New Jersey

State Rundown 1/20: Governors Eyeing Tax Cuts in Yearly Addresses

January 20, 2022 • By ITEP Staff

A common theme is emerging out of states, as governors around the U.S. begin the year with their annual state speeches, and the news does not bode well for long-term growth and sustainable budgets...

State Rundown 1/13: The Tax Cuts Cometh, But There Is a Better Way

January 13, 2022 • By ITEP Staff

As expected, with the start of many new legislative sessions around the country, lawmakers have introduced a slew of tax cut plans following better-than-expected budget outlooks that have, so far, weathered the impact of the pandemic...

NJ.com: 96% of N.J. residents would get their full property tax break restored under this Senate plan

December 9, 2021

According to the progressive Institute on Taxation and Economic Policy, the Senate proposal would encompass 96% of New Jersey taxpayers. The higher cap for what is known as SALT would be phased out for those making $400,000 to $475,000, and anyone making more than that would be limited to the $10,000 deduction currently in the […]

Latest Proposal from Senate Democrats Would Bar the Rich from SALT Cap Relief

December 7, 2021 • By Steve Wamhoff

Richest taxpayers would receive $0 benefit under new compromise compared with 51 percent of the benefit of House-passed SALT provision DOWNLOAD NATIONAL AND STATE-BY-STATE ESTIMATES In the latest chapter of the saga over SALT, some Senate Democrats are discussing a new compromise that would amend the House-passed provision providing relief from the SALT cap to […]

Analysis of the House of Representatives’ Build Back Better Legislation

November 18, 2021 • By Carl Davis, Steve Wamhoff

If the bill becomes law, in 2022 federal taxes would go up for the average taxpayer among the richest one percent and down for the average taxpayer in other income groups.

Senators Menendez and Sanders Show the Way Forward on the SALT Cap

November 3, 2021 • By Steve Wamhoff

Amending the Build Back Better bill to fully repeal the SALT cap would mean that the richest 1 percent could pay less in personal income taxes than they do now, which goes against everything President Biden has said for the past year as he promoted this legislation.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

Tax Changes in the House Ways and Means Committee Build Back Better Bill

September 21, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

This report finds that the vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts -- expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) -- would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

Extending Federal EITC Enhancements Would Bolster the Effects of State-Level Credits

September 13, 2021 • By Aidan Davis

The EITC expansion targets workers without children in the home. In 2022 it would provide a $12.4 billion boost, benefiting 19.5 million workers who on average would receive an income boost of $730 dollars.

Frequently Asked Questions about Proposals to Repeal the Cap on Federal Tax Deductions for State and Local Taxes (SALT)

September 3, 2021 • By Carl Davis, ITEP Staff, Steve Wamhoff

Even though Democrats in Congress uniformly opposed the TCJA because its benefits went predominately to the rich, many Democratic lawmakers now want to give a tax cut to the rich by repealing the cap on SALT deductions.

Labor Day is around the corner and in the spirit of celebrating the achievements of workers around the country, we here at ITEP want to call attention to the states (and territories) that are using tax policy to support workers and residents alike...

New Report from ITEP Describes Options for Changing the SALT Cap without Repealing It

August 26, 2021 • By Steve Wamhoff

A new report from ITEP provides policy recommendations to modify the $10,000 cap on federal tax deductions for state and local taxes (SALT), which was signed into law by President Trump as part of the Tax Cuts and Jobs Act. Because the SALT cap mostly restricts tax deductions for the richest 5 percent of Americans, the best options are to leave the cap as is or replace […]

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

State Rundown 7/21: States Go for Tax Policy Gold This Olympics Season

July 21, 2021 • By ITEP Staff

It’s Olympics season! As countries around the globe battle for first place in a plethora of sports and contests it’s as good a time as any to look around America to see which states deserve a gold medal in the ‘Equitable Tax Policy’ event...

State Rundown 7/7: The New Fiscal Year Starts off With a Bang, And Not Just Fireworks

July 7, 2021 • By ITEP Staff

States were busy over the past week despite the Fourth of July holiday. Many are gearing up for upcoming tax and budget clashes that could shape their futures for some time...

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

State Rundown 6/24: Late June State Fiscal Debates Unusually Active

June 24, 2021 • By ITEP Staff

Delayed legislative sessions and protracted federal aid debates have made for a busier June than normal for state fiscal debates. Arizona, New Hampshire, and North Carolina legislators, for example, are still pushing for expensive and regressive tax cuts in their states while they remain in session...

The Rockefeller Foundation: The Untold Benefits of State EITCs on Child Welfare

June 16, 2021

With the passing of the American Rescue Plan in March, more than 5 million children are projected to be lifted out of poverty this year, cutting child poverty by more than half, through Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) expansions. But what about state tax codes? What can states do to […]

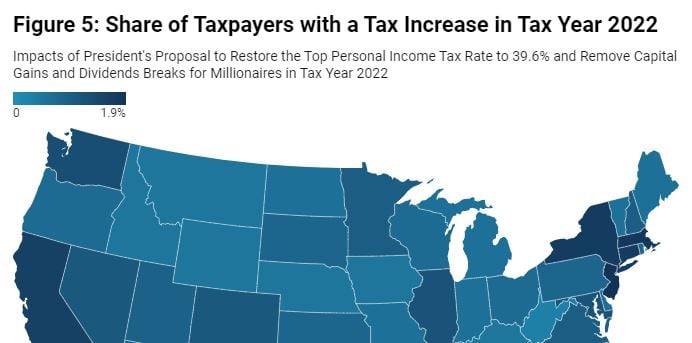

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

NJ.Com: Live in N.J.? You’ll pay more in taxes over a lifetime than anywhere else, study says

May 22, 2021

Five states, including New Jersey, would be the only states where more than 1% of their taxpayers would face a higher tax bill under Biden’s proposals, according to the progressive Institute on Taxation and Economic Policy. Read more

Take a minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.