Recent Work by ITEP

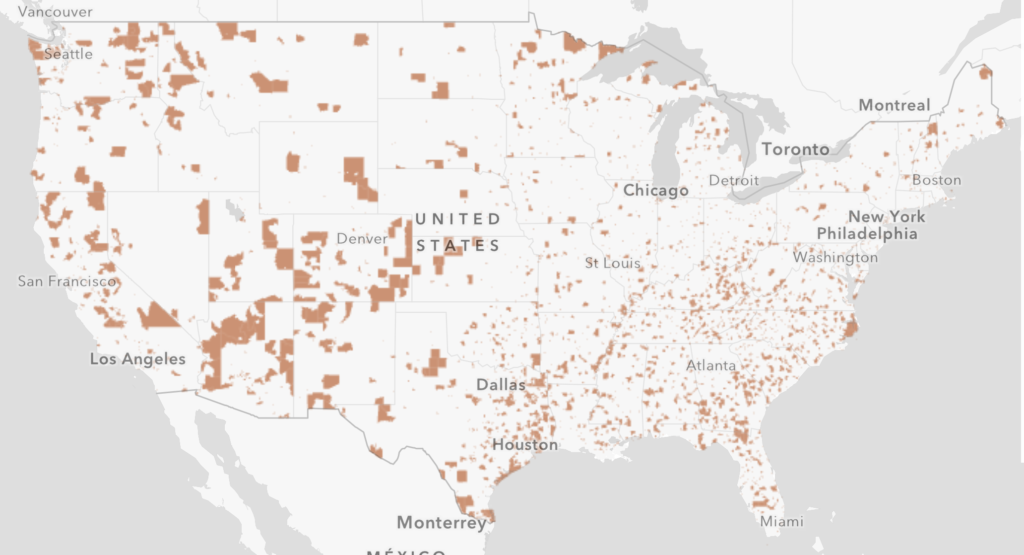

How Opportunity Zones Benefit Investors and Promote Displacement

August 10, 2018 • By ITEP Staff

The idea behind the new tax break is to provide an incentive for wealthy individuals to invest in the economies of struggling communities. Despite alleged intentions, it appears opportunity zones are turning into yet another windfall for wealthy investors and may encourage displacement of people in low-income areas, working against the provision’s intended goal.

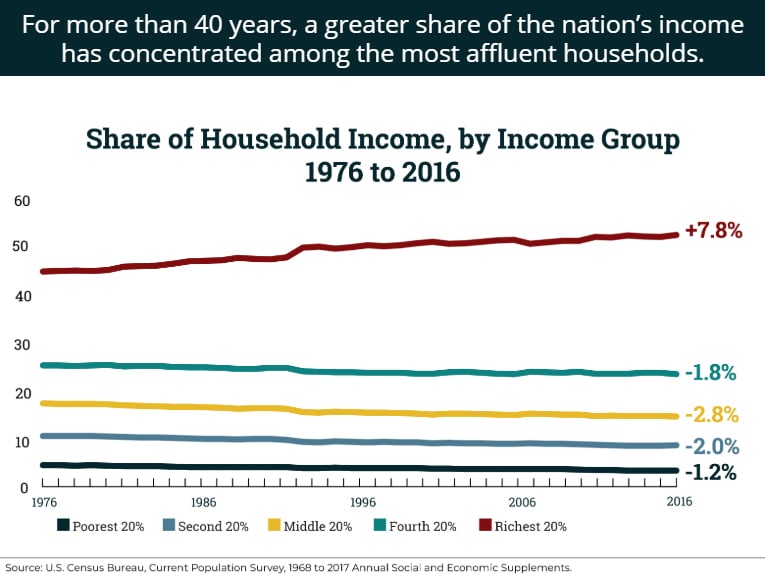

In this illustrated breakdown of the Tax Cuts and Jobs Act (TCJA) and Tax Cuts 2.0, ITEP staff examine TCJA's role in growing income inequality, broken promises from corporations pledging to invest tax savings into workers and wages, and the embarrassment of riches flowing to the wealthiest Americans as a result of these “middle-class tax cuts.”

State Rundown 8/8: States Setting Rules for Upcoming Tax Decisions

August 8, 2018 • By ITEP Staff

August is often a season for states to define the parameters of tax debates to come, and that is true this week in several states: a tax task force in Arkansas is nearing its final recommendations; residents of Missouri, Montana, and North Carolina await results of court challenges that will decide whether tax measures will show up on their ballots this fall; and Michigan and South Dakota are taking different approaches to making sure they’re ready to collect online sales taxes next year.

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

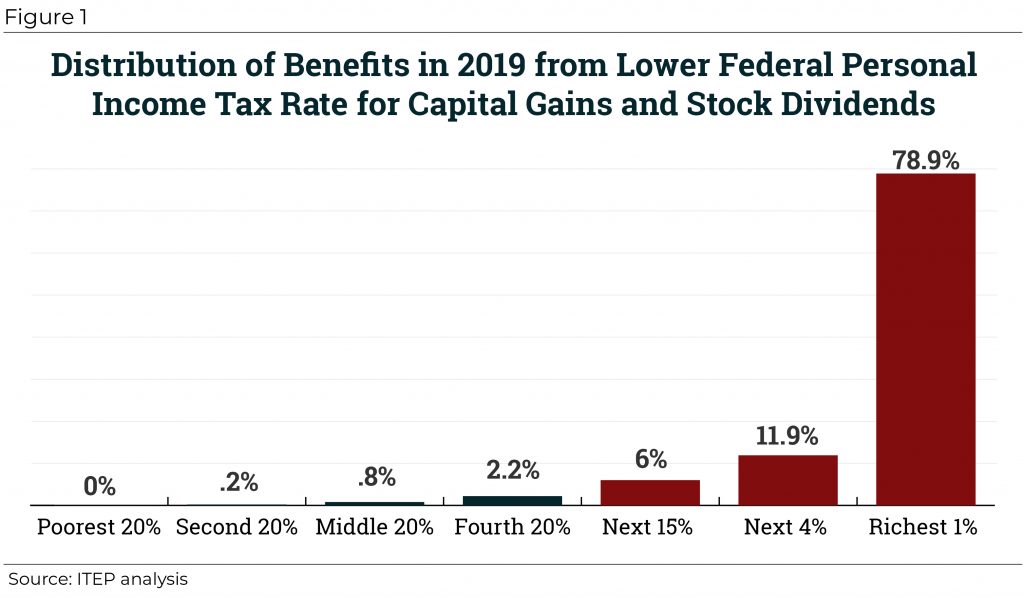

The Preferential Tax Treatment of Capital Gains Income Should Be Curbed, Not Substantially Expanded

August 1, 2018 • By Richard Phillips

For true believers in supply-side economics, however, one major flaw of the TCJA is that it did not further cut taxes for the wealthy by reducing capital gains tax rates. But now the Trump Administration is considering using executive action to remedy this by indexing capital gains to inflation for tax purposes.

The Fight for Education Funding: State Revenue Needs and Responses in 2018

July 24, 2018 • By Aidan Davis

States’ need for revenue and increased investment in key public services is not unique to this legislative session. But the extent of disinvestment—particularly in education—has been a driving force behind policy discussion and state legislative action this year. In many cases ill-advised tax cuts coupled with persistent school funding cuts led states to this common fate, initiating a powerful and growing trend. Here’s how lawmakers in a handful of state responded:

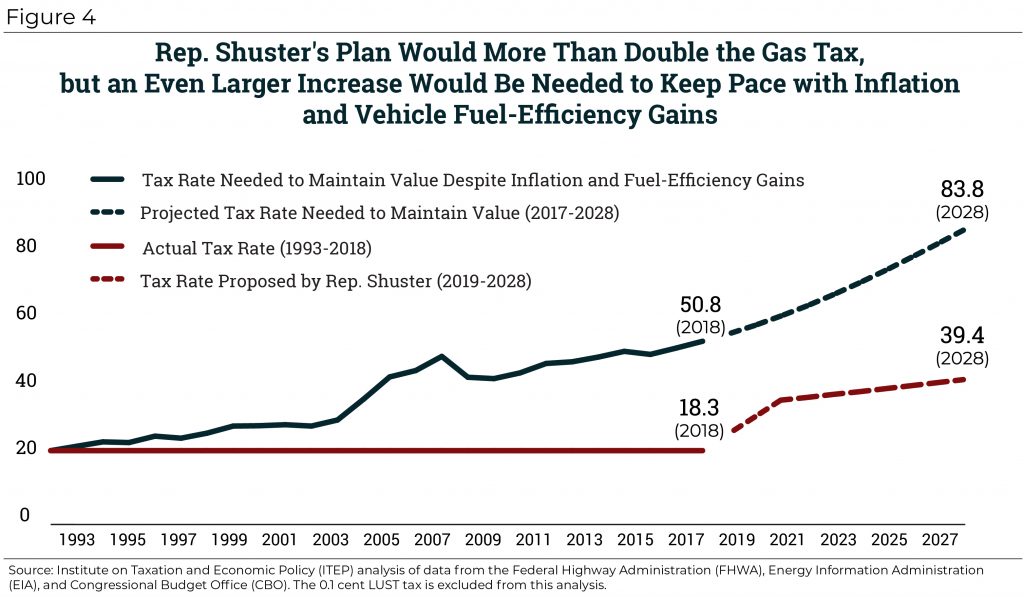

Rep. Shuster’s Mixed Bag: Doubling the Gas Tax before Repealing It Entirely

July 24, 2018 • By Carl Davis

This article examines the good aspects of Rep. Shuster’s infrastructure funding plan (a higher gas tax that is indexed to inflation), the bad (a flawed indexing formula and eventual gas tax repeal), and the downright ugly (tying the hands of a funding commission before their work even begins and refusing to ask more of high-income households).

State Rundown 7/19: Wayfair Fallout and Ballot Preparation Dominate State Tax Talk

July 19, 2018 • By ITEP Staff

In the wake of the U.S. Supreme Court's recent Wayfair decision authorizing states to collect taxes owed on online sales, Utah lawmakers held a one-day special session that included (among other tax topics) legislation to ensure the state will be ready to collect those taxes, and a Nebraska lawmaker began pushing for a special session for the same reason. Voters in Colorado and Montana got more clarity on tax-related items they'll see on the ballot in November. And Massachusetts moves closer toward becoming the final state to enact a budget for the new fiscal year that started July 1 in…

How should lawmakers fix the system? A new ITEP report breaks down how the international corporate tax code under the TCJA works, and how lawmakers can fix it. The report lays out three key principles for reform: equalize the rates, eliminate inversions, and create transparency.