On the Map

56 posts

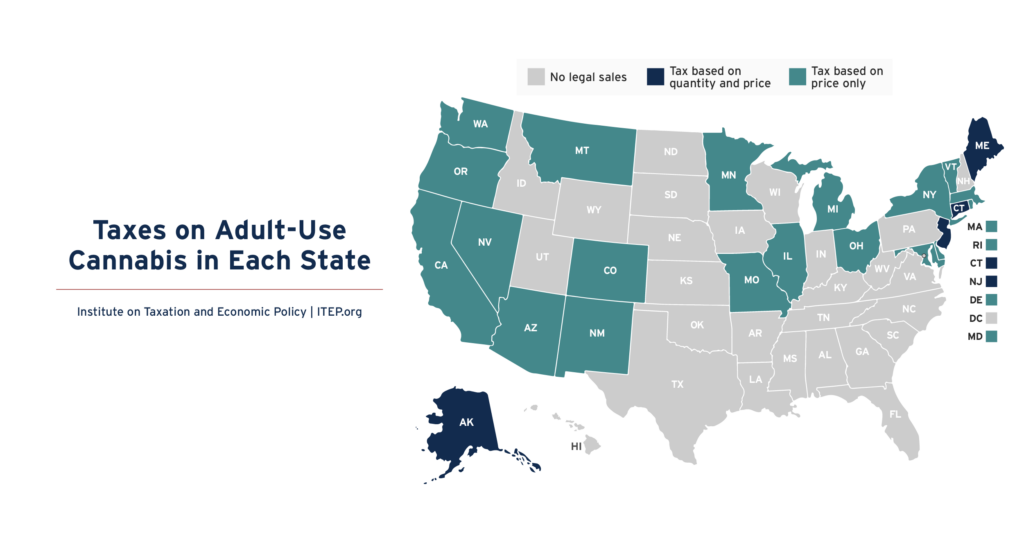

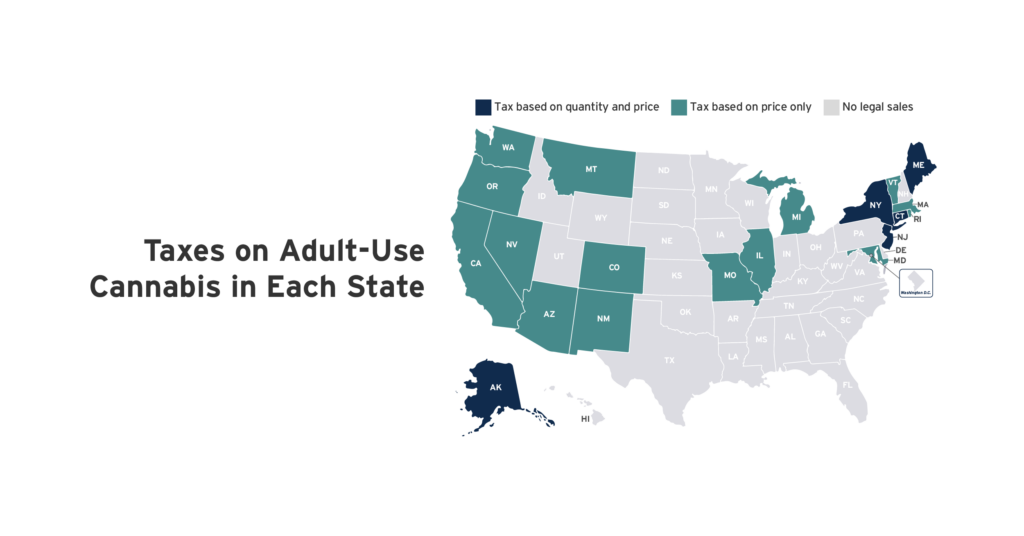

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes can be based on either overall product weight or the amount of THC sold. ITEP research indicates that taxes based on […]

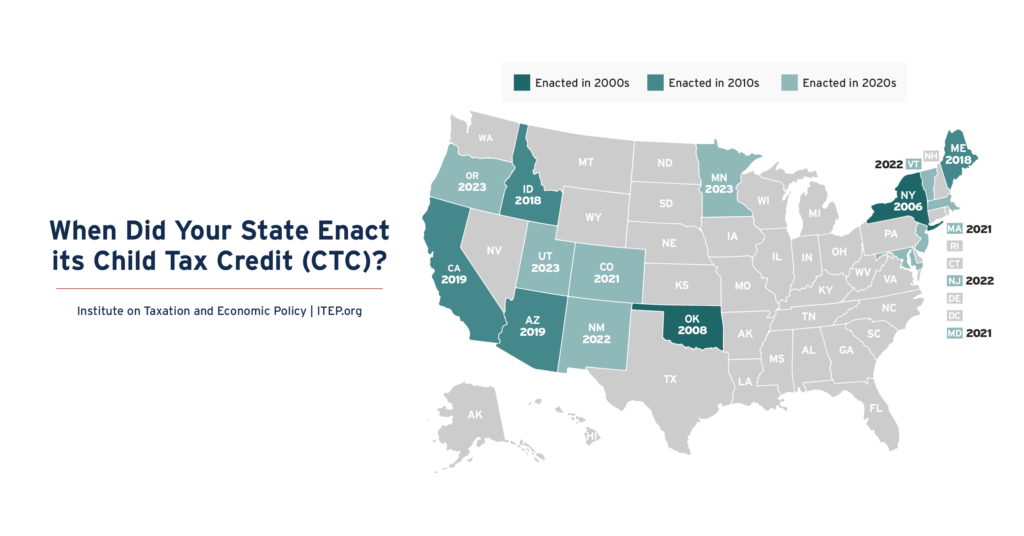

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

Two in Three Americans Live in States with Variable-Rate Gas Taxes

July 16, 2025 • By Carl Davis

As inflation and fuel efficiency undercut traditional gas tax revenue, many states are rethinking how they fund transportation. Lawmakers across the country are beginning to modernize outdated gas tax systems to keep pace with rising infrastructure costs and changing driving habits.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

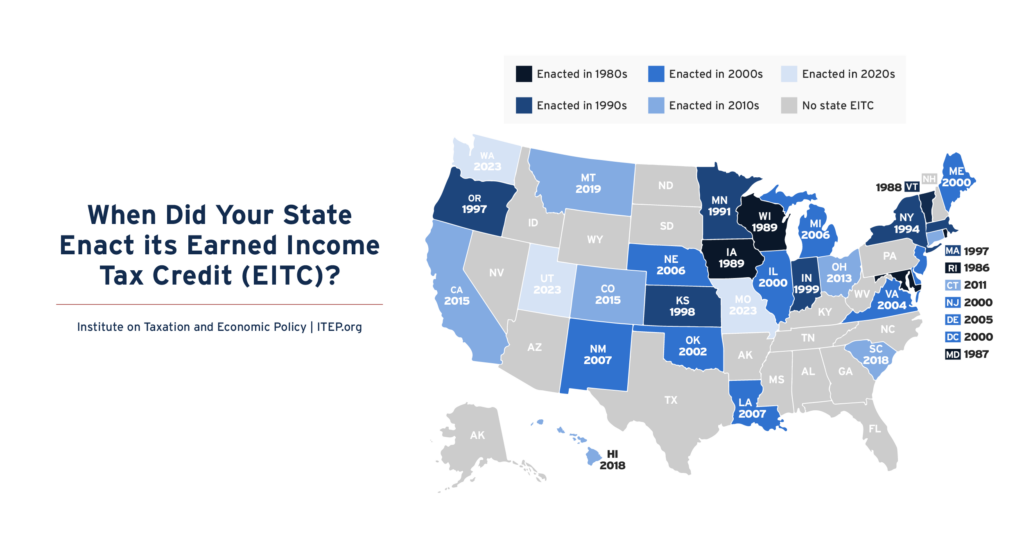

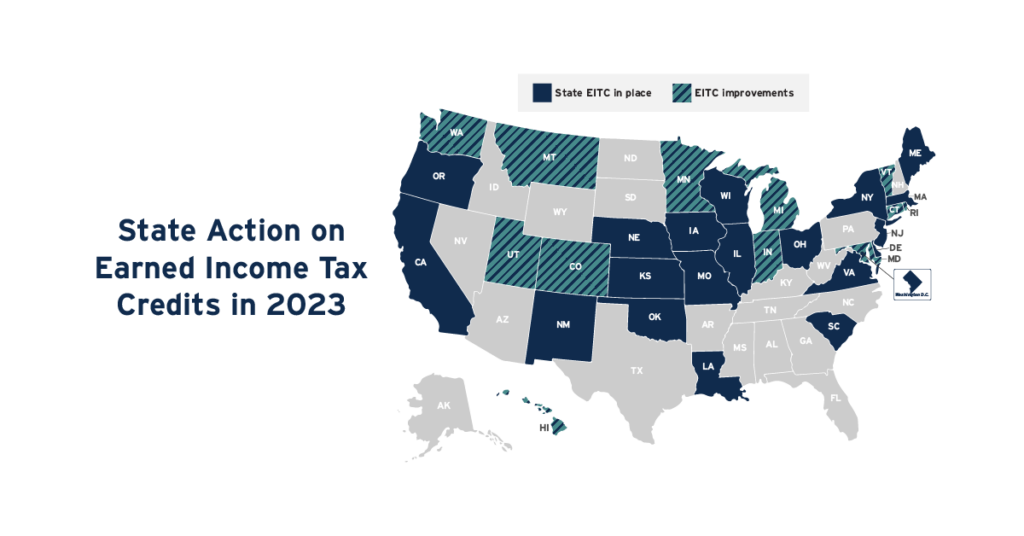

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

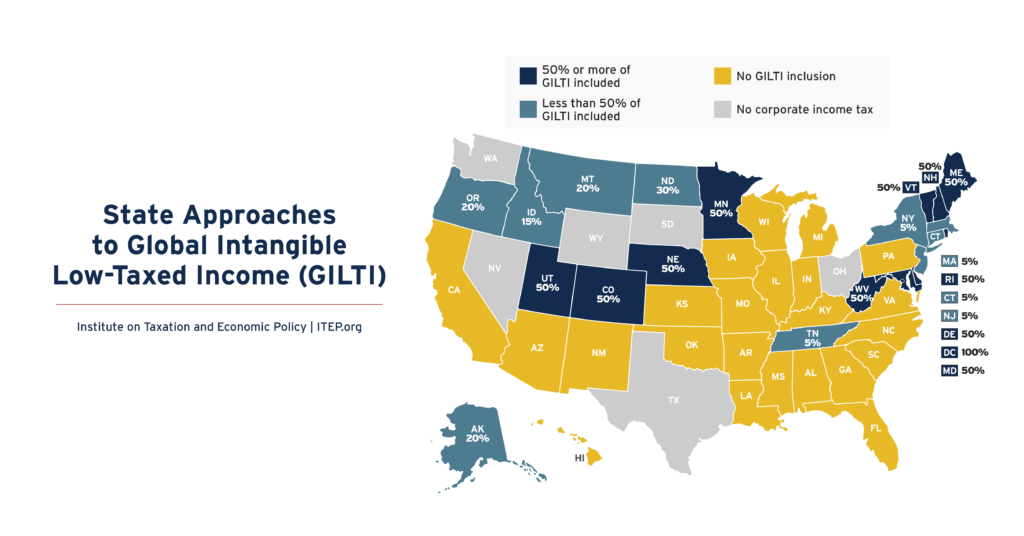

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

Revenue Effect of Mandatory Worldwide Combined Reporting by State

February 21, 2025 • By ITEP Staff

Universal adoption of mandatory worldwide combined reporting (WWCR) in states with corporate income taxes would boost state tax revenue by $18.7 billion per year. The revenue effects of mandatory WWCR would vary across states. We estimate that 38 states and the District of Columbia would experience revenue increases totaling $19.1 billion. The top 10 states […]

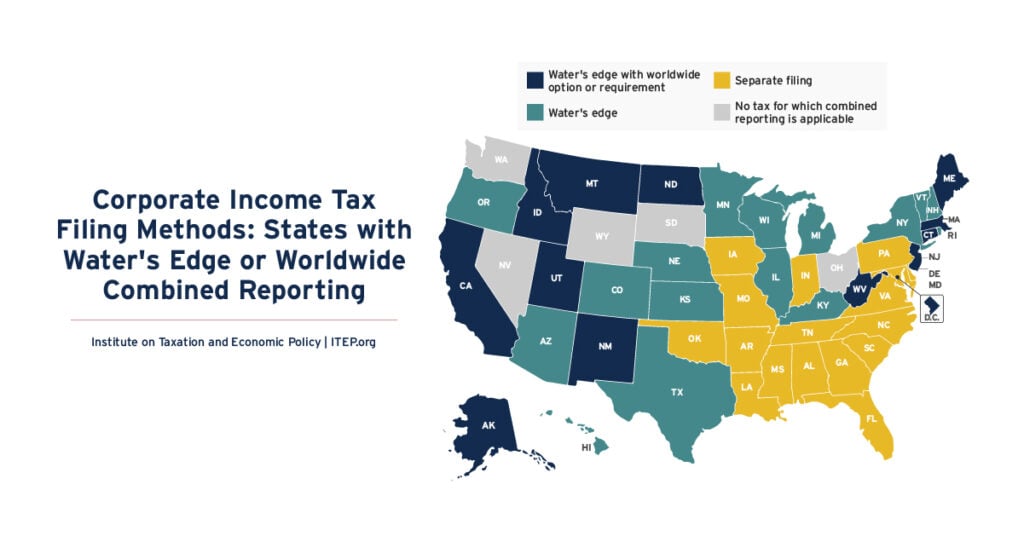

Corporate Income Tax Filing Methods: States with Water’s Edge or Worldwide Combined Reporting

February 21, 2025 • By ITEP Staff

The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions. Twenty-eight states plus D.C. now require a limited version of combined reporting called “water’s edge” […]

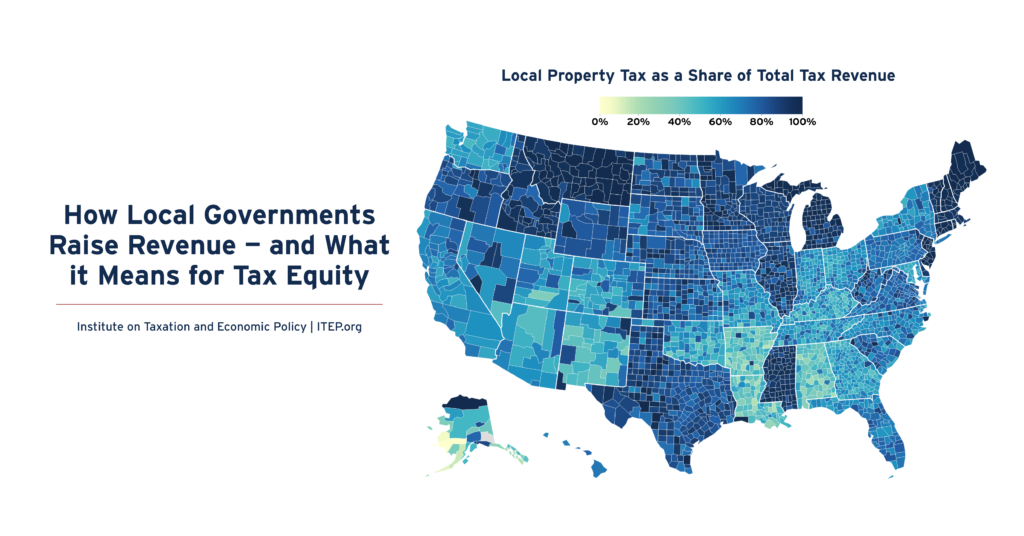

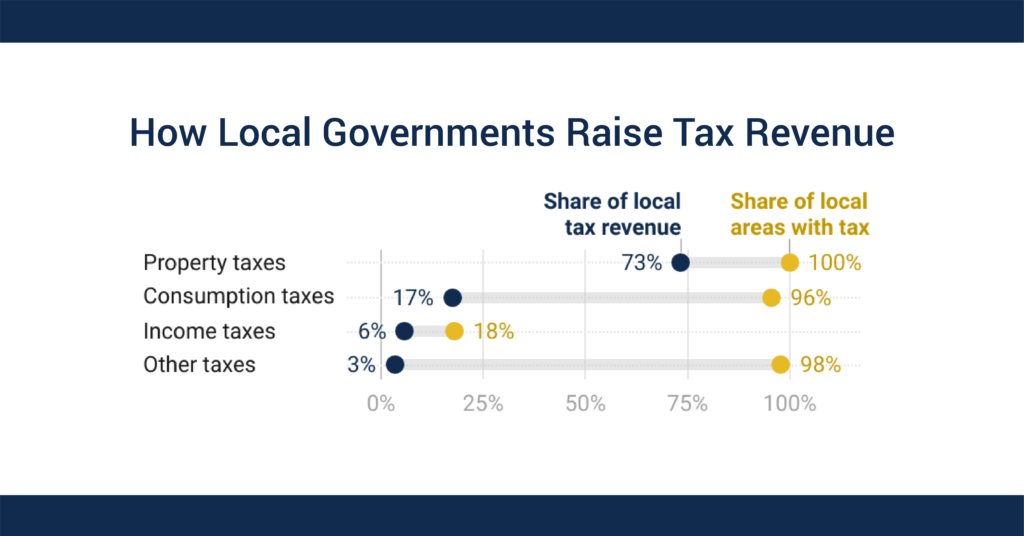

How Local Governments Raise Revenue — and What it Means for Tax Equity

December 5, 2024 • By Galen Hendricks, Rita Jefferson

Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

The IRS has opened its free tax filing service called Direct File to every state for the 2025 tax filing season. Direct File was made possible by President Biden’s Inflation Reduction Act, which provided new resources for the IRS to improve customer service and ensure taxpayers claim the benefits and deductions for which they are […]

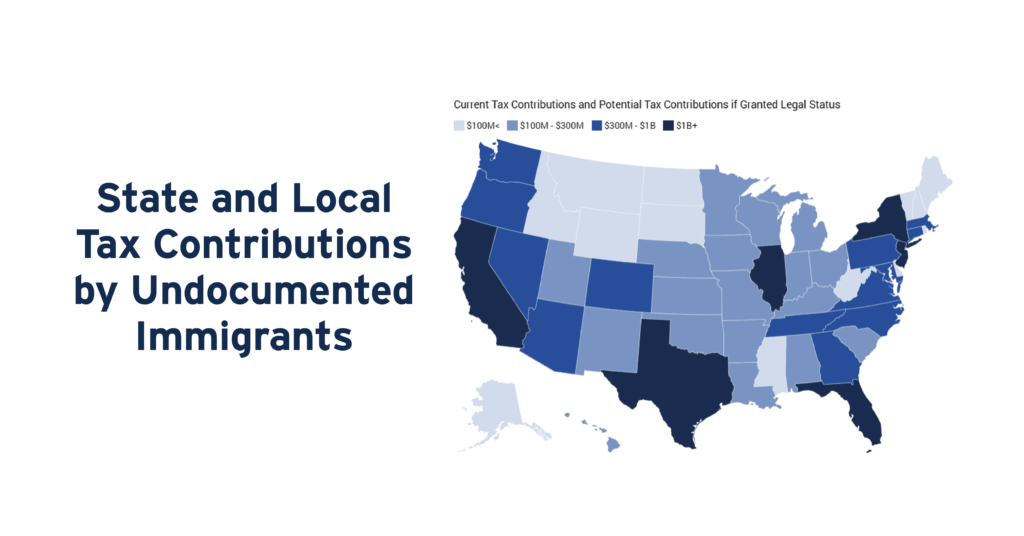

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

Three states allow an unusual income tax deduction for federal income taxes paid. Missouri and Oregon limit these deductions by capping and/or phasing out the deduction, while Alabama, offers what amounts to an unlimited deduction. These deductions are detrimental to state income tax systems on many fronts, as they offer large benefits to high-income earners […]

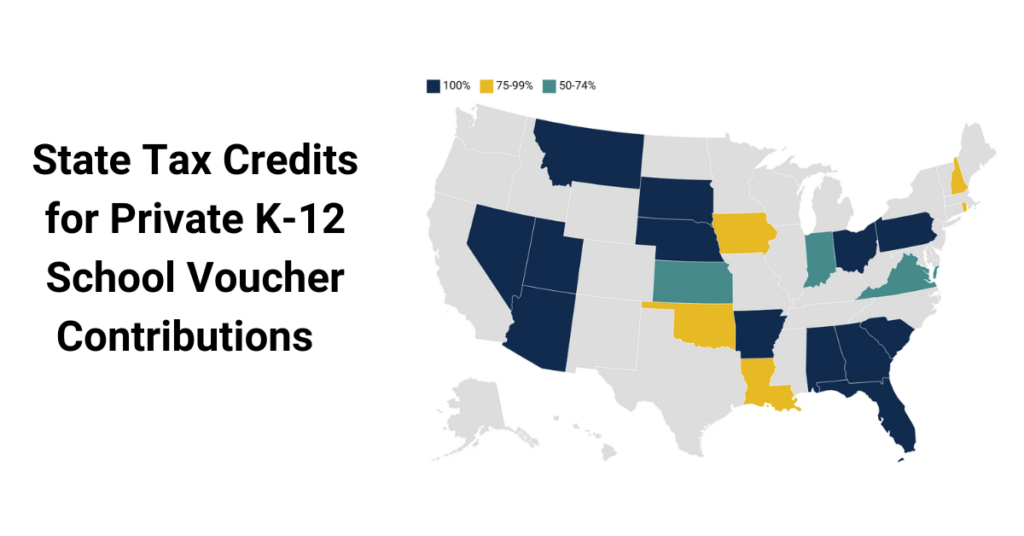

Does Your State Offer Tax Credits for Private K-12 School Voucher Contributions?

August 15, 2023 • By Carl Davis

Twenty-one states provide public support to private and religious K-12 schools through school voucher tax credits.

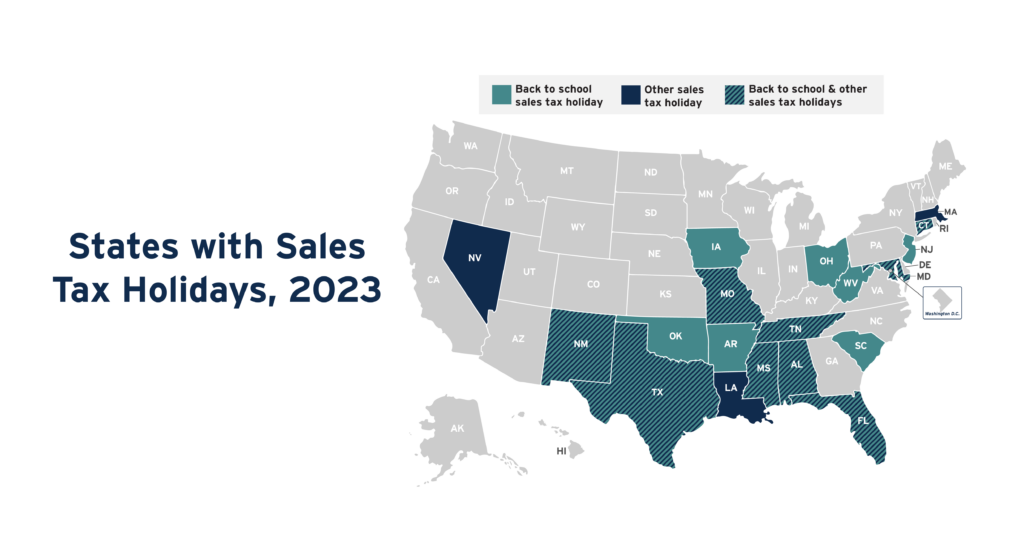

The number of states with sales tax holidays on the books fell to 19 in 2023 from 20 in 2022. Yet even as slightly fewer states have them, they are estimated to cost much more. In 2023, sales tax holidays will cost states and localities nearly $1.6 billion in lost revenue, up from an estimated $1 billion just a year ago.

State Action on Child Tax Credits and Earned Income Tax Credits in 2023

June 28, 2023 • By ITEP Staff

In 2023 so far, 17 states have either adopted or expanded a Child Tax Credit or Earned Income Tax Credit. Both these policies can help bolster the economic security of low- and middle-income families and position the next generation for success.

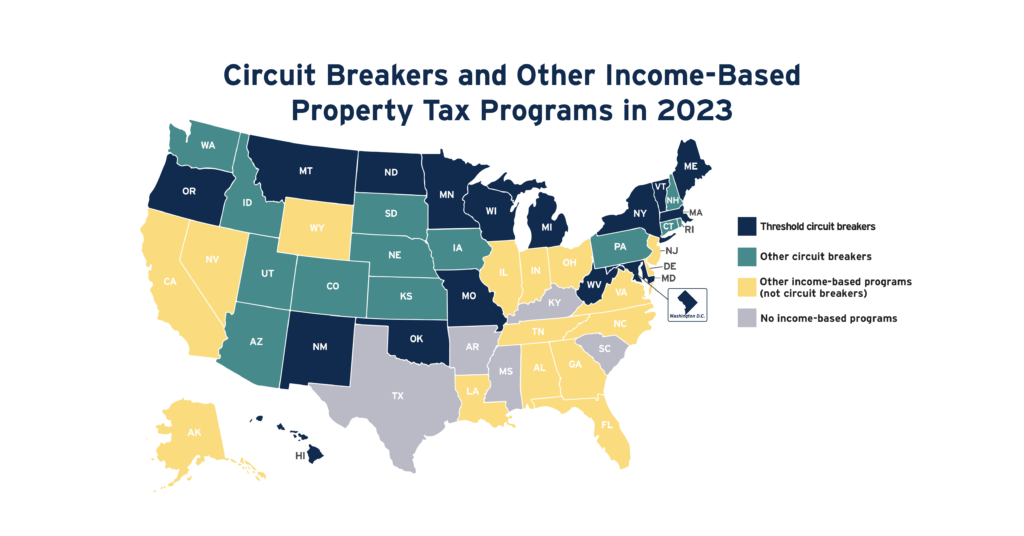

Circuit Breakers and Other Income-Based Property Tax Programs in 2023

May 19, 2023 • By ITEP Staff

No tax cut offers a more targeted solution to property tax affordability problems than circuit breaker credits. This is because circuit breakers are the only tools for reducing property taxes that measure the affordability of property taxes relative to families’ ability to pay. Circuit breakers protect families from property tax “overload” much like how traditional […]

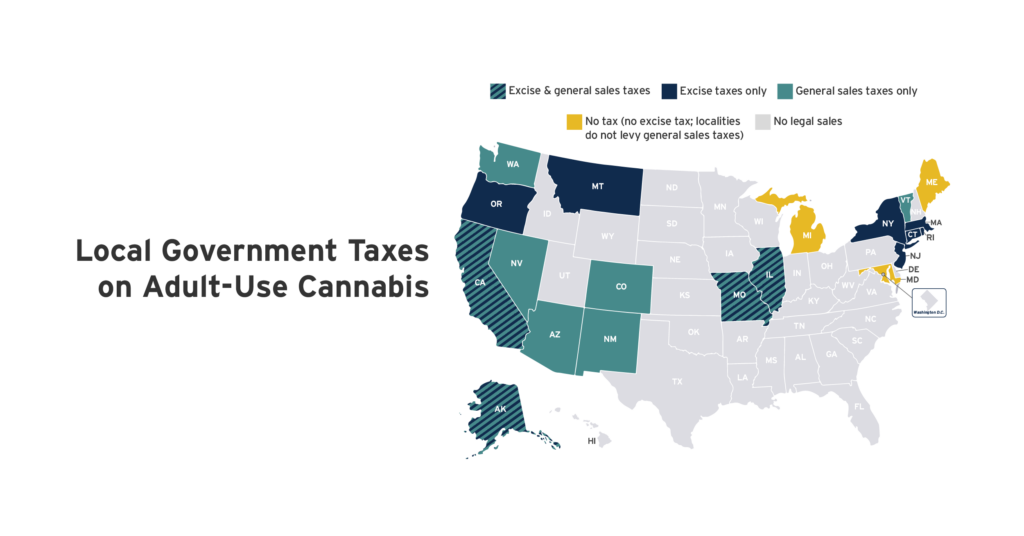

How is Adult-Use Cannabis Taxed by Your Local Government?

April 19, 2023 • By Carl Davis, Eli Byerly-Duke

Twenty states have legalized the sale of cannabis for general adult use. Cannabis taxes vary considerably depending on local authority. Some states allow local governments to levy standalone excise taxes applying narrowly to cannabis purchases. Most local excise taxes on cannabis are levied in states that do not permit local governments to levy general sales taxes.

Twenty states have legalized cannabis sales for general adult use. Every state allowing legal sales applies a cannabis tax based on the product’s quantity, its price, or both. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures.

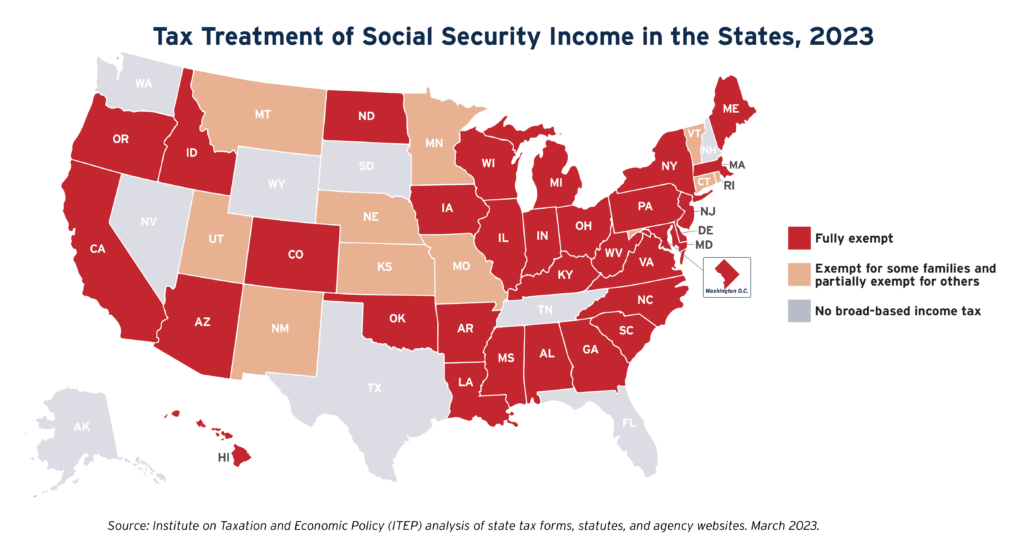

Every state with a personal income tax offers tax subsidies for seniors that are unavailable to younger taxpayers. The best academic research suggests that the median state asks senior citizens to pay about one-third less in personal income tax than younger families with similar incomes. The majority of these subsidies are costly and poorly targeted. […]

How Local Governments Raise Revenue—and What it Means for Tax Equity

March 30, 2023 • By Andrew Boardman, Kamolika Das

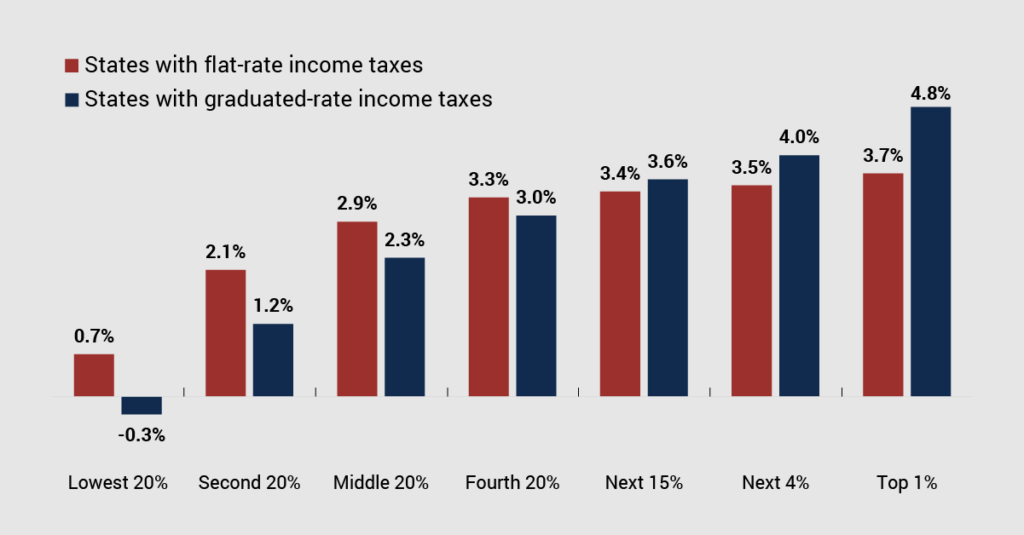

Most local tax systems are falling short of their potential. Well-structured local tax policies support communities by facilitating important investments and advancing fairness, but the tax revenue sources most utilized by local governments tend to disproportionately weigh on households with fewer resources. Learning from these realities can inform the path to improved tax policies and stronger communities.

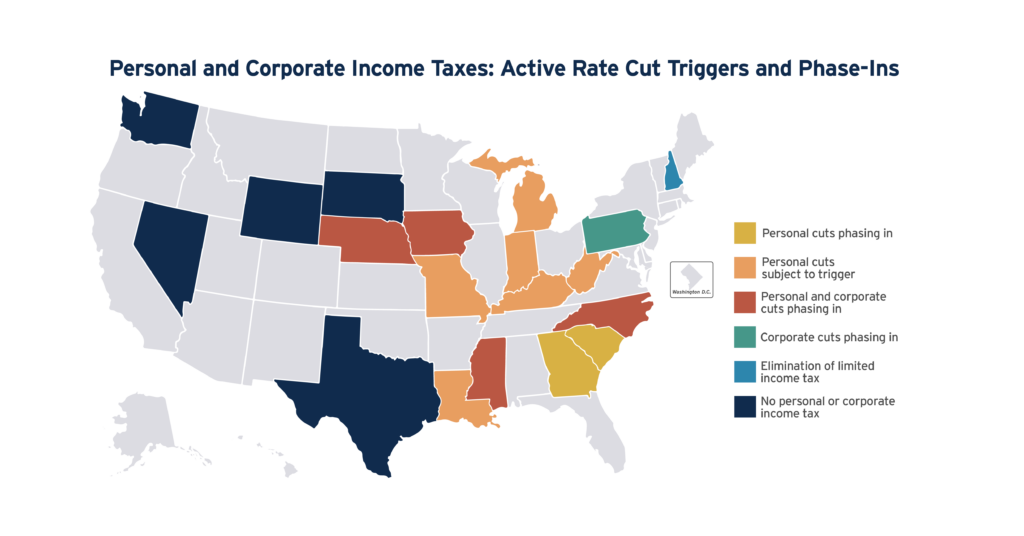

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

Two-thirds of states with broad-based personal income tax structures have a graduated rate, while one-third have flat taxes.

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

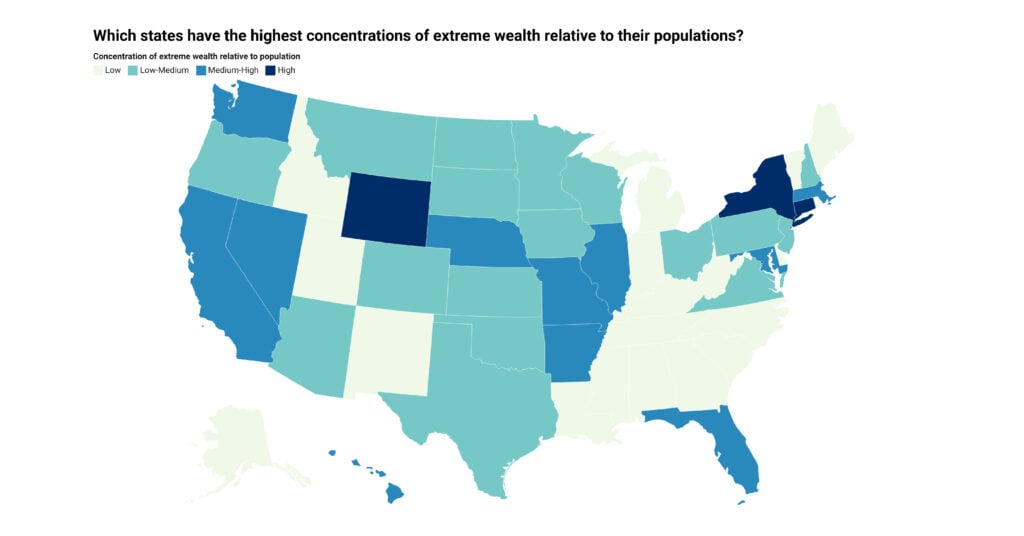

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. This extreme wealth is geographically concentrated, with the top 10 states accounting for more than 70 percent of nationwide extreme wealth and with New York and California alone accounting for nearly a third.