Blog

1298 posts

Trends We’re Watching in 2019: Attempting to Double Down on Failed Trickle-Down Regressive Tax Cuts

February 7, 2019 • By Lisa Christensen Gee

It’s always troubling for those concerned with adequate and fair public finance systems when states prioritize tax cuts at the cost of divesting in important public priorities and exacerbating underlying tax inequalities. But it’s even more nerve-racking when it happens on the eve of what many consider to be an inevitable economic downturn.

Trends We’re Watching in 2019: Cannabis Tax Implementation and Reform

February 7, 2019 • By Carl Davis

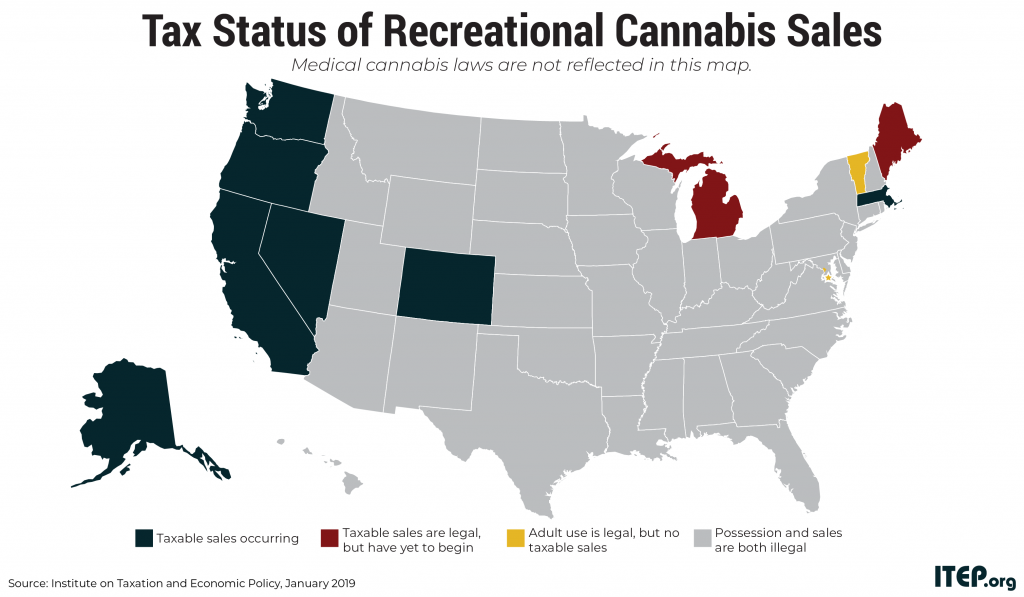

Few areas of state tax policy have evolved as rapidly as cannabis taxation over the last few years. The first legal, taxable sale of recreational cannabis in modern U.S. history did not occur until 2014. Now, just five years later, a new ITEP report estimates that recreational cannabis is generating more than $1 billion annually in excise tax revenues and $300 million more in general sales tax dollars.

Trends We’re Watching in 2019: Consumption Taxes: the Good, Bad and the Ugly

February 7, 2019 • By ITEP Staff

Consumption taxes are a significant source of state and local revenue, and we expect that lawmakers will continue to adjust state consumption tax levies to adapt to budget needs and a changing economy.

Trends We’re Watching in 2019: Addressing Lingering Federal Conformity Questions and Opportunities

February 7, 2019 • By Dylan Grundman O'Neill

In our last update on state responses to the federal tax cut (Tax Cuts and Jobs Act, or TCJA), we noted that several states were waiting until 2019 to make their final decisions, giving them additional time to (hopefully) respond in ways that improve their fiscal situations and upside-down tax codes. The TCJA is affecting the 2018 federal taxes people are filing now, in some cases adding urgency and/or confusion to these debates.

Trends We’re Watching in 2019: Raising Revenue and Spending Surpluses to Prioritize Critical Public Investments

February 7, 2019 • By Lisa Christensen Gee

A second notable trend in 2019 is states raising revenue to address longstanding needs and states allocating their surpluses to invest in critical public priorities such as early childhood programs, education and other human services.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

New ITEP Report Shows How Congress Can Meet Public Demand for Progressive Taxes

February 5, 2019 • By Steve Wamhoff

A recent headline tells us that bold tax plans proposed by lawmakers today reflect a “profound shift in public mood.” But, in fact, the public’s mood has not changed at all. Americans have long wanted progressive taxes but few, if any, lawmakers publicly backed this view. What’s happening now isn’t a shift in public opinion, rather it’s Washington finally catching up with the American people.

Netflix Posted Biggest-Ever Profit in 2018 and Paid $0 in Taxes

February 5, 2019 • By Matthew Gardner

The popular video streaming service Netflix posted its largest-ever U.S. profit in 2018—$845 million—on which it didn’t pay a dime in federal or state income taxes. In fact, the company reported a $22 million federal income tax rebate.

Progressive tax proposals are finally being discussed with the urgency and seriousness they deserve. Following Rep. Alexandria Ocasio-Cortez’s call for a much higher marginal tax rate for multi-millionaires and Sen. Elizabeth Warren’s proposal to introduce a wealth tax for those at the very top, Sen. Bernie Sanders has introduced a revised version of his proposal to reform the federal estate tax.

State Rundown 1/31: Governors and Teachers Dominate Headlines, Much More in Fine Print

January 31, 2019 • By ITEP Staff

Gubernatorial addresses and the prospect of teacher strikes continued to take center stage in state fiscal news this week, as governors of Connecticut, Maryland, and Utah gave speeches that all included significant tax proposals. Meanwhile, teachers walked out in Virginia, and many other states debated school funding increases to avoid similar results. State policymakers have many other debates on their hands as well, including what to do with online sales tax revenue, how to cut property taxes without undermining schools, whether and how to legalize and tax cannabis, and whether to update gas taxes for infrastructure investments.

Data for the Win: Advocating for Equitable State and Local Tax Policy (Webinar)

January 30, 2019 • By Aidan Davis, Dylan Grundman O'Neill, ITEP Staff, Meg Wiehe

Watch the video recording below for discussion on how ITEP’s distributional data can be part of an advocacy and communications strategy for securing state tax policies that raise enough revenue to fund various priorities. Outline includes a brief overview of findings from the sixth edition of Who Pays? A Distributional Analysis of the Tax Systems in All 50 States as well as insight from state advocates who use Who Pays? and other tax policy analyses research to pursue their legislative agendas.

Why We Should Talk about Progressive Taxes Despite Billionaires’ Objections

January 30, 2019 • By Jenice Robinson

It was the tone-deaf remark heard ‘round the world. Last week on CNBC’s Squawk Box, Commerce Secretary Wilbur Ross suggested that furloughed government employees who hadn’t been paid in a month could go to a bank and get a loan to make ends meet. This was not a gaffe. It’s hard to fathom how a […]

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

Yes, It’s Time to Talk about Progressive Taxes, Even a Wealth Tax

January 24, 2019 • By Alan Essig

Earlier today, several news organizations reported that Sen. Elizabeth Warren is set to formally propose a federal wealth tax. Immediately after, social media was atwitter with comments that ranged from praise to predictable outcries of how will the wealthy cope if forced to pay more in taxes.

Thoughts about a Federal Wealth Tax and How It Could Raise Revenue, Address Income Inequality

January 23, 2019 • By Steve Wamhoff

Wealth inequality is much greater than income inequality. The 1 percent of Americans with the highest incomes receive about a fifth of the total income in the United States. In contrast, the top 1 percent of wealth holders in the United States own 42 percent of the nation’s wealth, according to estimates from University of California at Berkley economists Emmanuel Saez and Gabriel Zucman.

Cannabis Tax Debates are Ramping Up; Here’s What We’ve Learned from Five Years of Cannabis Taxation Thus Far

January 23, 2019 • By Carl Davis

This year lawmakers in Connecticut, Delaware, Hawaii, Illinois, New Jersey, New York, Rhode Island, and Vermont will all be debating the taxation of recreational cannabis. A new ITEP report reviews the track record of recreational cannabis taxes thus far and offers recommendations for structuring cannabis taxes to achieve stable revenue growth over the long haul.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

How States Can Help Shut Down Tax Havens by Cracking Down on Profit Shifting

January 17, 2019 • By Richard Phillips

A core problem with our corporate income tax laws at the federal and state levels is that they allow companies to use accounting gimmicks to shift significant amounts of their profits into low or zero-tax jurisdictions. Federal lawmakers had an opportunity to address this with the 2017 tax law, but they failed to do so, and, in fact, the law may incentivize more offshore tax avoidance. State lawmakers, however, can buck the federal trend and crack down on profit shifting themselves.

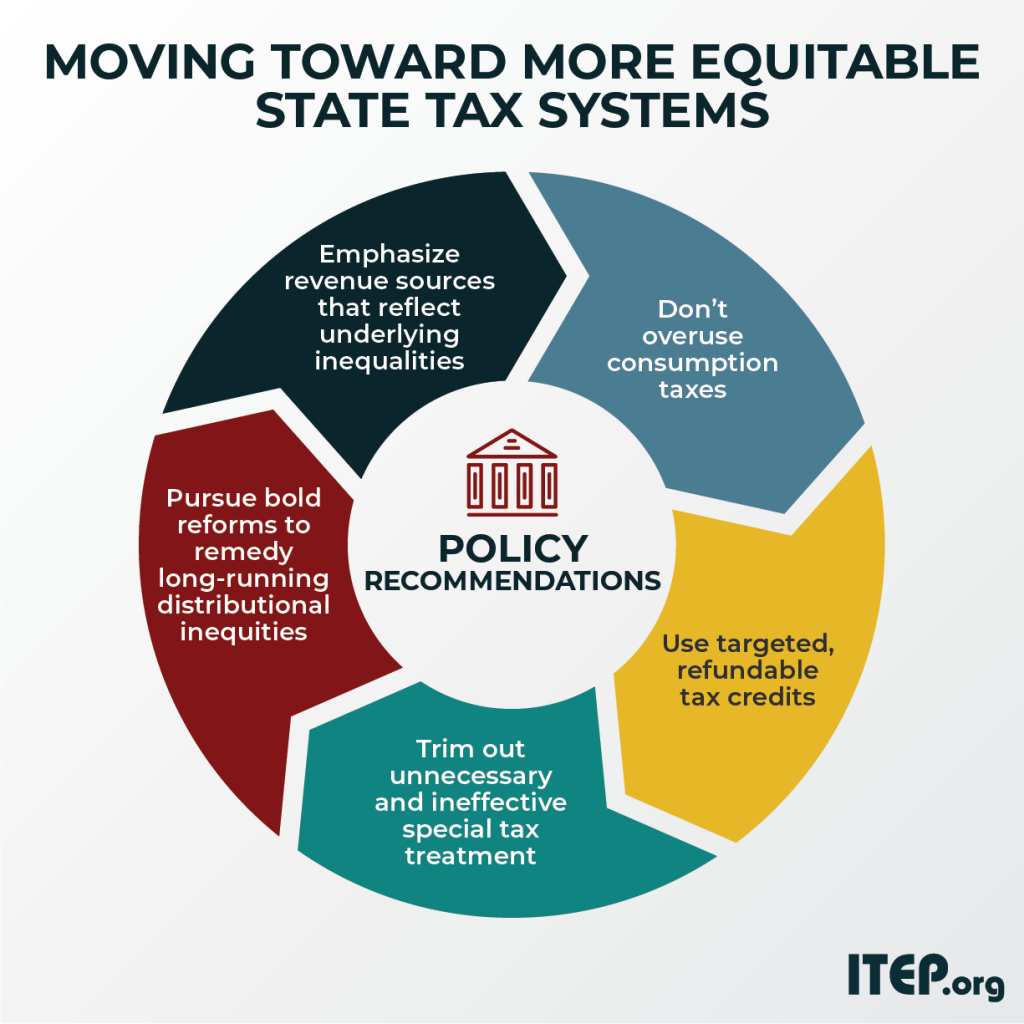

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

For those looking to start improving on these inequitable tax systems today, we now also offer a helpful companion to “Who Pays?” called "Moving Toward More Equitable State Tax Systems." This new report distills the findings of “Who Pays?” into a set of policy recommendations – from the foundational to the aspirational – that residents of every state can draw from and start work on now.

How to Think About the 70% Top Tax Rate Proposed by Ocasio-Cortez (and Multiple Scholars)

January 8, 2019 • By Steve Wamhoff

The uproar deliberately steers clear of any real policy discussion about what a significantly higher marginal tax rate would mean. Her critics are mostly the same lawmakers who enacted a massive tax cut for the rich last year that was not debated seriously or supported by serious research. Meanwhile, multiple scholarly studies conclude a 70 percent top tax rate would be an optimal way to tax the very rich. Ocasio-Cortez has brought more attention to the very real need to raise revenue and do it in a progressive way.

Sometimes policy developments move at a rapid-fire pace, so we’re taking time over the next 12 days to reflect on some of the most significant federal and state tax policy developments and/or tax policy analyses that happened this year.

It’s that time of year again. Members of Congress and the White House are negotiating the federal budget. Winter temperatures are unpredictable due to climate change. And news outlets, organizations and others are releasing end-of-year lists and the tax wonks at ITEP are joining the chorus. If you’re lucky enough to have some time off over the next couple of weeks or find yourself curling up on the couch this winter in need of a way to pass the time, the tax policy wonks at ITEP have compiled a winter reading/listening list that will appeal to wonks and non-wonks alike.

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

Five Things to Know on the One-Year Anniversary of the Tax Cuts and Jobs Act

December 17, 2018 • By Richard Phillips

While it has only been a year since passage of the Tax Cuts and Jobs Act (TCJA), it’s clear the law largely is both a debacle and a boondoggle. Below are the five takeaways about the legacy and continuing effect of the TCJA. 1. The Tax Cuts and Jobs Act will substantially increase income, wealth, and racial inequality. 2. The Tax Cuts and Jobs Act will continue to substantially increase the deficit. 3. The Tax Cuts and Jobs Act is not significantly boosting growth or jobs. 4. The Tax Cuts and Jobs Act continues to be very unpopular. 5. Despite…