The U.S. needs a tax code that is more progressive and that raises more revenue than the one we have now. An important way to achieve this is to reform the taxation of business profits. These four key policy reforms would greatly strengthen the corporate tax system:

- Eliminating or restricting special breaks and loopholes that allow profitable corporations to pay little or nothing in income taxes.

- Addressing corporate tax avoidance by implementing a minimum tax on corporations that meets (and preferably exceeds) the standards of the global minimum tax that other countries have begun to implement.

- Expanding the corporate income tax to apply to certain large businesses structured as “pass-through” businesses that are not required to pay it under the current rules.

- Raising the statutory corporate income tax rate.

Why is reforming the corporate tax system so important? Here are 10 reasons:

1. Many very profitable, very large corporations pay very little in federal income taxes.

Take Tesla for example. Despite being valued at well over $1 trillion and reporting profits of $10.8 billion from 2022 through 2024, Tesla paid just 0.4 percent of this amount in federal corporate income taxes during those years.

Tesla is not alone. From 2018 through 2022, 55 S&P and Fortune 500 corporations paid effective tax rates of less than 5 percent (sometimes paying nothing at all) despite reporting large profits in each of those five years. These companies include mammoths of finance, industry, and tech, including Bank of America, AT&T, Citigroup, General Motors, Nike, T-Mobile, FedEx, Netflix and many others.

2. The laws enacted in the first and second Trump administrations have significantly lowered taxes for large, profitable corporations.

America’s largest, consistently profitable corporations saw their effective tax rates fall from an average of 22 percent to an average of 12.8 percent after the first Trump tax law went into effect in 2018. While profits for the largest, continuously profitable U.S. corporations rose by 44 percent after passage of the 2017 Trump tax law, their federal tax bills dropped by 16 percent.

The new Trump tax and spending law reduces corporate taxes even more by reducing the amount of profits that companies are required to report to the IRS. Several major corporations have already announced significant tax savings as a result.

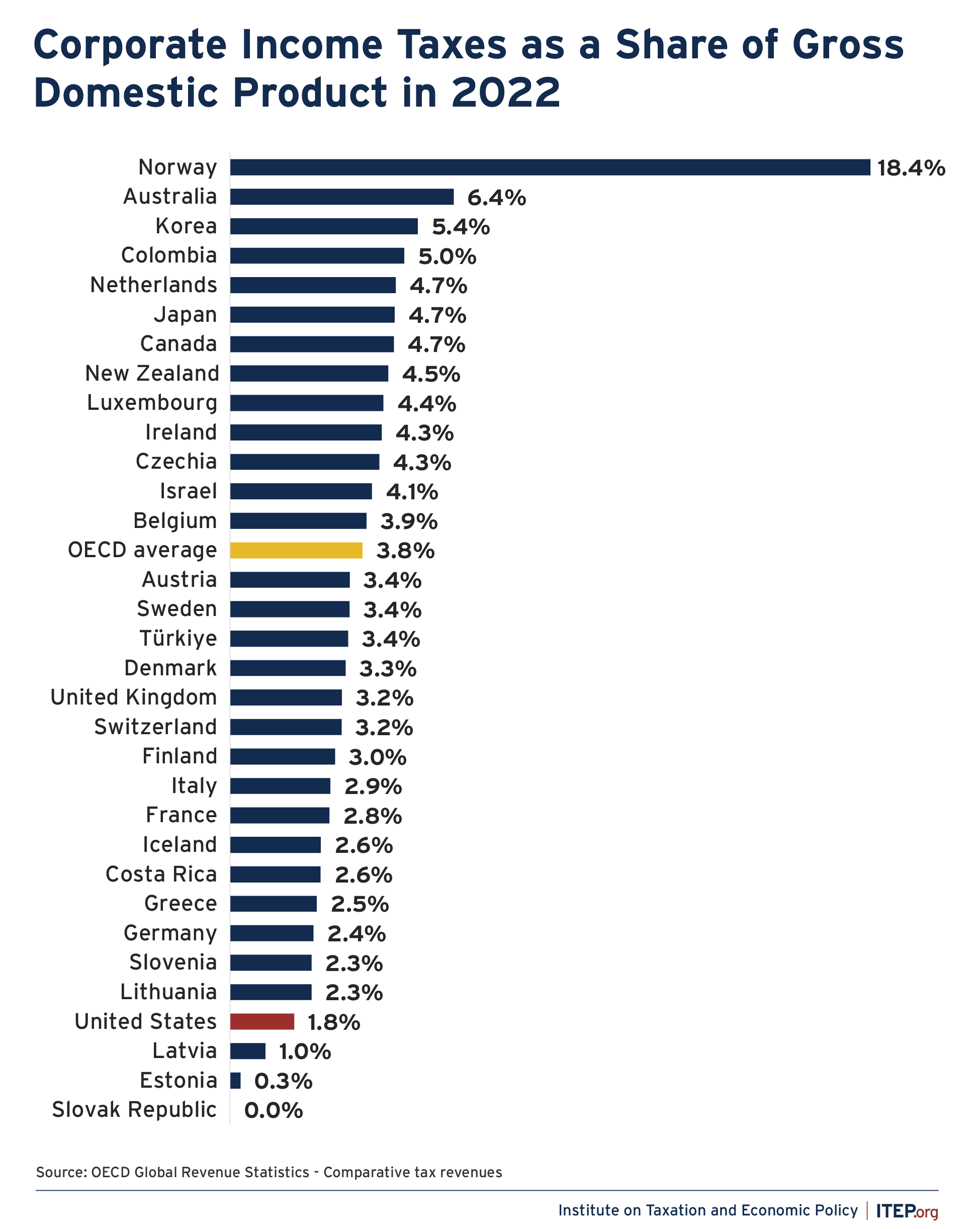

3. The U.S. collects little revenue from corporate income taxes compared to other developed countries.

The U.S. is an outlier in how little corporate tax revenue it collects compared to other countries in the Organisation for Economic Co-operation and Development (OECD).

In 2022, the most recent year for which the OECD has complete data, only three member countries collected less corporate tax revenue, as a share of their gross domestic product, than the U.S.: Latvia, Estonia, and the Slavic Republic. Meanwhile, the average OECD country collected more than twice as much corporate tax revenue as a share of GDP as the U.S. (3.8 percent vs 1.8 percent).

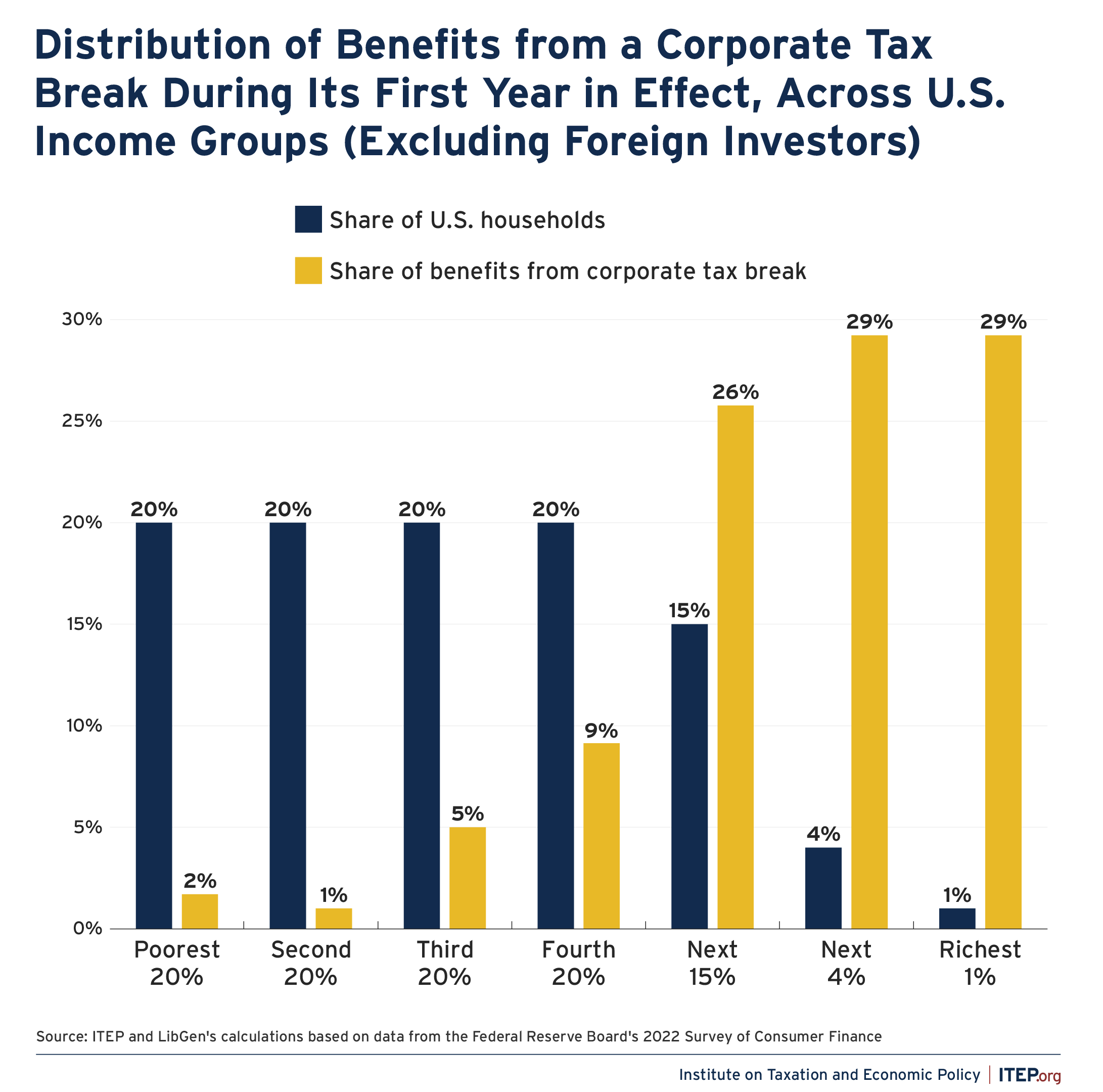

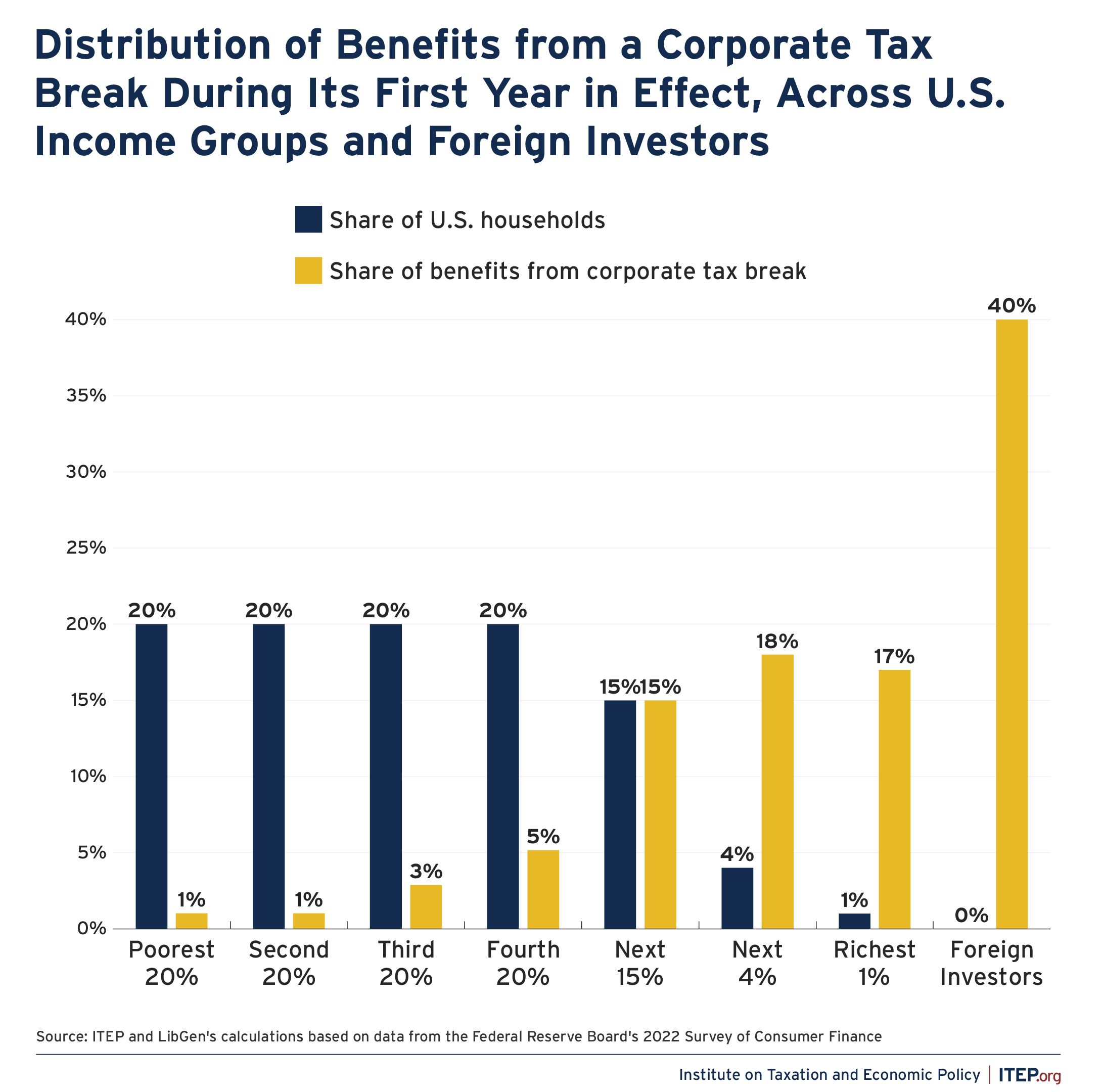

4. Corporate tax breaks and corporate tax avoidance most benefit the wealthiest Americans and foreign investors.

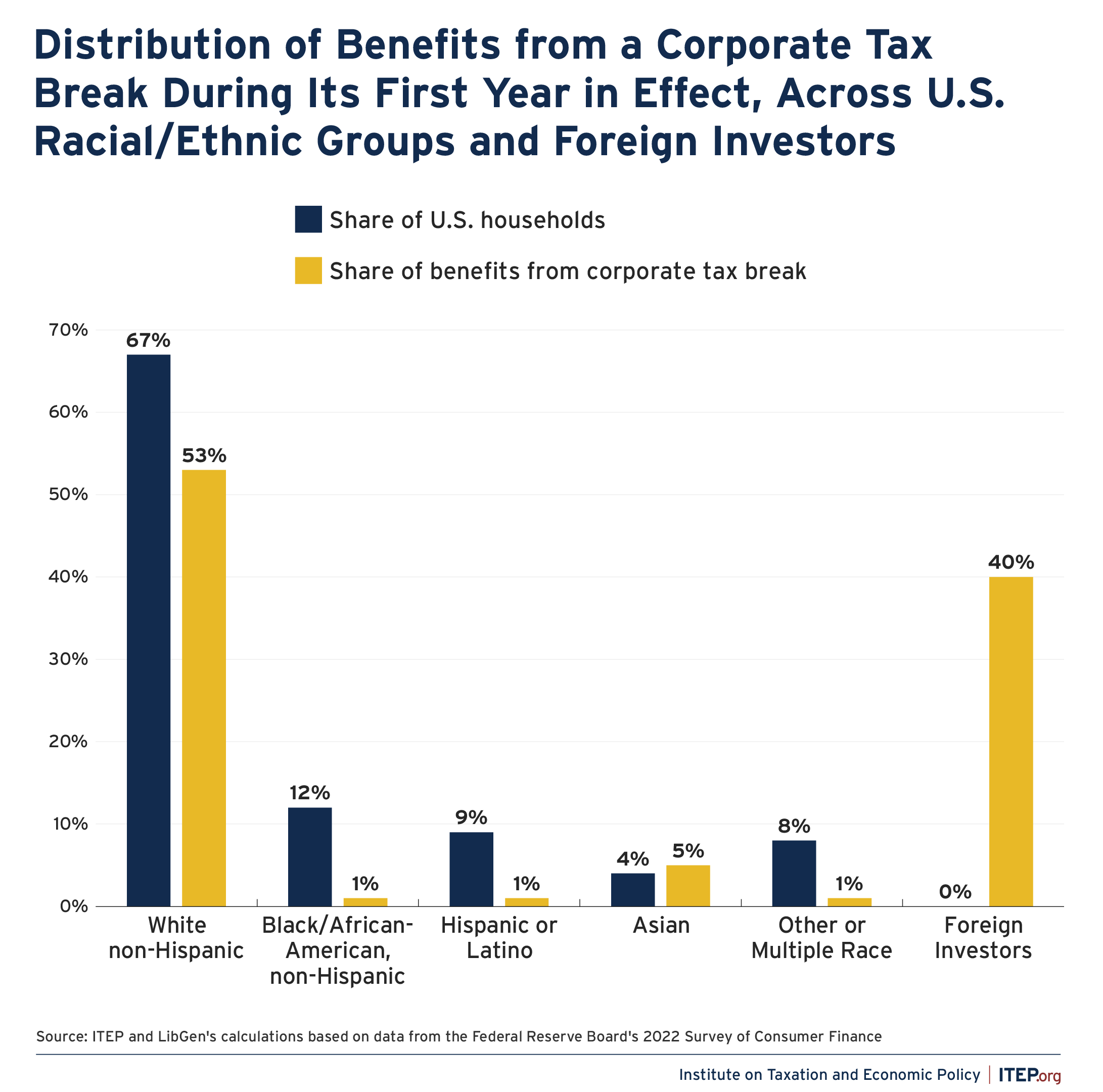

When corporations are allowed to pay less in taxes, the ultimate beneficiaries are mainly the owners of corporate stocks, who are concentrated among the wealthiest households. Within the U.S., the top 1 percent receive 29 percent of the benefits, the next richest 4 percent receive another 29 percent of the benefits, and only 2 percent of the benefits goes to the poorest fifth of Americans. This worsens income inequality within the U.S.

Corporate tax breaks and corporate tax avoidance are an even worse deal for Americans when we consider the total benefits, which include benefits to foreign investors as well as U.S. households. Foreign investors own roughly 40 percent of the shares in American corporations and therefore receive about 40 percent of the total benefits from corporate tax breaks and corporate tax avoidance. Foreign investors and the richest fifth of Americans together receive 90 percent of the total benefits while the poorest fifth of Americans receive just 1 percent of the total benefits.

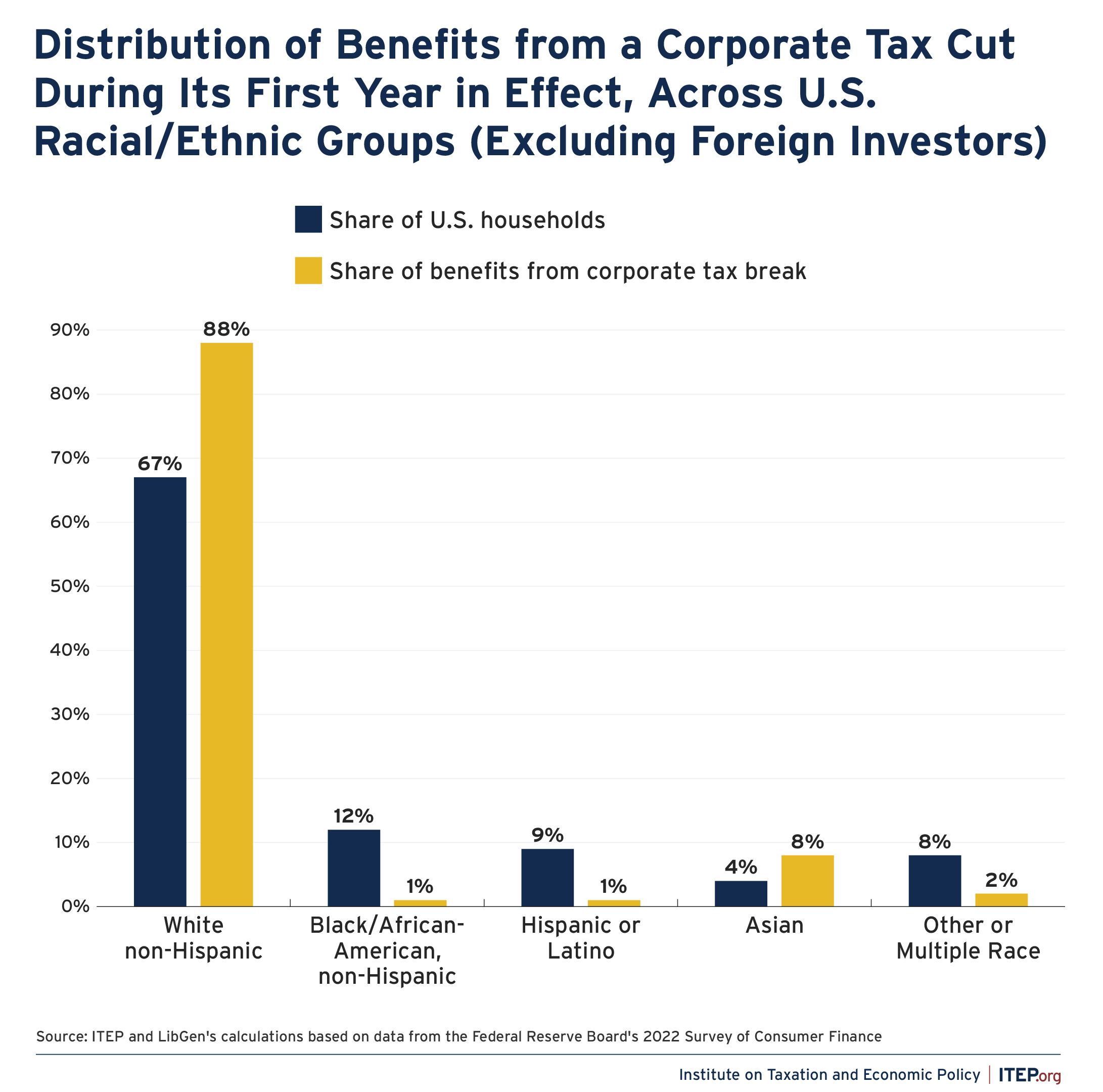

5. Corporate tax breaks and corporate tax avoidance worsen racial inequality in the U.S. while Americans of all races overall lose to foreign investors.

Because the wealthiest Americans who disproportionately own most corporate stocks are disproportionately white, white Americans as a group receive a disproportionate share of the benefits to U.S. households when corporations pay less in taxes. Black and Hispanic households each receive just 1 percent of the benefits to U.S. households despite making up 12 percent and 9 percent of U.S. households, respectively. Corporate tax breaks and corporate tax avoidance clearly worsen racial inequality within the U.S.

At the same time, even white Americans as a group lose out from corporate tax breaks and corporate tax avoidance when we consider the total benefits, including benefits to foreign investors as well as U.S. households. As explained above, 40 percent of the total benefits flows out of the country to foreign investors. The share of total benefits flowing to nearly all the major racial/ethnic groups is noticeably below their share of U.S. households because of the enormous benefits flowing out of the country to foreign investors.

6. The U.S. tax system makes it easy for corporations to engage in offshore tax avoidance.

American corporations use accounting gimmicks to make profits appear to be earned by subsidiaries in countries or jurisdictions known as tax havens, where they will be taxed very little or not at all, instead of in countries that would meaningfully tax them.

We know this is happening at a massive scale because the IRS publicizes the total profits that American corporations claim to earn through their subsidiaries in each country as well as the total workforce and tangible investments they have in each country. The total profits that U.S. corporations claimed to earn in Bermuda in 2022 came to about $1.3 million per employee there. The total profits reported for Ireland came to more than 100 percent of the tangible assets reported there. In Barbados and the British Virgin Islands, the total profits reported by American corporations exceeded the entire GDP (exceeded the entire economic output) of those jurisdictions, which is obviously impossible. Corporations are clearly using accounting fictions to claim to the IRS that their profits are earned in these tax havens.

7. Many large, profitable businesses operate like corporations but are officially “pass-through” businesses not subject to the corporate income tax.

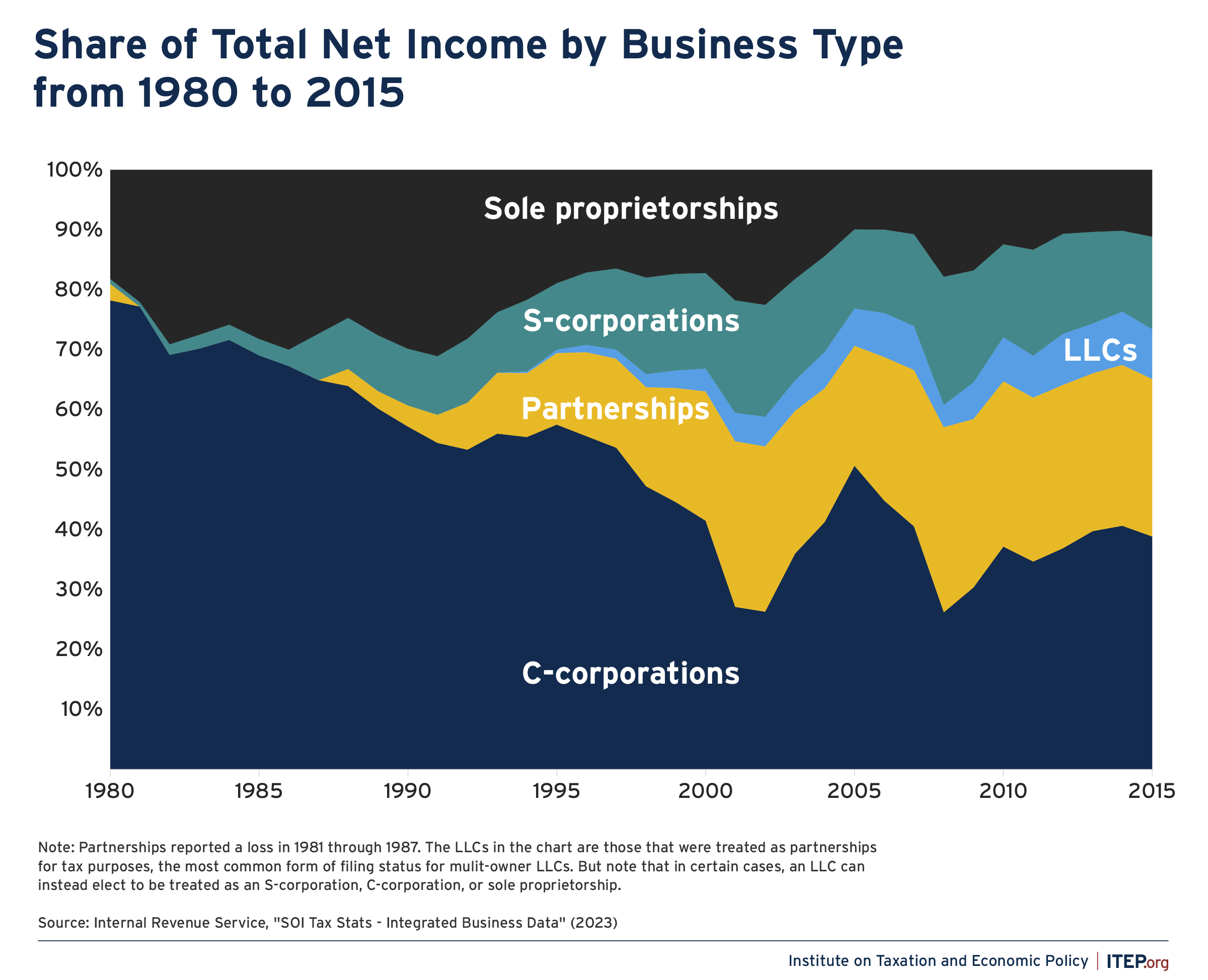

Generally, a business is organized as either a C corporation, which is subject to the corporate income tax, or a “pass-through entity,” which is not. Ostensibly, a pass-through business’s profits are “passed through” straight to the individual owners and reported on their personal income tax returns.

In the past, business owners needed to form corporations and pay the corporate income tax if they wanted to operate with certain privileges like limited liability. Large enterprises usually took this approach. However, over the past several decades, Congress and state governments facilitated the creation of pass-through entities that have many of the privileges of corporations without any requirement to pay the corporate income tax. Today, many massive companies like Bechtel and Bloomberg operate as pass-through businesses.

In recent years, more business profits have been reported from pass-through companies than from C corporations. Large pass-through entities are nearly impossible for the IRS to audit and are notoriously adept at ensuring that their owners avoid tax.

8. Without a strong corporate income tax, the wealthiest Americans can escape contributing to the infrastructure, legal system, and society that make their fortunes possible.

Some of richest people in America would pay almost no tax on their income if the corporate income tax did not exist. Elon Musk’s net worth has grown from around $200 billion at the end of 2024 to around $500 billion today. An economist would say that he therefore must have had income this past year of at least $300 billion but because this income was the appreciation of his stock (because his income was unrealized capital gains, in other words) it is not counted as income under the rules of the personal income tax. The shares that Musk owns in Tesla and his other companies can continue to grow in value exponentially for years, but he may report little or no income to the IRS for the rest of his life.

Billionaires like Musk, Jeff Bezos, and Mark Zuckerberg benefit vastly from the federal governments’ investments in technologies their businesses are built upon, in infrastructure used to move goods and people around the country, in the education system that produces their companies’ workforces, and in the legal system that creates and enforces property rights. How can policymakers ensure that they pay taxes and contribute to these public investments that make their wealth possible?

An essential strategy is to ensure that the companies generating the income for these billionaires are themselves taxed adequately. If the income flowing to the wealthiest Americans is not taxed very much at the personal level, it should be taxed at its source, which means effectively taxing the companies they own.

9. Without a strong corporate tax, foreign investors in U.S. companies can also escape contributing to the public investments that generate wealth for them.

Foreign investors in U.S. corporations also benefit from the public goods funded by federal taxes but are even more likely to avoid contributing to finance those public goods. While American investors defer paying income tax on unrealized gains, at least in some cases they will sell stocks during their lifetime and pay personal income tax (albeit at reduced rates) on the gains. But foreign investors who sell their stocks in American corporations and enjoy capital gains will pay any income taxes on those gains to their own governments, not to the U.S.

The U.S. personal income tax for the most part does not apply to foreign investors, but the corporate income tax is ultimately paid (indirectly) by all shareholders in U.S. corporations, regardless of whether those shareholders are Americans or foreign investors. This means that the corporate income tax is best suited to ensure that investors in American corporations all contribute to the public goods that make their profits possible.

10. Corporate tax reforms may be more resilient in the future than other types of progressive tax reforms that raise revenue.

The next time Congress and the White House are controlled by policymakers who support progressive tax reforms to raise revenue, they will need to decide which types of tax reforms are least likely to be undermined or reversed in the future. The most serious threat to progressive tax reforms is the judicial branch of the federal government, particularly the Supreme Court.

There is a complicated history behind when and under what circumstances the Supreme Court believes the Constitution gives Congress the power to tax personal incomes. As a result, there is some legal precedent that could be used by ideological justices to block the types of personal income tax reforms that would meaningfully affect extremely wealthy individuals (like taxing unrealized gains). Such an outcome would not be just and would not be a wise application of legal principles – but would a predictable response from many of the justices on the court today.

However, there is little, if any, legal precedent that courts could use to strike down the corporate tax reforms that have been described here. Courts have always justified the corporate income tax as an excise tax on the privilege of operating a business as a corporation, and the Constitution unambiguously grants Congress the power to impose excise taxes. It is therefore difficult to imagine how even the most ideological Supreme Court could sabotage these corporate tax reforms.