Recent Work

2149 items

New Leadership Should Seize Tax Justice Mandate; Cash Payments Offer On-ramp

January 8, 2021 • By Amy Hanauer

With the victory of Senators-elect Raphael Warnock and Jon Ossoff in Georgia, Democrats now control all three branches of government. New leaders should seize this moment to create a tax code that does much more to reduce inequality and to resource long-overdue investments in climate, health, education and other essentials. Most immediately, the historic election shifts power, making it easier to deliver on the promise to increase the recently enacted $600 cash payments to $2,000 per person.

State Rundown 1/7: State Work Continues in Shadow of National Events

January 7, 2021 • By ITEP Staff

Though most people’s attention is rightly focused on events unfolding in the nation’s capital this week, state legislative debates are also underway or soon to begin in many states, including proposals to tax the rich in New York and Rhode Island, provide a boost to low-income families in California, and legalize and tax cannabis in Missouri and Rhode Island.

How the Proposed $2,000 Cash Payments Compare to the $600 Already Provided by Congress

January 6, 2021 • By Steve Wamhoff

On Dec. 28, the House of Representatives passed the Caring for Americans with Supplemental Help (CASH) Act of 2020, which would increase the cash payment recently provided by Congress from $600 per person to $2,000 per person, among other changes. New estimates from ITEP compare the impacts of $2,000 payments to $600 payments.

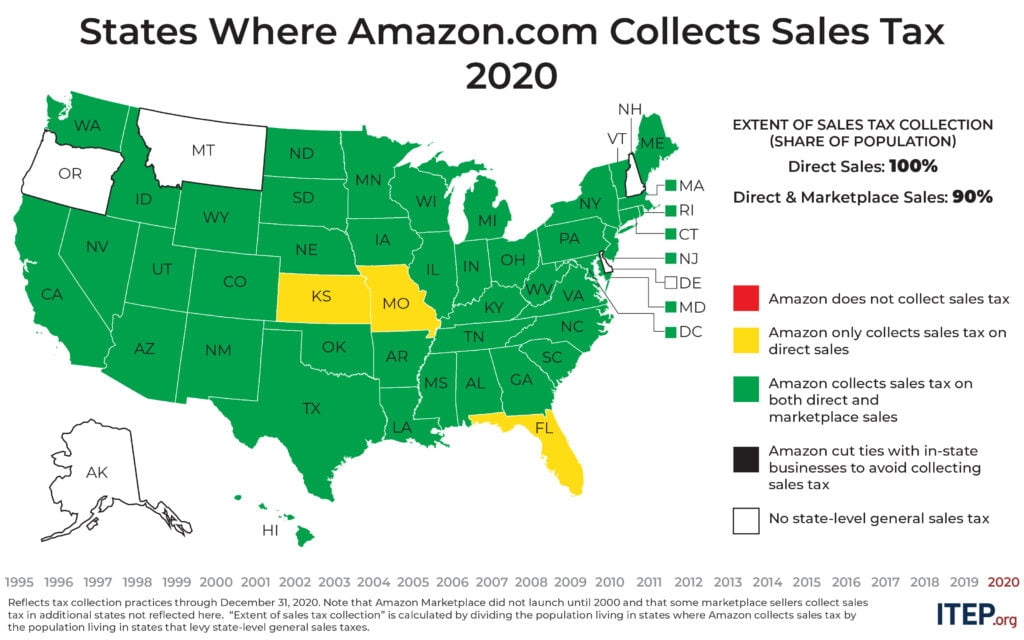

Today, Amazon is collecting state-level sales taxes on all its direct sales but it still usually fails to collect sales tax on the large volume of sales it makes through the Amazon Marketplace. This points to a broader problem in state tax enforcement that lawmakers in many states are moving quickly to address with laws and administrative action requiring tax collection by Amazon and other large online marketplaces such as Etsy and eBay.

Ghosts of Fiscal Crunches Past, Present, Future Have Advice for State Lawmakers

December 21, 2020 • By Dylan Grundman O'Neill

State policymakers and advocates may face some long sleepless nights as they close the book on 2020 and prepare for the important decisions they’ll be making in 2021 and beyond. So we at ITEP have consulted with ghosts of fiscal crunches past, present, and future, and distilled their lessons into seven key things to keep in mind for 2021 tax and budget debates:

COVID Relief Bill Will Help Families Now; Bigger, Bolder Package Needed in 2021

December 21, 2020 • By Amy Hanauer

Following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the COVID-19 relief deal reached Sunday night.

National and State-by-State Estimates of New $600 Cash Payments

December 21, 2020 • By Steve Wamhoff

The House and Senate are about to pass the first COVID-19 relief legislation since the CARES Act was enacted in March. The new relief package includes, among other provisions, cash payments of $600 per person, which is half as large as the payments provided under the CARES Act, but also extends payments to spouses and children of certain undocumented immigrants who were left out of the previous payments.

State Rundown 12/17: New and Old State Tax Debates Await in 2021

December 17, 2020 • By ITEP Staff

Our last Rundown of 2020 includes news of yet another misguided proposal to eliminate a state income tax, this time in Arkansas. Florida and Missouri, on the other hand, are looking to modernize their tax codes by becoming the last two states to enforce their own sales taxes on online retailers. Leaders in Maryland and Oregon, meanwhile, are working to decouple the state from unnecessary and regressive tax cuts included in the federal CARES Act. And Missouri and Nevada lawmakers both got updated estimates of the revenue shortfalls they will need to resolve when they convene in 2021. The Rundown…

A Second Round of Direct Cash Payments Could Provide an Average $1,550 to the Poorest Families

December 8, 2020 • By Jenice Robinson

It will not magically become easier for families to put food on the table or make their next rent payment. Policymakers must act. People are struggling because they are either out of work, involuntarily working part-time, trying to financially catch up after being out of work for a spell, or squeaking by because we live in a wealthy democracy that fails to guarantee basics such as access to affordable housing, health care, food, and jobs that pay living wages.

McConnell Balked at More Stimulus Aid to States, Betting Red States Wouldn’t Need It. Now?

December 4, 2020 • By Meg Wiehe

It is December 2020. Sen. McConnell has denied states—and their residents—relief for months. Congress must act now. Even if it does, it is unlikely to provide the robust aid needed to keep communities afloat and positioned for healthy recovery. Lawmakers across the country should be prepared to return to state capitals and city halls in the new year with plans to raise revenue not just to weather this crisis, but also to invest in long-term recovery.

These EITC Reforms Would Help Struggling Families Now and Address Systemic Challenges

December 4, 2020 • By Aidan Davis

The tepid economic recovery is leaving millions behind. The nation still has nearly 10 million jobs less than it did in February, according to the latest jobs report. The number of people living in or near poverty is rising. Twelve million workers are about to lose their unemployment insurance, roughly four in 10 people report experiencing food insecurity for the first time, and conditions are likely to deteriorate further in the weeks ahead as we brace for another deadly surge in COVID cases and new or tightened restrictions on business and personal activity.

COVID-19 Containment Is Key to Recovery—So Is Another Round of Stimulus

December 3, 2020 • By Aidan Davis

You can learn a lot about our leaders from how they act during times of crisis. This December, we are in our 10th month of the pandemic in the United States. With COVID cases climbing, deaths exceeding 270,000 and hospitalizations surpassing 100,000 for the first time, some states have halted reopening plans and imposed new restrictions. Containment of the virus is key to sustained economic recovery. As is another round of federal stimulus.

Lame-Duck Session No Time for Perfection, but a Bold Compromise on COVID Relief Is Needed

December 2, 2020 • By Amy Hanauer

Time for COVID relief is dwindling. A bipartisan group of lawmakers introduced a $908 billion COVID relief package on Tuesday, House Speaker Nancy Pelosi is floating a relief proposal and Sen. Mitch McConnell is circulating a wholly inadequate package. The best chance for legislation may be to include it in an omnibus appropriations bill, which Congress must pass this month. Following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding congressional negotiations over another round of economic relief.

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

State Rundown 11/24: Lawmakers and Families Thankful to Be Nearing End to 2020

November 24, 2020 • By ITEP Staff

Just as people will search their hearts to give thanks this week for the small and large things that got them through a difficult year, state lawmakers are also doing their best to count their blessings while keeping fingers crossed for badly needed federal relief to give them something to be truly grateful for.