Colorado

President Joe Biden's American Families and Jobs plans intend to “build back better” and create a more inclusive economy. To fully live up to this ideal, the final plan must include undocumented people and their families.

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

State Rundown 6/24: Late June State Fiscal Debates Unusually Active

June 24, 2021 • By ITEP Staff

Delayed legislative sessions and protracted federal aid debates have made for a busier June than normal for state fiscal debates. Arizona, New Hampshire, and North Carolina legislators, for example, are still pushing for expensive and regressive tax cuts in their states while they remain in session...

State Rundown 5/27: State Legislatures Step Back, Advocates Push Forward

May 27, 2021 • By ITEP Staff

As more and more state legislatures wrap up their sessions and we reflect on the whirlwind that is this past year, it’s easy to focus on the steps back that states like Oklahoma have taken and Nebraska, North Carolina, and Arizona are trying to take. We have had some significant wins in states over the course of the year, but not every development will be a good one. However, we know advocates are on the ground, working tirelessly to help states maintain equity and progressivity in their tax codes. And for that, we have many of you—our intrepid readers of…

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

It was a relatively quiet week in state fiscal policy, likely partly due to states waiting for federal guidance on some of the details in the American Rescue Plan. As they await those details, lawmakers in Mississippi and West Virginia continue to wrangle over whether to recklessly eliminate their income taxes, while leaders in states including Connecticut and New York considered more productive and progressive reforms. And in the meantime, groundbreaking work on the intersection of race and tax policy is now available.

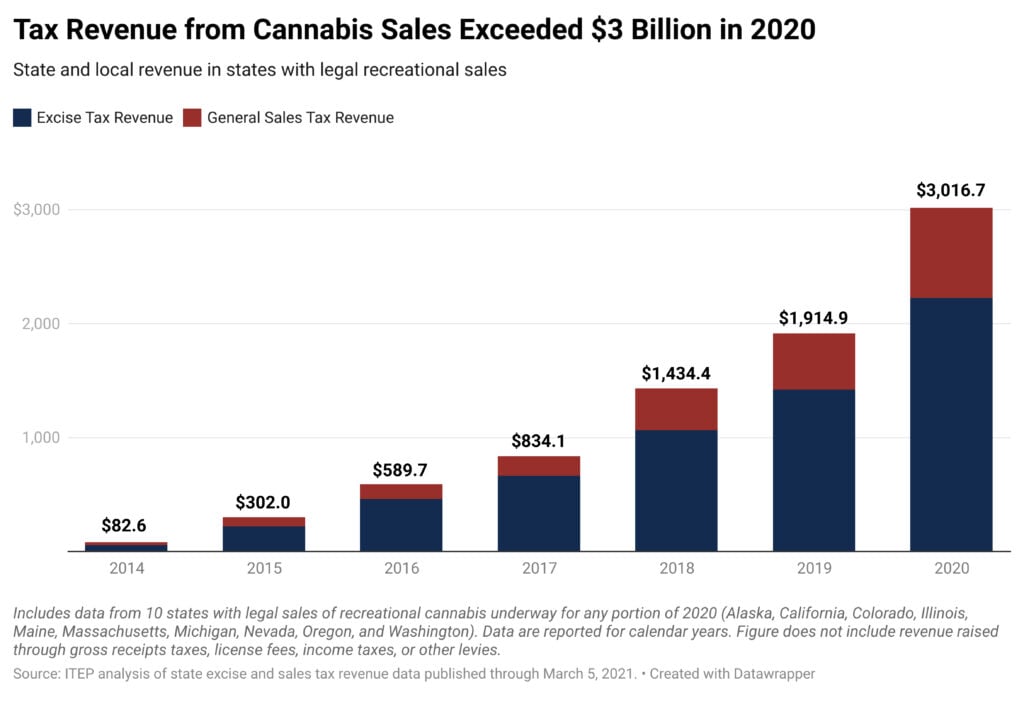

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

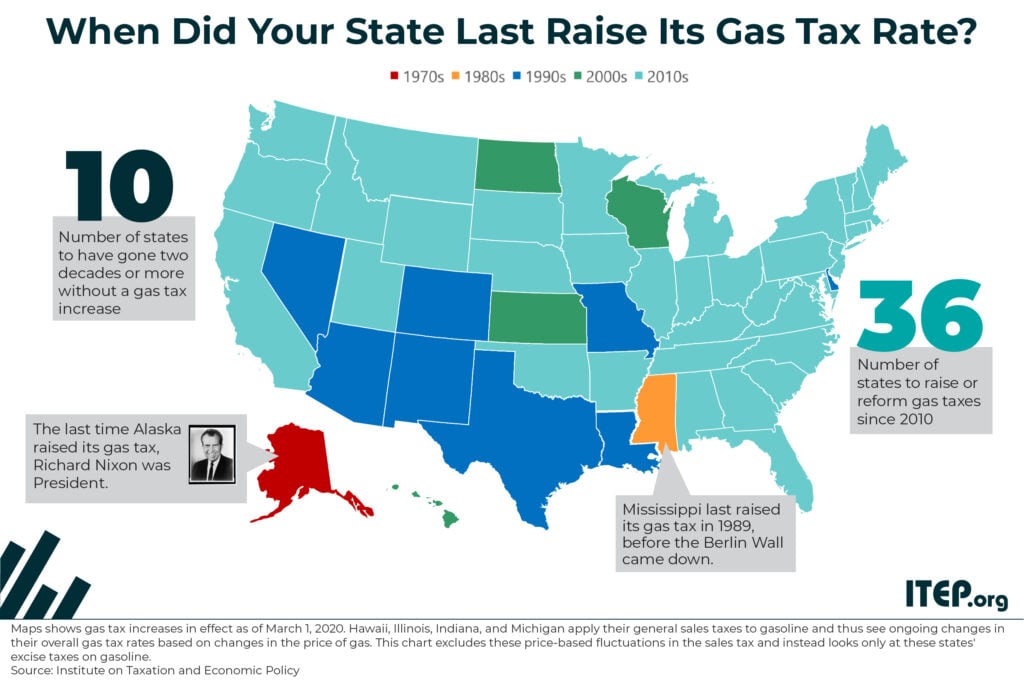

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Although lawmakers in some states continue to push for expensive and regressive tax cuts that would primarily benefit wealthy households, worsen economic and racial injustices, and undermine funding for key public services, this week’s state fiscal news is dominated by efforts to do the opposite. Leaders in the District of Columbia, Maine, Nebraska, New York, Washington, and Wyoming made recent headlines by advocating for policies that improve on upside-down tax codes and generate needed funding for shared priorities like schools and health care.

Marketplace: High-income taxpayers help some states stay above water

March 1, 2021

However, in 22 states, tax revenue actually increased, with revenue in four states — Idaho, Utah, South Dakota and Colorado — up more than 5%. Revenue fell in the remaining states, with seven down more than 10% —Texas, Oregon, Florida, Nevada, North Dakota, Hawaii and Alaska. This disparity has a lot to do with the […]

State Rundown 2/24: State Tax Debates Quickly Thaw Out with Warmer Weather

February 24, 2021 • By ITEP Staff

Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas…

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

Does New York’s Cannabis Tax Idea Offer a Glimpse of the Future?

February 9, 2021 • By Carl Davis

Taxing cannabis won’t end New York’s budget difficulties, but a potency tax could bring New York a more sustainable stream of cannabis tax revenue than we see in most states. It could also have significant benefits for cannabis consumers.

State Rundown 1/22: Somewhere Between a Flurry and a Blizzard of State Tax Activity So Far

January 22, 2021 • By ITEP Staff

You won’t find any images of Bernie Sanders and his mittens photoshopped into this week’s Rundown, but you will find the latest news on state fiscal debates, including proposals to generate needed funding by raising taxes on high-income households and profiting businesses in California, Delaware, Hawaii, Maryland, and Washington, as well as misguided efforts to slash taxes in Arizona, Iowa, South Carolina, Utah, and West Virginia. Also in the news are thoughtful improvements to targeted tax credits for families in need in Connecticut and Maryland, harmful obstacles to revenue generation proposed in Nebraska and Wyoming, and renewed hope on the…

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

Ghosts of Fiscal Crunches Past, Present, Future Have Advice for State Lawmakers

December 21, 2020 • By Dylan Grundman O'Neill

State policymakers and advocates may face some long sleepless nights as they close the book on 2020 and prepare for the important decisions they’ll be making in 2021 and beyond. So we at ITEP have consulted with ghosts of fiscal crunches past, present, and future, and distilled their lessons into seven key things to keep in mind for 2021 tax and budget debates:

These EITC Reforms Would Help Struggling Families Now and Address Systemic Challenges

December 4, 2020 • By Aidan Davis

The tepid economic recovery is leaving millions behind. The nation still has nearly 10 million jobs less than it did in February, according to the latest jobs report. The number of people living in or near poverty is rising. Twelve million workers are about to lose their unemployment insurance, roughly four in 10 people report experiencing food insecurity for the first time, and conditions are likely to deteriorate further in the weeks ahead as we brace for another deadly surge in COVID cases and new or tightened restrictions on business and personal activity.

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

State Rundown 11/13: States Can Find Inspiration in Arizona Ballot Success; Must Look to Congress for More Immediate Help

November 13, 2020 • By ITEP Staff

Although progressive tax policy doesn’t always succeed in in statehouses or voting booths, Arizona voters showed once again that when offered a clear choice, most people resoundingly support requiring fairer tax contributions from rich individuals and highly profitable corporations over allowing their schools and other shared priorities to wither and decay. Still, a similar effort in Illinois and a more complicated measure in California were defeated, and anti-tax zealots in West Virginia and many other states will continue to push for tax cuts for the rich and defunding public investments, leaving much work to be done to advance tax justice.

Voters Have the Chance in 2020 to Increase Tax Equity in Arizona, Illinois, and California, And They Should

October 22, 2020 • By Marco Guzman

There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects brought on by the coronavirus pandemic and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

The Colorado Sun: Amendment B puts spotlight on Gallagher’s mixed legacy of budget cuts, tax relief and inequality in Colorado

September 15, 2020

Notably, property taxes are regressive — though not as much as sales tax, according to the left-leaning Institute on Taxation and Economic Policy. Read more

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.