Mississippi

A Better Alternative: New Mexico Prioritizes Targeted, Temporary Tax Cuts

March 9, 2022 • By Marco Guzman

New Mexico stands in stark contrast to the many examples of poorly targeted tax-cut proposals currently being considered around the country.

New 50-State Analysis: Poorest Two-Fifths Would Bear the Brunt of Sen. Rick Scott’s Proposed Tax Increase

March 7, 2022 • By ITEP Staff

“Billionaires are getting richer, and some of them are altogether avoiding taxes or paying a tiny percentage relative to their income and wealth. The 2017 tax law further worsened inequality by giving huge tax breaks to the rich. It’s inconceivable that a lawmaker would propose to single out the most vulnerable households for higher taxes.” --Steve Wamhoff

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

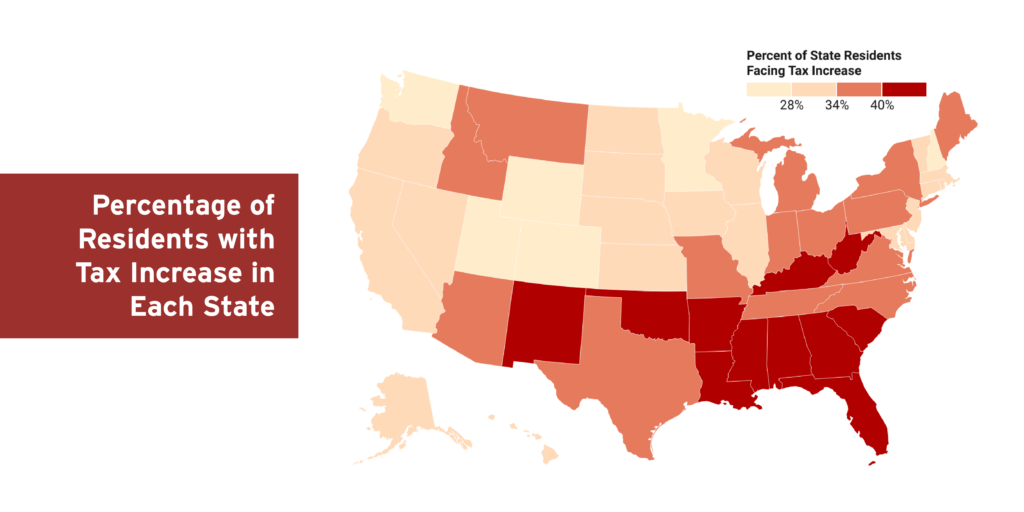

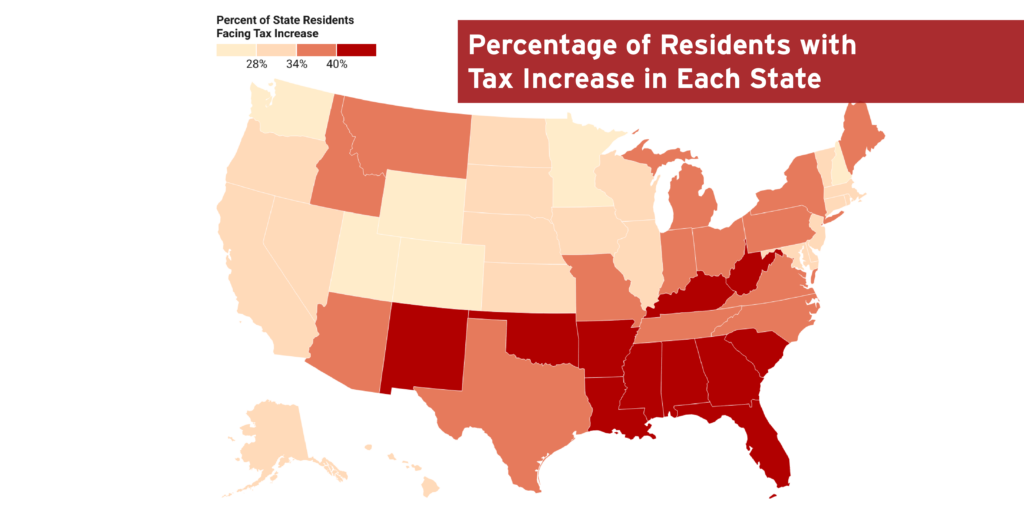

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

SOTU and GOP Response Highlight Dramatic Difference in Parties’ Tax Policy Approach

March 2, 2022 • By Aidan Davis, ITEP Staff, Jenice Robinson

Since last year, multiple states across the country have proposed or are pursuing costly income and other tax cuts that are heavily tilted toward the highest-income households. State advocates have worked to beat back these proposals and sounded the alarm about the long-term consequences of tax cuts, but legislatures (most GOP-led) continue to introduce and approve top-heavy and permanent tax cuts. This state tax-cut fervor took center stage last night when Gov. Kim Reynolds of Iowa gave the Republican response to President Biden's SOTU address.

Several state legislatures are continuing to push ahead this year with significant tax cut packages that are regressive and would dramatically reduce revenues and leave states in a bad position should they experience another unexpected economic shock...

American Prospect: The Year of the Tax Cut

February 17, 2022

State lawmakers are also pointing to substantial, but temporary, budget surpluses to justify tax cuts, but these surpluses are “deceptive and fleeting,” says Neva Butkus of the Institute on Taxation and Economic Policy (ITEP), a Washington think tank. Twenty-three states lowered their revenue estimates compared to pre-pandemic levels, and 19 states counted delayed fiscal year […]

State Rundown 2/16: Spending Priorities Emerge as the Votes Are Counted

February 16, 2022 • By ITEP Staff

State lawmakers have been busy working out deals and negotiating how best to use excess revenues, and as the votes are beginning to come in, spending priorities are becoming clearer...

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

One Voice: Eliminating Individual Income Tax is Bad for Mississippi

February 7, 2022

House Bill 531 would eliminate the state individual income tax. Eliminating the income tax is bad for Mississippi, especially the state’s working families, communities of color, and retirees. While some lawmakers are suggesting that Mississippi’s revenue system is sound enough to support this tax cut, due to the current surplus, this couldn’t be further from […]

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

State Rundown 1/20: Governors Eyeing Tax Cuts in Yearly Addresses

January 20, 2022 • By ITEP Staff

A common theme is emerging out of states, as governors around the U.S. begin the year with their annual state speeches, and the news does not bode well for long-term growth and sustainable budgets...

Mississippi Is the Latest in a String of States Pursuing Short-Sighted, Top-Heavy Tax Cuts

January 19, 2022 • By Kamolika Das

Not only is Mississippi's latest tax proposal deeply inequitable, the state simply cannot afford it.

State Rundown 1/13: The Tax Cuts Cometh, But There Is a Better Way

January 13, 2022 • By ITEP Staff

As expected, with the start of many new legislative sessions around the country, lawmakers have introduced a slew of tax cut plans following better-than-expected budget outlooks that have, so far, weathered the impact of the pandemic...

The New Trend: Short-Sighted Tax Cuts for the Rich Will Not Grow State Economies

January 10, 2022 • By Neva Butkus

The same legislators who touted tax cuts for the rich as solution to our problems before the pandemic are also saying tax cuts for the rich are a solution during the pandemic. Tax cuts cannot be a solution to everything, especially at a time when the richest Americans are amassing more wealth than ever.

Rather than resorting to tax cuts, which can eventually create revenue shortfalls, lawmakers should determine whether they have adequately invested in people and communities. There are better ways to leverage tax systems to help those who need it most.

The new year often brings with it a reinvigorated commitment to new goals and a fresh perspective on how to accomplish them, but it seems like lawmakers in states around the country are giving up already...

Here at ITEP we want to give thanks and say we’re grateful for all of the hard work that advocates in states across the country are doing to secure progressive tax policy victories...

The release of the ‘Pandora Papers’ showed once again that states and their tax systems play an important role in wealth inequality, and in this case, worsening it...

State Income Tax Reform Can Bring Us Closer to Racial Equity

October 4, 2021 • By Carl Davis, ITEP Staff, Marco Guzman

To pave the way for a more racially equitable future, states must move away from poorly designed, regressive policies that solidify the vast inequalities that exist today.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

Labor Day is around the corner and in the spirit of celebrating the achievements of workers around the country, we here at ITEP want to call attention to the states (and territories) that are using tax policy to support workers and residents alike...

Eliminating the State Income Tax Would Wreak Havoc on Mississippi

August 25, 2021 • By Kamolika Das

History has repeatedly shown that such policies harm state economies, dismantle basic public services, and exacerbate tax inequities.

Mississippi Today: Mississippi tax laws place higher burden on people of color

August 19, 2021

“Black households pay an average of 8.7% of their income in state and local tax while Hispanic families pay 9.1%,” according to a recently released study by non-profit One Voice, based on data compiled by the Institute on Taxation and Economic Policy. “Those rates are significantly above the statewide average tax rate of 8.4% and […]