Blog - Federal Policy

525 posts

Megabill Takes Cap Off Unprecedented Private School Voucher Tax Credit, Potentially Raising Cost by Tens of Billions Relative to Earlier Version

July 2, 2025 • By Carl Davis

It is clear that this tax credit has the potential to come with an enormous cost if private school groups are successful in convincing their supporters to participate. In these times of very high debt and deficits, this is reason for all of us to be uneasy.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

Senate Republicans Rig the Rules to Make Their Tax Bill Look Responsible. It’s Not.

June 24, 2025 • By Jon Whiten, Steve Wamhoff

No matter how much Senate leadership bends the rules to make their tax cuts look better on paper, the cost and impact on the deficit remains the same under a current policy baseline. It’s a move meant to mask the true cost and push a reckless bill through.

The ‘Big, Beautiful’ Bill Creates a $5 Billion Tax Shelter for Private School Donors

June 9, 2025 • By Amy Hanauer

On May 22, Congress passed the House reconciliation bill or “One Big Beautiful Bill Act” by a one-vote margin. The bill’s dozens of destructive tax provisions would supercharge inequality and force devastating cuts to health and food aid that have been bedrocks of the American safety net since the 1960s.

Our tax policies enable people like Elon Musk and Donald Trump to accumulate more wealth than anyone could ever use in a lifetime. They then use it to steer elections and shape public policy to further enrich themselves and others like them. We should defeat the enormously destructive tax bill in Congress and instead craft tax policy that taxes the rich, makes our democracy more fair, and returns resources to the rest of the country.

House Bill’s $164 Billion Giveaway to Multinational Corporations Puts America Last

May 27, 2025 • By Sarah Austin

The House of Representatives’ recently passed tax bill changes course on taxing multinational corporations engaged in shifting U.S. profits overseas, offering massive tax giveaways that weaken American revenues and risk sending more American corporate investment offshore.

The House of Representatives unveiled a sprawling piece of tax legislation earlier this week that would extend temporary tax changes enacted in 2017 and layer various kinds of tax cuts and increases on top. The JCT analysis makes clear that the House tax plan would be regressive, meaning it would offer larger tax cuts as a share of income to high-income taxpayers than to either middle-class or working-class families. It also makes clear that most of the tax cuts would go to families with above-average incomes.

Trump Megabill Will Encourage Dynastic Wealth Hoarding by Further Weakening the Estate Tax

May 15, 2025 • By Jon Whiten

The tax and spending megabill signed into law by President Trump on July 4 will cut nearly $200 billion from food assistance, affecting tens of millions adults and children, while providing an estate tax cut costing roughly the same amount to a few thousand people who will leave behind more than $7 million to their heirs.

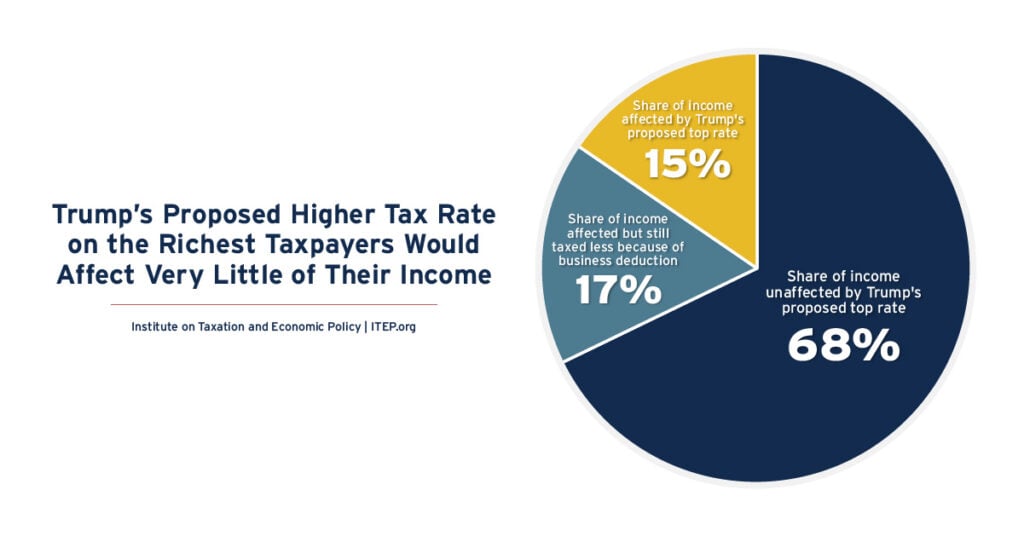

Trump’s Proposed Higher Tax Rate on the Richest Taxpayers Would Affect Very Little of Their Income

May 10, 2025 • By Carl Davis, Steve Wamhoff

President Donald Trump has proposed allowing the top rate to revert from 37 percent to 39.6 percent for taxable income greater than $5 million for married couples and $2.5 million for unmarried taxpayers. But many other special breaks in the tax code would ensure that most income of very well-off people would never be subject to Trump’s 39.6 percent tax rate.

America Has Left the Building: U.S. Loses from Our Global Tax Policy Choices, Others Could Gain

May 5, 2025 • By Amy Hanauer

Countries that once looked to the U.S. for direction on tax policy have concluded they need to form alliances without us. If so, it will often be to the benefit of other people around the globe and to the deficit of U.S. communities.

Millions of Citizen Children Would be Harmed by Proposal Billed as Targeting Immigrant Tax Filers

April 24, 2025 • By Emma Sifre, Joe Hughes

Congressional Republicans have floated a proposal to strip the Child Tax Credit from millions of children who are U.S. citizens and legal residents in situations where their parents do not have Social Security numbers. Approximately 4.5 million citizen children with Social Security numbers would lose access to the credit under this proposal.

The tariffs proposed by Donald Trump, which are far larger than any on the books today, would significantly raise the prices faced by American consumers across the income scale.

Ending Direct File Program is a Gift to the Tax-Prep Industry That Will Cost Taxpayers Time and Money

April 17, 2025 • By Jon Whiten

The Trump administration reportedly plans to shutter the IRS Direct File program before it has a chance to get fully off the ground, taking away a free option for people to file their tax returns directly to the agency. Ending Direct File is another gift from this administration to large corporations, this time to the multibillion-dollar tax prep industry that profits from you filing your taxes.

It’s Tax Day. You’ve Paid Your Share, but the Billionaires Haven’t.

April 15, 2025 • By Amy Hanauer

You likely had most of your federal taxes deducted from your paychecks throughout the year. This is not true, however, for mega-millionaires and billionaires, some of whom are practically running our government right now.

What the Wall Street Journal Editorial Board Got Wrong About Tesla’s Tax Avoidance

April 4, 2025 • By Matthew Gardner

Tesla’s income tax avoidance is still in the news, and that’s a good thing.

Senate Republicans Rig Congressional Rules to Make Their Tax Cuts Appear Cost-Free

April 4, 2025 • By Steve Wamhoff

This week, members of Congress are arguing about whether extending Trump’s 2017 tax cuts would cost trillions of dollars over a decade or cost nothing.

Why Americans Are Right to Be Unhappy About Corporate Tax Avoidance

March 26, 2025 • By Matthew Gardner

If lawmakers wanted to reduce income inequality and racial inequality, shutting down or at least limiting corporate tax breaks would be one option to achieve that goal. Unfortunately, President Trump and the current Congress show little interest in this and may even move in the opposite direction by introducing new corporate tax breaks.

Two Ways a 2025 Federal Tax Bill Could Worsen Income and Racial Inequality

March 26, 2025 • By Joe Hughes

Two parts of Trump’s 2017 tax law that are particularly expensive and beneficial to the richest individuals are the changes in income tax rates and brackets and the special deduction for “pass-through” business owners. Lawmakers should not extend these provisions for high-income households past the end of this year, when they are scheduled to expire.

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

A Well Targeted Federal Renter Credit Could Help Reduce Wealth Gaps

March 3, 2025 • By Brakeyshia Samms

While lawmakers often speak about income inequality, less attention is paid to wealth inequality. Wealth is distributed even more unequally than income in the U.S. in ways that reinforce racial divides, leave some households with too little to handle unexpected expenses, and enable some households to pass down enormous intergenerational wealth. A renter tax credit is one tool lawmakers can use to reduce wealth inequalities both within racial and ethnic groups and between these groups. As we show in our new analysis, Black and Hispanic households are more likely to be renters and hold less wealth than white households.

The budget resolution passed by House Republicans will enrich the richest, blow up the deficit, and decimate vital public services. The budget resolution allows Congress to pass reconciliation legislation with $4.5 trillion in tax cuts that would mostly flow to the wealthiest families in the country. Congressional Republicans have no way to pay for the massive tax cuts promised by President Trump during his campaign other than to dismantle fundamental parts of the government and increase the federal budget deficit.

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

The Five Biggest Corporations Represented at Trump’s Inauguration Could Save $75 Billion from One Tax Break Before Congress

February 11, 2025 • By Matthew Gardner, Spandan Marasini

New financial reports indicate five of America’s biggest corporations—Alphabet, Amazon, Apple, Meta, and Tesla—could win $75 billion in tax breaks if Congress and the President satisfy demands from corporate lobbyists to reinstate a provision repealed under the 2017 Trump tax law.

Policymakers Could Consider Using Tax and Transfer Policy to Reduce the Racial Retirement Wealth Gap

February 3, 2025 • By Brakeyshia Samms, Carl Davis

As we show in our recent study, this is, in part, due to longstanding discrimination shaping racial differences in economic wellbeing in the U.S. Moreover, aspects of federal and state tax policies have helped create the vast racial retirement wealth gap in place today. For this reason, we evaluate how tax and transfer policy reforms could help shrink racial retirement wealth inequality. To inform lawmakers as they approach the 2025 debates, below we offer several guiding principles.