Iowa

How the Revised Senate Tax Bill Would Affect Iowa Residents’ Federal Taxes

November 13, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Iowa, 34 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

How the House Tax Proposal Would Affect Iowa Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

State Rundown 10/25: Marijuana Taxes a Bright Spot amid Underperforming State Revenues

October 25, 2017 • By ITEP Staff

This week in state tax news saw Alaska begin yet another special session, Louisiana lawmakers holding meetings to begin preparing for the state’s looming (self-imposed) fiscal cliff, and Alabama policymakers beginning a study of school finance (in)adequacy and (in)equity. Meanwhile, state revenue performance is poor well into 2017 in many states, though Montana, Nevada, and Oregon are all enjoying modest but welcome revenue bumps from legalized marijuana.

Tax Foundation Updates Its Problematic Wishlist for State Tax Policy

October 18, 2017 • By Carl Davis

This week the Tax Foundation published its 2018 State Business Tax Climate Index, or as University of Iowa economist Peter Fisher has nicknamed it, the “Waste of Time Index.”

State Rundown 10/13: Soda Taxes, Business Subsidies, and Gas Taxes Considered in Several States

October 13, 2017 • By ITEP Staff

A comprehensive tax study is underway in Arkansas this week as other states hone in on more specific issues. Soda taxes hit setbacks in Illinois and Michigan, business tax subsidies faced scrutiny in Iowa and Missouri, and gas tax update efforts are underway in Mississippi and North Dakota.

Select State News Coverage of ITEP’s 50-State Analysis of the GOP Tax Proposal

October 10, 2017

The Sentinel: Trump Tax Even in Harrisburg Will Feature Truckers The Columbus Dispatch: 15% of Ohioans Could See Tax Increase Under GOP Plan KGW Portland: Richest Oregonians Benefit Most from Proposed Tax Cuts Raleigh News & Observer: The Racial Wealth Divide Could Grow with Tax Changes Northwest Indiana Times: Hoosiers Would Lose in Trump Tax […]

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

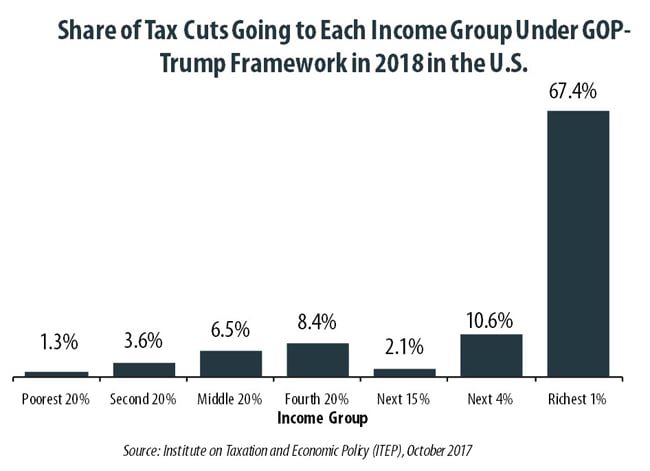

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

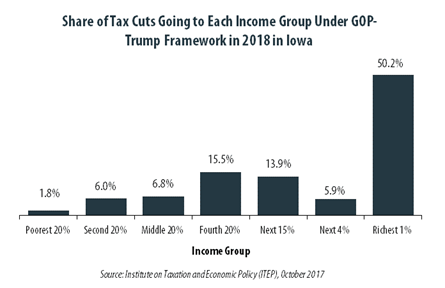

GOP-Trump Tax Framework Would Provide Richest One Percent in Iowa with 50.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Iowa equally. The richest one percent of Iowa residents would receive 50.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $440,800 next year. The framework would provide them an average tax cut of $50,050 in 2018, which would increase their income by an average of 4.3 percent.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

In Iowa 36.9 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Iowa population (0.4 percent) earns more than $1 million annually. But this elite group would receive 36.9 percent of the tax cuts that go to Iowa residents under the tax proposals from the Trump administration. A much larger group, 43.0 percent of the state, earns less than $45,000, but would receive just 7.0 percent of the tax cuts.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

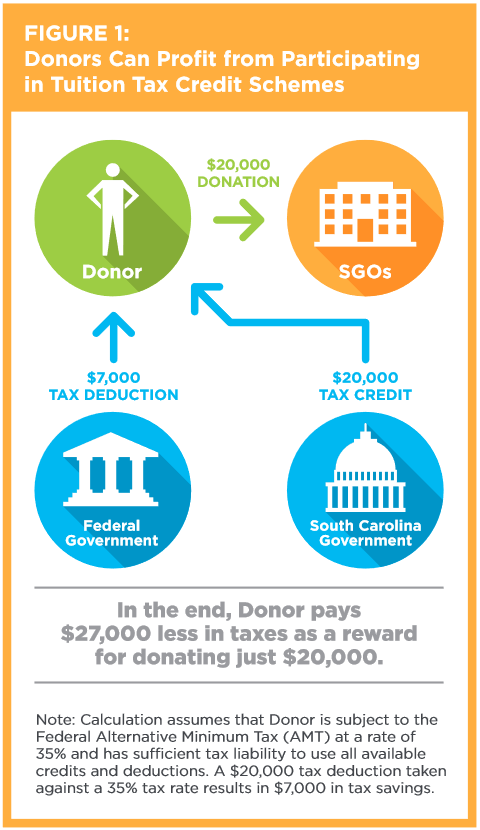

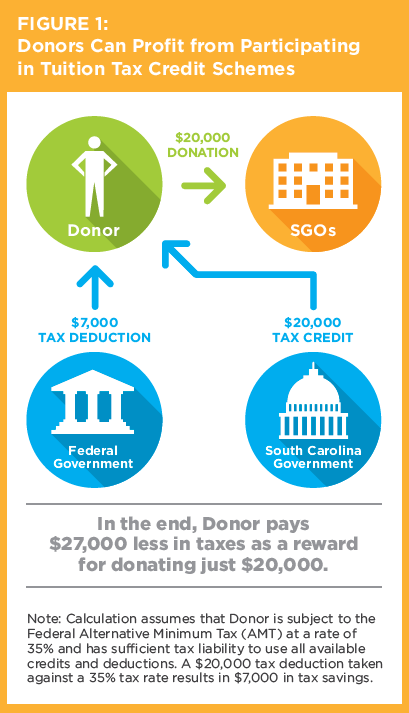

It’s a Fact: Voucher Tax Credits Offer Profits for Some “Donors”

August 9, 2017 • By Carl Davis

In nine states, tax rewards gained by donating to fund private K-12 vouchers are so oversized that “donors” can turn a profit. This is the shocking but true finding of a pair of studies released by ITEP over the last year.

Trump Tax Proposals Would Provide Richest One Percent in Iowa with 44.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Iowa would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,164,200 in 2018. They would receive 44.7 percent of the tax cuts that go to Iowa’s residents and would enjoy an average cut of $84,860 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

State Rundown 7/11: Some Legislatures Get Long Holiday Weekends, Others Work Overtime

July 11, 2017 • By ITEP Staff

Illinois and New Jersey made national news earlier this month after resolving their contentious budget stalemates. But they weren’t the only states working through (and in some cases after) the holiday weekend to resolve budget issues.

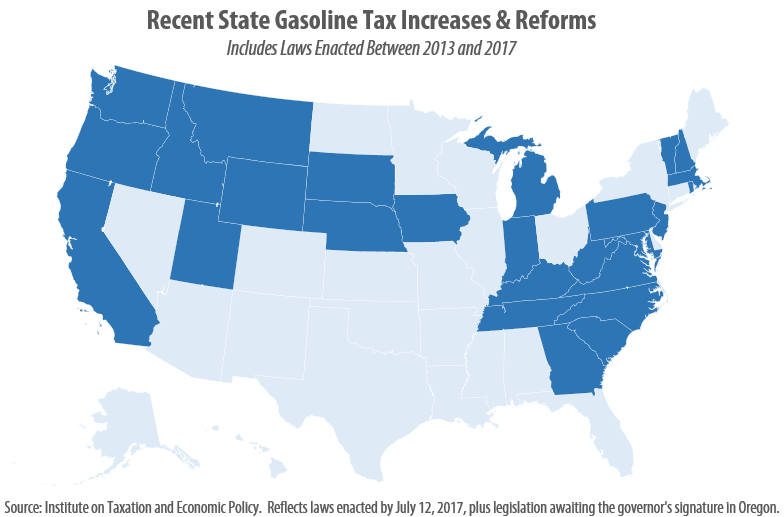

Gas Taxes Will Rise in 7 States to Fund Transportation Improvements

June 28, 2017 • By Carl Davis

Summer gas prices are at their lowest level in twelve years, which makes right now a sensible time to ask drivers to pay a little more toward improving the transportation infrastructure they use every day. Seven states will be doing this on Saturday, July 1 when they raise their gasoline tax rates. At the same time, two states will be implementing small gas tax rate cuts.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.