Alabama

In different ways, Earth Day and the COVID-19 pandemic convey a similar lesson: people around the world face shared struggles and disparate impacts, which they must work together to overcome through both emergency action and systemic change. In keeping with that lesson, state fiscal policy news this week was strikingly similar around the country, as states take account of the major threat posed by the pandemic to their budgets and attempt to grapple with its disproportionate impacts on communities of color and low-income families.

State Rundown 4/9: Pandemic’s Fiscal Effects Slowly Coming into Focus

April 9, 2020 • By ITEP Staff

The COVID-19 pandemic continued this week to wreak havoc on lives and communities around the world. The fiscal fallout of the virus in the states is growing as well, and beginning this week to come into sharper focus. This week’s Rundown brings together what we know of that slowly clarifying picture and how states are responding so far.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

ITEP Testimony Regarding Connecticut Senate Bill 16, An Act Concerning the Adult Use of Cannabis

March 4, 2020 • By Carl Davis

This testimony explains the advantages of the cannabis tax structure proposed in Connecticut’s Senate Bill 16 and offers additional background information as well as ideas for potential changes to the bill.

This weekend’s Leap Day should be a welcome extra day for state lawmakers, advocates, and observers who care about tax and budget policy, as there is an overflow of proposals and information to digest. Most importantly, as emphasized in our “What We’re Reading” section, there are never enough days in a month to do justice to the importance of Black History Month and Black Futures Month. In state-specific debates, Oregon and Washington leaders are hoping to take a leap forward in raising funds for homelessness and housing affordability measures. Lawmakers in West Virginia and Wisconsin could use a day to…

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

Alabama Arise: End Alabama’s state grocery tax and protect school funding

January 30, 2020

How to untax groceries without costing education a dime It’s crucial to replace the grocery tax revenue without hurting the people who would benefit most from the tax’s elimination. Fortunately, Alabama has a way to untax groceries while protecting both struggling families and education funding. That solution would be to end an unusual tax loophole […]

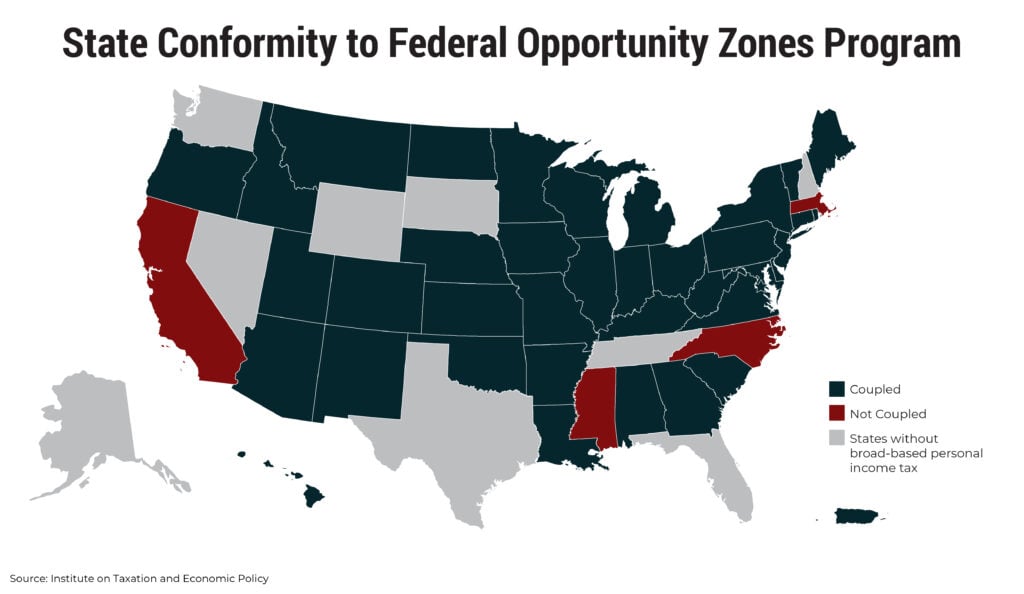

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

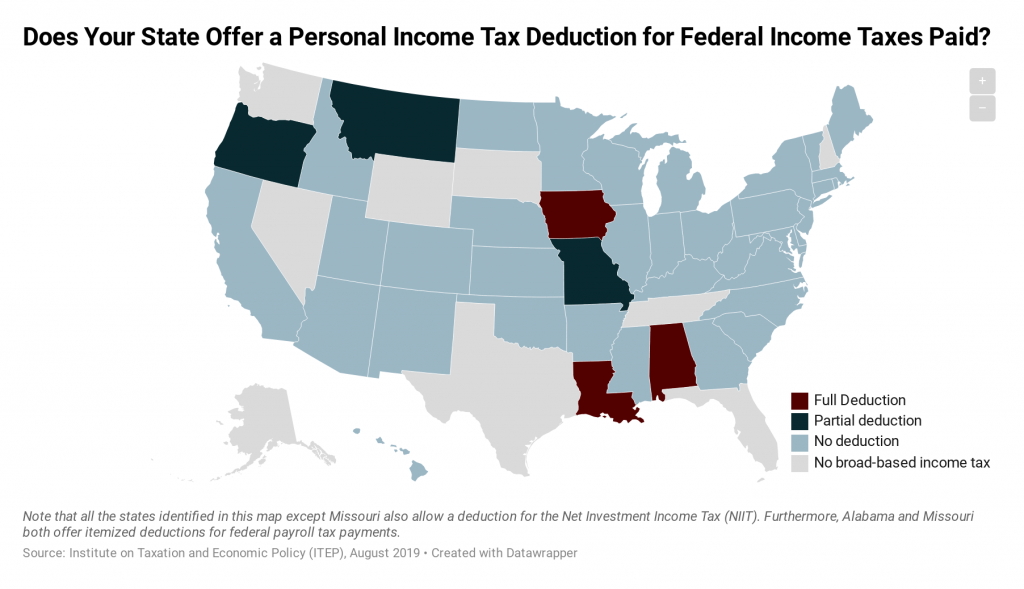

Six states allow an unusual income tax deduction for federal income taxes paid. These deductions are detrimental to state income tax systems on many fronts, as they offer large benefits to high-income earners and undercut the adequacy and stability of state income tax systems.

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

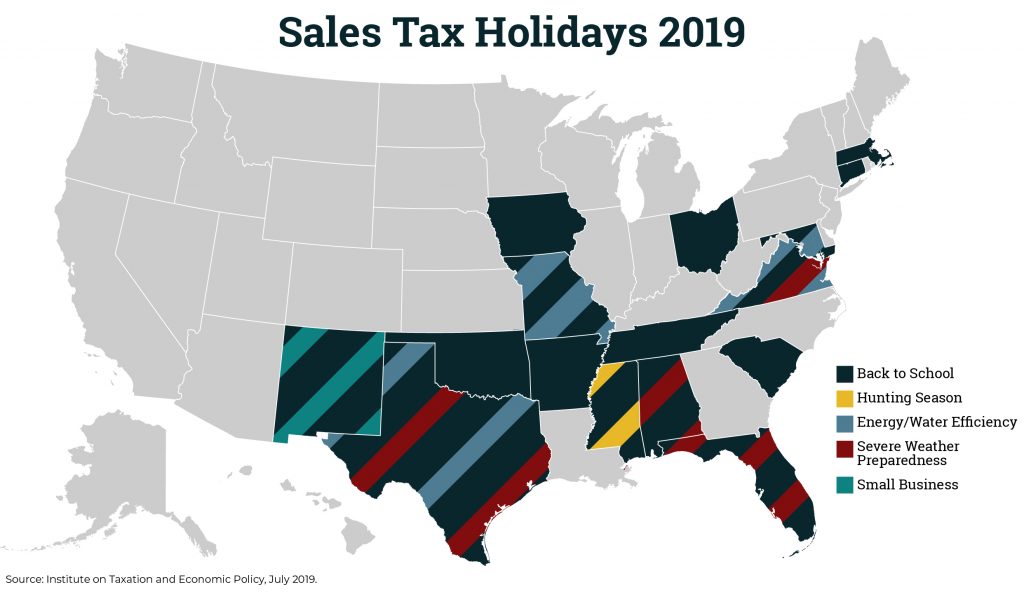

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

Ohio now enjoys the distinction of being the 30th state to raise or reform its gas tax this decade, and the third state to do so this year, under a bill signed into law by Gov. Mike DeWine. While state tax policy can be a contentious topic, there has been a remarkable level of agreement on the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies. These actions are helping reverse losses in gas tax purchasing power caused by rising construction costs…

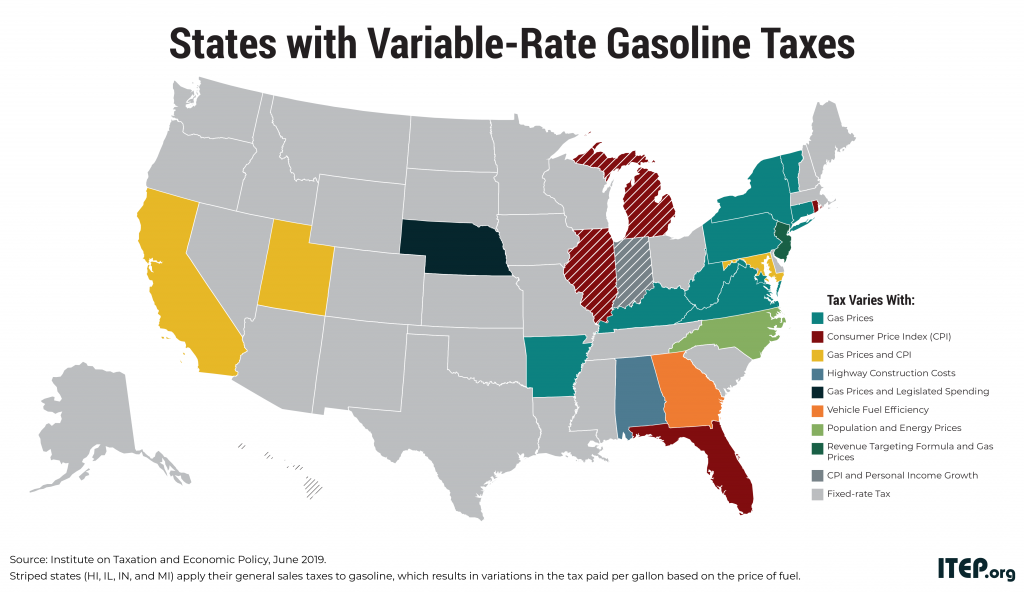

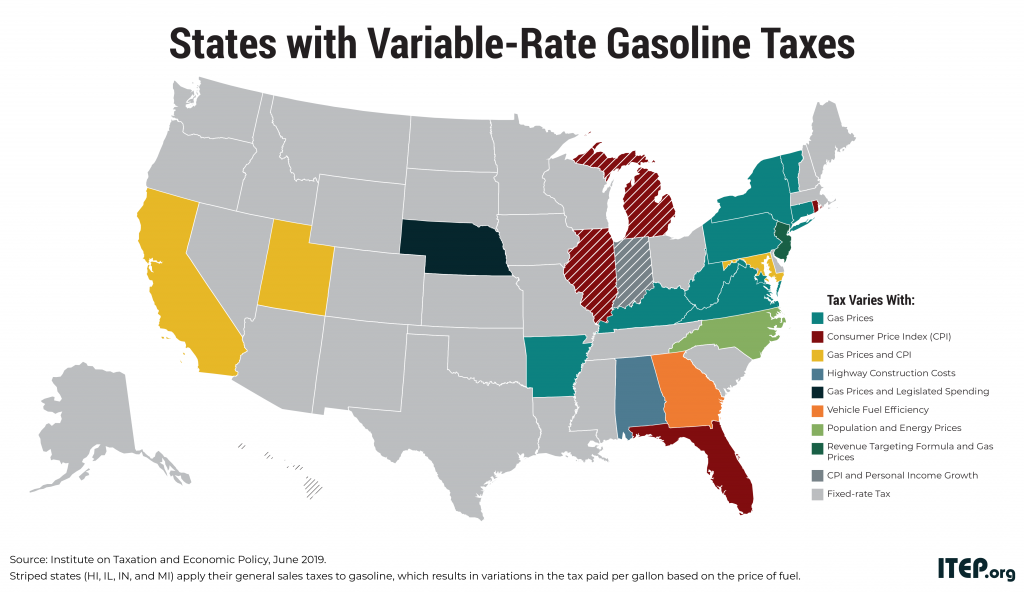

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Twenty-eight states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers purchase more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4-cent gas tax, for example, has not increased in over 25 years. Many states have waited a decade or more since last raising their own gas tax rates.

After states implemented laws that allow taxpayers to circumvent the new $10,000 cap on deductions for state and local taxes (SALT), the IRS has proposed regulations to address this practice. It’s a safe bet the IRS will try to crack down on the newest policies that provide tax credits for donations to public education and other public services, but it remains to be seen whether new regulations will put an end to a longer-running practice of exploiting tax loopholes in some states that allow public money to be funneled to private schools.

Gas Taxes Have Gone Up in Most States, but Decades-Long Procrastinators Remain

May 21, 2019 • By Carl Davis

The upcoming Memorial Day weekend marks the start of the traditional summer driving season. In most states, summer road-trippers are paying more gas tax than they did a few years ago and are benefiting from smoother and safer roads as a result. In total, 30 states have raised or reformed their gas taxes in the last six years.

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

Bloomberg: Gas Tax for Infrastructure Sparks Fears of Political Backlash

May 1, 2019

Some 30 states have raised their fuel taxes since 2003 -- including Republican-led Ohio, Arkansas and Alabama this year -- according to the Institute on Taxation and Economic Policy. States tack on an average tax of nearly 29 cents per gallon, according to the U.S. Energy Information Administration.

Tax and budget debates are now mostly complete in Alabama, Arkansas, and Colorado, but just starting or just getting interesting in several other states. Delaware and Massachusetts lawmakers, for example, are looking at progressive income tax increases on wealthy households, and New Hampshire may use a progressive tax on capital gains to simultaneously improve its upside-down tax code and invest in education. Nebraska and Texas, on the other hand, are also looking to improve school funding but plan to do so on the backs of low- and middle-income families through regressive sales tax increases. Fiscal debates are heating up in…