Corporate Tax Watch

President Trump’s 2021 Budget: Promises Made, Promises Broken

February 10, 2020 • By Steve Wamhoff

President Trump has kept only one of his promises--his pledge to lower taxes for corporations and their investors. The budget plan he released today again breaks his promise to reject cuts in Medicaid that would affect millions of people. His budget once again fails to eliminate the deficit, much the less the national debt, during his presidency as he promised. It cuts trillions from safety net programs and student aid programs despite his pledge to stand for forgotten Americans.

If President Trump puts forth another tax proposal this year, as he is hinting, it will be his third. The second round, already costing the U.S. Treasury billions, was implemented largely out of the public’s view.

From 0% to 1.2%: Amazon Lauds Its Minuscule Effective Federal Income Tax Rate

January 31, 2020 • By Matthew Gardner

If we focus on the taxes the company paid in 2019, we see an effective federal income tax rate of just 1.2 percent. And since the company enjoyed federal income tax rebates in 2017 and 2018, this means that over the last three years Amazon has paid zero on $29 billion of U.S. pretax income.

GOP Legacy on IRS Administration: Auditing Mississippi, not Microsoft

January 24, 2020 • By Matthew Gardner

Money doesn’t buy happiness—but it can buy immunity from the reach of Uncle Sam. The IRS is outgunned in cases against corporate giants because that’s how Republican leaders want it to be. They have systematically assaulted the agency’s enforcement capacity through decades of funding cuts. Instead of saving money, these cuts have cost billions: each dollar spent on the IRS results in several dollars of tax revenue collected.

Guilty, Not GILTI: Unclear Whether Corps Continue to Lower Their Tax Bills Via Tax Haven Abuse

January 7, 2020 • By Matthew Gardner

President Trump and GOP lawmakers often cited corporations’ abuse of tax havens, e.g. shifting profits offshore to avoid taxes, as justification for dramatically lowering the federal corporate tax rate under the 2017 Tax Cuts and Jobs Act. By 2016, corporations’ offshore cash haul had grown to $2.6 trillion, representing hundreds of billions in lost federal tax […]

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

Corporate tax avoidance boosts companies’ bottom lines, and this benefits the owners of corporate stocks, which are mostly concentrated in the hands of the well-off. The cost of corporate tax dodging is borne by everyone, in several different ways.

More of the Same: Corporate Tax Avoidance Hasn’t Changed Much Under Trump-GOP Tax Law

December 16, 2019 • By Matthew Gardner

A new report from ITEP released today shows that, based on the first year of financial reports released by companies operating under the new tax law, tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect.

Fortune 500 Companies Avoided $73.9 Billion in Tax Under First Year of Trump Tax Law

December 16, 2019 • By Matthew Gardner

A comprehensive examination of Fortune 500 companies’ financial filings in 2018, the first year of the Tax Cuts and Jobs Act, finds that the law did nothing to curb corporate tax avoidance, with 91 companies paying $0 in taxes on U.S. income in 2018 and profitable companies overall paying a collective effective tax rate of 11.3 percent, which is barely more than half the 21 percent rate established by the tax law, the Institute on Taxation and Economic Policy (ITEP) said today.

Corporate Tax Avoidance in the First Year of the Trump Tax Law

December 16, 2019 • By ITEP Staff, Lorena Roque, Matthew Gardner, Steve Wamhoff

Profitable Fortune 500 companies avoided $73.9 billion in taxes under the first year of the Trump-GOP tax law. The study includes financial filings by 379 Fortune 500 companies that were profitable in 2018; it excludes companies that reported a loss.

Earlier this year, Amazon and Netflix made headlines when ITEP reported findings that these and at least 58 other companies paid no federal income taxes in 2018. One of the tax breaks they use to manage this feat is related to stock options. Some companies saved hundreds of millions, and in some cases more than a billion dollars, in taxes in 2018 alone with this break. It’s time for Congress to eliminate the stock options tax dodge.

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

House Passes Landmark Bipartisan Bill to Crack Down on Shell Companies Used for Tax Evasion and Other Crimes

October 24, 2019 • By Steve Wamhoff

On Tuesday night, 25 Republicans joined nearly all the chamber’s Democrats to approve the Corporate Transparency Act, a bill that would require those creating a company to report its owners to the federal government. The White House expressed support but called for the House and Senate to work on certain details, creating the possibility that the measure could be enacted.

Depreciation Tax Breaks Are a Problem that Deserves More Attention

October 18, 2019 • By Steve Wamhoff

Sen. Bernie Sanders’ recently released corporate tax plan would shut down the major breaks and loopholes that allow corporations to dodge taxes. The reforms in his plan that are most likely to get attention are proposals to shut down offshore tax dodging, as ITEP has long called for.

Business Roundtable’s Newfound Devotion to Corporate Responsibility Doesn’t Include Paying Taxes

August 20, 2019 • By Matthew Gardner

If you squint really hard, the Business Roundtable’s newly declared fondness for “supporting the communities in which we work” could be read as an acknowledgment of the need for a tax system that can pay for needed services. But it’s not.

One Tax System for Most Americans, and a Second System for the Wealthiest

August 16, 2019 • By Matthew Gardner

Last year, the Walton family's fortune grew by $100 million a day. This level of wealth is particularly obscene in the context of the Walmart Corporation’s dark store strategy. The company works nationwide to reduce its property tax assessments, which, when successful, deprives local communities of revenue necessary to fund education, libraries, parks, public health and other services.

Taxing Offshore Profits and Domestic Profits Equally Could Curb Corporate Tax Dodging

August 9, 2019 • By Steve Wamhoff

In recent days, presidential candidates Sen. Kamala Harris and New York Mayor Bill DeBlasio have called for taxing corporate profits the same whether they are earned in the United States or abroad. These calls echo the position of Sen. Bernie Sanders, who has long had a proposal along these lines. As ITEP has explained, correcting […]

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

Things Get Worse for Uber: Ride-Sharing Giant’s Taxes Under Scrutiny

June 4, 2019 • By Matthew Gardner

Since Uber’s much-hyped initial public offering last month, the news has been relentlessly bad for the scandal-plagued ride-sharing company. The company’s share price has fallen by 8 percent from its initial $45, meaning that billions of dollars of the company’s apparent value have vanished. This week the news got a little worse: Uber is under […]

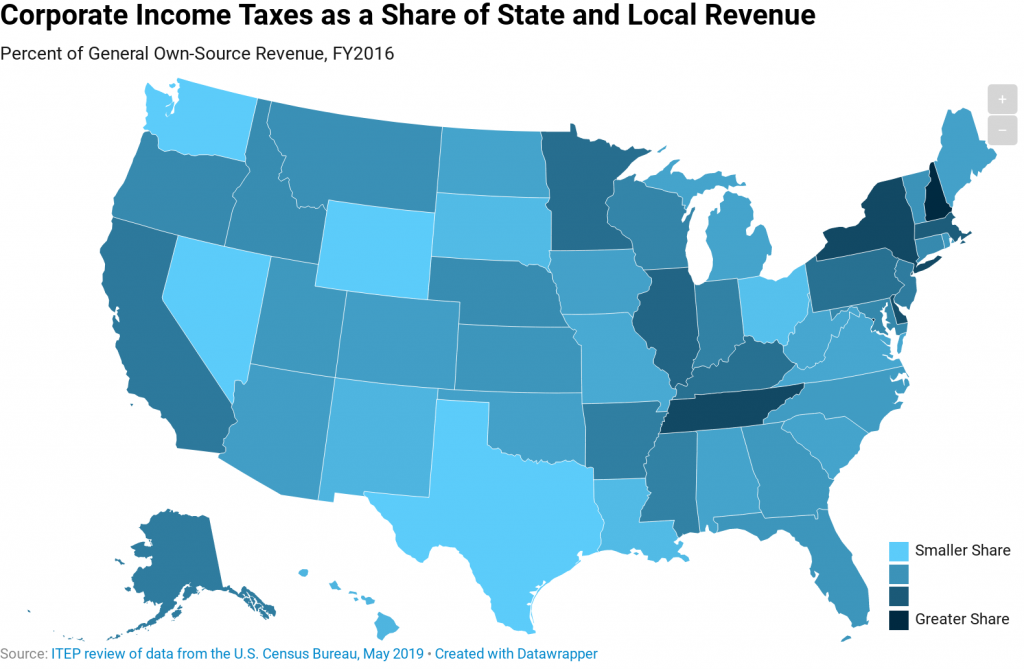

Corporate income taxes are an important source of revenue for state governments and ensure that profitable corporations benefiting from public services pay toward the maintenance of those services.

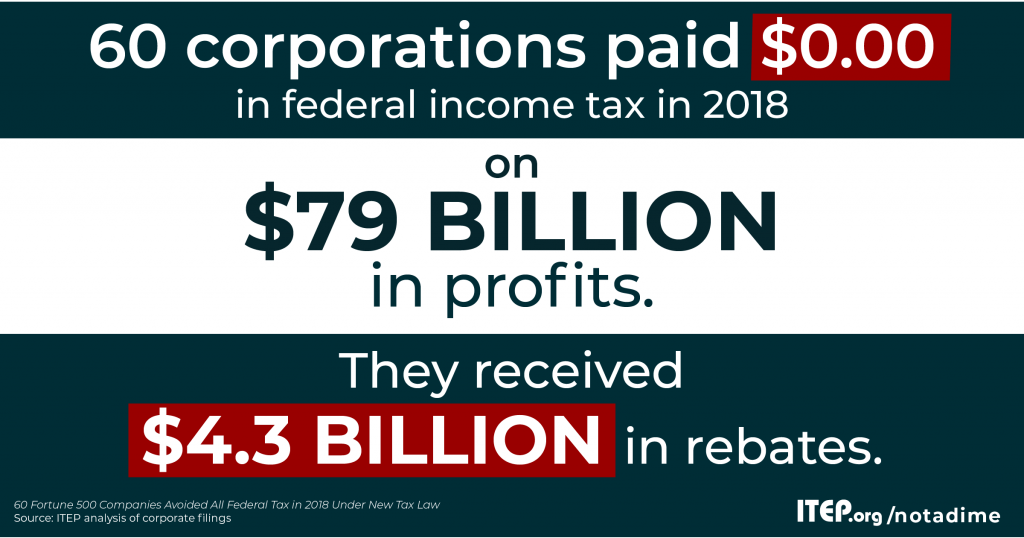

$4.3 Billion in Rebates, Zero-Tax Bill for 60 Profitable Corps Directly Related to Loopholes

April 12, 2019 • By Matthew Gardner

Meet the new corporate tax system, same as the old corporate tax system. That’s the inescapable conclusion of a new ITEP report assessing the taxpaying behavior of America’s most profitable corporations. The report, Corporate Tax Avoidance Remains Rampant Under New Law, released earlier this week, finds that 60 Fortune 500 corporations disclose paying zero in federal income taxes in 2018 despite enjoying large profits.

Corporate Tax Avoidance Remains Rampant Under New Tax Law

April 11, 2019 • By Lorena Roque, Matthew Gardner, Steve Wamhoff

For decades, profitable Fortune 500 companies have been able to manipulate the tax system to avoid paying even a dime in tax on billions of dollars in U.S. profits. This ITEP report provides the first comprehensive look at how the new corporate tax laws that took effect after the passage of the 2017 Tax Cuts and Jobs Act affects the scale of corporate tax avoidance.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

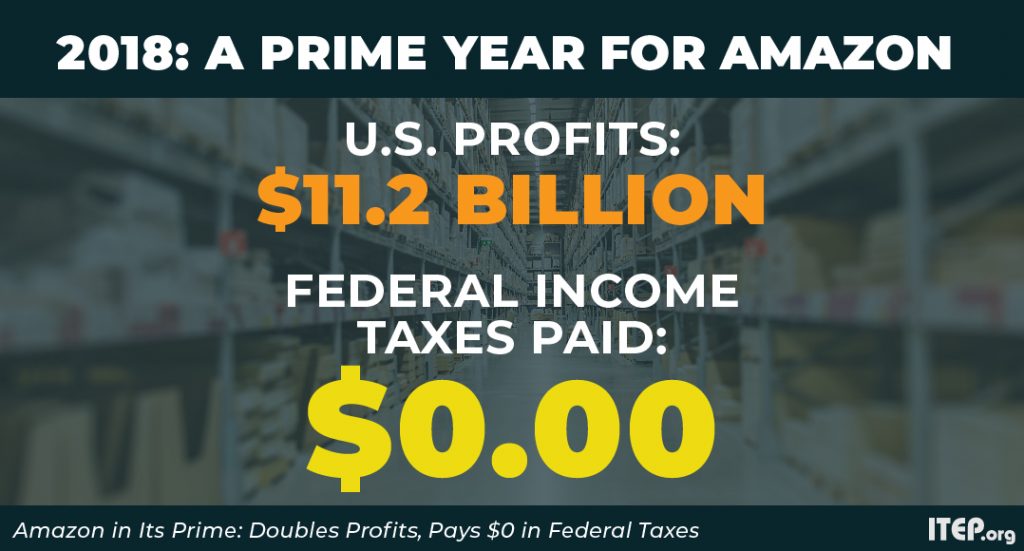

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

February 13, 2019 • By Matthew Gardner

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.