Alaska

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

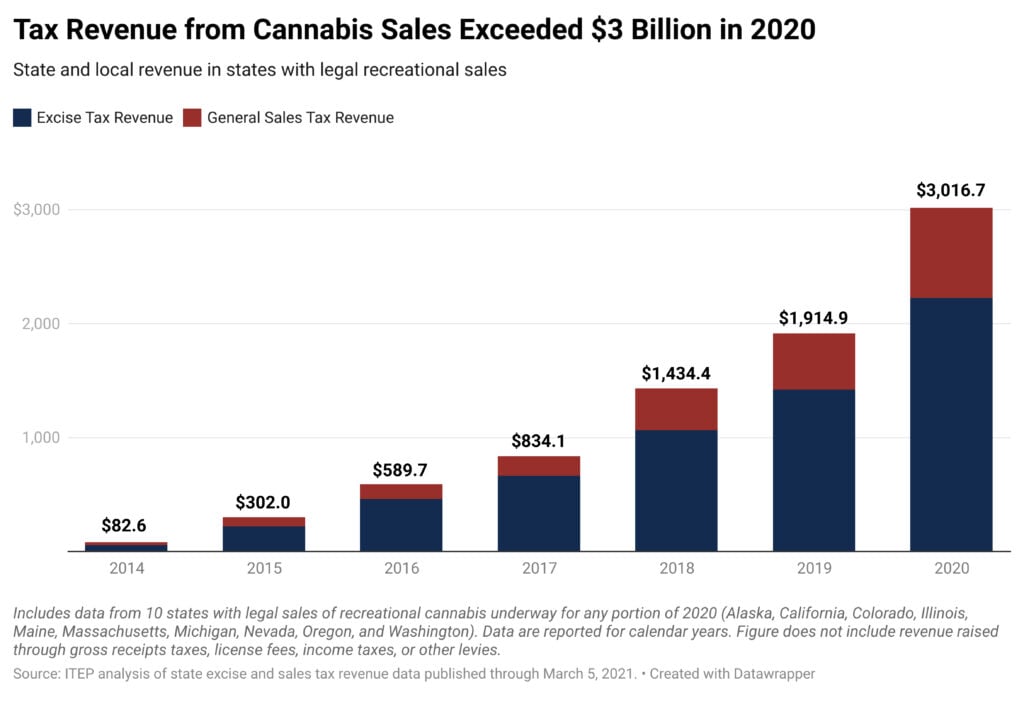

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

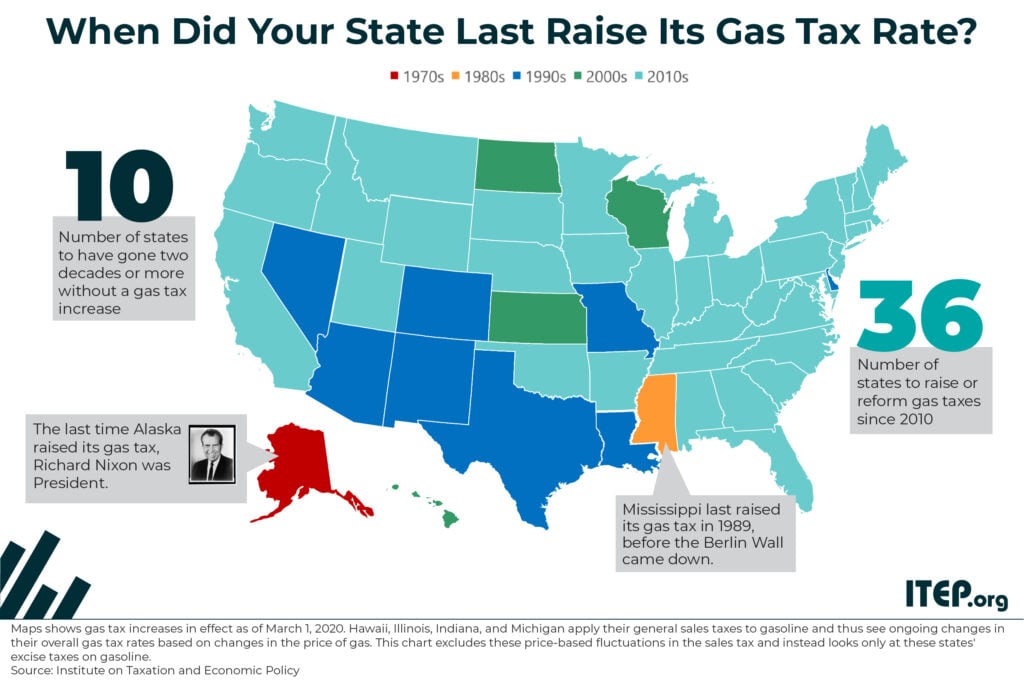

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Marketplace: High-income taxpayers help some states stay above water

March 1, 2021

However, in 22 states, tax revenue actually increased, with revenue in four states — Idaho, Utah, South Dakota and Colorado — up more than 5%. Revenue fell in the remaining states, with seven down more than 10% —Texas, Oregon, Florida, Nevada, North Dakota, Hawaii and Alaska. This disparity has a lot to do with the […]

Alaska is notoriously reliant on tax and royalty revenue from oil to fund vital public services and institutions, but declining oil prices and production levels have rendered those revenues inadequate to meet the state’s needs. ITEP analysis of potential state income tax options in Alaska shows the potential to raise between $526 million and $696 million per year yet are quite modest compared to personal income tax structures in other states. When measured relative to state residents’ incomes, any of these options would rank among the bottom five lowest state income taxes in the nation.

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

New Jersey lawmakers passed an innovative tax design that other states debating cannabis legalization should look to for inspiration. The state officially legalized cannabis in November when voters overwhelmingly approved a constitutional amendment by a margin of 67 to 33 percent. The amendment applied the state’s general sales tax to cannabis and allowed local governments to create their own taxes on the industry. The legislature added the most notable part of the tax structure last month with a Social Equity Excise Fee.

State Rundown 12/17: New and Old State Tax Debates Await in 2021

December 17, 2020 • By ITEP Staff

Our last Rundown of 2020 includes news of yet another misguided proposal to eliminate a state income tax, this time in Arkansas. Florida and Missouri, on the other hand, are looking to modernize their tax codes by becoming the last two states to enforce their own sales taxes on online retailers. Leaders in Maryland and Oregon, meanwhile, are working to decouple the state from unnecessary and regressive tax cuts included in the federal CARES Act. And Missouri and Nevada lawmakers both got updated estimates of the revenue shortfalls they will need to resolve when they convene in 2021. The Rundown…

State Rundown 11/24: Lawmakers and Families Thankful to Be Nearing End to 2020

November 24, 2020 • By ITEP Staff

Just as people will search their hearts to give thanks this week for the small and large things that got them through a difficult year, state lawmakers are also doing their best to count their blessings while keeping fingers crossed for badly needed federal relief to give them something to be truly grateful for.

State Rundown 11/13: States Can Find Inspiration in Arizona Ballot Success; Must Look to Congress for More Immediate Help

November 13, 2020 • By ITEP Staff

Although progressive tax policy doesn’t always succeed in in statehouses or voting booths, Arizona voters showed once again that when offered a clear choice, most people resoundingly support requiring fairer tax contributions from rich individuals and highly profitable corporations over allowing their schools and other shared priorities to wither and decay. Still, a similar effort in Illinois and a more complicated measure in California were defeated, and anti-tax zealots in West Virginia and many other states will continue to push for tax cuts for the rich and defunding public investments, leaving much work to be done to advance tax justice.

Voters Have the Chance in 2020 to Increase Tax Equity in Arizona, Illinois, and California, And They Should

October 22, 2020 • By Marco Guzman

There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects brought on by the coronavirus pandemic and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

State Rundown 8/26: Progressive Revenue Ideas Featured in Many States’ Fiscal Debates

August 26, 2020 • By ITEP Staff

Voters could significantly change the tax landscape through ballot measures this November regarding oil taxes in Alaska and a high-income surcharge for education funding in Arizona. Legislators are doing their part to bring progressive tax ideas to the fore as well, including a possible wealth tax in California, a millionaires tax in New Jersey, and a pied-a-terre proposal in New York. And Nebraska lawmakers reached a property tax and business tax subsidy compromise before closing out their session, but did not identify progressive revenue sources to fund it and will likely be back at the bargaining table before long.

As many of the country’s major professional sports leagues attempt to return to action amid concerns that the pandemic will find a way to ruin even the best-laid plans, state legislatures find themselves in a similar boat. Lawmakers would normally be enjoying their summer breaks at this time of year, but instead are returning to work in special sessions surrounded by plexiglass and uncertainty. Read on for information on ongoing sessions in states including California, Massachusetts, and Nebraska, as well as upcoming sessions in Missouri and Oregon.

New Prosperity Now Report Identifies Upside-Down Tax Incentives

July 15, 2020 • By Jessica Schieder

Ahead of this year’s delayed Tax Day, our partners at Prosperity Now released a powerful report providing a comprehensive overview of many of the ways our federal tax system privileges wealth over work, while also lifting up several provisions which could serve as a template for improving progressivity within the tax code. The report makes […]

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

Crain’s New York Business: Legalizing Marijuana Can’t Cure Inequality, But It Will Ease Budget Crisis

June 14, 2020

My methodology is informed by the work of Carl Davis, research director at the Institute on Taxation and Economic Policy, who recently published a thoughtful blog post on per-capita cannabis excise tax collections. Davis found that last year more than $1.9 billion of tax revenue was collected across seven adult-use states (Alaska, California, Colorado, Massachusetts, Nevada, Oregon, […]

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

State Rundown 5/7: State Fiscal Responses to Pandemic Starting to Get Real

May 7, 2020 • By ITEP Staff

State lawmakers are starting to use fiscal policy levers to address the COVID-19 pandemic, but the actions vary greatly and are just a start. Mississippi, for example, is one state still clarifying who has authority to determine how federal aid dollars are spent. Colorado, Georgia, Missouri, and Ohio are among the many states identifying painful funding cuts they will likely make to shared priorities like health care. The Louisiana House and the Minnesota Senate each advanced tax cuts and credits that could dig their budget holes even deeper. Connecticut leaders are looking at one of the more comprehensive packages, which…

A bipartisan group of governors and senators from Louisiana to Maryland to Ohio have called for at least $500 billion in state and local fiscal relief. They also need specific help with testing, protective equipment, unemployment costs, Medicaid costs, social services, education and infrastructure. States can’t be on their own as they address the double whammy of plunging revenue and skyrocketing needs.

In different ways, Earth Day and the COVID-19 pandemic convey a similar lesson: people around the world face shared struggles and disparate impacts, which they must work together to overcome through both emergency action and systemic change. In keeping with that lesson, state fiscal policy news this week was strikingly similar around the country, as states take account of the major threat posed by the pandemic to their budgets and attempt to grapple with its disproportionate impacts on communities of color and low-income families.

State Rundown 4/15: Tax Day Delayed but Other Important Work Accelerated

April 15, 2020 • By ITEP Staff

April 15 is traditionally the day federal and state income taxes are due, but like so much else, Tax Day is on hold for the time being. Meanwhile the pandemic’s disastrous and uneven effects on communities and shared institutions are decidedly not suspended. But nor are the efforts of individuals, advocates, and policymakers to develop solutions to respond to the immediate crisis while also building better systems going forward. ITEP’s recommendations for state tax policy responses are now available here, and this week’s Rundown includes experiences and perspectives on paths forward from around the country.