Recent Work

2162 items

More of the Same: Corporate Tax Avoidance Hasn’t Changed Much Under Trump-GOP Tax Law

December 16, 2019 • By Matthew Gardner

A new report from ITEP released today shows that, based on the first year of financial reports released by companies operating under the new tax law, tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect.

Corporate Tax Avoidance in the First Year of the Trump Tax Law

December 16, 2019 • By ITEP Staff, Lorena Roque, Matthew Gardner, Steve Wamhoff

Profitable Fortune 500 companies avoided $73.9 billion in taxes under the first year of the Trump-GOP tax law. The study includes financial filings by 379 Fortune 500 companies that were profitable in 2018; it excludes companies that reported a loss.

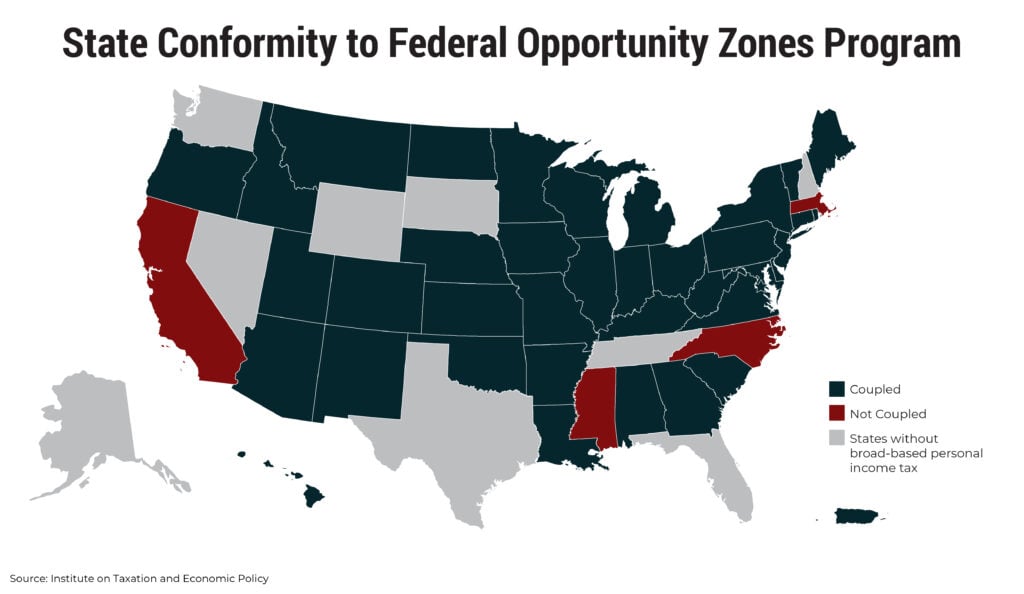

New ITEP Reports Call for the Repeal of Opportunity Zones and Urge States to Decouple

December 12, 2019 • By Lorena Roque

Two new ITEP reports lay bare the irreparable flaws of the federal Opportunity Zones program, created by the Tax Cuts and Jobs Act signed into law by President Trump in 2017.

Opportunity Zones Bolster Investors’ Bottom Lines Rather than Economic or Racial Equity

December 12, 2019 • By Lorena Roque

This policy brief provides an overview of how opportunity zones are designed and highlights some of the flaws of the policy, including the detrimental impact opportunity zones have on communities of color.

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

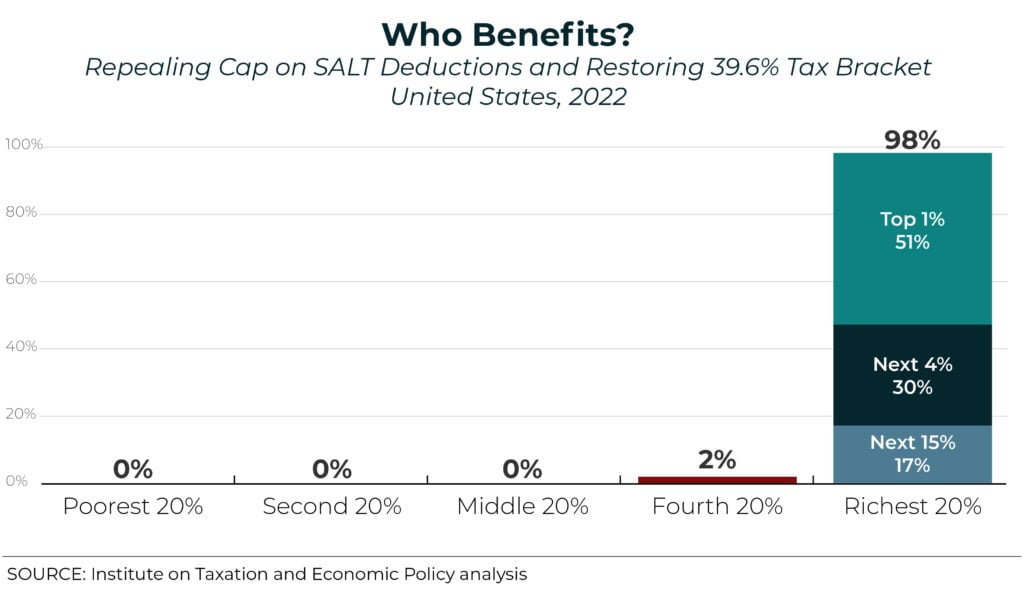

House Democrats’ Latest Bill on SALT Deductions Would Mean Bigger Tax Cuts for the Rich

December 11, 2019 • By Steve Wamhoff

ITEP estimates show that if the House Democrats' proposal was in effect in 2022, it would have a net cost of $81 billion in that year alone. The estimates also show that 51 percent of the benefits would go to the richest 1 percent of taxpayers in the U.S. Clearly, lawmakers concerned about the SALT cap need to go back to the drawing board.

Earlier this year, Amazon and Netflix made headlines when ITEP reported findings that these and at least 58 other companies paid no federal income taxes in 2018. One of the tax breaks they use to manage this feat is related to stock options. Some companies saved hundreds of millions, and in some cases more than a billion dollars, in taxes in 2018 alone with this break. It’s time for Congress to eliminate the stock options tax dodge.

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

A new ITEP report explains that an income tax cut for cannabis businesses embedded in the MORE Act is probably larger than the new 5 percent sales tax. This means that the average cannabis retailer—and its customers—could expect to pay LESS tax if the MORE Act is signed into law. Congress might have good reasons for structuring legalization this way, but it is an underappreciated aspect of the bill that should be made clearer as this debate progresses.

Understanding the full tax consequences of cannabis legalization requires evaluating not only the excise taxes proposed in most legalization bills, but also the effects on the federal income tax liability of cannabis businesses.

Worker Relief and Credit Reform Act

December 2, 2019 • By ITEP Staff

Data available for download The Worker Relief and Credit Reform (WRCR) Act would replace the existing EITC. In most cases, the WRCR credit would be $4,000 for single people and $8,000 for married couples. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less. People caring for […]

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

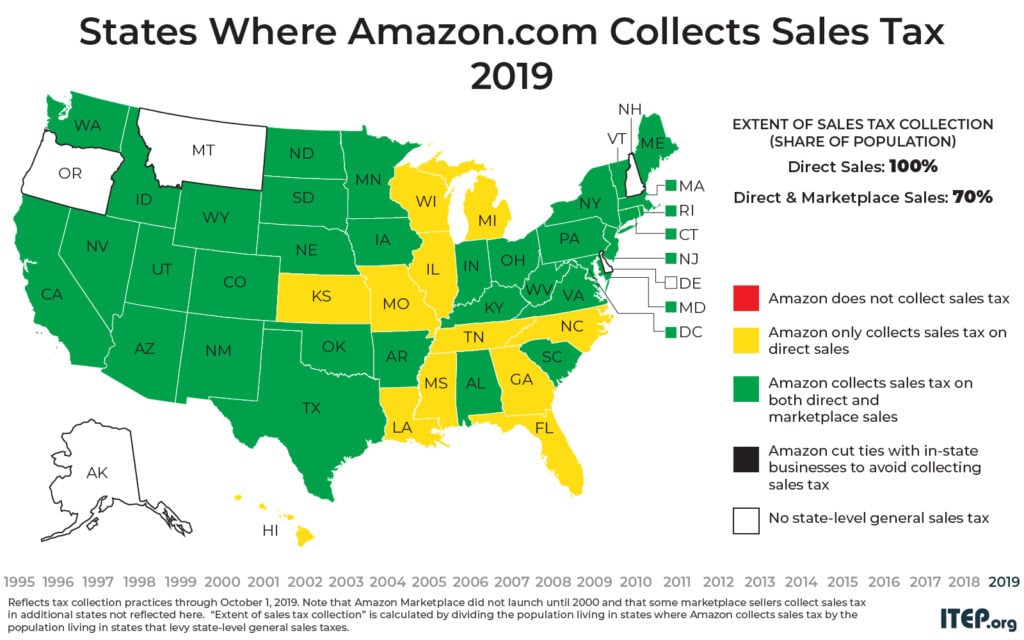

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

Sen. Warren Proposes Sweeping Tax Changes to Finance Medicare for All

November 1, 2019 • By Steve Wamhoff

Senator and presidential candidate Elizabeth Warren released a plan today to offset the costs of Medicare for All, a publicly funded single-payer health care program. While ITEP has not crunched the numbers, it seems likely overall that her proposals would raise trillions of dollars and leave costs and taxes either unchanged or lower for most low- and middle-income people.