Recent Work

2146 items

Efforts to increase taxes usually face some opposition, particularly increases to broad-based taxes such as the sales or income tax. Yet in many states, lawmakers have been able to agree on one approach to revenue-raising: the cigarette tax. Since 2002, nearly every state has enacted a cigarette tax in-crease to fund health care, discourage smoking, or to help balance state budgets. This policy brief looks at the advantages and disadvantages of cigarette taxes, and cigarette tax increases, as a source of state and local revenue.

This report explains the workings, and problems, with state-level tax subsidies for private K-12 education. It also discusses how the Internal Revenue Service (IRS) has exacerbated some of these problems by allowing taxpayers to claim federal charitable deductions even on private school contributions that were not truly charitable in nature. Finally, an appendix to this report provides additional detail on the specific K-12 private school tax subsidies made available by each state.

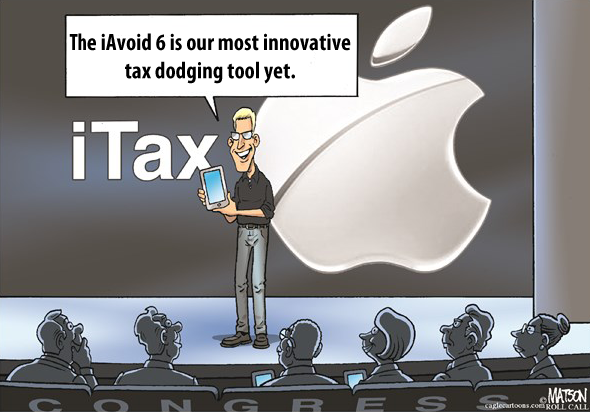

This study explores how in 2015 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country's wealthiest corporations benefit the most from this tax avoidance scheme.

We appreciate the Financial Accounting Standards Board's (FASB) ongoing review of its accounting standards to ensure that financial statements are "facilitating clear communication of information that is important to financial statement users." Overall, the changes to disclosure requirements proposed by FASB in the exposure draft would represent a significant step forward toward providing users of financial statements the clarity that they need. We believe, however, that the exposure draft does not go far enough in providing the clarity needed and sought by investors and the public alike.

Despite this unlevel playing field states create for their poorest residents through existing policies, many state policymakers have proposed (and in some cases enacted) tax increases on the poor under the guise of "tax reform," often to finance tax cuts for their wealthiest residents and profitable corporations.

State lawmakers seeking to make residential property taxes more affordable have two broad options: across-the-board tax cuts for taxpayers at all income levels, such as a homestead exemption or a tax cap, and targeted tax breaks that are given only to particular groups of low- and middle-income taxpayers. One such targeted program to reduce property taxes is called a "circuit breaker" because it protects taxpayers from a property tax "overload" just like an electric circuit breaker: when a property tax bill exceeds a certain percentage of a taxpayer's income, the circuit breaker reduces property taxes in excess of this "overload"…

Reducing the Cost of Child Care Through State Tax Codes

September 14, 2016 • By Aidan Davis, Meg Wiehe

Low- and middle-income working parents spend a significant portion of their income on child care. As the number of parents working outside of the home continues to rise, child care expenses have become an unavoidable and increasingly unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Rewarding Work Through State Earned Income Tax Credits

September 14, 2016 • By Aidan Davis, Lisa Christensen Gee, Meg Wiehe

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

News Release: U.S. Should Take a Page from European Commission’s Book And Crack Down on Corporate Tax Avoidance

August 30, 2016 • By ITEP Staff

Following is a statement by Matt Gardner of the Institute on Taxation and Economic Policy regarding the European Commission’s ruling today that the Apple Corporation must pay as much as €13 billion ($14.5 billion) in back taxes due to an illegal tax break granted by the Irish government. “The European Commission action is a chastening […]

The Little-Known Effect of State Tax Changes: More or Less Money to the Federal Government

August 24, 2016 • By Jenice Robinson

The Institute on Taxation and Economic Policy (ITEP) this week published a new policy brief whose conclusions may be surprising to those who don’t spend their days analyzing the intersection of state and federal tax policy. The brief, How State Tax Changes Affect Your Federal Taxes, outlines how the “federal offset,” or the deductibility of […]

How State Tax Changes Affect Your Federal Taxes: A Primer on the “Federal Offset”

August 22, 2016 • By Dylan Grundman O'Neill

Read this brief in PDF here. State lawmakers frequently make claims about how proposed tax changes would affect taxpayers at different income levels. Yet too many lawmakers routinely ignore one important consequence of their tax reform proposals: the effect of state tax changes on their constituents’ federal income tax bills. Wealthier taxpayers in particular can […]

Indexing Income Taxes for Inflation: Why It Matters

August 22, 2016 • By Dylan Grundman O'Neill

Read brief in PDF here. All of us experience the effects of inflation as the price of the goods and services we buy gradually goes up over time. Fortunately, as the cost of living goes up, our incomes often tend to rise as well in order to keep pace. But many state tax systems are […]

The Folly of State Capital Gains Tax Cuts

August 17, 2016 • By Dylan Grundman O'Neill, Meg Wiehe

Read the brief in a PDF here. The federal tax system treats income from capital gains more favorably than income from work. A number of state tax systems do as well, offering tax breaks for profits realized from local investments and, in some instances, from investments around the world. As states struggle to cope with […]

Tim Cook’s Disingenuous Argument to Justify Apple’s $215 Billion Offshore Cash Hoard

August 9, 2016 • By Jenice Robinson

Tim Cook is a persuasive CEO. In a wide-ranging interview published earlier this week in the Washington Post, he discussed his vision for the company, thoughts about leadership succession, and humbly admitted he has made mistakes. So it would be very easy to view as reasonable his declaration that Apple will not repatriate its offshore […]