Florida

New Study: Increase in Working from Home Could Depress Commercial Real Estate Prices, Reduce Local Tax Revenue

November 4, 2021 • By ITEP Staff

Covid-19 dramatically altered how and where many employees work, a shift that could have a long-term negative effect on commercial real estate occupancy rates and, ultimately, on local governments’ tax revenue base, a new study reveals. The Impact of Work from Home on Commercial Property Values and the Property Tax in U.S. Cities concludes that even as the recovery strengthens, if […]

The Impact of Work From Home on Commercial Property Values and the Property Tax in U.S. Cities

November 4, 2021 • By ITEP Staff

The fiscal implications of a decline in commercial property values are important because the property tax is the dominant local source of taxes, and commercial property makes up a significant portion of the property base in cities.

The end of Spooky Season is near but that hasn’t stopped state lawmakers from adding their frightening plans into the bubbling cauldron of bad tax policy ideas...

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

Florida Policy Institute: A Working Floridians Tax Rebate for a Stronger and More Equitable Florida

September 24, 2021

Floridians who are paid lower wages spend significantly more of their income on state and local taxes than those with high income. This is because the state lacks a personal income tax and relies mostly on the sales tax to raise revenue. The state’s upside-down tax code also exacerbates racial inequity because Floridians with low […]

We asked New York state resident Morris Pearl, former Blackrock executive and current chair of the Patriotic Millionaires, a few questions to hear straight from the mouth of a millionaire how the SALT cap and its proposed repeal would affect his life.

Eliminating the State Income Tax Would Wreak Havoc on Mississippi

August 25, 2021 • By Kamolika Das

History has repeatedly shown that such policies harm state economies, dismantle basic public services, and exacerbate tax inequities.

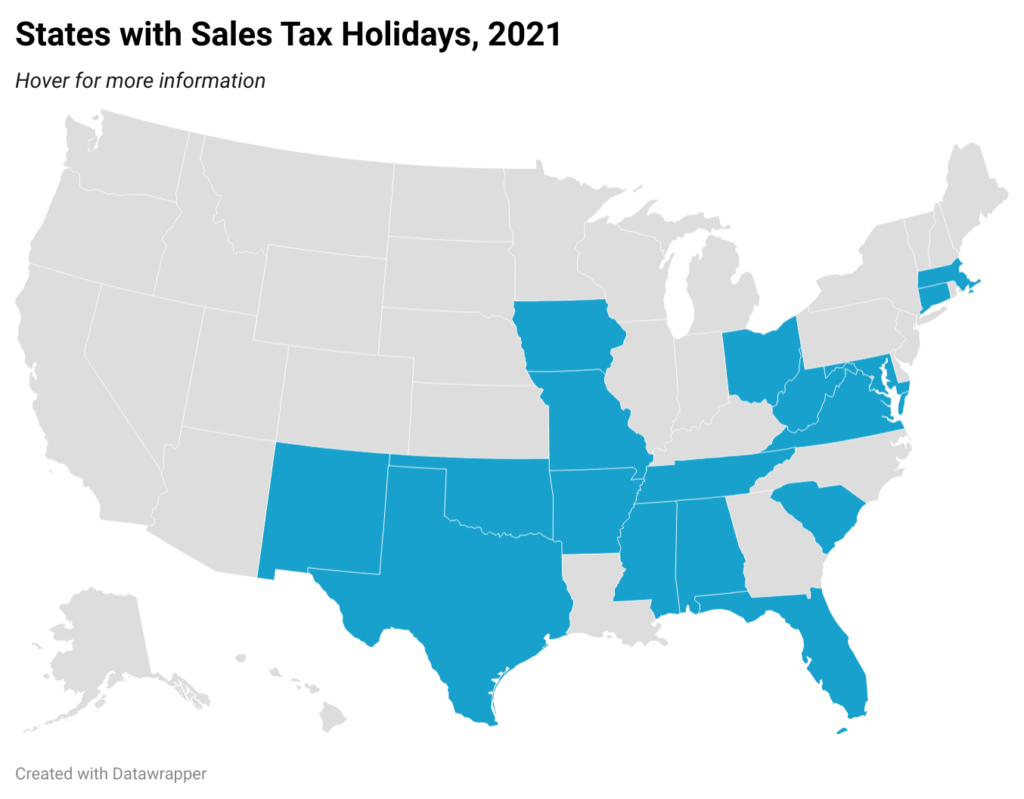

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 7/7: The New Fiscal Year Starts off With a Bang, And Not Just Fireworks

July 7, 2021 • By ITEP Staff

States were busy over the past week despite the Fourth of July holiday. Many are gearing up for upcoming tax and budget clashes that could shape their futures for some time...

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

Taxing rich households and large corporations to fund vital investments in education and other shared priorities has long been a winner in the eyes of the American public, and more recently has also enjoyed a string of victories in state legislatures and at the ballot box. That win streak continued this week as Arizona’s voter-approved tax surcharge on the rich and Seattle, Washington’s payroll tax on high-profit, high-salary businesses both survived court challenges, and Massachusetts leaders approved a millionaires tax to go before voters next year.

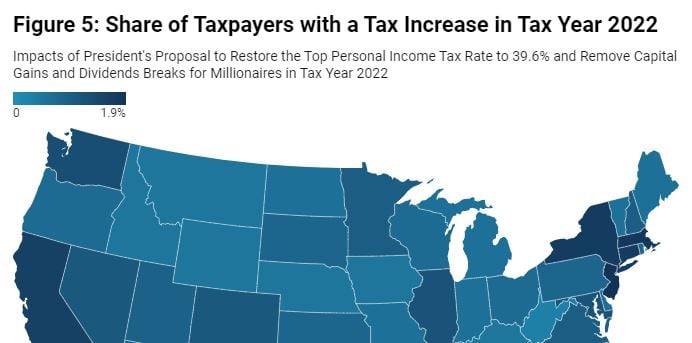

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

Jacobin: In Washington State, the Left Won a Major Victory for Taxing the Rich

May 14, 2021

Last week, Washington State passed a capital gains tax aimed at the state’s ultra-wealthy. The tax is historic because Washington, despite its progressive reputation, until now had the worst tax code in the nation when it comes to fairness, behind Texas, Florida, and South Dakota. A landmark 2018 report by the Institute on Taxation and […]

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Attacks on Voting Rights, Secret Tax-Cut Negotiations in Arizona Reflect Broader Trend to Undermine Democracy

May 13, 2021 • By Carl Davis, ITEP Staff, Jenice Robinson

The onslaught of news about multiple states introducing or passing legislation to make it harder to vote is a clear signal that our democracy is in crisis. Decades of policymaking and judicial rulings have created a system in which the voices of the wealthy and powerful have more weight, and some lawmakers are determined to further rig the system and keep it that way.

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

This week’s state fiscal news brings a reminder that even though advocates for great economic and racial justice have won some major progressive victories recently, anti-tax zealots have been hard at work too. Lawmakers advanced or enacted troubling regressive tax cuts or shifts in Idaho, Kansas, and Montana, and are actively debating them in Iowa, […]

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

Bloomberg: Biden Targets $41 Billion Tax Break for Real Estate Investors

April 28, 2021

Simply put, that it unfairly benefits wealthier Americans who can afford to make large investments. Middle-class families, meanwhile, are never likely to own many assets outside their own homes and 401(k)s. The left-leaning Institute on Taxation and Economic Policy argues the tax break has expanded far from its original intention of supporting small-scale transactions and […]

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

State Rundown 4/1: Most States Resisting Foolish Tax Cut Games That Tear Revenues Apart

April 1, 2021 • By ITEP Staff

Supporters of tax fairness and adequate funding for public needs are hoping West Virginia’s income tax elimination effort turns out to be a prank, but most states are not fooling around with such harmful policies this year. For example...

Florida Policy Institute: Florida Policymakers Need to Reassess How the Minimum Wage is Enforced

March 4, 2021

Finally, the state budget could take a hit if wage theft persists. Sales tax revenue as an effect of higher minimum wages is particularly relevant to highlight in Florida. The state lacks a personal income tax and over 75 percent of its general revenue fund is comprised of sales tax revenue. General revenue supports critical […]