Minnesota

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect Minnesota Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Minnesota, 47 percent of the federal tax cuts would go to the richest 5 percent of residents, and 15 percent of households would face a tax increase, once the bill is fully implemented.

How the House Tax Proposal Would Affect Minnesota Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

State Rundown 10/18: Ballot Initiative Efforts Being Finalized

October 18, 2017 • By ITEP Staff

Ballot initiatives relating to taxes made news around the country this week, with Oregon voters to consider reversing new health care taxes, Washingtonians to vote on improving education funding, and Nebraskans to potentially vote on a state tax credit for school property taxes. Meanwhile, multiple states are finalizing their proposals to lure Amazon to build a new headquarters in their state, often through the use of massive tax subsidies. And in our "What We're Reading" section we have sobering news from Moody's Investors Service on states' struggles to fund their infrastructure and save for the next recession.

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

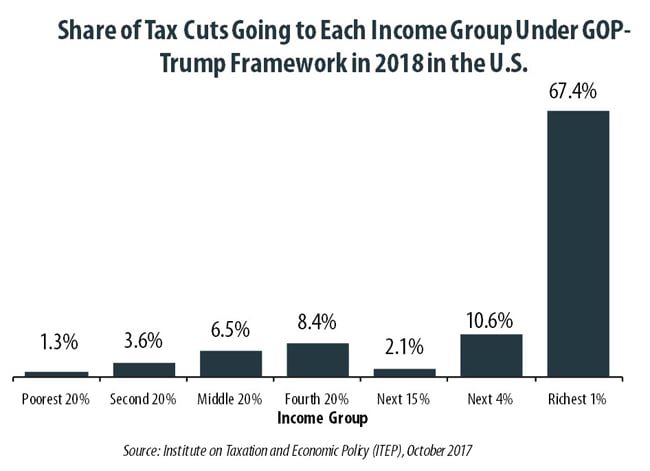

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

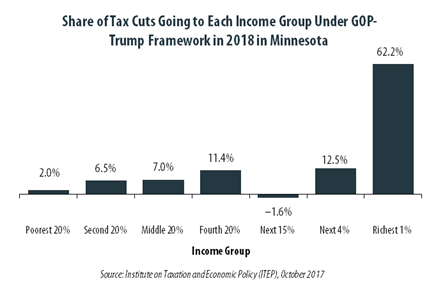

GOP-Trump Tax Framework Would Provide Richest One Percent in Minnesota with 62.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Minnesota equally. The richest one percent of Minnesota residents would receive 62.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $632,000 next year. The framework would provide them an average tax cut of $65,780 in 2018, which would increase their income by an average of 2.5 percent.

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

State Rundown 9/13: The Year of Unprecedented State Budget Impasses Continues

September 13, 2017 • By ITEP Staff

This week, Pennsylvania lawmakers risk defaulting on payments due to their extremely overdue budget and Illinois legislators will borrow billions to start paying their backlog of unpaid bills. Governing delves into why there were more such budget impasses this year than in any year in recent memory. And Oklahoma got closure from its Supreme Court on whether closing special tax exemptions counts as "raising taxes" (it doesn't).

State lawmakers seeking to make residential property taxes more affordable have two broad options: across-the-board tax cuts for taxpayers at all income levels, such as a homestead exemption or a tax cap, and targeted tax breaks that are given only to particular groups of low- and middle-income taxpayers. One such targeted program to reduce property taxes is called a “circuit breaker” because it protects taxpayers from a property tax “overload” just like an electric circuit breaker: when a property tax bill exceeds a certain percentage of a taxpayer’s income, the circuit breaker reduces property taxes in excess of this “overload”…

The Epoch Times: Trump Targets Amazon Over Sales Tax and Retail Jobs

August 23, 2017

More than half of items sold on Amazon are coming through third-party retailers, according to a CNBC report. These retailers can benefit from Amazon’s facilities or payment system, but they are not required to collect sales tax. It is still a pending issue and a meaningful revenue loss for states, said Carl Davis, research director […]

In Minnesota 46.6 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Minnesota population (0.7 percent) earns more than $1 million annually. But this elite group would receive 46.6 percent of the tax cuts that go to Minnesota residents under the tax proposals from the Trump administration. A much larger group, 36.9 percent of the state, earns less than $45,000, but would receive just 5.0 percent of the tax cuts.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

Trump Tax Proposals Would Provide Richest One Percent in Minnesota with 50.8 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Minnesota would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,589,800 in 2018. They would receive 50.8 percent of the tax cuts that go to Minnesota’s residents and would enjoy an average cut of $120,420 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

Minnesota Budget Project: DACA recipients make important tax contributions to Minnesota

June 22, 2017

Minnesota’s Deferred Action for Childhood Arrival (DACA) recipients pay an estimated $15 million in state and local taxes, according to a report from the Institute on Taxation and Economic Policy (ITEP). They are contributing to our communities and our economy, and the report shows they would contribute even more if given the opportunity to apply […]

Explaining our Analysis of Washington State’s Highly Regressive Tax Code

June 22, 2017 • By Carl Davis

Supporters of creating a local personal income tax in Seattle are rightly concerned about the lopsided nature of their state’s tax code. In a 50-state study titled Who Pays?, produced using our microsimulation tax model, we found that Washington State’s tax system is the most regressive in the nation.

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.

This week saw tax debates heat up in many states. Late-session discovered revenue shortfalls, for example, are creating friction in Delaware, New Jersey, and Oklahoma, while special sessions featuring tax debates continue in Louisiana, New Mexico, and West Virginia. Meanwhile the effort to revive Alaska's personal income tax has cooled off.

The Minneapolis Star-Tribune: Tax the Rich? Done. Tax Fairness, Well …

April 29, 2017

A broader comparison of all state and local taxes comes from the Institute on Taxation and Economic Policy, a progressive Washington research group. It, too, ranks Minnesota’s tax system today among the country’s most progressive — or, as ITEP says, among the “least regressive.” “Virtually every state tax system is fundamentally unfair,” the report declares, […]