Massachusetts

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

Measures on the November Ballot Could Improve or Worsen State Tax Codes

October 26, 2022 • By Jon Whiten

In a couple of weeks, voters in a handful of states will weigh in on several tax-related ballot measures that could make state tax codes more equitable and raise money for public services, or take states in the opposite direction, making tax systems less fair and draining state coffers of dollars needed to maintain critical […]

Report: Ten States Hold 71 Percent of America’s Extreme Wealth

October 13, 2022 • By ITEP Staff

Tackling wealth inequality through the tax code can boost economic opportunity Washington, DC: Wealth inequality is rampant in every state and particularly concentrated in a handful of states, according to a first-of-its-kind analysis released today by the Institute on Taxation and Economic Policy (ITEP). This extreme wealth hinders economic opportunities for all but the […]

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. Nationally, we estimate that wealth over $30 million per household will reach $26 trillion in 2022 with roughly one-fifth of that amount ($4.5 trillion) held by billionaires.

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

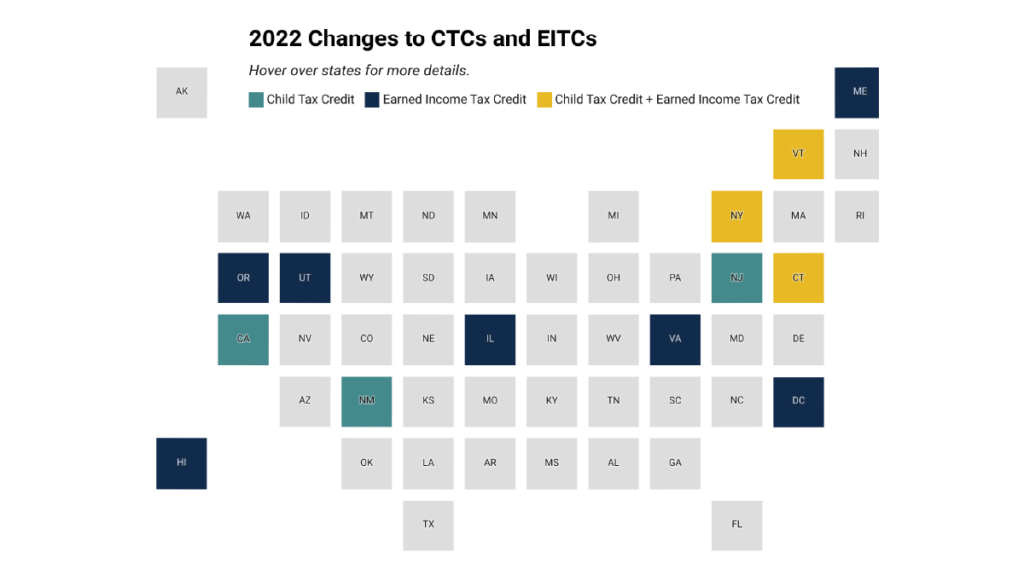

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

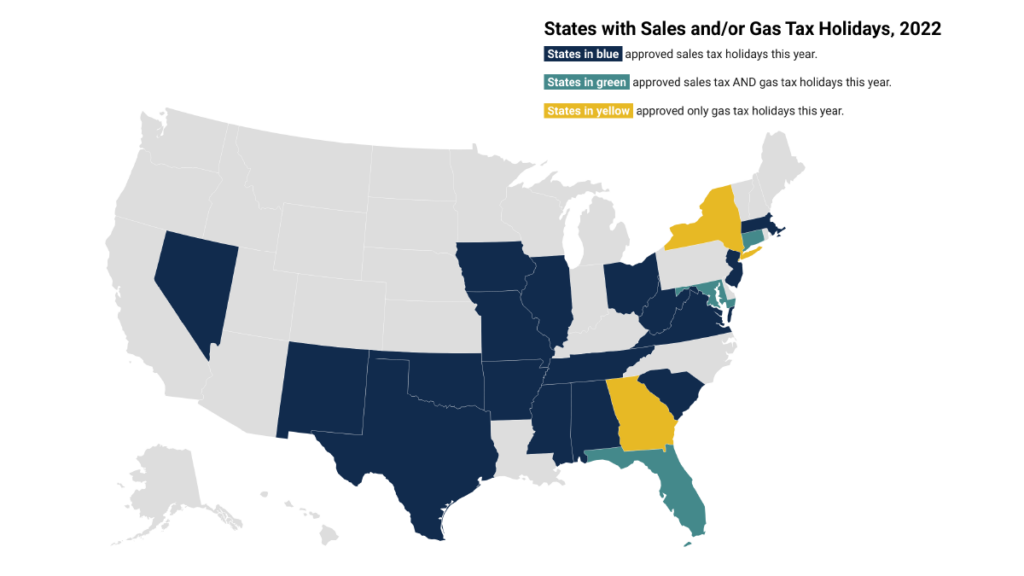

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...

With many state legislative sessions wrapped or wrapping up, we at ITEP want to take a moment to direct your attention south, and specifically, to the American South...

State Rundown 6/8: Tax Policy Features Prominently During Budget and Primary Season

June 8, 2022 • By ITEP Staff

As voters head to the polls to weigh in on their state’s primary elections and legislators convene to hash out budget deals, tax policy remains atop the agenda...

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

While tax discussions among federal lawmakers continue in fits and starts, major tax news continues to make waves across the nation...

State Rundown 4/13: Recent State Budgets Prove Not All Tax Cuts are the Same

April 13, 2022 • By ITEP Staff

Two prominent blue states made headlines this past week when they passed budget agreements that include relief for taxpayers, and fortunately, the budget plans don’t include costly tax cuts that primarily benefit the wealthy...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

Several state legislatures are continuing to push ahead this year with significant tax cut packages that are regressive and would dramatically reduce revenues and leave states in a bad position should they experience another unexpected economic shock...

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

State Rundown 1/20: Governors Eyeing Tax Cuts in Yearly Addresses

January 20, 2022 • By ITEP Staff

A common theme is emerging out of states, as governors around the U.S. begin the year with their annual state speeches, and the news does not bode well for long-term growth and sustainable budgets...

Here at ITEP we want to give thanks and say we’re grateful for all of the hard work that advocates in states across the country are doing to secure progressive tax policy victories...

The Impact of Work From Home on Commercial Property Values and the Property Tax in U.S. Cities

November 4, 2021 • By ITEP Staff

The fiscal implications of a decline in commercial property values are important because the property tax is the dominant local source of taxes, and commercial property makes up a significant portion of the property base in cities.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

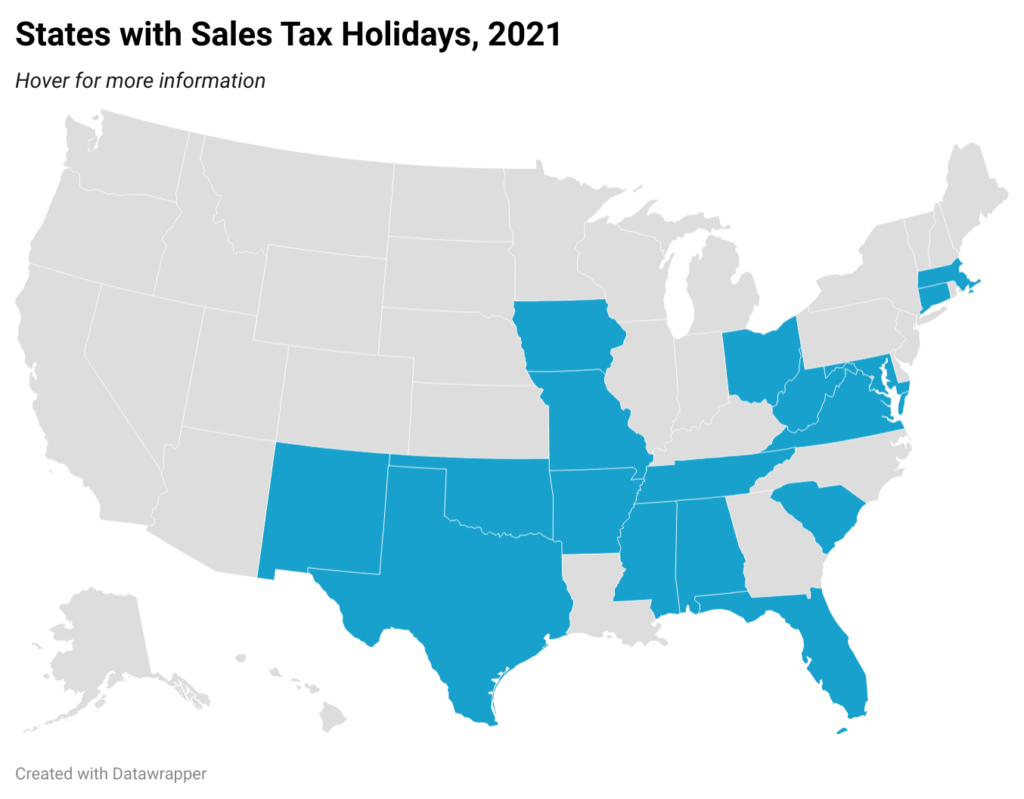

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...

State Rundown 7/21: States Go for Tax Policy Gold This Olympics Season

July 21, 2021 • By ITEP Staff

It’s Olympics season! As countries around the globe battle for first place in a plethora of sports and contests it’s as good a time as any to look around America to see which states deserve a gold medal in the ‘Equitable Tax Policy’ event...