New York

The New York Times: How FedEx Cut Its Tax Bill to $0

November 17, 2019

“Something like $1.5 billion in future taxes that they had promised to pay, just vanished,” said Matthew Gardner, an analyst at the liberal Institute on Taxation and Economic Policy in Washington. “The obvious question is whether you can draw any line, any connection between the tax breaks they’re getting, ostensibly designed to encourage capital expenditures, and what […]

Benefits of a Financial Transaction Tax

October 28, 2019 • By Jessica Schieder, Lorena Roque, Steve Wamhoff

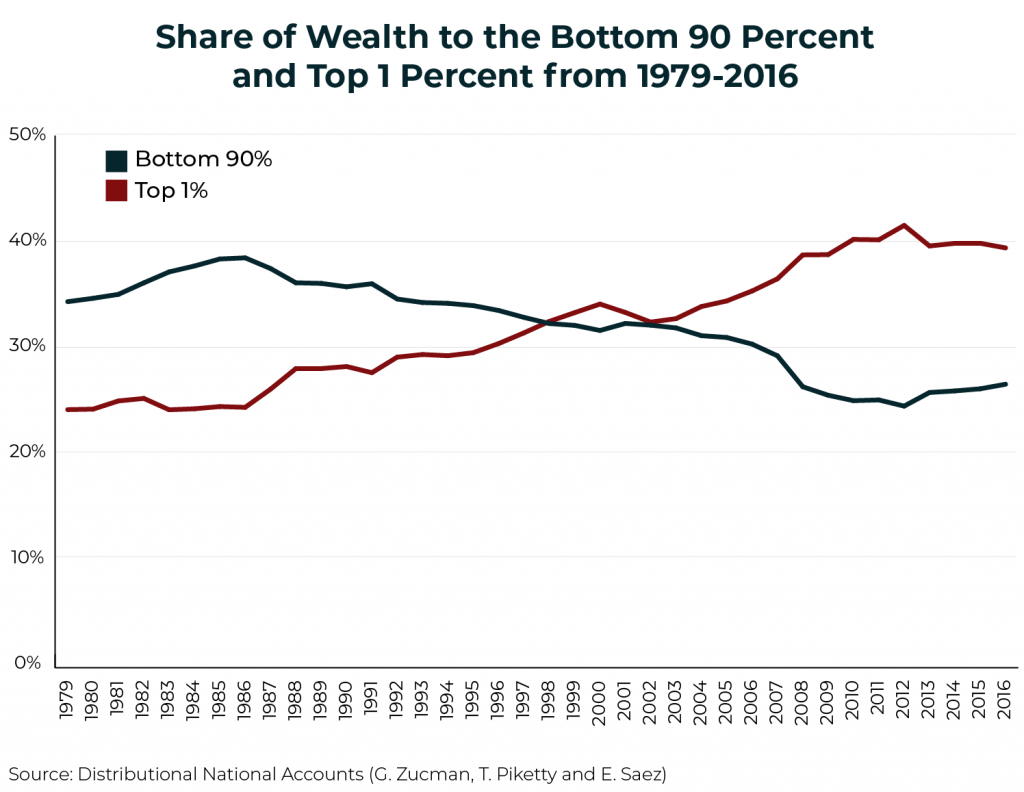

A financial transaction tax (FTT) has the potential to curb inequality, reduce market inefficiencies, and raise hundreds of billions of dollars in revenue over the next decade. Presidential candidates have proposed using an FTT to fund expanding Medicare, education, child care, and investments in children’s health. Any of these public investments would be progressive, narrowing resource gaps between the most vulnerable families and the most fortunate.

State Rundown 10/10: Always Something Old, Something New in State Tax Debates

October 10, 2019 • By ITEP Staff

Creative thinking from Pennsylvania lawmakers has helped them discover that the Wayfair ruling allowing states to collect sales tax from online retailers can also help them identify and tax corporate profits earned in their borders. Similarly, New York leaders had the vision to put bold environmental goals in place and identify a carbon price as a potential pay-for. Gubernatorial candidates in Mississippi and Kentucky showed less ingenuity, proposing tax cuts even though Mississippi is still phasing in a massive tax cut from a few years ago and Kentucky’s next election isn’t until 2020. Meanwhile, the old idea of eliminating income…

Press-Republican: Cuomo Loses Opening Round in Fight Against New Tax Law

October 6, 2019

The Institute on Taxation and Economic Policy, a national think tank, projected in late 2017 that more than 70 percent of New York taxpayers would end up paying less in federal taxes as a result of the code revisions. Cuomo, though, has maintained the capping of the SALT deduction would motivate some wealthy earners to […]

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

CNBC: New York Judge Dismisses Blue State Suit Over SALT Tax Deductions

September 30, 2019

Whether the final rule will ultimately deter people from donating to these funds remains to be seen. “If you’re really passionate about private school vouchers in Georgia, you donate and you still get 100% of your donation back,” Carl Davis, research director at the Institute on Taxation and Economic Policy, told CNBC earlier. “You just […]

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2019

September 26, 2019 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Promoting Greater Economic Security Through A Chicago Earned Income Tax Credit: Analyses of Six Policy Design Options

September 12, 2019 • By Lisa Christensen Gee

A new report reveals that a city-level, Chicago Earned Income Tax Credit would boost the economic security of 546,000 to 1 million of the city’s working families. ITEP produced a cost and distributional analysis of six EITC policy designs, which outlines the average after-tax income boost for families at varying income levels. The most generous policy option would increase after-tax income for more than 1 million working families with an average benefit, depending on income, ranging from $898 to $1,426 per year.

New Report: A Chicago EITC Would Benefit up to 1 Million Chicago Families

September 12, 2019 • By Lisa Christensen Gee

Media contact Report outlines policy options for Chicago Resilient Families Initiative Task Force Recommendations A new report reveals that a city-level, Chicago Earned Income Tax Credit would boost the economic security of 546,000 to 1 million of the city’s working families, the Institute on Taxation and Economic Policy (ITEP) and Economic Security for Illinois said today. […]

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

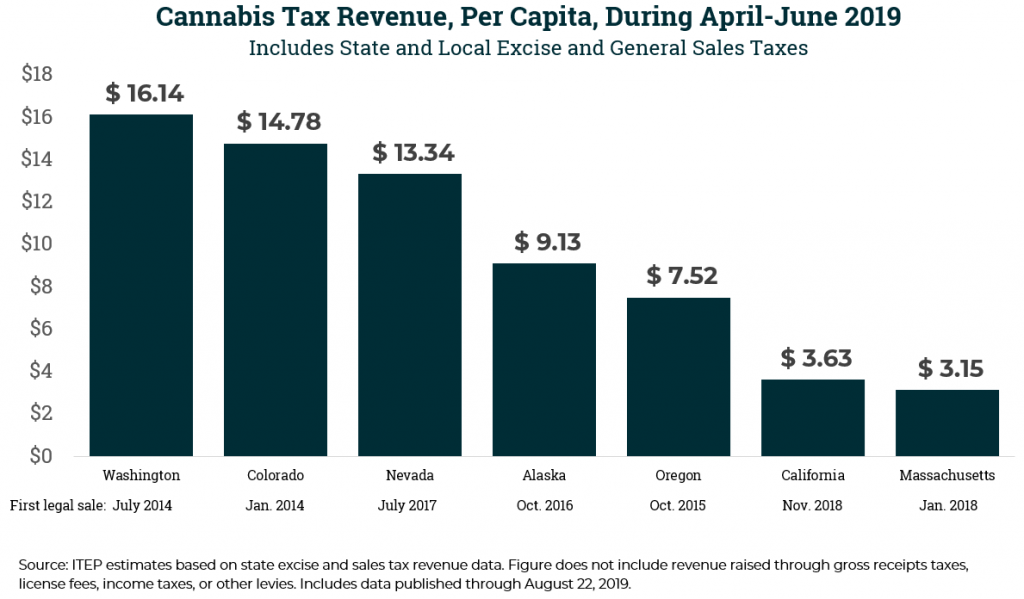

Why California’s Cannabis Market May Not Tell You Much about Legalization in Your State

August 22, 2019 • By Carl Davis

New tax data out of California, the world’s largest market for legal cannabis, tell a complicated story about the cannabis industry and its tax revenue potential. Legal cannabis markets take time to establish, and depending on local market conditions, the revenue states raise can vary significantly.

New York Times: Trump’s Policy Could Alter the Face of the American Immigrant

August 15, 2019

For example, an updated report released in March 2017 by the Institute on Taxation and Economic Policy found that undocumented immigrants alone contribute $11.74 billion each year in taxes, though they do not qualify for most public benefits. Read more

Given how much more exclusively this deduction now benefits the highest-income households, its continued existence is hard to justify. Even when the credit was available to a larger swath of families, it was ineffective at promoting homeownership.

Taxing Offshore Profits and Domestic Profits Equally Could Curb Corporate Tax Dodging

August 9, 2019 • By Steve Wamhoff

In recent days, presidential candidates Sen. Kamala Harris and New York Mayor Bill DeBlasio have called for taxing corporate profits the same whether they are earned in the United States or abroad. These calls echo the position of Sen. Bernie Sanders, who has long had a proposal along these lines. As ITEP has explained, correcting […]

New York Times: Debate Fact Check: What Were They Talking About, and What Was True?

August 1, 2019

What Mr. Bennet said: “Since 2001, we have cut $5 trillion worth of taxes. Almost all of it has gone to the wealthiest people in America.” This is exaggerated. Mr. Bennet’s claim is based on a 2018 report from the liberal Institute on Taxation and Economic Policy in Washington. It finds tax cuts under Presidents […]

New York Times: Trump Administration Is Divided Over Tax Cut for Investors

July 31, 2019

But critics argue that the administration could open the door to a variety of unintended consequences, including allowing investors to exploit the change. Steve Wamhoff, the director of federal tax policy at the Institute on Taxation and Economic Policy, wrote in a June report criticizing the proposal that indexing capital gains for just certain types […]

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.

Reno News Review: Another Portrait of Ripped-off Nevadans

July 25, 2019

But wait, there’s more bad news for Nevada. The New York Times editorialized last Sunday on the growing trend toward inequality caused by how state and local taxes are assessed. According to a 2018 study by the Institute on Taxation and Economic Policy, (ITEP) “the poor pay taxes at higher rates in 45 of the […]

New York Times: State and Local Taxes Are Worsening Inequality

July 21, 2019

Low-income households in Illinois pay about 14 cents in state and local taxes from every dollar of income, while the state’s most affluent households pay about 7 cents per dollar. That gap between the poor and the wealthy in Illinois is one of the largest in any state, but the poor pay taxes at higher […]

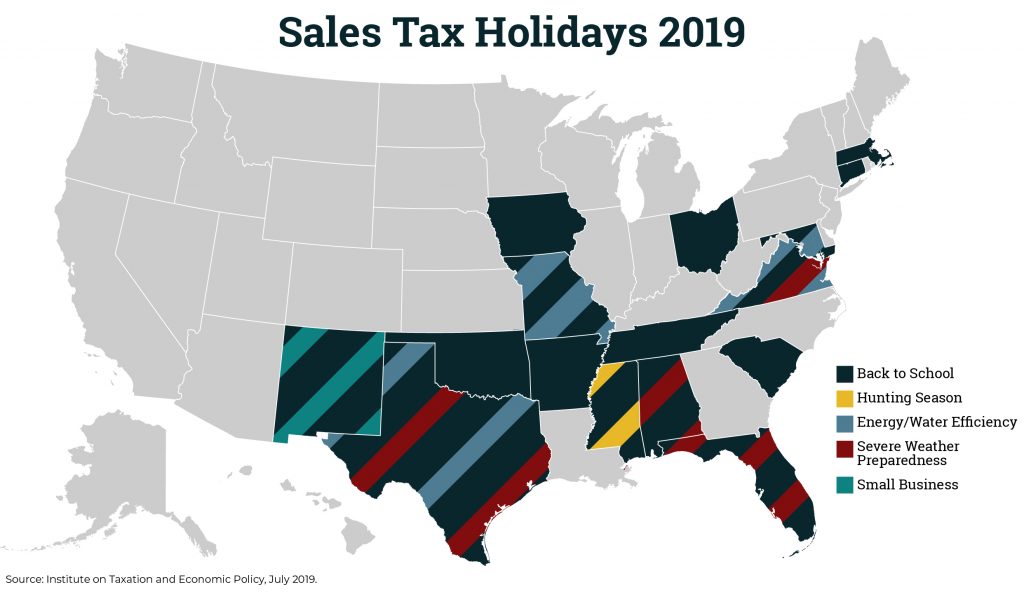

New York Times: Back-to-School Sales Tax ‘Holidays’ Lure Shoppers Despite Slim Savings

July 19, 2019

But the tax holidays put a damper on state revenue and don’t necessarily deliver the business results they promise, said Dylan Grundman, a senior policy analyst at the Institute on Taxation and Economic Policy. “People shift purchases, but don’t increase their overall spending,” Mr. Grundman said. “So the boost to business doesn’t really materialize.” Read […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 17, 2019 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2019), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief looks at sales tax holidays as a tax reduction device.

We've said it before, and we'll say it again: states don't have to wait for federal lawmakers to make moves toward progressive tax policy. And so far, 2019 has been a good year for equitable and sustainable tax policy in the states. With July 1 marking the start of a new fiscal year for most states, this special edition of the Rundown looks at how discussions in 2019 have been dominated by plans to raise revenue for vital investments, tax the rich and corporations fairly, use the tax code to help workers and families and advance racial equity, and shore…

Missouri’s Creative Approach to Ending the “Race to the Bottom” in State Business Taxes

July 10, 2019 • By Matthew Gardner

Each year, state and local governments spend billions of dollars on targeted tax incentives—special tax breaks ostensibly designed to encourage businesses to relocate, expand or simply stay where they are. A law enacted by the Missouri legislature creates a template for states to work bilaterally to put the brakes on the “race to the bottom” in state business taxes.