Mississippi

While most states have a graduated rate income tax, some state lawmakers have recently become enamored with the idea of moving away from graduated rate personal income taxes and toward flat rate taxes instead. But flat taxes create problems for ordinary families and let the wealthy off the hook. When faced with a flat income […]

The new year often brings with it new goals and a desire to take on complex problems with a fresh perspective. Unfortunately, that doesn’t always apply to state lawmakers when considering tax policy...

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Massachusetts Voters Score Win for Tax Fairness with ‘Fair Share Amendment’

November 9, 2022 • By Marco Guzman

In a significant victory for tax fairness, Massachusetts voters approved Question 1—commonly known as the Fair Share Amendment—Tuesday night with 52 percent of the vote. The new constitutional amendment creates a 4 percent surcharge on income over $1 million, and the revenue will specifically fund education and transportation projects in the Bay State.

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

State Rundown 9/7: Labor Day Week Provides Sobering Reminder of Steps Forward, Back

September 7, 2022 • By ITEP Staff

Though Labor Day has passed, advocates on the ground in states across the country are continuing to uphold the spirit of the labor movement...

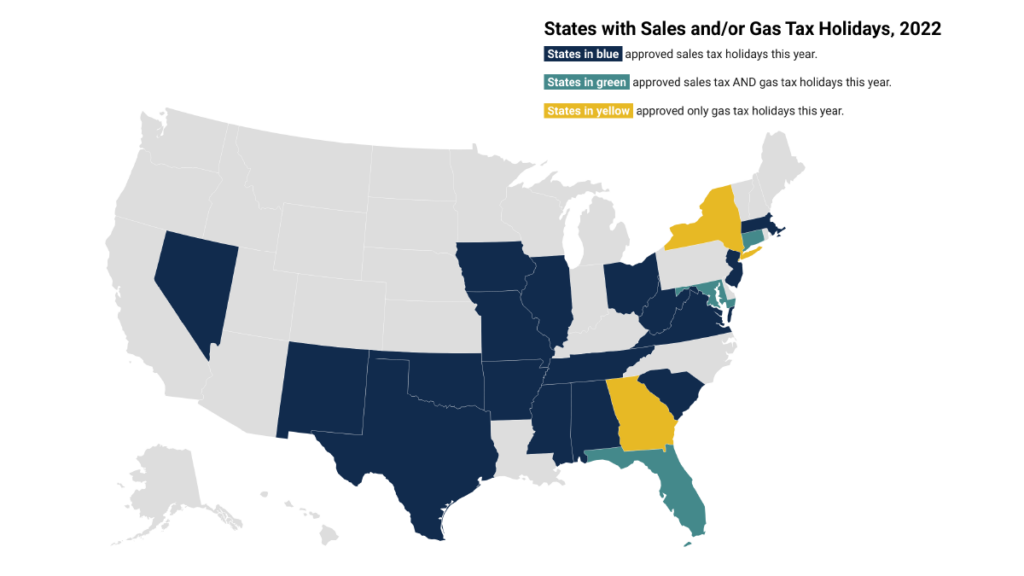

State Rundown 7/27: It’s (Sales Tax) Holiday Season, But Who’s Really Celebrating?

July 27, 2022 • By ITEP Staff

It’s the holiday season – well, the sales tax holiday season, that is. But after taking a closer look, you may notice that there is little to celebrate...

Most States Used Surpluses to Reduce Taxes But Not in Sustainable or Progressive Ways

July 22, 2022 • By Kamolika Das

The average person on the street would have no idea that many states experienced unprecedented budget surpluses this year. Iowa, for instance, has the most structurally deficient bridges of any state with nearly 1 in 5 falling apart. The Iowa Board of Regents proposed a 4.25 percent tuition increase for all three state universities and […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...

With many state legislative sessions wrapped or wrapping up, we at ITEP want to take a moment to direct your attention south, and specifically, to the American South...

New ITEP Report Examines the Path to Equitable Tax Policy in the South

June 22, 2022 • By Kamolika Das

“From the inception of the emerging American nation, the South is a central battleground in the struggles for freedom, justice, and equality. It is the location of the most intense repression, exploitation, and reaction directed toward Africans Americans, as well as Native Americans and working people generally. At the same time the South is the […]

Creating Racially and Economically Equitable Tax Policy in the South

June 21, 2022 • By Kamolika Das

The South's negative outcomes on measures of wellbeing are the result of a century and a half of policy choices. Lawmakers have many options available to make concrete improvements to tax policy that would raise more revenue, do so equitably, and generate resources that could improve schools, healthcare, social services, infrastructure, and other public resources.

Bloomberg Tax: Flat Income Tax Revival Draws Sharply Mixed Reviews (Podcast)

June 14, 2022

With cash cushions plump with federal pandemic relief dollars and a surge in tax revenues, state legislatures across the country have cut taxes aggressively this year. But several states went further, converting their tiered income tax structures to flat-rate systems. Arizona, Georgia, Iowa, and Mississippi have committed to the flat tax in recent weeks, and […]

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

Bloomberg: Did You Pay Your ‘Fair Share’ of Federal Income Tax This Year?

March 31, 2022

And according to the Institute on Taxation and Economic Policy, the impact would have a definite geographic tilt. The states where more than 40% of residents would face tax increases are largely in the South, including Mississippi, West Virginia, Arkansas, Louisiana, Alabama, Kentucky, Oklahoma, Georgia, New Mexico, South Carolina, and Florida. read more

Several states have dropped a few late-session surprises, and from the looks of it, they’re not the good kind...

Women’s History Month is a Reminder that Sensible Tax Policy is Central to Women’s Economic Security

March 24, 2022 • By Brakeyshia Samms

Women’s History Month is a chance to remember what happens for women when tax policy becomes more progressive, boosts income, and helps make raising a family more affordable.

Spring is around the corner and like those pesky allergies that come along with it, equally pesky tax proposals continue to pop up in states across the U.S....

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

It’s unlikely that state gas tax holidays will meaningfully benefit consumers, and they come with risks for states’ infrastructure quality.

Pennsylvania Capital Star: GOP plan would be a tax hike for 35% of Pa. residents

March 9, 2022

The share of households facing tax hikes would vary across states, according to an analysis by the Institute on Taxation and Economic Policy, ranging from a low of about 24 percent in Washington State to high of roughly 50 percent in Mississippi, which is among the poorest states in the country. Read more