Recent Work

2146 items

South Strong: Racial Equity and Taxes in Southern States

August 26, 2020 • By Amy Hanauer, Meg Wiehe

Southern states have a particularly egregious record on tax equity, rooted partly in racism. Lawmakers baked some of the most egregious and anti-democratic tax policies into southern state constitutions, such as supermajority requirements to raise taxes in Florida, Mississippi and Louisiana, income tax rate caps in North Carolina and Georgia, and the recent elimination of […]

Missed Opportunity: Flimsy Paper Touts Flawed Program

August 25, 2020 • By Amy Hanauer, ITEP Staff, Lorena Roque

Republicans continue to tout Opportunity Zones as their main vehicle to assist poor people, most recently with a deeply flawed report from President Trump’s White House Council of Economic Advisors and a mention from Donald Trump Jr. in his opening night convention speech. The report purports to compare—as a way of cutting poverty—tax breaks for investors vs food, cash or health insurance coverage for struggling families.

Analysis: Trump’s Proposed Capital Gains Break Almost Exclusively Benefits Top 1 Percent

August 18, 2020 • By Steve Wamhoff

On Aug. 13, President Trump pledged to cut the top federal income tax for capital gains to 15 percent. The Institute on Taxation and Economic Policy estimates that 99 percent of the benefits would go to the richest 1 percent of taxpayers. This is unsurprising given that only those with taxable income of nearly half a million dollars are subject to a capital gains tax rate higher than 15 percent.

Trump’s Executive Order on Social Security Payroll Taxes Is a Mess

August 17, 2020 • By Steve Wamhoff

President Trump’s executive order that would supposedly allow workers to delay paying Social Security taxes, along with his related public statements, have created a situation that is bizarre even by 2020 standards.

Action (lack thereof) on Economic Aid Reflects Longstanding Anti-Government Agenda

August 14, 2020 • By Amy Hanauer

The biggest danger we face right now is that politicians will fail to get this health crisis under control and Americans will continue to die. The second biggest danger is that elected officials will fail to help families and communities, leading to foreclosures, evictions, and impoverishment—and also torpedoing the economy. With their inaction this week, the Senate seems determined to do both. Hold on everyone, we’re in for a sickening ride.

State Rundown 8/12: States Find Themselves in New Unemployment Pickle

August 12, 2020 • By ITEP Staff

Even in statehouses, many eyes remained on Congress and President Trump this week as state lawmakers advocated for needed federal fiscal relief and debated whether they can afford to join in on the president’s executive order requiring states to partially fund a new version of enhanced unemployment benefits that have otherwise expired.

IRS Rule Leaves the Door Open for Private/Religious School Voucher Donation Schemes, Broader SALT Cap Workarounds

August 12, 2020 • By Carl Davis

An IRS regulation released last Friday sanctions a widely derided tax dodge that allows profitable businesses to avoid taxes by sending money to private and religious school voucher funds. It also leaves the door open to a brand of state and local tax (SALT) cap workaround that previously appeared to be on its way out.

This week, voters in Missouri approved Medicaid expansion, Nevada lawmakers moved to amend their Constitution to raise taxes on the state’s mining industry, and leaders in California and New York continued to push for needed revenues through tax increases on their richest households.

Between the Lines: Amazon Q2 Report Hints It Will Avoid Taxes on This Year’s Record Profit Haul

August 5, 2020 • By Matthew Gardner

The House Judiciary Committee last week held an antitrust hearing to scrutinize Amazon and other tech companies’ growing dominance. A look at the online retail giant’s new quarterly report and past tax avoidance reveals why lawmakers should be equally concerned about how the tax system allows dominant, profitable corporations to avoid most or all federal tax on their profits. Amazon, yet again, is poised to pay little or no federal income tax on its record profits, and it appears likely to do so using entirely legal tax breaks for stock options and research and development.

Sorry, States: GOP Senate Ignores Need for Federal Relief to State and Local Governments

July 31, 2020 • By Meg Wiehe

During the Great Recession, the most ambitious state revenue-raising efforts closed just 10 percent of shortfalls and most states relied heavily on federal aid and budget cuts to balance their budgets. Of course, states can and should turn to progressive revenue-raising options now, but as the pandemic rages on, the extent of this crisis will become too significant for states and localities to handle on their own. The federal government should step in to help.

As many of the country’s major professional sports leagues attempt to return to action amid concerns that the pandemic will find a way to ruin even the best-laid plans, state legislatures find themselves in a similar boat. Lawmakers would normally be enjoying their summer breaks at this time of year, but instead are returning to work in special sessions surrounded by plexiglass and uncertainty. Read on for information on ongoing sessions in states including California, Massachusetts, and Nebraska, as well as upcoming sessions in Missouri and Oregon.

Biden’s Minimum Corporate Tax Proposal: Yes, Please Limit Amazon’s Tax Breaks

July 29, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

A large majority of Americans want corporations to pay more taxes and Democratic presidential candidate Joe Biden has several proposals to achieve that. The newest idea is to require corporations to pay a minimum tax equal to 15 percent of profits they report to shareholders and to the public if this is less than what they pay under regular corporate tax rules. A recent article in the Wall Street Journal quotes several critics of the proposal, but none of their points are convincing.

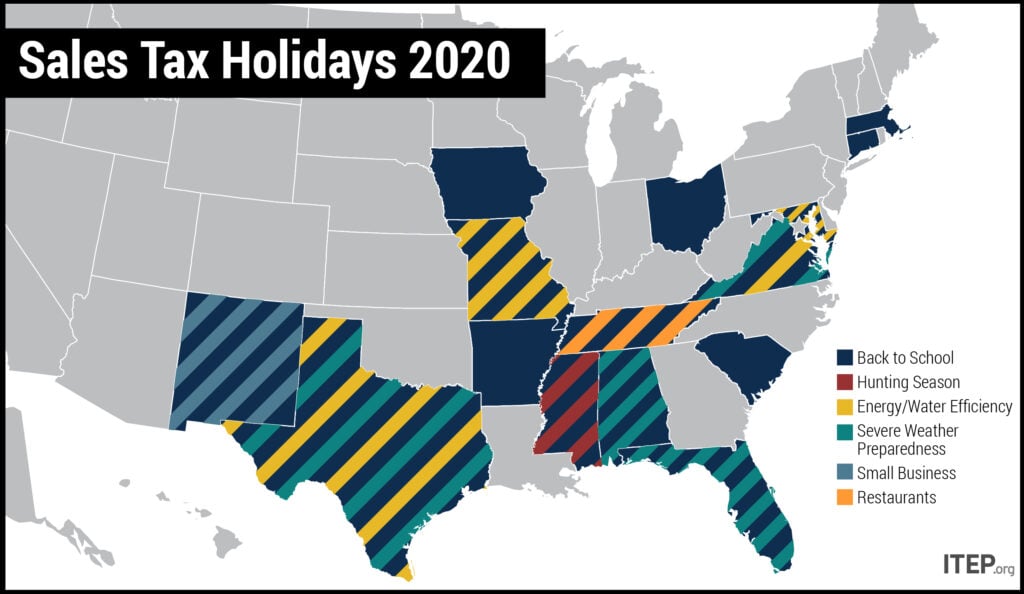

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

A Cautionary Tale on Sales Tax Holidays During a Pandemic

July 29, 2020 • By Dylan Grundman O'Neill

Sixteen U.S. states will hold “sales tax holidays” this year. As ITEP’s newly updated brief explains, these events offer dubious benefits at significant public expense even in normal years, problems which are only amplified in the context of the COVID-19 pandemic.

Americans are demanding policy that meets the needs of this urgent moment. There are now competing proposals from the U.S. House and Senate: One is a reasonable response to the staggering crisis we’re in. One is not.