Recent Work by ITEP

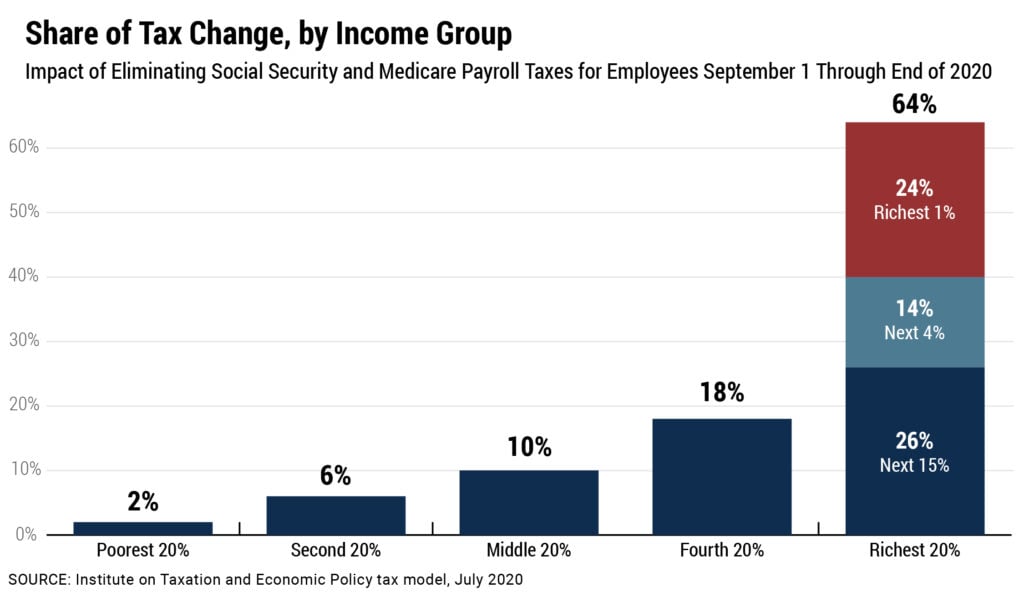

While the White House hasn’t clarified what it is proposing, we know that a payroll tax cut would not be well-targeted. In a new report, ITEP estimates the effects of suspending Social Security and Medicare payroll taxes for employees and employers from September 1 through the end of the year. We find that 64 percent of the benefits would go to the richest 20 percent of Americans while 24 percent of the benefits would go to the richest 1 percent.

An Updated Analysis of a Potential Payroll Tax Holiday

July 21, 2020 • By Jessica Schieder, Matthew Gardner, Steve Wamhoff

ITEP estimates that if Congress and the president eliminated all Social Security and Medicare payroll taxes paid by employers and employees from Sept. 1 through the end of the year, 64 percent of the benefits would go the richest 20 percent of taxpayers and 24 percent of the benefits would go to the richest 1 percent of taxpayers, as illustrated in the table below. The total cost of this hypothetical proposal would be $336 billion.

SALT Cap Repeal Has No Place in COVID-19 Legislation: National and State-by-State Data

July 17, 2020 • By Steve Wamhoff

The Trump-GOP tax law enacted at the end of 2017 includes a $10,000 cap on the amount of state and local taxes (SALT) that people can deduct on their federal tax returns, and this is one of the few limits the law places on tax breaks for high-income people. Unfortunately, it is also the provision that some Democrats are most determined to remove.

Trade Deals Aren’t Enough: Fixing the Tax Code to Bring American Jobs Back

July 16, 2020 • By Amy Hanauer

We all need the public sector to protect public health, keep us safe, educate our children, and much more. Companies, particularly multinational corporations, could not function without the legal, infrastructure, financial, regulatory, health, and transportation resources that the government provides.

With tax day finally coming at the federal level and in many states this week, policymakers in Nevada and New Jersey began to talk about revenue solutions to their revenue shortfalls, even if they fell well short of wholeheartedly backing needed reforms. Like their counterparts in most states, they remain primarily focused on temporary solutions to their short-term emergencies. Still, advocates in these and other states continue to push for more fundamental fixes to their inadequate and upside-down tax codes, including a new campaign for better tax policy in Massachusetts and efforts to rein in tax subsidies and loopholes in…

New Prosperity Now Report Identifies Upside-Down Tax Incentives

July 15, 2020 • By Jessica Schieder

Ahead of this year’s delayed Tax Day, our partners at Prosperity Now released a powerful report providing a comprehensive overview of many of the ways our federal tax system privileges wealth over work, while also lifting up several provisions which could serve as a template for improving progressivity within the tax code. The report makes […]

Who Pays Taxes in America in 2020?

July 14, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

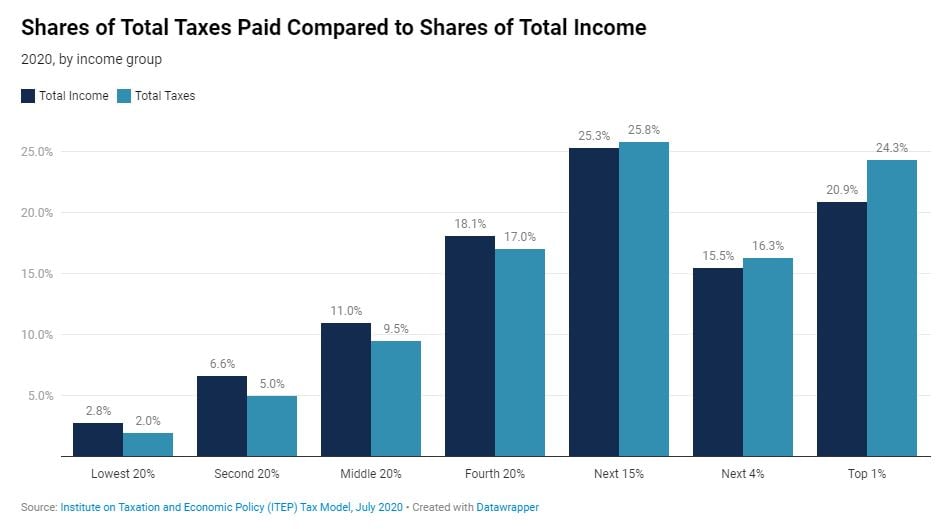

Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals, families and communities afloat. This year, the share of all taxes paid by the richest 1 percent of Americans (24.3 percent) will be just a bit higher than the share of all income going to this group (20.9 percent). The share of all taxes paid by the poorest fifth of Americans (2 percent) will be just…

Adequately Funding the IRS Would Be One Small Step Toward Racial Equity in the Tax Code

July 10, 2020 • By Jenice Robinson

IRS Commissioner Charles Rettig vowed to work with Congress to explore how the federal tax system contributes to the racial wealth gap. There are at least two ways this can happen: tax policies enacted by Congress and IRS enforcement of these policies.

Congressional Budget Office Confirms That IRS Budget Cuts Lose Money and Benefit the Rich

July 9, 2020 • By Steve Wamhoff

Lawmakers often claim that they are “saving” taxpayers money by slashing federal spending, but the truth is that these cuts often are counterproductive and costly in the long-term. One type of budget-cutting has costs that are immediate and obvious—cuts to the IRS, the agency that collects the revenue that pays for federal spending. A new report from the Congressional Budget Office (CBO) confirms that lawmakers’ anti-government, IRS funding-cuts zeal has increased the deficit.

State Rundown 7/8: Many State Legislatures Reconvene for Special or Resumed Sessions

July 8, 2020 • By ITEP Staff

Local leaders in the District of Columbia and Seattle, Washington, approved progressive tax changes to raise needed funding this week for priorities such as coronavirus relief, affordable housing, and mental health. Arizona advocates submitted signatures to place a high-income surcharge on the ballot for November. And as a number of states made decisions on how to use federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funds, North Carolina decoupled from costly business tax cuts contained in the act and Nebraska started discussing doing the same.