Corporate Taxes

There is every reason to believe that Amazon will continue its tax-avoidance ways in 2020. The entirely-legal tax avoidance tools the company used to zero out its federal income tax bills over the last three years remain entirely legal today. From accelerated depreciation to the research and development tax credit to the deduction for executive stock options, Amazon’s tax avoidance tools have been blessed by lawmakers, and presidents, of all stripes.

Partying Like It’s 2017: How Congress Went Overboard on Helping Businesses with Losses

April 24, 2020 • By Steve Wamhoff

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides some needed relief for individuals and families, but two arcane tax provisions related to business losses will further enrich the wealthy and fail to boost our economy more broadly.

Last week, President Trump destroyed everyone’s coronavirus press conference bingo card by announcing that a conversation he had with celebrity chef Wolfgang Puck inspired him to propose restoring a corporate tax deduction for business entertainment expenses. Trump’s own signature tax plan repealed this break two years ago.

Boeing “CARES” A Lot About its Shareholders—But What about the Rest of Us?

April 1, 2020 • By Matthew Gardner

The gigantic Coronavirus-related tax and spending bill enacted last week, the so-called “CARES Act,” sets aside $17 billion in loans for “businesses critical to maintaining national security.” It’s generally understood that the bill’s authors want much, if not all, of this $17 billion to go to a single company: Boeing. So it behooves us to ask whether Boeing benefits America and its economy in ways that merit this largesse.

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

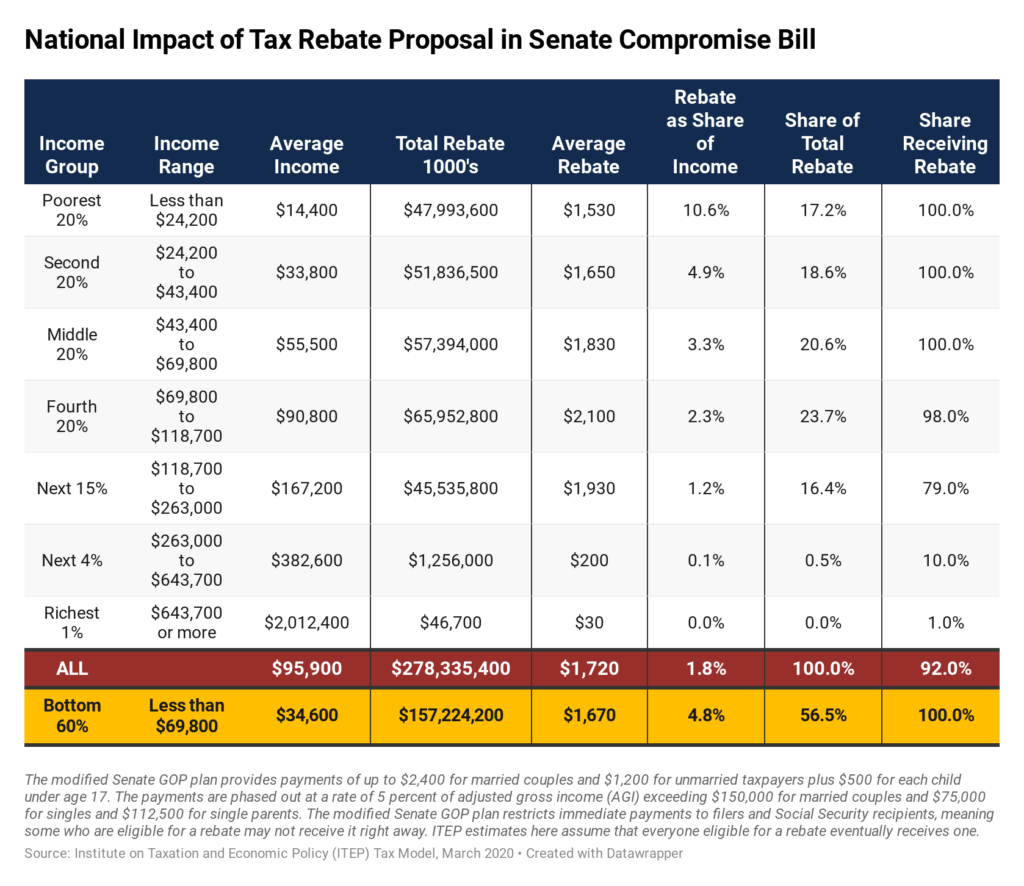

Data available for download Congress passed and the president signed a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. Though the bill improves on flaws in […]

COVID-19 Is No Excuse for Airline Industry or Any Other Corporate Tax Cut

March 10, 2020 • By Matthew Gardner

Trump administration officials have reportedly floated the idea of including tax breaks for the airline industry in its package of COVID-19-related stimulus proposals, which would allow airline companies to defer income taxes into the future. This is an odd policy choice since most of the biggest airlines are already using deferral to zero out most or all of their federal income taxes on billions of dollars in profits.

GOP Legacy on IRS Administration: Auditing Mississippi, not Microsoft

January 24, 2020 • By Matthew Gardner

Money doesn’t buy happiness—but it can buy immunity from the reach of Uncle Sam. The IRS is outgunned in cases against corporate giants because that’s how Republican leaders want it to be. They have systematically assaulted the agency’s enforcement capacity through decades of funding cuts. Instead of saving money, these cuts have cost billions: each dollar spent on the IRS results in several dollars of tax revenue collected.

Guilty, Not GILTI: Unclear Whether Corps Continue to Lower Their Tax Bills Via Tax Haven Abuse

January 7, 2020 • By Matthew Gardner

President Trump and GOP lawmakers often cited corporations’ abuse of tax havens, e.g. shifting profits offshore to avoid taxes, as justification for dramatically lowering the federal corporate tax rate under the 2017 Tax Cuts and Jobs Act. By 2016, corporations’ offshore cash haul had grown to $2.6 trillion, representing hundreds of billions in lost federal tax […]

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

More of the Same: Corporate Tax Avoidance Hasn’t Changed Much Under Trump-GOP Tax Law

December 16, 2019 • By Matthew Gardner

A new report from ITEP released today shows that, based on the first year of financial reports released by companies operating under the new tax law, tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect.

Corporate Tax Avoidance in the First Year of the Trump Tax Law

December 16, 2019 • By ITEP Staff, Lorena Roque, Matthew Gardner, Steve Wamhoff

Profitable Fortune 500 companies avoided $73.9 billion in taxes under the first year of the Trump-GOP tax law. The study includes financial filings by 379 Fortune 500 companies that were profitable in 2018; it excludes companies that reported a loss.

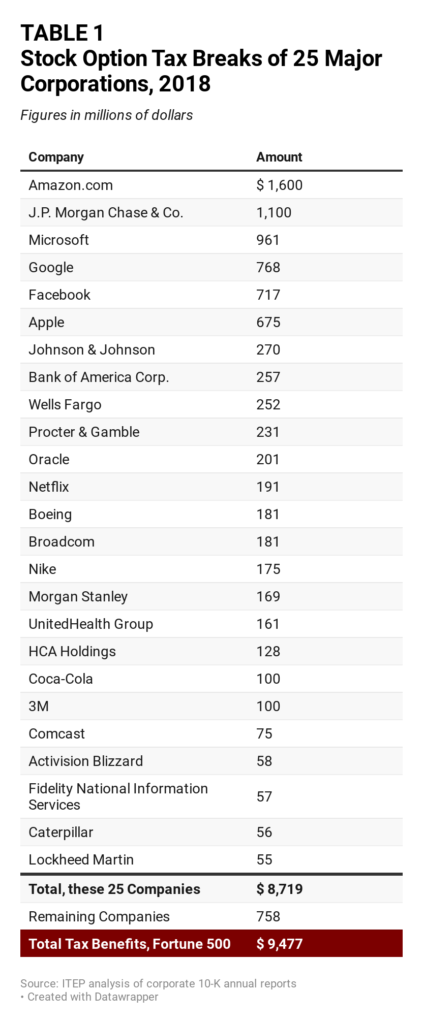

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

Several Democratic candidates have proposed raising the statutory corporate tax rate from its current level of 21 percent to fund their spending proposals. Political reporters and observers may read a great deal into the different corporate rates proposed by candidates, but the truth is that rates mean very little on their own.

Business Roundtable’s Newfound Devotion to Corporate Responsibility Doesn’t Include Paying Taxes

August 20, 2019 • By Matthew Gardner

If you squint really hard, the Business Roundtable’s newly declared fondness for “supporting the communities in which we work” could be read as an acknowledgment of the need for a tax system that can pay for needed services. But it’s not.

If a future Congress and president enact a real tax reform, one that requires corporations to pay their fair share and ends TCJA’s various corporate breaks for offshore profits, then companies will use inversions and other tactics to dodge taxes once again—if lawmakers let them. That’s why any real tax reform will include something like the Stop Corporate Inversions Act, introduced last week by Sens. Dick Durbin and Jack Reed to block inversions.

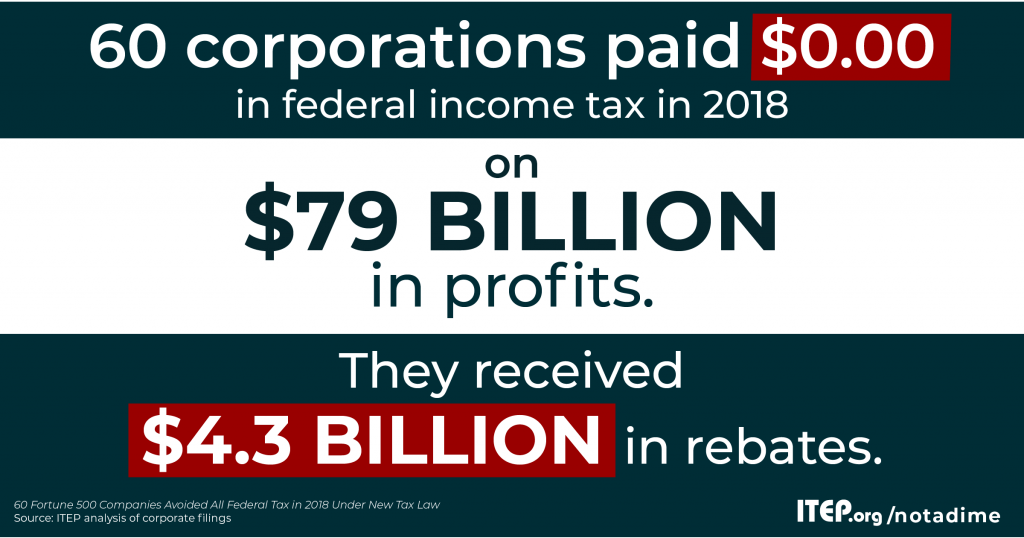

$4.3 Billion in Rebates, Zero-Tax Bill for 60 Profitable Corps Directly Related to Loopholes

April 12, 2019 • By Matthew Gardner

Meet the new corporate tax system, same as the old corporate tax system. That’s the inescapable conclusion of a new ITEP report assessing the taxpaying behavior of America’s most profitable corporations. The report, Corporate Tax Avoidance Remains Rampant Under New Law, released earlier this week, finds that 60 Fortune 500 corporations disclose paying zero in federal income taxes in 2018 despite enjoying large profits.

Corporate Tax Avoidance Remains Rampant Under New Tax Law

April 11, 2019 • By Lorena Roque, Matthew Gardner, Steve Wamhoff

For decades, profitable Fortune 500 companies have been able to manipulate the tax system to avoid paying even a dime in tax on billions of dollars in U.S. profits. This ITEP report provides the first comprehensive look at how the new corporate tax laws that took effect after the passage of the 2017 Tax Cuts and Jobs Act affects the scale of corporate tax avoidance.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

Rep. Doggett and Sen. Whitehouse Reintroduce Bill to End Offshore Tax Avoidance

March 15, 2019 • By Lorena Roque

On Thursday, Representative Lloyd Doggett and Senator Sheldon Whitehouse announced that they are reintroducing the “No Tax Breaks for Outsourcing Act.” Our international corporate tax rules have been a mess for a long time, and Tax Cuts and Jobs Act (TCJA) failed to resolve the problems. The old rules and the new rules under TCJA both tax offshore corporate profits more lightly than domestic corporate profits, but in different ways. The No Tax Breaks for Outsourcing Act would create rules that tax domestic profits and foreign profits in the same way.

Fear, Not Facts: Netflix Misleads Media Reporting on Corporate Tax Avoidance

February 13, 2019 • By Matthew Gardner

In an age when even the most incontrovertible facts are routinely dismissed as “fake news,” reporting on corporate taxes can be a daunting challenge for members of the media. ITEP’s recent analysis of the income tax disclosures made by Netflix in its annual financial report last week provide an excellent reminder of this.

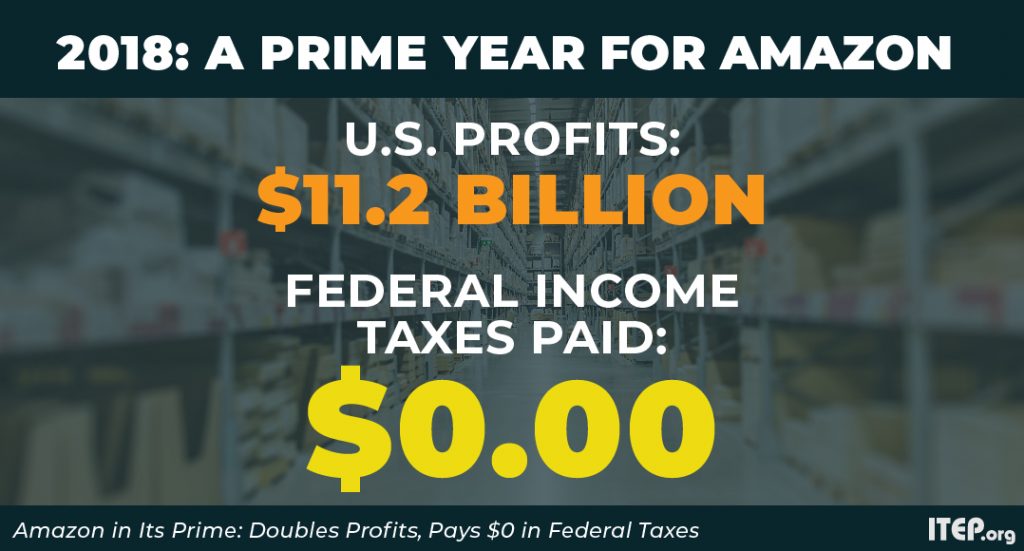

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

February 13, 2019 • By Matthew Gardner

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.

Joint Letter: End the Tax Extenders Once And For All

December 7, 2018 • By ITEP Staff

A joint letter to Congressional leadership and the heads of the taxwriting committees making the case that it is time to end the practice of enacting tax policy one year at a time.

New Legislation Aims to Change Tax Law Provisions That Incentivize Outsourcing

November 29, 2018 • By Richard Phillips

Sen. Amy Klobuchar (D-MN) and several Senate co-sponsors this week introduced the Removing Incentives for Outsourcing Act, which curbs harmful new incentives created by the Tax Cuts and Jobs Act (TCJA) that encourage companies like GM to move their profits and operations offshore.

GM Announcement Confirms Tax Cuts Don’t Prevent, May Encourage Layoffs

November 27, 2018 • By Matthew Gardner

GM’s most recent quarterly financial report reveals the company has saved more than $150 million so far this year due to last year’s corporate tax cuts. So the layoffs announcement may seem especially jarring to anyone who believed President Trump’s claim that his tax cuts would spur job creation—including the Ohio residents Trump told directly “don’t sell your homes” because lost auto-making jobs “are all coming back.”

ITEP’s corporate tax research examines the tax practices of major corporations. Besides its corporate study on average effective tax rates paid by the nation’s largest, most profitable corporations, throughout the year, ITEP produces research on subjects such as offshore cash holdings, tax haven abuse, executive stock options and other tax loopholes. See ITEP’s more recent study of profitable corporations’ tax rates.