Wisconsin

Trends We’re Watching in 2018, Part 4: Tax Cuts & Tax Shifts

April 4, 2018 • By Lisa Christensen Gee

While a lot of tax activities in the states this year have focused on figuring out the impact of federal tax changes on states' bottom lines and residents, there also have been unrelated efforts to cut state taxes or shift from personal income taxes to more regressive sales taxes.

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

State Rundown 3/22: Some Spring State Tax Debates in Full Bloom, Others Just Now Surfacing

March 22, 2018 • By ITEP Staff

The onset of spring this week proved to be fertile ground for state fiscal policy debates. A teacher strike came to an end in West Virginia as another seems ready to begin in Oklahoma. Budgets were finalized in Florida, West Virginia, and Wyoming, are set to awaken from hibernation in Missouri and Virginia, and are being hotly debated in several other states. Meanwhile Idaho, Iowa, Maryland, and Minnesota continued to grapple with implications of the federal tax-cut bill. And our What We're Reading section includes coverage of how states are attempting to further public priorities by taxing carbon, online gambling,…

Trends We’re Watching in 2018, Part 2: State Revenue Shortfalls and the Impact on Education and Other Services

March 12, 2018 • By Aidan Davis

Many states struggle with a need for revenue, yet their lawmakers show little will to raise taxes to fund public services. Revenue shortfalls can prove to be a moving target. Some states with expected shortfalls are now seeing rosier forecasts. But as estimates come in above or below projections, states continue to grapple with how and whether to raise the revenue necessary to adequately fund key programs. Here are a few trends that are leading to less than cushy state coffers this year.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

This Valentine's week finds California, Georgia, Missouri, New York, Oregon, and other states flirting with the idea of coupling to various components of the federal tax-cut bill. Meanwhile, lawmakers seeking revenue solutions to budget shortfalls in Alaska, Oklahoma, and Wyoming saw their advances spurned, and anti-tax advocates in many states have been getting mixed responses to their tax-cut proposals. And be sure to check out our "what we're reading" section to see how states are getting no love in recent federal budget developments.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

State Rundown 1/31: Low-Income Families’ Taxes Getting Some Much-Needed Attention

January 31, 2018 • By ITEP Staff

This week was promising for advocates of Earned Income Tax Credits (EITCs) and other tax breaks for workers and their families, which are making headway in Alabama, Maine, Massachusetts, Missouri, Utah, and Wisconsin. The week also saw the unveiling of a tax cut plan in Missouri, a budget-balancing tax increase package in Oklahoma, the end of an unproductive film tax credit in West Virginia, and a very busy week for tax policy in Utah.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

Select state coverage of ITEP’s analyses of Republican tax Plans

January 1, 2018

Burlington County Times: Will Phil Murphy raise NJ’s taxes (and 4 other political questions for .. Kaplan Herald: This chart exhibits how the GOP tax plan will hit your pockets Wiscnews: Tax cuts increase inequity Patch.com: MacArthur Touts Tax Reform; Will It Help NJ As Much As He Says? NJ.com: Long lines spring up as […]

Wisconsin Budget Project: Giving Young Immigrants a Pathway to Citizenship Would Boost Wisconsin’s Farm Economy

December 20, 2017

According to a new report from the Wisconsin Budget Project, passing the Dream Act and establishing a pathway to citizenship for immigrant youth would help Wisconsin farms and communities by: Expanding Wisconsin’s economy by up to $600 million a year by improving the access that immigrants have to educational and economic opportunity; Increasing state and […]

Wisconsin Budget Project: Dream Act Would Boost Wisconsin Economy and Tax Revenues: Revoking DACA Hurts Both

December 20, 2017

There are 10,000 young immigrants potentially eligible for DACA who call Wisconsin home. They currently contribute a total of $16 million to local and state taxes annually through sales and excise taxes, property taxes, and income tax. Read more here

How the Final GOP-Trump Tax Bill Would Affect Wisconsin Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

Politifact: Paul Ryan’s partially accurate claim that House tax bill saves typical Wisconsin household $2,000

December 8, 2017

The $2,081 savings figure is correct, according to experts at four think tanks we contacted: Amir El-Sibaie, an analyst at the Tax Foundation; Chuck Marr, director of federal tax policy at the Center on Budget and Policy Priorities; and Urban-Brookings Tax Policy Center senior fellow Frank Sammartino; and Institute on Taxation and Economic Policy deputy […]

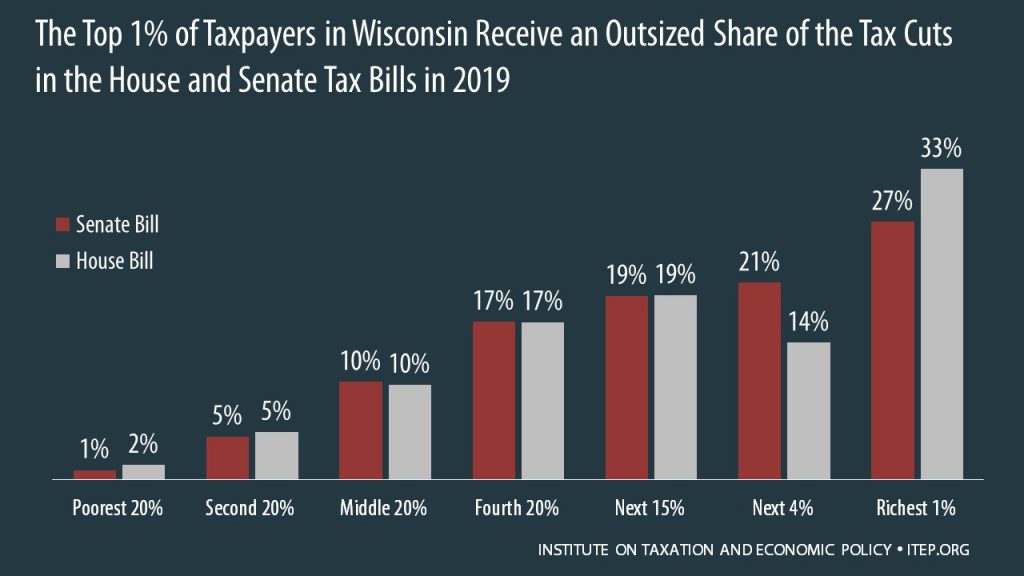

How the House and Senate Tax Bills Would Affect Wisconsin Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Wisconsin residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

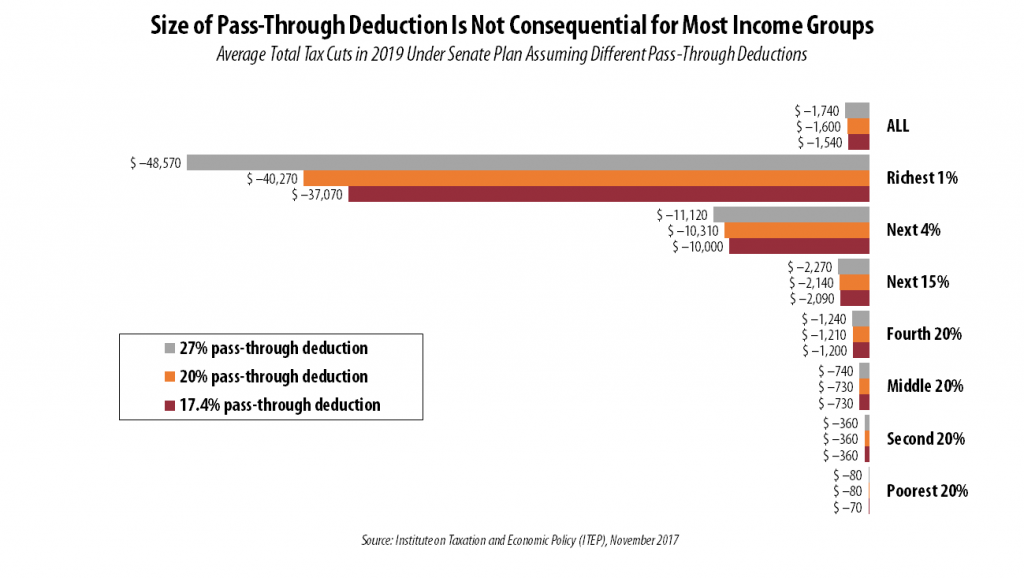

Republican Senators Debate Size of “Pass-Through” Break, But Proposed Compromises Will Make No Difference to Anyone Who Is Not Well-Off

November 30, 2017 • By Steve Wamhoff

Senators Ron Johnson of Wisconsin and Steve Daines of Montana want the tax bill on the Senate floor to be amended to offer a more generous tax break for “pass-through” businesses. We have estimated how all the provisions in the tax bill would impact each income group under three possible scenarios. The only thing different in each scenario is the size of the deduction for pass-through income: 17.4 percent (the deduction in the bill as this is written), 20 percent and 27 percent. We find that the size of the pass-through break makes no difference for anyone who is not…

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect Wisconsin Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Wisconsin, 47 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect Wisconsin Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

State Rundown 10/25: Marijuana Taxes a Bright Spot amid Underperforming State Revenues

October 25, 2017 • By ITEP Staff

This week in state tax news saw Alaska begin yet another special session, Louisiana lawmakers holding meetings to begin preparing for the state’s looming (self-imposed) fiscal cliff, and Alabama policymakers beginning a study of school finance (in)adequacy and (in)equity. Meanwhile, state revenue performance is poor well into 2017 in many states, though Montana, Nevada, and Oregon are all enjoying modest but welcome revenue bumps from legalized marijuana.

Wisconsin Public Radio: Paul Ryan Defends Tax Proposal Health Insurance Subsidy Cut

October 17, 2017

A study by the Institute on Taxation and Economic Policy in Washington DC found about 60 percent of the proposed tax cuts would benefit the top 1 percent of income earners in Wisconsin. Ryan said Monday he hadn’t seen that report, but maintained his stance that cutting taxes on businesses would help middle-income people by creating more jobs. […]

Wisconsin Budget Project: What the Trump Tax Plan Means for Wisconsin Taxpayers, in Six Charts

October 17, 2017

The tax plan being advanced by President Trump and Republican members of Congress would mostly benefit the extremely rich, despite initial claims by proponents that it would be targeted at members of the middle class...Using data from an analysis by the Institute on Taxation and Economic Policy, we have prepared six charts that show how the Trump-GOP tax framework would affect Wisconsin taxpayers: