Maine

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

Maine Beacon: Report: Maine losing $52 million annually to corporations using offshore tax havens

February 10, 2020

The amount of money U.S. companies move through tax havens is considerable. Fortune 500 companies made $2.6 trillion in offshore profits in 2016, according to the Institute on Taxation and Economic Policy. Read more

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

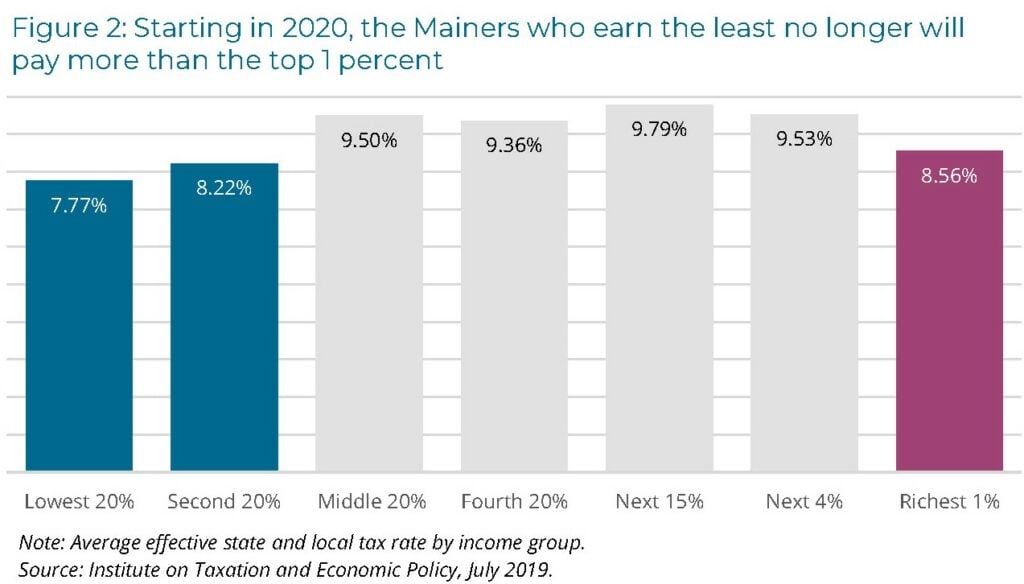

Lawmakers in Maine this year took bold steps toward making the state’s tax system fairer. Their actions demonstrate that political will can dramatically alter state tax policy landscape to improve economic well-being for low-income families while also ensuring the wealthy pay a fairer share.

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2019

September 26, 2019 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

Press Herald: Think Tank Says Maine Has Reached ‘Tax Fairness’ Milestone

September 4, 2019

The center cited a 2018 report by the Washington, D.C.-based Institute on Taxation and Economic Policy that said only five states and the District of Columbia had tax codes in which the bottom 20 percent paid a lower average effective tax rate than the top 1 percent. It said legislative changes this year in Maine […]

MECEP: NEW REPORT: Maine reaches new milestone on the road to tax fairness

September 4, 2019

Starting in 2020 and for the first time in decades, the Mainers who earn the least will no longer pay a larger share of their income to state and local taxes than those who earn the most, according to a policy brief published today by the Maine Center for Economic Policy.

Many States Move Toward Higher Taxes on the Rich; Lower Taxes on Poor People

July 18, 2019 • By Meg Wiehe

Several states this year proposed or enacted tax policies that would require high-income households and/or businesses to pay more in taxes. After years of policymaking that slashed taxes for wealthy households and deprived states of revenue to adequately fund public services, this is a necessary and welcome reversal.

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

State Rundown 6/19: Juneteenth Highlights Role of State Policy in Racial Equity Fight

June 19, 2019 • By ITEP Staff

As Americans observe Juneteenth today–the day two years after the Emancipation Proclamation on which news of the end of the Civil War and slavery reached some of the last slaves in Texas—most people’s attention should be on celebrating victories, remembering losses, gathering strength to continue the fight for racial justice, and the accompanying Congressional reparations hearings. In comparison, state tax debates over matters such as reluctance to invest in infrastructure in Michigan and Missouri, approval of income tax cuts in Wisconsin, and a budget standoff in New Jersey may seem unimportant and irrelevant. But we encourage our readers to think about how state policies often serve to enrich and empower white and wealthy households, and…

State Rundown 6/12: Progress in Taxing the Rich, Expanding EITCs, and Taming Tax Subsidies

June 12, 2019 • By ITEP Staff

This week saw lawmakers in Ohio propose significant harmful tax cuts, leaders in California and Oregon work toward strengthening the state Earned Income Tax Credits (EITCs), and governors in Missouri and Kansas declare a truce to end the practice of bribing businesses in the Kansas City area with tax cuts to move from one side of the state line to the other. Meanwhile, Massachusetts leaders are discussing ways of raising taxes on their richest households, which our latest Just Taxes blog post notes is a promising trend this year across many states.

States are putting evidence into practice with multiple efforts to improve services and tax codes through more progressive taxes on the wealthy. Clear evidence has spread widely this year, informing a national conversation about progressive taxation and leading lawmakers in multiple states to eschew supply-side superstition and act on real evidence instead. Taxing the rich works, and in this Just Taxes blog we review state-level efforts to put these proven findings into effect.

Illinois made big news in several tax and budget areas recently, including sending a graduated income tax amendment to voters in 2020, as well as legalizing and taxing cannabis and updating gas and cigarette taxes for infrastructure improvements. Connecticut made smaller waves with sales tax reforms, a plastic bag tax, and a progressive mansion tax. Property tax credits were proposed in both Maine and New Jersey. And Nevada extended a business tax to give teachers a raise. And our What We’re Reading section is brimming with good reads on how states are doing with recovering from the Great Recession, funding…

Income inequality continues to be an undercurrent in public discourse about our economy and how working families are faring. It drove the national debate over the 2017 Tax Cuts and Jobs Act, which, mounds of data reveal has exacerbated the problem. Some elected federal officials have responded to this step backward with calls for higher […]

Like certain recent controversially concluded television shows, tax and budget debates can end in many ways and often receive mixed reviews. Illinois leaders, for example, ended on a cliffhanger by approving a historic constitutional amendment to create a graduated income tax in the state, whose ultimate conclusion will be crowdsourced by voters next November. Arizona’s fiscal finale fell flat with many observers due to corner-cutting on needed investments and a heavy focus on tax cuts. Texas legislators went for crowd-pleasing property tax cuts and school funding increases but left a gigantic “but how will we pay for this” plot hole…

State Rundown 4/26: Capital Gains Taxes Make Gains and Regressive Proposals Regress

April 26, 2019 • By ITEP Staff

Progressive capital gains tax proposals made news this week in Connecticut and Massachusetts, while Nebraskans came out in force to oppose a regressive tax shift, and North Carolina teachers prepare to rally over their legislature’s proclivity to cut taxes on wealthy households while underfunding schools.

Tax and budget debates are now mostly complete in Alabama, Arkansas, and Colorado, but just starting or just getting interesting in several other states. Delaware and Massachusetts lawmakers, for example, are looking at progressive income tax increases on wealthy households, and New Hampshire may use a progressive tax on capital gains to simultaneously improve its upside-down tax code and invest in education. Nebraska and Texas, on the other hand, are also looking to improve school funding but plan to do so on the backs of low- and middle-income families through regressive sales tax increases. Fiscal debates are heating up in…

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.