Arizona

NPR: This Tax Loophole for Wealthy Donors Just Got Bigger

December 29, 2017

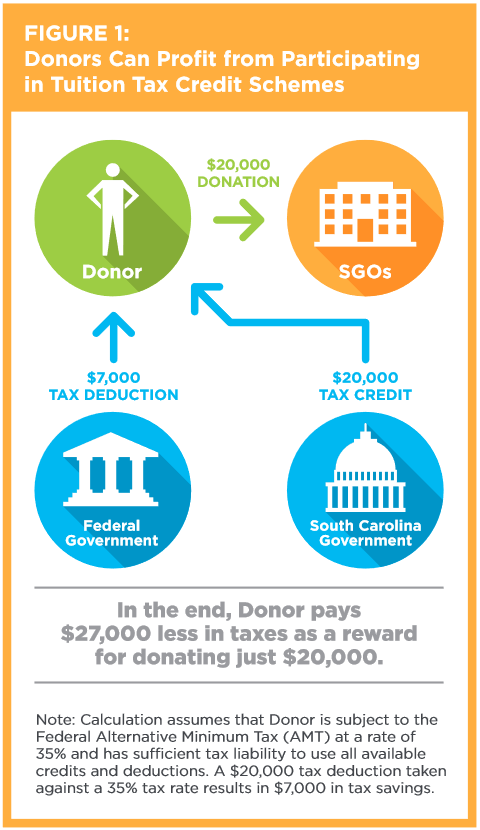

One of the changes, according to the Institute on Taxation & Economic Policy, which advocates for a “fair and sustainable” tax system, allows far more wealthy donors in 10 states to turn a profit through “donations” to private school scholarships. Yes, you read that right. If your income is high enough, you can actually make […]

How the Final GOP-Trump Tax Bill Would Affect Arizona Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

Private Schools Donors Likely to Win Big from Expanded Loophole in Tax Bill

December 14, 2017 • By Carl Davis

For years, private schools around the country have been making an unusual pitch to prospective donors: give us your money, and you’ll get so many state and federal tax breaks in return that you may end up turning a profit. Under tax legislation being considered in Congress right now, that pitch is about to become even more persuasive.

Tax Bill Would Increase Abuse of Charitable Giving Deduction, with Private K-12 Schools as the Biggest Winners

December 14, 2017 • By Carl Davis

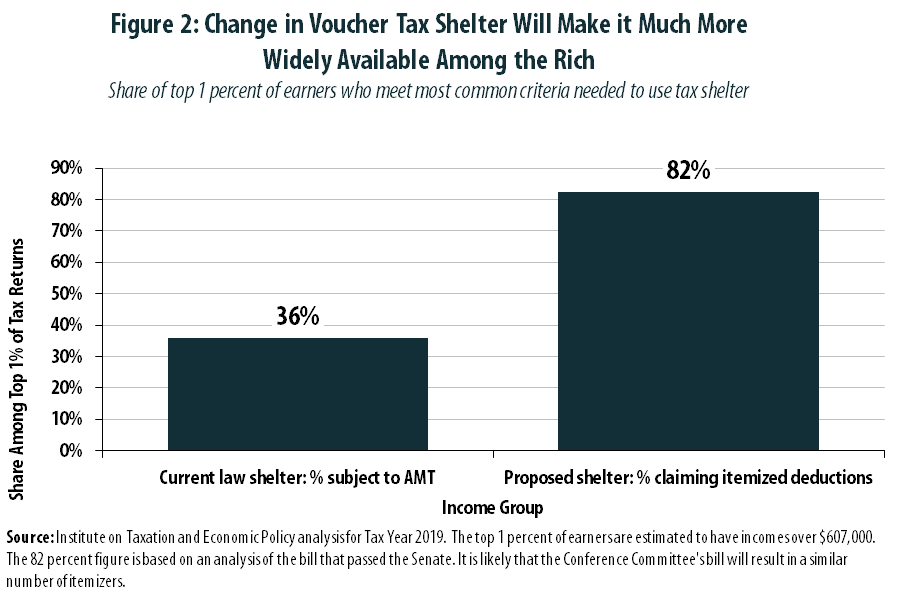

In its rush to pass a major rewrite of the tax code before year’s end, Congress appears likely to enact a “tax reform” that creates, or expands, a significant number of tax loopholes.[1] One such loophole would reward some of the nation’s wealthiest individuals with a strategy for padding their own bank accounts by “donating” to support private K-12 schools. While a similar loophole exists under current law, its size and scope would be dramatically expanded by the legislation working its way through Congress.[2]

How the House and Senate Tax Bills Would Affect Arizona Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

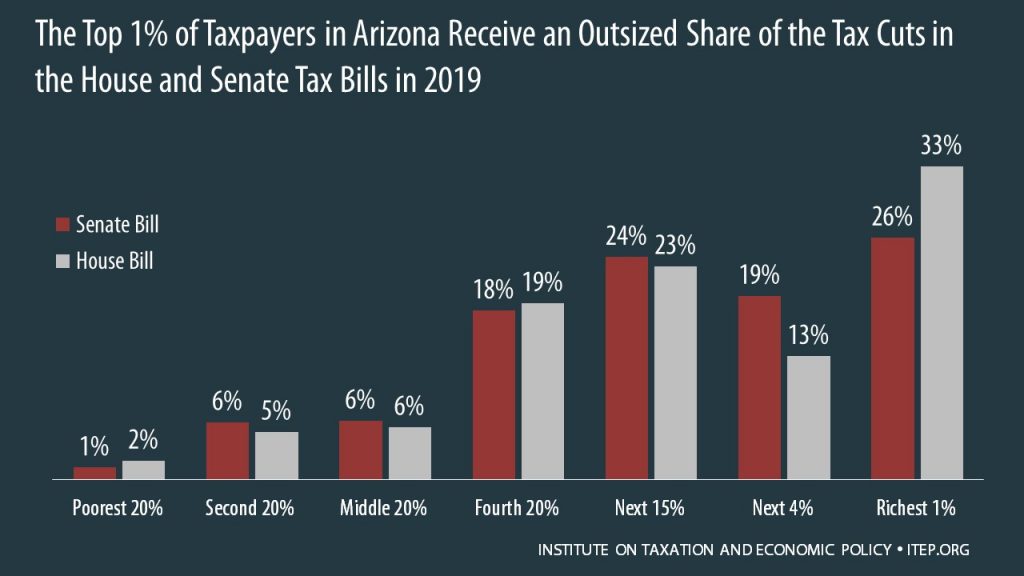

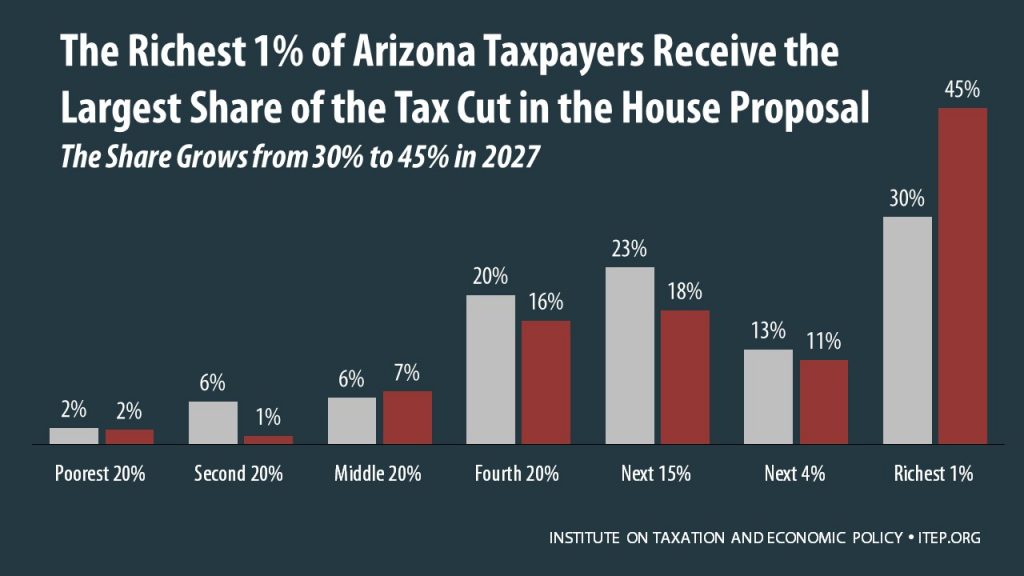

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Arizona residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

Senate “Pass-Through” Deduction Threatens to Undermine State Tax Systems

December 1, 2017 • By Carl Davis

The U.S. Senate will soon be voting on a bill that would, among other things, allow so-called “pass-through” businesses to pay significantly lower taxes than their employees...If the Senate “pass-through” deduction is enacted into law, dozens of states will be forced to confront the possibility of reduced revenue collections, more regressive tax codes, and increased tax avoidance.

A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

November 30, 2017 • By Carl Davis

The centerpiece of the House and Senate tax plans is a major tax cut for profitable corporations that the American public does not want, and that will overwhelmingly benefit a small number of wealthy investors living in traditionally “blue” states. New ITEP research shows that poorer states such as West Virginia, Oklahoma, Alabama, and Tennessee would be largely left behind by a corporate tax cut, while the lion’s share of the benefits would remain with a relatively small number of wealthy investors who tend to be concentrated in larger cities near the nation’s coasts.

The State Rundown is back from Thanksgiving break with a heaping helping of leftover state tax news, but beware, some of it may be rotten.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

Arizona Center for Economic Progress: Just Like the House GOP Plan, the Senate GOP Tax Plan Is Another Handout to the Wealthiest Households and Large Corporations

November 14, 2017

Newly published data shows that the new Senate GOP tax plan isn’t much better than the House GOP tax plan for the middle-class, small businesses, and lower-income Americans. The Institute on Taxation and Economic Policy analysis (https://itep.org/senatetaxplan/) shows that on average, the top 5% of Americans will receive around 50% of the tax cuts. Read […]

How the Revised Senate Tax Bill Would Affect Arizona Residents’ Federal Taxes

November 13, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Arizona, 48 percent of the federal tax cuts would go to the richest 5 percent of residents, and 12 percent of households would face a tax increase, once the bill is fully implemented.

Arizona Center for Economic Progress: With Further Analysis Completed, It’s Time to Call the GOP Tax Plan What it Is: Welfare for the Wealthy

November 6, 2017

A 50-state analysis of the House tax plan released last week reveals that in Arizona the wealthiest 1% of Arizonans will receive the greatest share of the total tax cut in year one and their share would grow through 2027. And during that 10-year window, the value of the tax cut gets smaller and smaller for every […]

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect Arizona Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

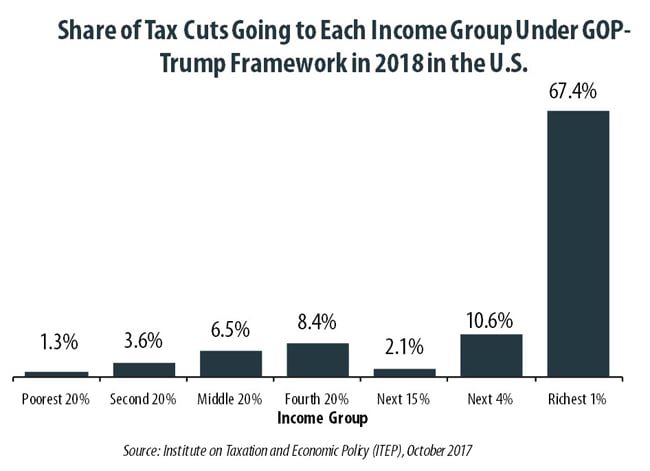

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

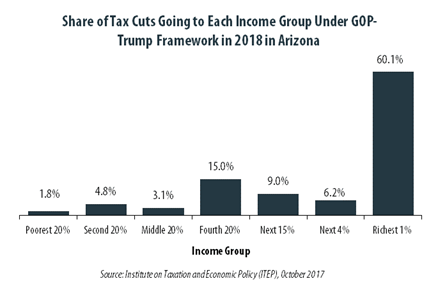

GOP-Trump Tax Framework Would Provide Richest One Percent in Arizona with 60.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arizona equally. The richest one percent of Arizona residents would receive 60.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $470,200 next year. The framework would provide them an average tax cut of $59,210 in 2018, which would increase their income by an average of 4.4 percent.

State lawmakers seeking to make residential property taxes more affordable have two broad options: across-the-board tax cuts for taxpayers at all income levels, such as a homestead exemption or a tax cap, and targeted tax breaks that are given only to particular groups of low- and middle-income taxpayers. One such targeted program to reduce property taxes is called a “circuit breaker” because it protects taxpayers from a property tax “overload” just like an electric circuit breaker: when a property tax bill exceeds a certain percentage of a taxpayer’s income, the circuit breaker reduces property taxes in excess of this “overload”…

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

In Arizona 38.6 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Arizona population (0.4 percent) earns more than $1 million annually. But this elite group would receive 38.6 percent of the tax cuts that go to Arizona residents under the tax proposals from the Trump administration. A much larger group, 47.8 percent of the state, earns less than $45,000, but would receive just 4.0 percent of the tax cuts.

It’s a Fact: Voucher Tax Credits Offer Profits for Some “Donors”

August 9, 2017 • By Carl Davis

In nine states, tax rewards gained by donating to fund private K-12 vouchers are so oversized that “donors” can turn a profit. This is the shocking but true finding of a pair of studies released by ITEP over the last year.

Trump Tax Proposals Would Provide Richest One Percent in Arizona with 51 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Arizona would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,355,400 in 2018. They would receive 51 percent of the tax cuts that go to Arizona’s residents and would enjoy an average cut of $99,090 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

Scripps News Service: Money Diverted from Public Schools?

June 26, 2017

All the programs basically work this way: Individuals and businesses make cash or stock donations to scholarship granting organizations. The organizations award scholarships to qualifying families with K-12 students, primarily children in failing public schools or whose families’ income meets the state’s poverty threshold. Students can then attend a private or religious school of their […]