Taxing Wealth and Income from Wealth

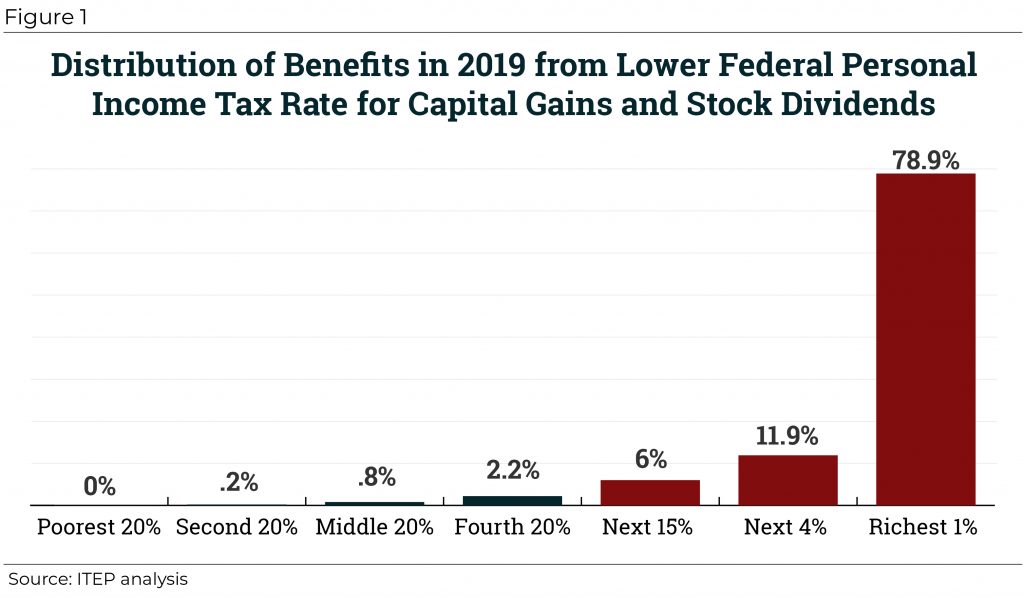

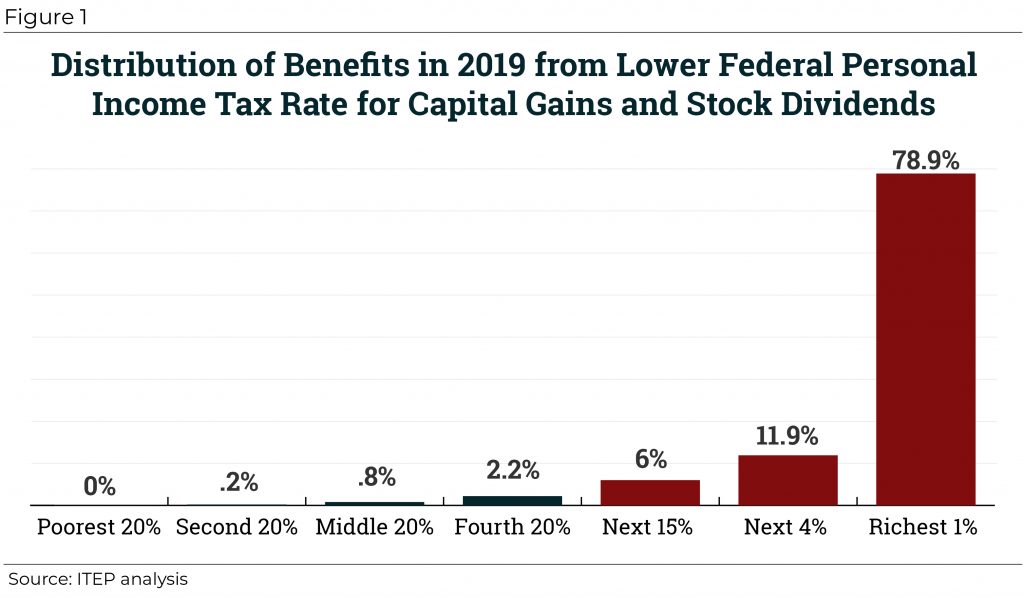

One of the most glaring sources of unfairness in the federal tax code are rules that tax capital gains, which mostly go to the rich, less than wages and other types of income that most of us depend on. The capital gains tax breaks have for decades been comfortably ensconced behind trenches filled with special interests who would defend them until the end. But the end is now conceivable.

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and address economic inequality. This new video from ITEP makes the case for a federal wealth tax.

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting

September 12, 2019 • By Steve Wamhoff

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

A direct federal tax on wealth, as described in a January report from ITEP and proposed by Sen. Elizabeth Warren, could raise substantial revenue to make public investments, curb rising inequality, and is supported by a large majority of Americans. But would it work? Recent research highlighted in a new academic paper outlines approaches that would make it easier than you might think.

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

Why Trump Administration’s Plan to Index Capital Gains to Inflation Is Just Another Giveaway to the Wealthy

June 28, 2019 • By Steve Wamhoff

The White House is reported to be planning to unilaterally adjust the way capital gains are assessed to benefit the wealthiest Americans. The proposal would adjust capital gains for inflation, reducing taxes disproportionately for the wealthiest households who own most assets by limiting their taxable gains to those above and beyond the inflation rate.

Wealth Tax Is Supported by Basically Everyone Who Is Not a Politician

June 27, 2019 • By Steve Wamhoff

A February survey found that 61 percent of registered voters supported a wealth tax proposal, including 51 percent of Republican voters. And it’s not just the non-rich wanting to tax the very rich. A June survey found that 60 percent of millionaires support the idea.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

File Under “No Surprise”: Wealthiest Taxpayers Use Offshore Tax Shelters More Than the Rest of Us, New Research Finds

June 4, 2019 • By Matthew Gardner

Tax evasion matters. It drains needed revenues from the public treasury, and saps public confidence in rules of the game. A recent Pew Research poll finds that 60 percent of Americans are bothered “a lot” by the feeling that the best-off don’t pay their fair share of taxes. And now, thanks to a new report, […]

ITEP Testimony Supporting H.B. No. 7415, An Act Concerning a Surcharge on Capital Gains

April 26, 2019 • By Aidan Davis

Comments are intended to offer some perspective on the broader tax policy context in which this proposal is being considered. We find that this proposal would help to lessen long-running inequities in Connecticut’s state and local tax law that have allowed high-income taxpayers to pay lower overall effective tax rates than most low- and middle-income families.

Sen. Ron Wyden of Oregon, the ranking Democrat on the Senate Finance Committee, announced that he would soon release a proposal to eliminate massive tax breaks enjoyed by the wealthy on their capital gains income. If successful, the proposal would ensure that income from wealth is taxed just like income from work.

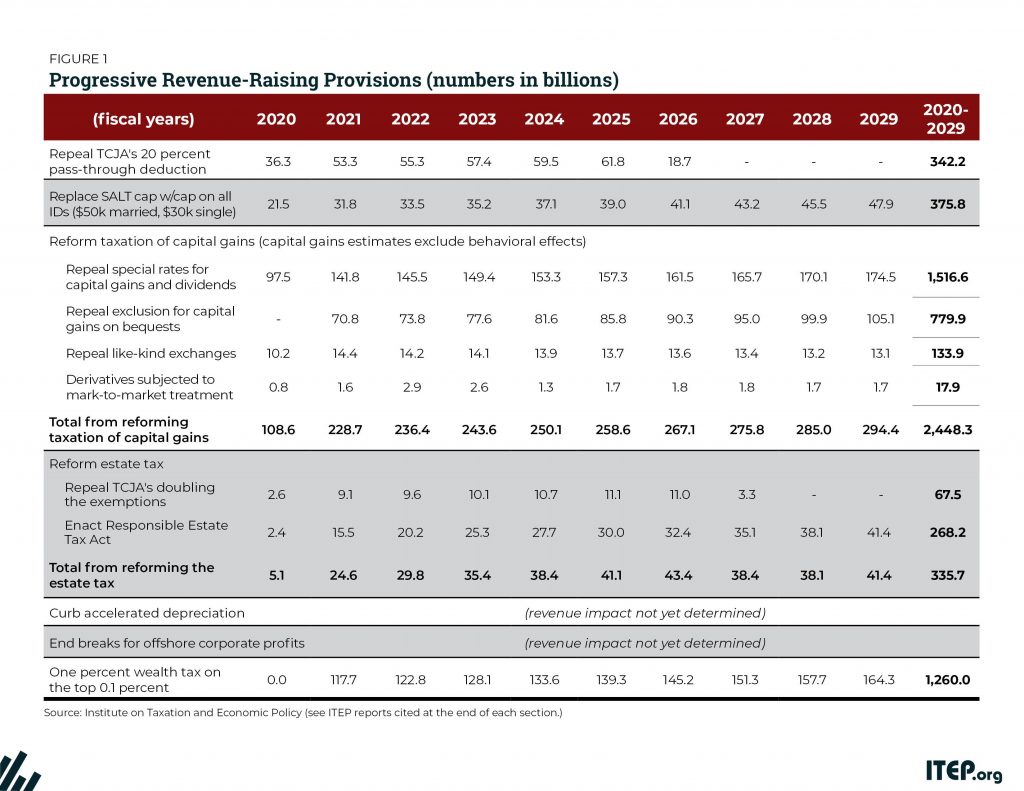

America has long needed a more equitable tax code that raises enough revenue to invest in building shared prosperity. The Tax Cuts and Jobs Act (TCJA), enacted at the end of 2017, moved the federal tax code in the opposite direction, reducing revenue by $1.9 trillion over a decade, opening new loopholes, and providing its most significant benefits to the well-off. The law cut taxes on the wealthy directly by reducing their personal income taxes and estate taxes, and indirectly by reducing corporate taxes.

Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains

February 1, 2019 • By Steve Wamhoff

Even though income derived from capital gains receives a special lower tax rate and is therefore undertaxed, some proponents of lower taxes on the wealthy claim that capital gains are overtaxed due to the effects of inflation. But existing tax breaks for capital gains more than compensate for any problem related to inflation. Congress should repeal or restrict special tax provisions for capital gains rather than creating even more breaks.

Why We Should Talk about Progressive Taxes Despite Billionaires’ Objections

January 30, 2019 • By Jenice Robinson

It was the tone-deaf remark heard ‘round the world. Last week on CNBC’s Squawk Box, Commerce Secretary Wilbur Ross suggested that furloughed government employees who hadn’t been paid in a month could go to a bank and get a loan to make ends meet. This was not a gaffe. It’s hard to fathom how a […]

The Preferential Tax Treatment of Capital Gains Income Should Be Curbed, Not Substantially Expanded

August 1, 2018 • By Richard Phillips

For true believers in supply-side economics, however, one major flaw of the TCJA is that it did not further cut taxes for the wealthy by reducing capital gains tax rates. But now the Trump Administration is considering using executive action to remedy this by indexing capital gains to inflation for tax purposes.

ITEP analyzes proposals to address the many special breaks in loopholes for income from wealth, such as capital gains and stock dividends. We also analyze the federal estate tax, which is a tax on wealth itself, as well as proposals to create a comprehensive federal wealth tax.