Louisiana

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

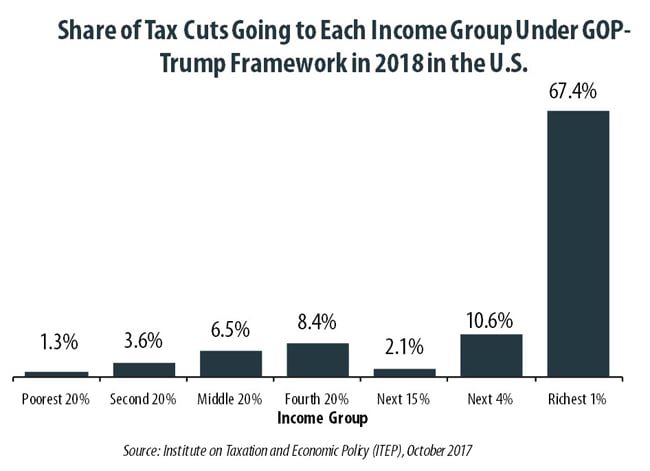

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

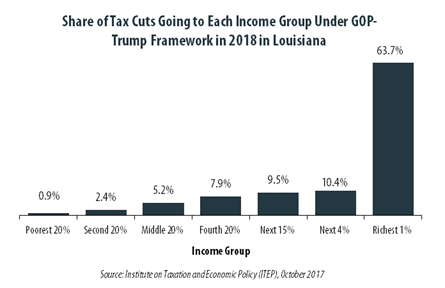

GOP-Trump Tax Framework Would Provide Richest One Percent in Louisiana with 63.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Louisiana equally. The richest one percent of Louisiana residents would receive 63.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $568,200 next year. The framework would provide them an average tax cut of $97,200 in 2018, which would increase their income by an average of 6.4 percent.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

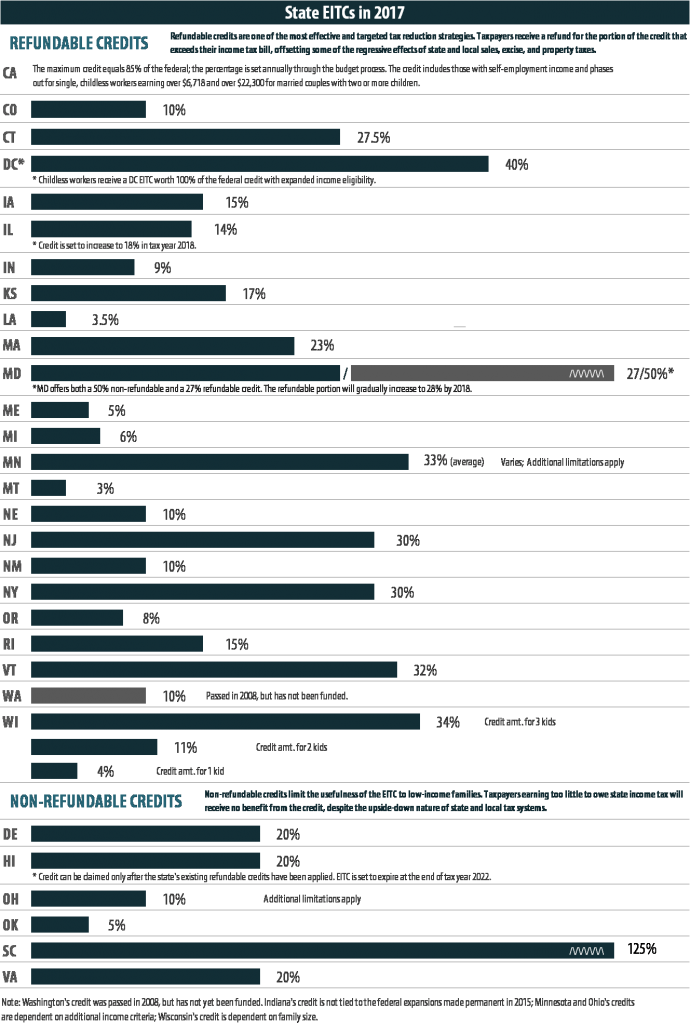

Rewarding Work Through State Earned Income Tax Credits in 2017

September 11, 2017 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

In Louisiana 41.5 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Louisiana population (0.3 percent) earns more than $1 million annually. But this elite group would receive 41.5 percent of the tax cuts that go to Louisiana residents under the tax proposals from the Trump administration. A much larger group, 45.6 percent of the state, earns less than $45,000, but would receive just 3.1 percent of the tax cuts.

This week, Rhode Island lawmakers agreed on a budget, leaving only three states – Connecticut, Pennsylvania, and Wisconsin – without complete budgets. Texas, however, remains in special session and West Virginia could go back into another special session over tax issues. And in New York City, the mayor proposes a tax on the wealthy to […]

State Rundown 8/2: Legislative Tax Debates Wind Down as Ballot Initiative Efforts Ramp Up

August 2, 2017 • By ITEP Staff

Budget deliberations continue in earnest this week in Alaska, Connecticut, Pennsylvania, and Rhode Island. In South Dakota and Utah, the focus is on gearing up for ballot initiative efforts to raise needed revenue, though be sure to read about legislators nullifying voter-approved initiatives in Maine and elsewhere in our "what we're reading" section.

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Trump Tax Proposals Would Provide Richest One Percent in Louisiana with 55.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Louisiana would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,521,500 in 2018. They would receive 55.6 percent of the tax cuts that go to Louisiana’s residents and would enjoy an average cut of $155,290 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2017 • By ITEP Staff

Sales taxes are an important revenue source, composing close to half of all state tax revenues. But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 16 states will hold them in 2017), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief…

Gas Taxes Will Rise in 7 States to Fund Transportation Improvements

June 28, 2017 • By Carl Davis

Summer gas prices are at their lowest level in twelve years, which makes right now a sensible time to ask drivers to pay a little more toward improving the transportation infrastructure they use every day. Seven states will be doing this on Saturday, July 1 when they raise their gasoline tax rates. At the same time, two states will be implementing small gas tax rate cuts.

State Rundown 6/21: Crunch Time for Many States with New Fiscal Year on Horizon

June 21, 2017 • By Meg Wiehe

This week several states rush to finalize their budget and tax debates before the start of most state fiscal years on July 1. West Virginia lawmakers considered tax increases as part of a balanced approach to closing the state’s budget gap but took a funding-cuts-only approach in the end. Delaware legislators face a similar choice, […]

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.

This week saw tax debates heat up in many states. Late-session discovered revenue shortfalls, for example, are creating friction in Delaware, New Jersey, and Oklahoma, while special sessions featuring tax debates continue in Louisiana, New Mexico, and West Virginia. Meanwhile the effort to revive Alaska's personal income tax has cooled off.

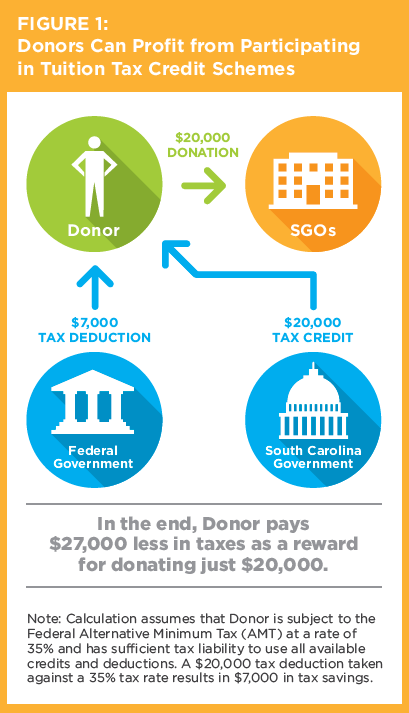

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

State Rundown 5/10: Spring Tax Debates at Different Stages in Different States

May 10, 2017 • By Meg Wiehe

This week saw a springtime mix of state tax debates in all stages of life. In West Virginia and Louisiana, debates over income tax reductions and comprehensive tax reform are full of vigor. Other debates that bloomed earlier are now settled, such as Florida‘s now-complete budget debate and the more florid debates over gas taxes […]

Two states are on the verge of embracing a tried and tested anti-poverty policy, the Earned Income Tax Credit (EITC). In the past two weeks, lawmakers in both Hawaii and Montana passed EITC legislation, which governors in both states are expected to sign. Once officially enacted, these states will join 26 other states and the […]