Corporate Taxes

New Legislation Aims to Change Tax Law Provisions That Incentivize Outsourcing

November 29, 2018 • By Richard Phillips

Sen. Amy Klobuchar (D-MN) and several Senate co-sponsors this week introduced the Removing Incentives for Outsourcing Act, which curbs harmful new incentives created by the Tax Cuts and Jobs Act (TCJA) that encourage companies like GM to move their profits and operations offshore.

GM Announcement Confirms Tax Cuts Don’t Prevent, May Encourage Layoffs

November 27, 2018 • By Matthew Gardner

GM’s most recent quarterly financial report reveals the company has saved more than $150 million so far this year due to last year’s corporate tax cuts. So the layoffs announcement may seem especially jarring to anyone who believed President Trump’s claim that his tax cuts would spur job creation—including the Ohio residents Trump told directly “don’t sell your homes” because lost auto-making jobs “are all coming back.”

New ITEP Report on Depreciation Breaks: The Most Important Tax Giveaway that People Don’t Know About

November 19, 2018 • By Steve Wamhoff

Many Americans sense that the tax code is riddled with unnecessary and costly breaks for big business, but if asked to name one, few would reply “accelerated depreciation.” While they may seem arcane, tax breaks like “full expensing” and other types of accelerated depreciation are among the central problems in our tax code. A new report from ITEP makes the case that any serious tax reform would repeal or sharply curb these provisions.

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

15 Companies Report an Average 10.4 Percentage Point Drop in Effective Tax Rates Since 2017

November 13, 2018 • By ITEP Staff

Comparing the year’s first three quarterly filings of 2018 with those of 2017, we find that 15 of the largest Fortune 500 companies reported worldwide effective income tax rates declining by an average of 10.4 percentage points and by as much as 16 percentage points. In total these companies owed $22.3 billion less in taxes than they would have under their 2017 effective rates, saving an average of $1.5 billion each.

New Report Finds Tax Transparency Is Not Just Ethical: It Has a Real Fiscal Impact

November 5, 2018 • By Monica Miller

A new report by Hubertus Wolff and Michael Overesch finds that public country-by-country reporting (CBCR) can have a significant fiscal impact. In fact, the report shows that new CBCR rules applied to European banks appear to have substantially increased the tax rates paid by banks that engage in tax-haven activities. This means that CBCR may not just improve the integrity of the tax system and provide critical information so investors can gauge investment risks, but may also have a much more immediate impact on curbing tax avoidance.

Post-TCJA, International Corporate Tax System Still Leaking Hundreds of Billions in Profits

November 5, 2018 • By Richard Phillips

A recently released working paper from Kimberley Clausing of Reed College finds that U.S. corporations will avoid taxes on nearly $300 billion in offshore profits every year for the foreseeable future. The paper provides an informative new look into the level of offshore tax avoidance before and after the Tax Cuts and Jobs Act (TCJA). While advocates of the TCJA claimed the tax law would end tax haven abuse through lowering the statutory rate and other measures, Clausing’s analysis shows that the TCJA will still allow the vast majority of offshore tax avoidance to remain intact.

Lawmakers Want Working People to Foot the Bill for Top-Heavy Tax Cuts

October 18, 2018 • By ITEP Staff

Earlier this week, the Treasury Department reported that the federal deficit this fiscal year climbed by 17 percent to $779 billion, and next year is expected to be at least $1 trillion. The increased deficit comes after Congress last December passed an unpopular tax cut (The Tax Cuts and Jobs Act) that will cost nearly $2 trillion over a decade. GOP leaders repeatedly claimed the measure would pay for itself and not increase annual deficits, in spite of multiple economic predictions to the contrary.

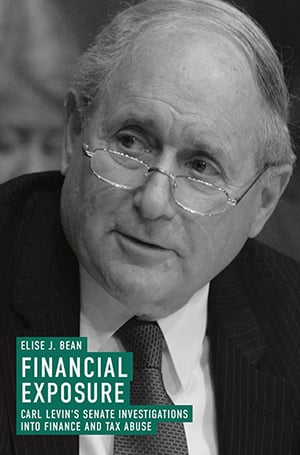

‘Financial Exposure’ Showcases Tax Misconduct by Powerful Individuals and Corporations

October 10, 2018 • By Peter Della-Rocca

Elise J. Bean’s Financial Exposure reiterates the point that tax avoidance and tax evasion were endemic to our financial system long before allegations against a sitting president brought them to the forefront of the public consciousness.

Oxfam Report Finds Pharmaceuticals Profiteering Off Crises in Developing Countries

September 20, 2018 • By Peter Della-Rocca

The report indicates, pharmaceutical companies have taken steps to hide their profits in low-tax countries, sapping billions in revenue from the governments that invest in the science that drives their products and safeguard the patents that undergird their business. Pharmaceutical companies made use of a familiar battery of methods to exploit the international system this way, including inversions to disguise an American company as a foreign one and passing profits into low-tax jurisdictions through artificial usage fees on intangible assets like intellectual property.

New Study Confirms Offshore Earnings are Flowing into Stock Buybacks, Not Jobs and Investments

September 7, 2018 • By Richard Phillips

A new study by the Federal Reserve found that the evidence so far suggests that the new repatriation tax break has resulted in a surge in stock buybacks and little discernable impact in investment by its biggest beneficiaries, just as critics predicted.

How should lawmakers fix the system? A new ITEP report breaks down how the international corporate tax code under the TCJA works, and how lawmakers can fix it. The report lays out three key principles for reform: equalize the rates, eliminate inversions, and create transparency.

Understanding and Fixing the New International Corporate Tax System

July 17, 2018 • By Richard Phillips

The Tax Cuts and Jobs Act (TCJA) radically changed the international tax system. It slashed taxes on corporate income, both domestic and foreign. It encouraged U.S. multinational corporations to shift jobs, profits, and tangible property abroad, and keep intangibles home. This report describes the new international tax system—and its many gaps—and also provides a road map for how to fix these gaps and surveys recent legislative approaches.

New Legislation Would Close Significant Offshore Loopholes in the Tax Cuts and Jobs Act

June 6, 2018 • By Richard Phillips

One simple rule should drive the nation’s international tax policies: tax the offshore profits of American companies the same way their domestic profits are taxed. The latest legislation to approach that ideal is the Per-Country Minimum Act (H.R. 6015), from Rep. Peter DeFazio (D-OR). The DeFazio bill closes the loophole that allows corporations to use foreign tax credits to shelter profits in tax havens from U.S. taxes. No other bill addresses this.

The New International Corporate Tax Rules: Problems and Solutions

June 6, 2018 • By Steve Wamhoff

The nation’s corporate tax system has been dysfunctional for decades. Unfortunately, the recently enacted Tax Cuts and Jobs Act (TCJA) fails to solve fundamental problems facing the corporate tax and, in some ways, makes these problems even worse.

ITEP’s Senior Policy Analyst Richard Phillips Remarks at Facebook Shareholders Meeting in Favor of Tax Principles Resolution

May 31, 2018 • By Richard Phillips

Read the Remarks in PDF Listen to Webcast of Shareholders Meeting (Richard’s remarks begin at 21:20) My name is Richard Phillips and I am here to present Item 8 on behalf of the AFL-CIO Office of Investments. This proposal requests that the board articulate a set of responsible global tax principles that ensure the company […]

Facebook Facing Shareholder Scrutiny for Its Offshore Tax Avoidance

May 30, 2018 • By Richard Phillips

In advance of its annual shareholders meeting on May 31, Facebook was confronted with a shareholder resolution asking it to endorse a set of principles to guide its tax policy and to ensure that such principles consider the impact of its tax strategies on local economies and public services. The resolution is a signal from a group of concerned shareholders that Facebook’s tax avoidance hurts its reputation, the communities in which it operates, and creates financial risks to the company’s shareholders.

Apple’s Three-Month Tax Savings under President Trump’s New Tax Law: $1.68 Billion

May 2, 2018 • By Matthew Gardner

By now, it should come as no shock that profitable Fortune 500 corporations are reaping huge benefits from the corporate tax cuts enacted last December. But as first quarter earnings reports are released, we’re learning just how big.

15 Companies Report Tax Savings of $6.2 Billion in First Three Months of 2018

April 26, 2018 • By Matthew Gardner

In reports released over the past week, covering the first three months of 2018, a few of the biggest and most profitable Fortune 500 corporations acknowledge receiving billions in tax cuts in the first quarter of 2018 alone. Fifteen of these companies collectively disclosed reducing their effective tax rates by $6.2 billion compared to the rates they faced in the first quarter of last year.

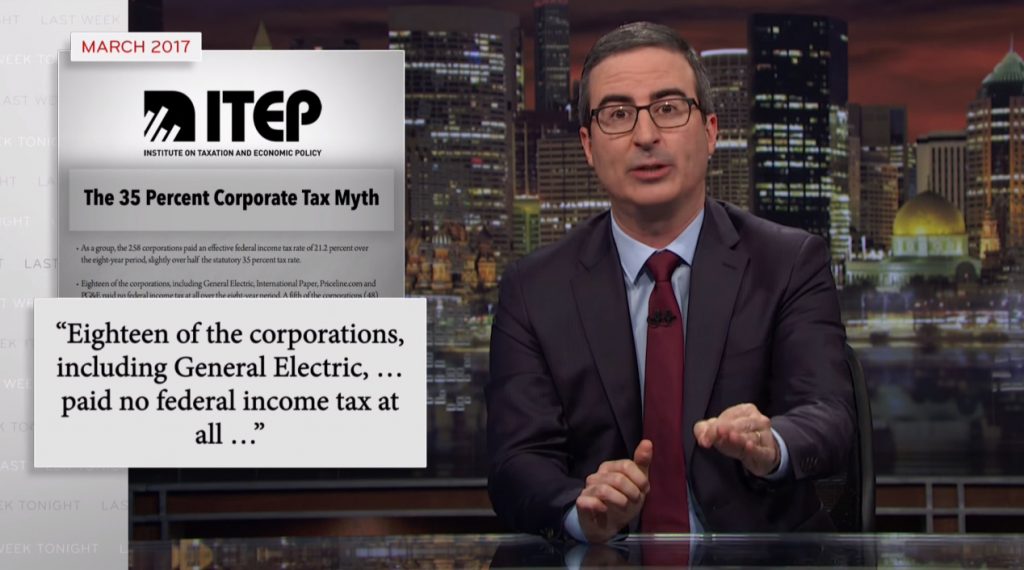

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

Many Large Corporations Reporting Tax Cut-Inspired Employee Bonuses Were Paying Low Tax Rates to Begin With

April 12, 2018 • By Matthew Gardner

Since the corporate tax cut took effect at the beginning of 2018, a number of large corporations have announced plans to give bonuses or pay raises to some of their employees. Some of these companies have explicitly said that the new tax law, which sharply reduced the federal corporate income tax rate from 35 to 21 percent, made these moves possible. But an examination of the tax-paying habits of these corporations found that many of them used various tax breaks and accounting maneuvers to reduce their tax rates to below 21 percent year after year before the new tax law…

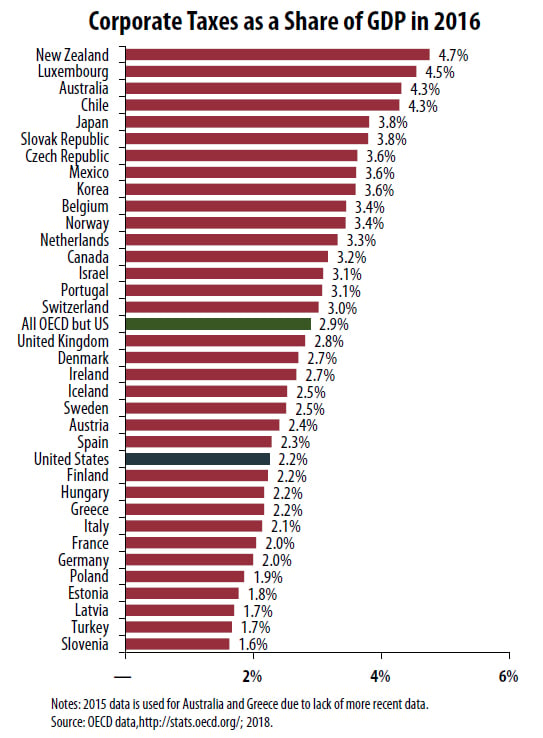

Trump Tax Cuts Likely Make U.S. Corporate Tax Level Lowest Among Developed Countries

April 11, 2018 • By Richard Phillips

U.S. corporate tax collection was equal to 2.2 percent of the nation’s gross domestic product (GDP) in 2016, significantly less than the average 2.9 percent collected by the other 34 other OECD countries for which data were available.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

Fifteen (of Many) Reasons We Need Real Corporate Tax Reform

April 11, 2018 • By Matthew Gardner

This ITEP report examines a diverse group of 15 corporations’ federal income tax disclosures for tax year 2017, the last year before the recently enacted tax law took effect, to shed light on the widespread nature of corporate tax avoidance. As a group, these companies paid no federal income tax on $24 billion in profits in 2017, and they paid almost no federal income tax on $120 billion in profits over the past five years. All but one received federal tax rebates in 2017, and almost all paid exceedingly low rates over five years.

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

ITEP’s corporate tax research examines the tax practices of major corporations. Besides its corporate study on average effective tax rates paid by the nation’s largest, most profitable corporations, throughout the year, ITEP produces research on subjects such as offshore cash holdings, tax haven abuse, executive stock options and other tax loopholes. See ITEP’s more recent study of profitable corporations’ tax rates.