2025 featured a variety of major tax debates across the federal, state, and local levels. From Congressional discussions over the so-called “One Big Beautiful Bill Act” to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

To close out the year, we’re reviewing some of the important topics that shaped our work in 2025. Here’s a rundown of some of our most impactful work this year.

The 2025 Federal Tax Debate

Trump’s New Tax Law Marks a Win for the Wealthy

The biggest tax debate this year centered on tax cuts proposed by President Trump and congressional Republicans. In July, Trump signed into law a tax and spending “megabill” that Congress rushed to pass. It featured huge tax cuts for wealthy Americans and little for the rest of the country.

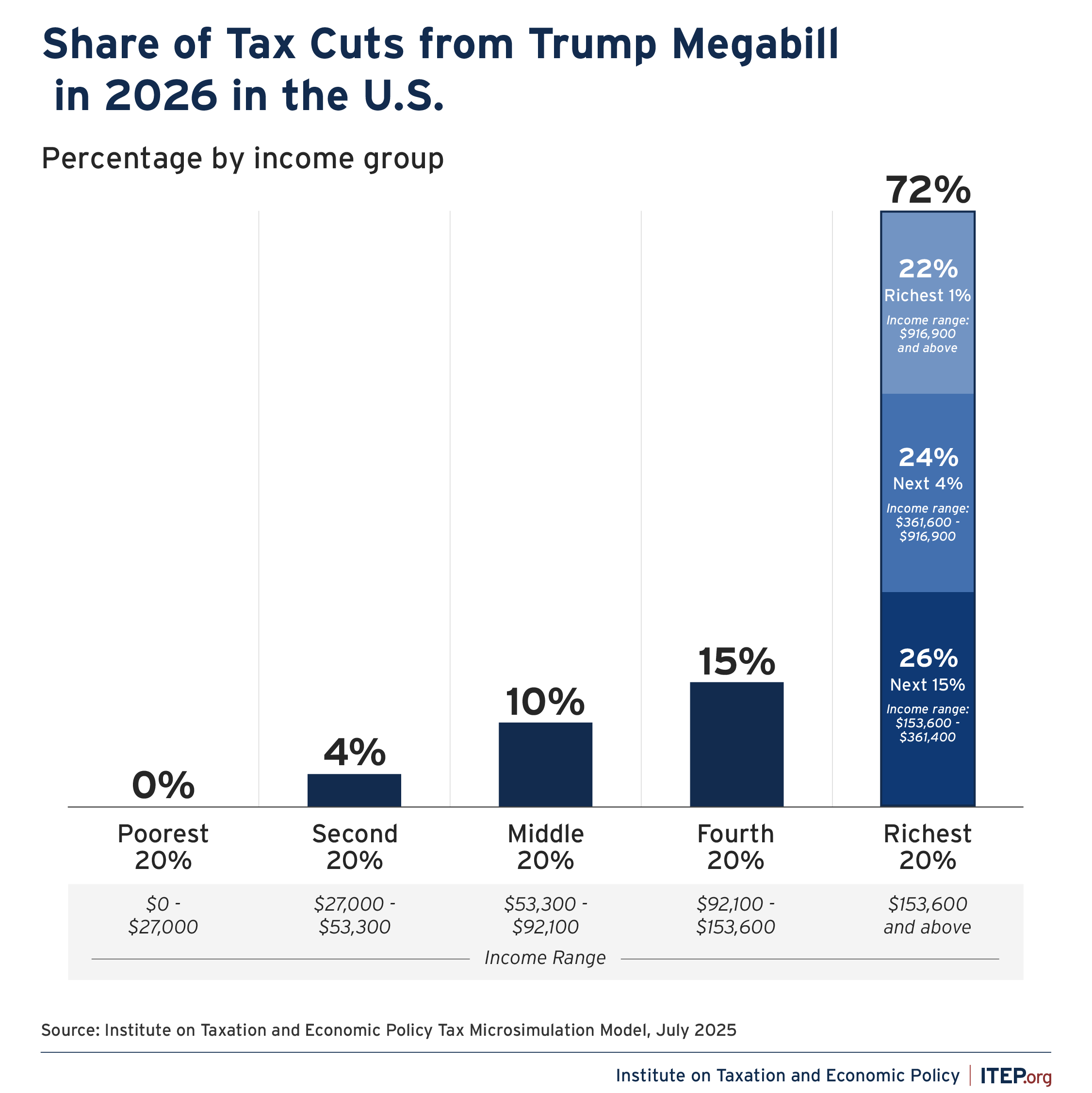

Much like the 2017 tax law, the new law favors the richest taxpayers. More than 70 percent of the net tax cuts will go to the richest fifth of Americans in 2026, only 10 percent will go to the middle fifth of Americans, and less than 1 percent will go to the poorest fifth.

$1 Trillion for the Richest Americans

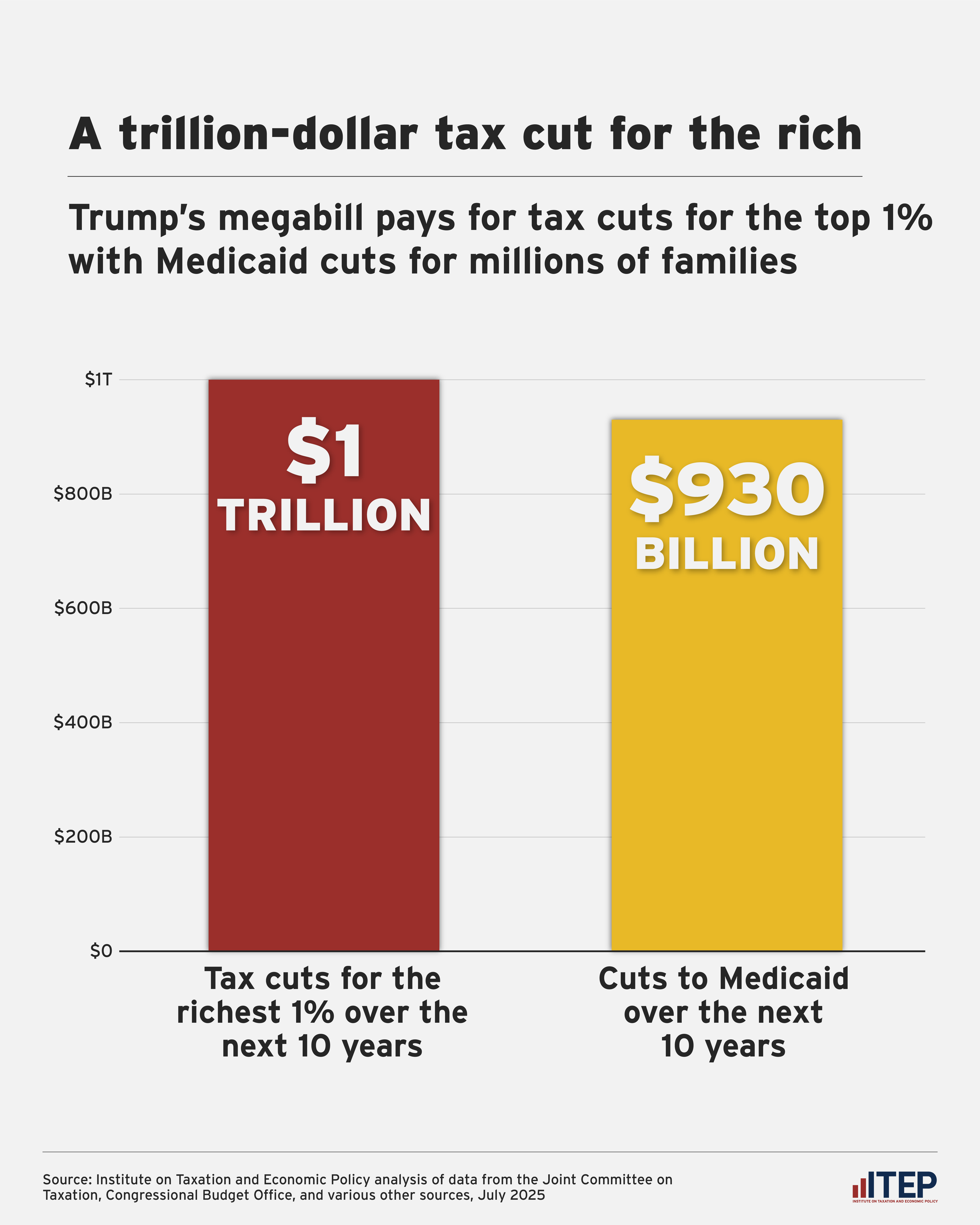

The new tax law not only sends enormous tax cuts to the wealthy, but it pays for it in part with deep cuts to crucial programs like food assistance and Medicaid.

We found that the top 1 percent by income—households with incomes of $916,900 and above—will receive tax cuts totaling about $1 trillion over the next decade. For comparison, the bill’s cuts to Medicaid will total $930 billion over the same period.

Corporate Taxes

Tesla Pays $0 in Income Tax

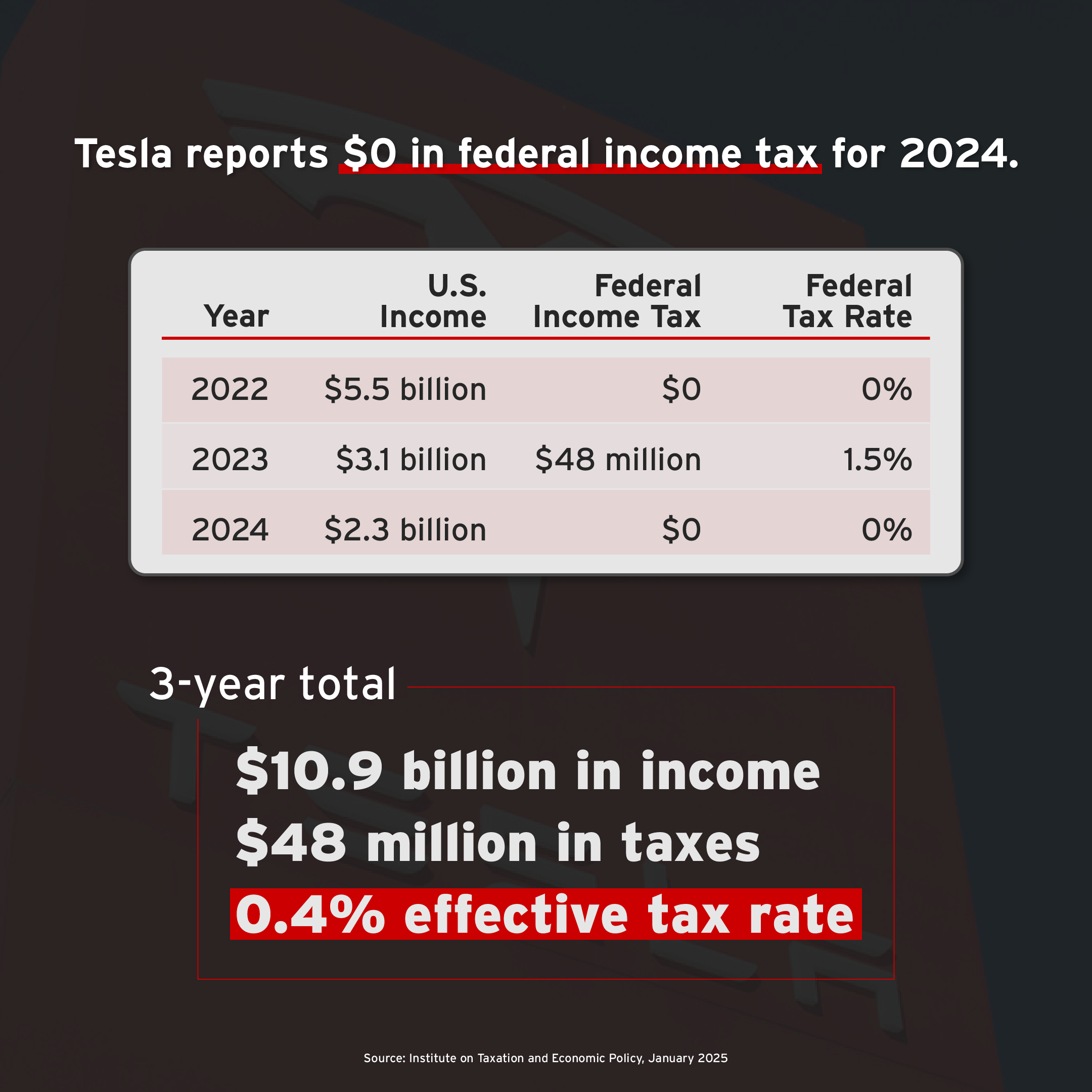

Tesla, the automaker valued at over $1 trillion, did not pay any federal income tax last year.

Tesla’s annual financial report showed the company had $2.3 billion of U.S. income in 2024 but reported precisely zero federal income tax. Over the past three years, the Elon Musk-led company reported $10.8 billion of U.S. income and paid just $48 million in federal income tax. That comes to a three-year federal tax rate of 0.4 percent – more than 50 times less than the statutory corporate tax rate of 21 percent.

Meta Gets Hit with $16 Billion Bill

The tech giant Meta made news in October when it announced its quarterly income was reduced by a whopping $16 billion due to income taxes. Meta’s earnings setback is entirely attributable to the Corporate Alternative Minimum Tax (CAMT) championed by the Biden administration in 2022.

The Congressional Budget Office concluded that Trump’s new tax law was mainly responsible for a 15 percent drop in corporate tax collections over the past year. But Meta’s earnings report provided an important reminder that, despite the Trump administration’s efforts, reforms put in place by the Biden administration are preventing the worst abuses of our corporate tax laws.

State Tax Decisions

How to Deal with the New Tax Law

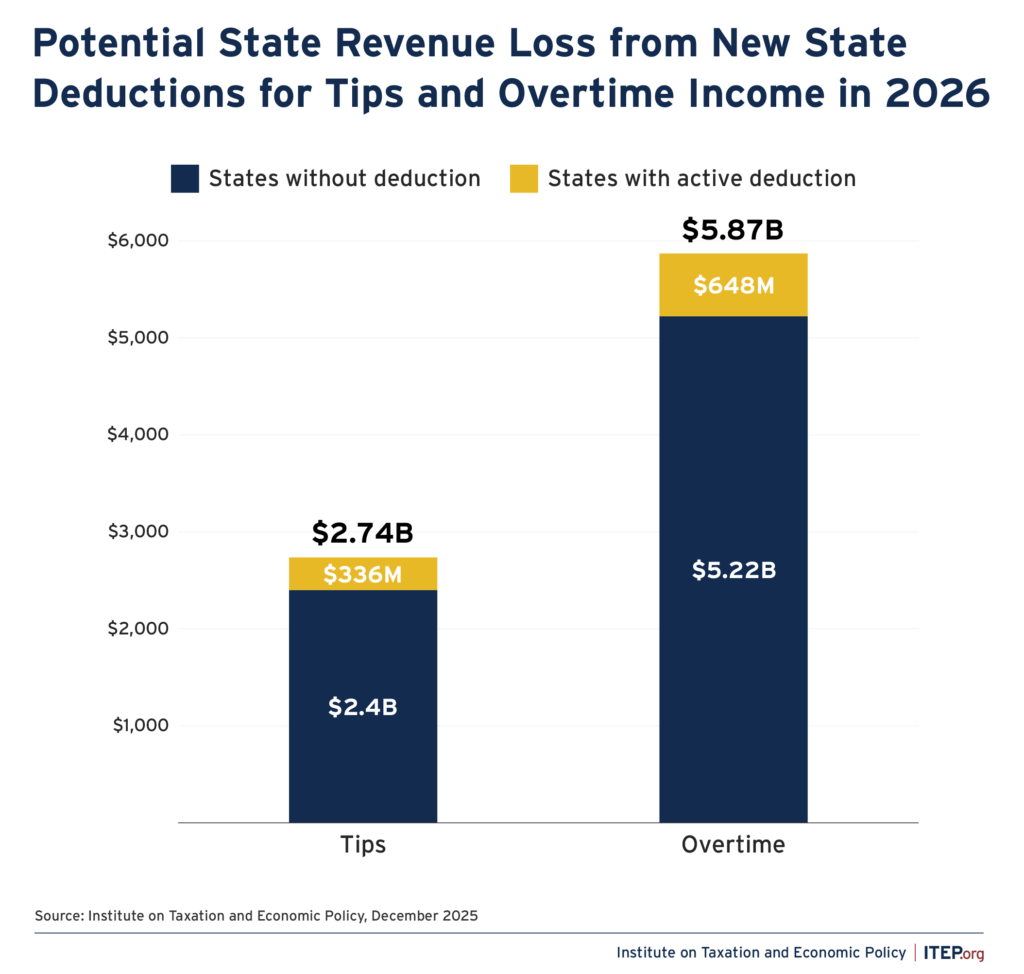

States are grappling with the fallout from the many federal tax changes that are part of that sweeping new law. Many states have already rightly decided to preserve vital revenues by “decoupling” – or not mimicking in their own tax codes – from provisions of the new law that needlessly reward profitable corporations or wealthy venture capitalists. Other states will have to decide soon whether to connect to other elements, like the misguided tipped and overtime income deductions.

Some States Prioritize Tax Cuts for Millionaires

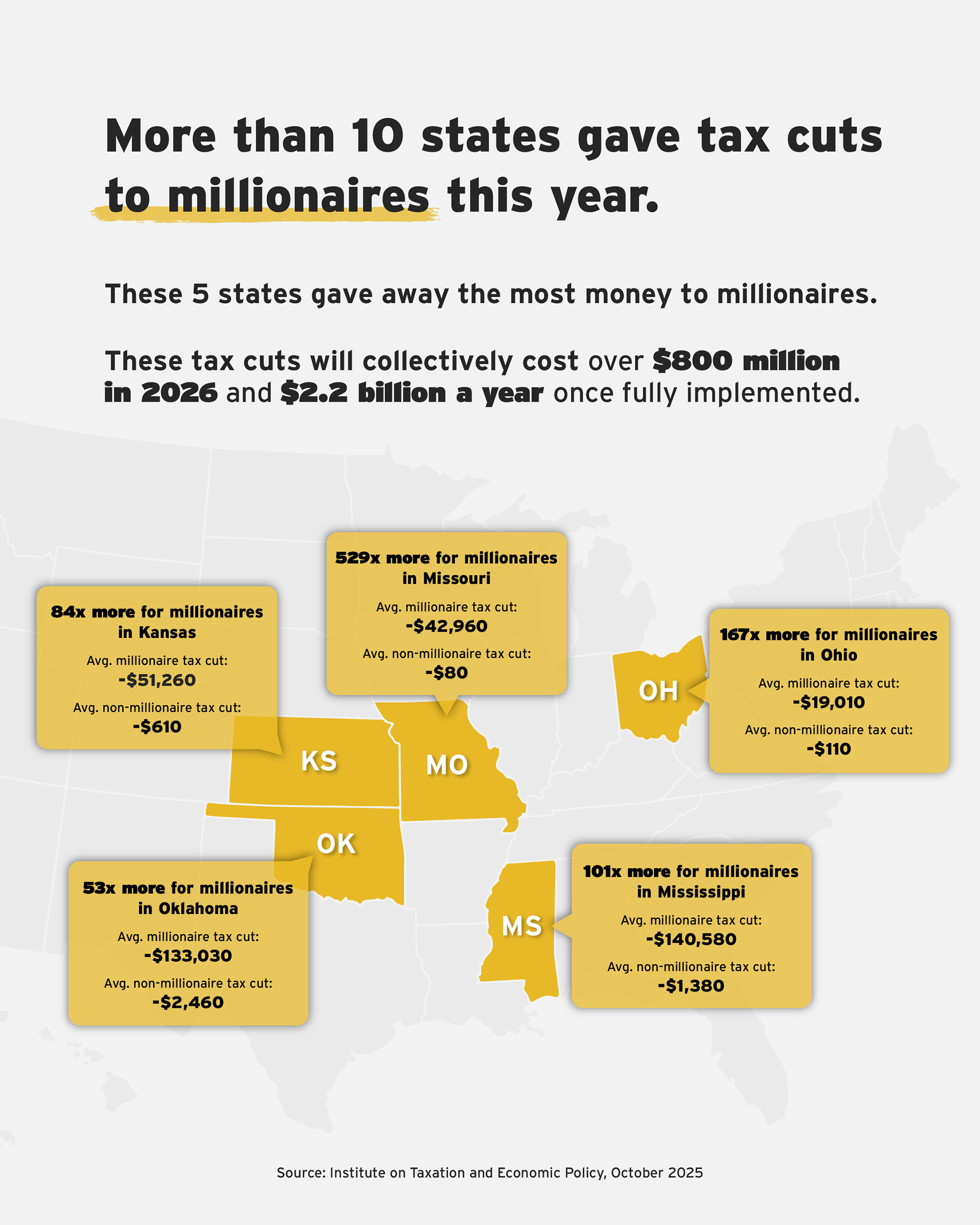

States across the country are dealing with tighter budgets, federal funding cuts, and an uncertain economic picture. But that didn’t stop more than 10 states from handing out massive tax cuts to millionaires this year.

Mississippi led the way by approving an average tax cut of $140,580 for millionaires in their state. Followed by Oklahoma, Kansas, Missouri, and Ohio, these states will collectively lose over $800 million in 2026 alone thanks to these millionaire tax cuts.

Other States Advance Tax Fairness

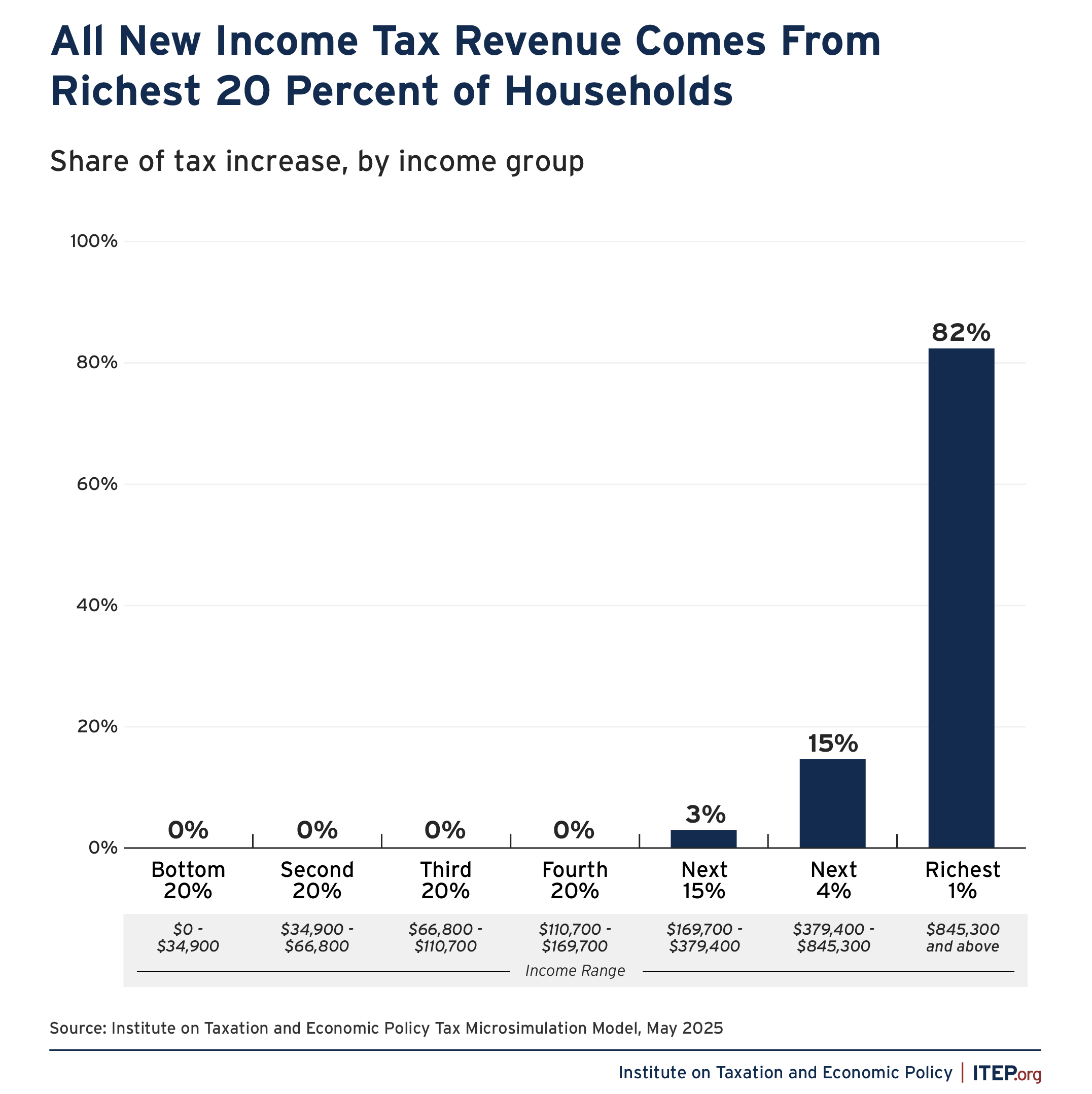

To help close a $3.3 billion budget deficit, Maryland legislators enacted much-needed tax reforms and progressive revenue raisers that help meet the state’s needs while making the tax code less regressive. All Marylanders will chip in to fund vital services and avoid deeper cuts, but high-income families will contribute a greater amount.

The personal income tax changes alone are estimated to raise $580 million per year in new revenue. Nearly all the new income tax revenue – 82 percent – will be paid by the wealthiest 1 percent of Maryland households with incomes over $845,000. When looking at the income tax changes alone, no household earning less than roughly $200,000 per year will pay more. In fact, 63 percent of Maryland residents will see an income tax cut.

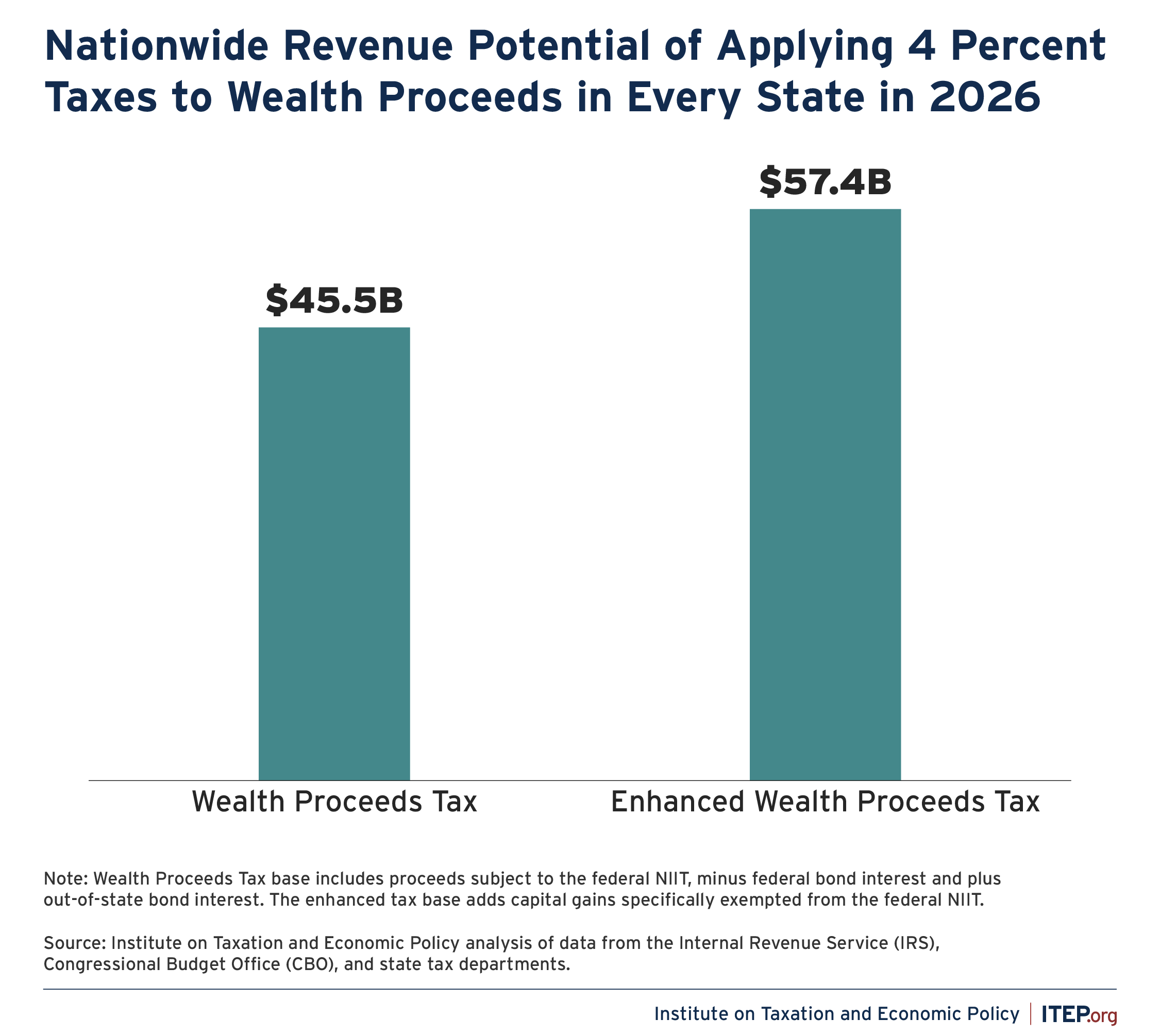

As states gear up for 2026, we’ve also got a simple new way for them to tax the wealthy. The federal tax code offers a shovel-ready definition of passive proceeds derived from wealth—such as capital gains, dividends, interest, and certain business profits—that states can use as the starting point for levying their own Wealth Proceeds Taxes on wealthy families. These taxes have the potential to raise considerable revenue from a tiny sliver of the most well-off households.

Tax Payments by Undocumented Immigrants

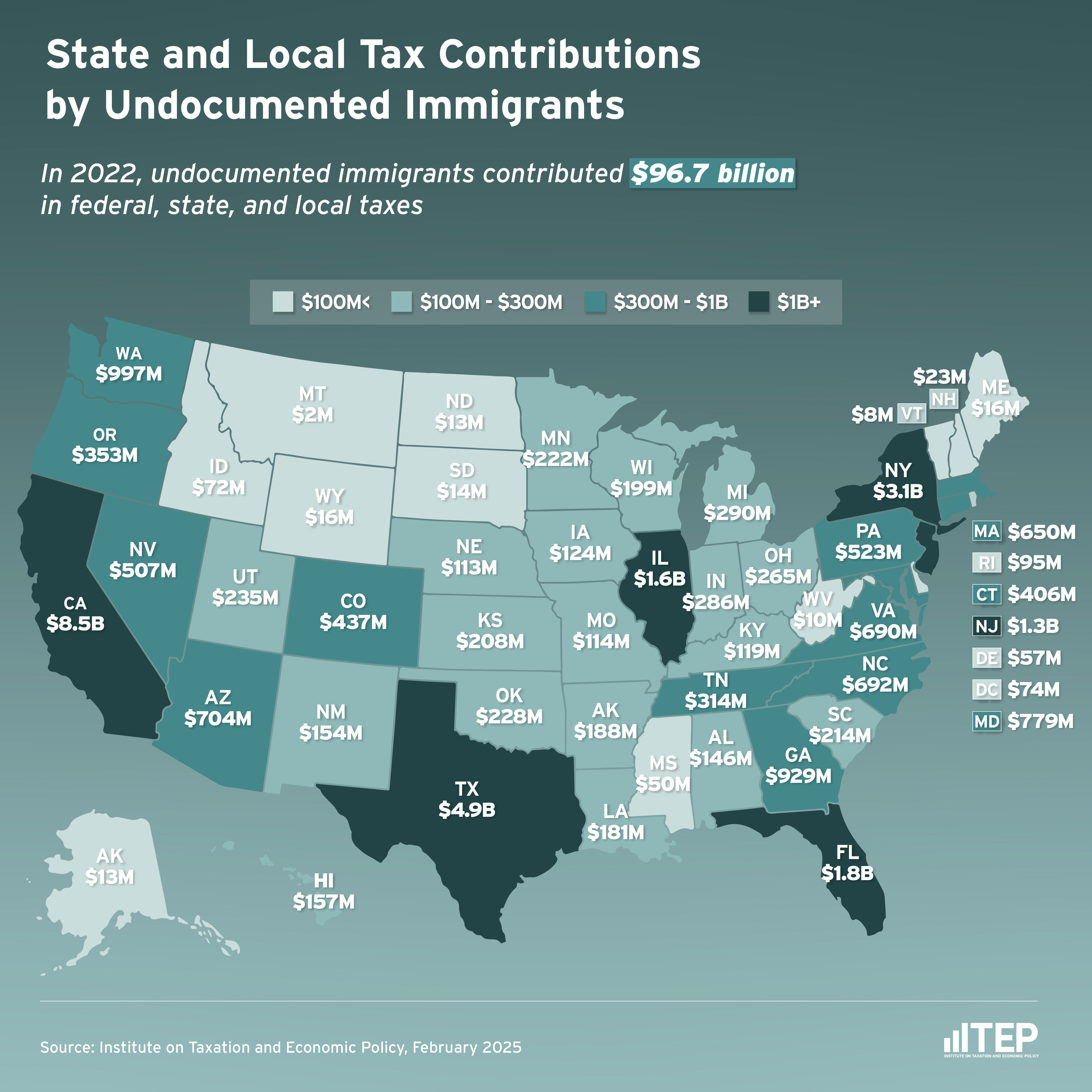

There continues to be plenty of misinformation shared about undocumented immigrants. But the fact remains that they make meaningful tax contributions in every state.

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. More than a third of those tax dollars go toward payroll taxes dedicated to funding programs that these workers are barred from accessing. Undocumented immigrants paid $25.7 billion in Social Security taxes, $6.4 billion in Medicare taxes, and $1.8 billion in unemployment insurance taxes in 2022.

While these findings come from our 2024 report, this remains one of the most-read publications on our site this year.

Local Taxes

The Potential of Local Child Tax Credits

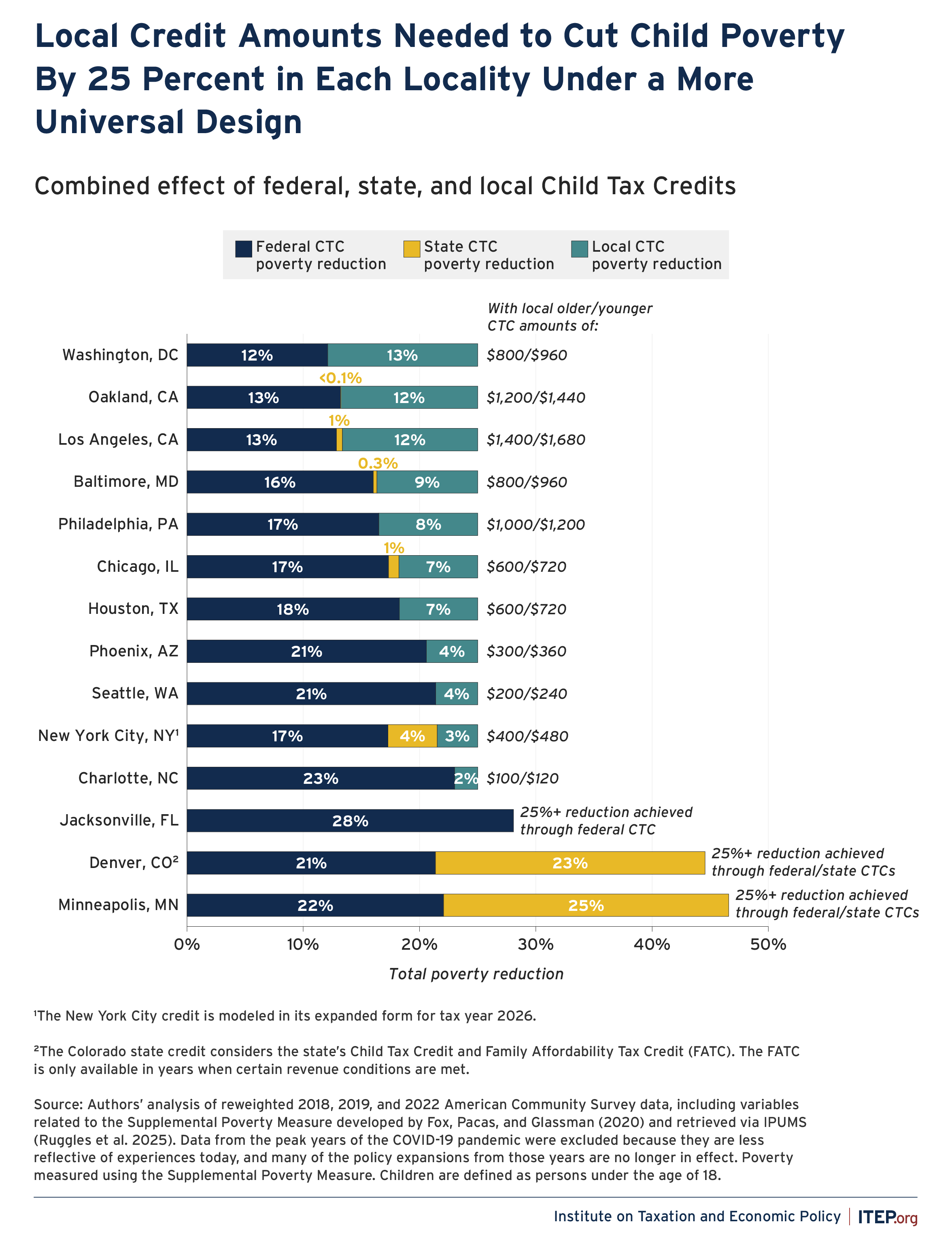

Child poverty rates in cities across the country sit well above the national average. A local Child Tax Credit could address this issue and transform the lives of families with children in American cities.

Our October report found that a base credit of $1,000 or less would be sufficient to reduce child poverty by 25 percent in 12 cities. In 10 of the cities we examined, a credit that would cut poverty by 25 percent when combined with federal and state credits would cost less than 3 percent of the city’s revenues.

Local governments have a critical role to play in reducing child poverty and filling the gaps left by existing state and federal policies with local credits. Local Child Tax Credits could provide large tax cuts (as a percentage of income) to families at the bottom of the income scale, lessening the overall regressivity of state and local tax systems.

Problems With Property Tax Cuts

Lawmakers across the country pushed for property tax cuts this year, often accompanied by proposals for sales tax increases. This plan only creates a regressive tax shift that unfairly burdens renters and reduces the strength of local government revenues.

Property tax cuts do not address the primary factors that contribute to housing unaffordability. Fortunately, states and municipalities have other tools to deal with housing crises like inclusive zoning, housing assistance to low-income residents, and subsidized supportive housing.