Recent Work

2162 items

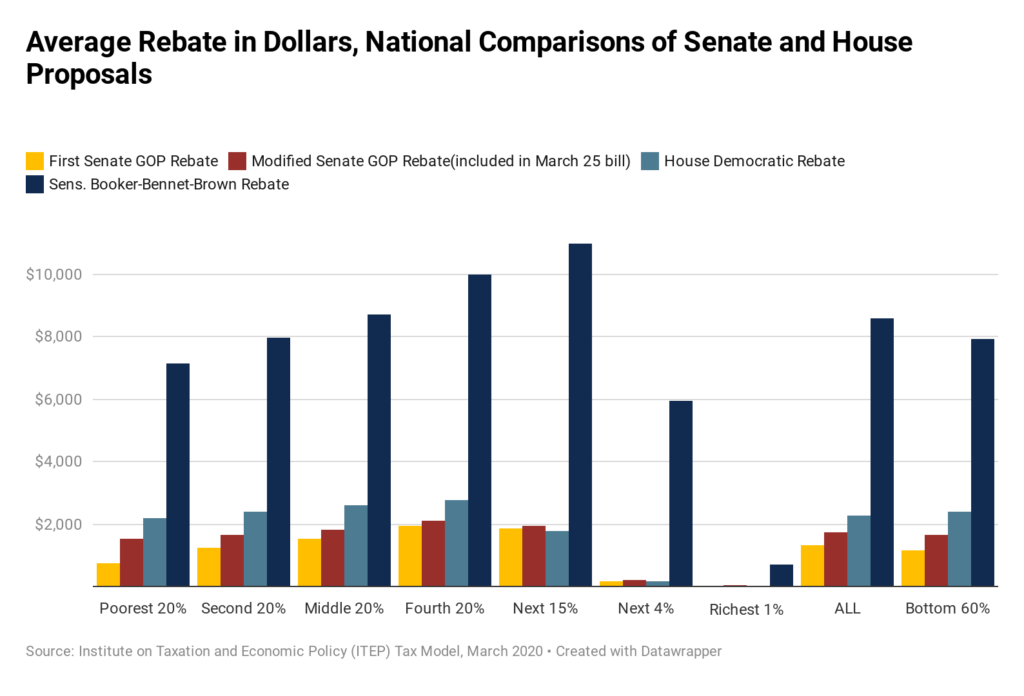

How the Tax Rebate in the Senate’s Bill Compares to Other Proposals

March 25, 2020 • By Steve Wamhoff

Congress is poised to pass a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. As the Senate votes on its stimulus/COVID19 bill, one provision ITEP has deeper insights on is the payments to households in the form of tax rebates. ITEP has provided several analyses over the past few days showing that the rebate in the current bill is an improvement over a previous GOP proposal but still falls short of…

New Analysis Shows Average Rebate for Families in the Stimulus Bill

March 25, 2020 • By ITEP Staff

The Senate agreed to a compromise stimulus bill last night that improves on flaws in its initial bill but still fails to go as far as other proposals and leaves out immigrants who file taxes via Individual Taxpayer Identification Numbers (ITIN), the Institute on Taxation and Economic Policy said today.

COVID-19 and the Case for Race-Forward Economic Policy Prescriptions

March 24, 2020 • By Jenice Robinson

Unconscious bias runs deep. Legislative proposals to assuage the exploding economic crisis are advancing and changing quickly, but initial GOP proposals are consistent with the nation’s long history of ostensibly race-neutral policies that are discriminatory in their outcomes.

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

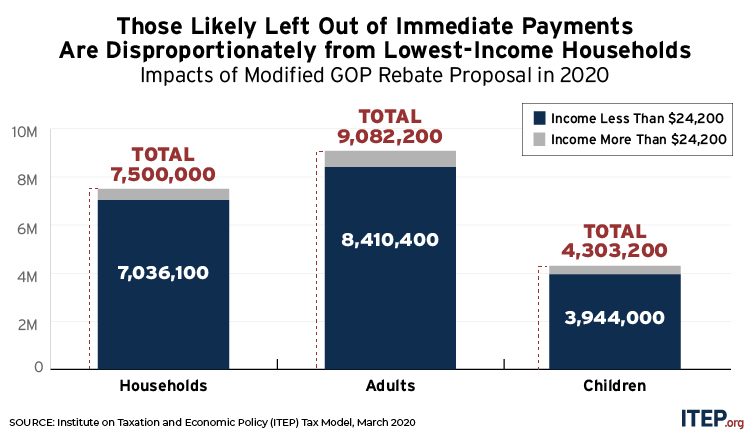

New State-by-State Estimates: Modified Senate GOP Stimulus Bill Still Falls Short

March 23, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The GOP Senate stimulus bill voted down yesterday is a slight improvement over the first GOP proposal released Thursday, but it still fails to prioritize workers and families or provide fast relief to those who need it most.

Why the GOP Senate Bill Fails to Address the Crisis, and Why a Democratic Bill Looks More Promising

March 20, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

National and state-by-state data available for download By Steve Wamhoff and Meg Wiehe On Thursday night, Senate Majority Leader Mitch McConnell released a bill that reportedly cost more than $1 trillion, most of which would go toward breaks for corporations and other businesses. A provision in the bill to provide payments to families would cost […]

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.

It’s Time for Some State Fiscal Policy Triage

March 18, 2020 • By Carl Davis, Dylan Grundman O'Neill, ITEP Staff

The COVID-19 novel coronavirus’s effects on public health and economies at all scales are creating a daunting situation for state budgets as well. Lawmakers can choose and prioritize their responses through a straightforward approach similar to that taken by health professionals: marshal and reinforce available resources, triage response options to prioritize the most vital services and most vulnerable people, and enact or strengthen the policies that will help address longer-term issues as well as immediate emergencies.

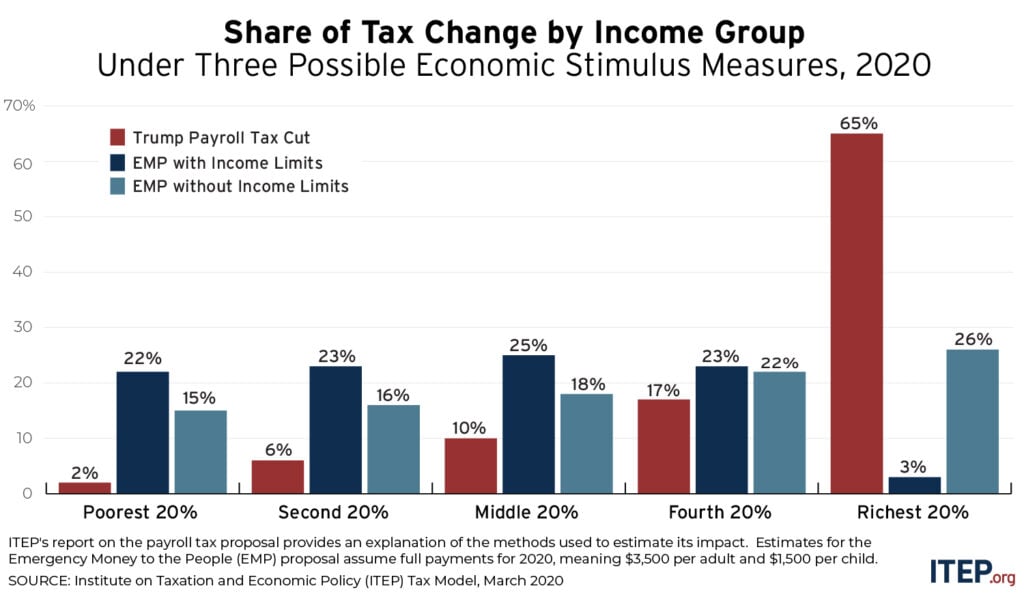

A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings. Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

New ITEP Report on President’s Misguided Payroll Tax Proposal

March 13, 2020 • By Steve Wamhoff

Earlier this week, ITEP analyzed what would happen if Congress and the President repeated the 2 percentage-point cut in the Social Security payroll tax that was enacted for two years during the last recession. Little did we know that President Trump was about to propose something far more radical: eliminating all Social Security and Medicare […]

President Trump has proposed to eliminate payroll taxes that fund Social Security and Medicare through the end of the year. ITEP estimates that this would cost $843 billion and 65 percent of the benefits would go to the richest 20 percent of taxpayers, as illustrated in the table below.

An Overload of Pie Graphs and Metaphors for Pi Day

March 13, 2020 • By ITEP Staff, Jenice Robinson, Stephanie Clegg

For Pi Day, we’re doubling down on the pie metaphor to reiterate the compelling case for progressive tax policies to ensure more of us have an opportunity to share a slice of this nation’s economic pie.

State Rundown 3/11: Georgia Bucks Trend of Cautious Policymaking Amid Crises

March 11, 2020 • By ITEP Staff

With all eyes on the potential effects of the oil price war and COVID-19 coronavirus on lives, communities, and economies, Georgia House lawmakers this week crammed through a regressive and costly tax cut for the rich with essentially no debate, information, or transparency. Most states are proceeding much more responsibly, assessing the ramifications for their service provision needs and revenues to fund those needs.

ITEP Testimony on the Illinois Earned Income Credit

March 11, 2020 • By Lisa Christensen Gee

Read as PDF Testimony of Lisa Christensen Gee, Director of Special Initiatives, Institute on Taxation and Economic Policy Submitted to: Illinois House Revenue Committee Chairman Zalewski, committee members—thank you for holding this subject matter hearing this morning on the Earned Income Credit (EIC) and its importance for hard working Illinoisans and their families. My name […]

The Trump administration is floating a cut in the Social Security payroll tax as a measure to counteract a potential economic downturn related to the COVID-19 virus. It should go without saying that a public health crisis requires government interventions that have nothing to do with taxes. But even if policymakers want to find ways to stimulate the economy beyond solving the health crisis, the payroll tax cut is not likely to be very effective.