2022 • By Carl Davis

In 2021, the 11 states that allowed legal sales within their borders raised nearly $3 billion in cannabis excise tax revenue, an increase of 33 percent compared to a year earlier. While the tax remains a small part of state budgets, it’s beginning to eclipse other “sin taxes” that states have long had on the books.

CSPAN Washington Journal: Biden Tax Proposals

April 12, 2022

ITEP Senior Fellow Matthew Gardner appeared on CSpan’s Washington Journal on Tuesday, April 12, 2022, to discuss President Biden’s tax proposals.

Washington Post: Want to really fix Virginia’s standard deduction? Index it.

April 6, 2022

On that topic, the Institute on Taxation and Economic Policy wrote: Any feature of an income tax that is based on a fixed dollar amount will be vulnerable to inflationary effects. In many states, this means that tax breaks designed to provide low-income tax relief — including exemptions, standard deductions, and most tax credits — […]

Excess Profits Tax Proposals Meet the Moment, But Lawmakers Should Keep Their Eye on Fundamentally Fixing Our Corporate Tax

March 25, 2022 • By Steve Wamhoff

New corporate tax proposals address the current situation, but ultimately leaders in Washington must fix federal law to tax all corporate profits and stop the tax dodging that is rampant today.

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

Washington Post: Congress urges DOJ, Treasury to examine drug companies aiming to turn opioid settlements into tax breaks

March 14, 2022

There is uncertainty in the law about these types of tax breaks, said Matthew Gardner, a senior fellow at the nonprofit Institute on Taxation and Economic Policy. Though recent changes to the tax code have attempted to close loopholes that permit companies to deduct legal settlements or governmental fines from taxes when they have committed […]

Washington Post: Yes, voters ‘deserve to know’ this GOP plan would raise taxes by $1 trillion

March 12, 2022

The bean counters at the Urban-Brookings Tax Policy Center and the Institute on Taxation and Economic Policy ran the numbers on what ITEP called the “only possible interpretation of Sen. Scott’s proposal” (making sure every household pays at least $1 in federal income tax) and found that the Republican plan would raise taxes by $100 […]

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

Pennsylvania Capital Star: GOP plan would be a tax hike for 35% of Pa. residents

March 9, 2022

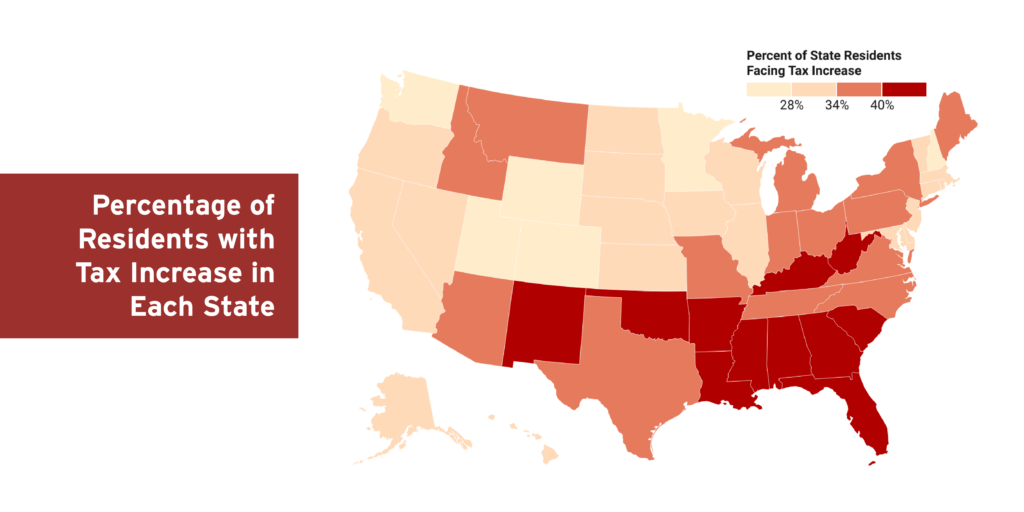

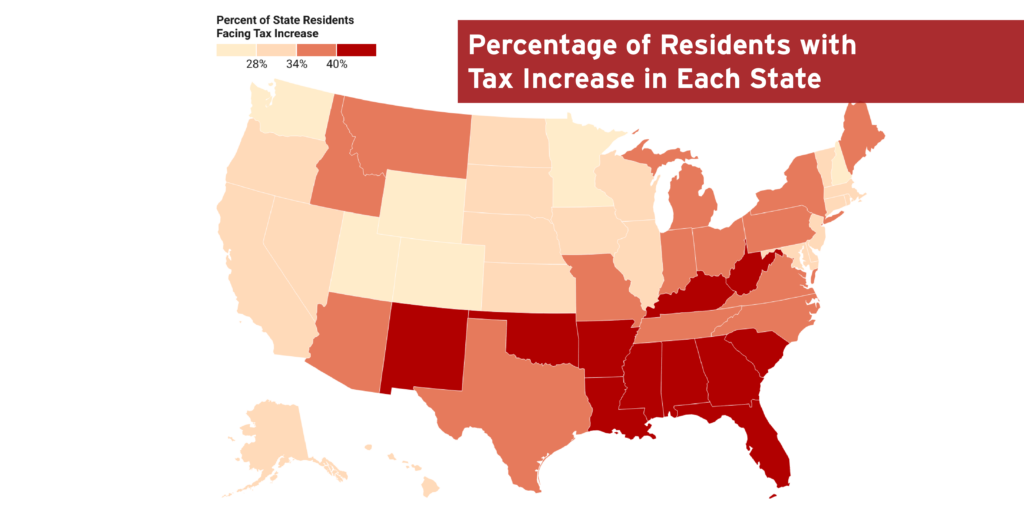

The share of households facing tax hikes would vary across states, according to an analysis by the Institute on Taxation and Economic Policy, ranging from a low of about 24 percent in Washington State to high of roughly 50 percent in Mississippi, which is among the poorest states in the country. Read more

New 50-State Analysis: Poorest Two-Fifths Would Bear the Brunt of Sen. Rick Scott’s Proposed Tax Increase

March 7, 2022 • By ITEP Staff

“Billionaires are getting richer, and some of them are altogether avoiding taxes or paying a tiny percentage relative to their income and wealth. The 2017 tax law further worsened inequality by giving huge tax breaks to the rich. It’s inconceivable that a lawmaker would propose to single out the most vulnerable households for higher taxes.” --Steve Wamhoff

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

Reality Check: Drastic Income Tax Cuts Are Dangerous Despite What Anti-Tax Supporters Say

March 3, 2022 • By Brakeyshia Samms

Income taxes are the backbone of most state budgets, but you wouldn't gather this fact based on the current trend to cut or eliminate them. A recent, cheerful Wall Street Journal op-ed from anti-government advocate Grover Norquist offers a clear sign that tax-cutting states are taking the wrong approach. The long-time proponent of anti-tax pledges wrote favorably about the legislative and gubernatorial plans to cut income tax cuts across the country. As usual, he failed to address that income taxes support state investments in education, infrastructure, health care and other important public services.