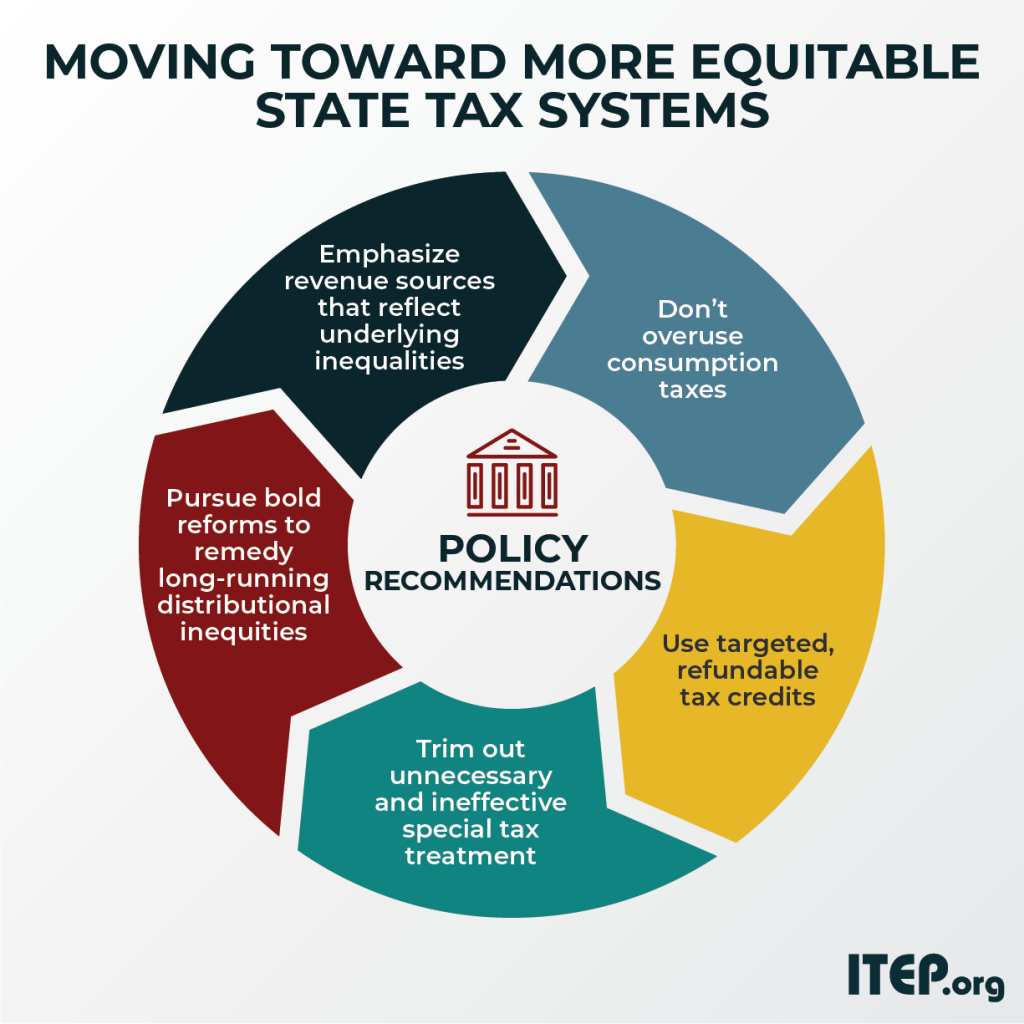

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts in multiple states to consult the research and pursue equitable options instead! We have a lot of news to kick off 2019, but be sure to make it down to our “What We’re Reading” section for recent reports on how the federal shutdown is affecting states, previews of the issues likely to dominate legislative sessions this year, and more.

— MEG WIEHE, ITEP Deputy Director, @megwiehe

Major State Tax Developments and Proposals

- VIRGINIA lawmakers have an opportunity to enact some of our recommended equitable options as they dive right into tax questions this week. The state could gain more than $1 billion in revenue as an indirect result of the federal tax cut, but leaders are at odds over how to respond. Gov. Ralph Northam wants to devote $216 million to aiding low- and middle-income working families by making the state Earned Income Tax Credit (EITC) refundable, and use other amounts to boost state employee and teacher salaries and invest in education, infrastructure, and environmental protection. House Republicans prefer to add state tax cuts on top of the federal tax cuts. And another proposal splits the difference by adopting some of the federal changes and making the EITC partially refundable. — DYLAN GRUNDMAN

- A broad sweeping tax package was adopted in PUERTO RICO. The new law decreases corporate and individual income taxes as well as establishes a credit for workers similar to the EITC. Federally, Congresswoman Jennifer González introduced a bill that would allow island residents to claim the Child Tax Credit if they have fewer than three children. — MISHA HILL

Governors’ Budget Proposals and State of the State Speeches

- Incoming CALIFORNIA Gavin Newsom is releasing his much anticipated first budget on January 10. Given proposals to improve investments across a range of issues—including early childhood, education, paid family leave, and healthcare—many are anxiously awaiting the details as to how Newsom suggests this be accomplished without depleting the state’s Rainy Day fund. Stay tuned!

- Gubernatorial State of the State addresses scheduled the remainder of this week and next include Gov. Jared Polis of COLORADO, Gov. Doug Ducey of ARIZONA, Gov. Kate Brown of OREGON, Gov. Asa Hutchinson of ARKANSAS, Gov. Eric Holcomb of INDIANA, Gov. Kim Reynolds of IOWA, Gov. Phil Bryant of MISSISSIPPI, Gov. Pete Ricketts of NEBRASKA, Gov. Gina Raimondo of RHODE ISLAND, Gov. Jay Inslee of WASHINGTON, Gov. Laura Kelly of KANSAS, Gov. Eric Greitens of MISSOURI, Gov. Steve Sisolak of NEVADA, and Gov. John Carney of DELAWARE.

State Roundup

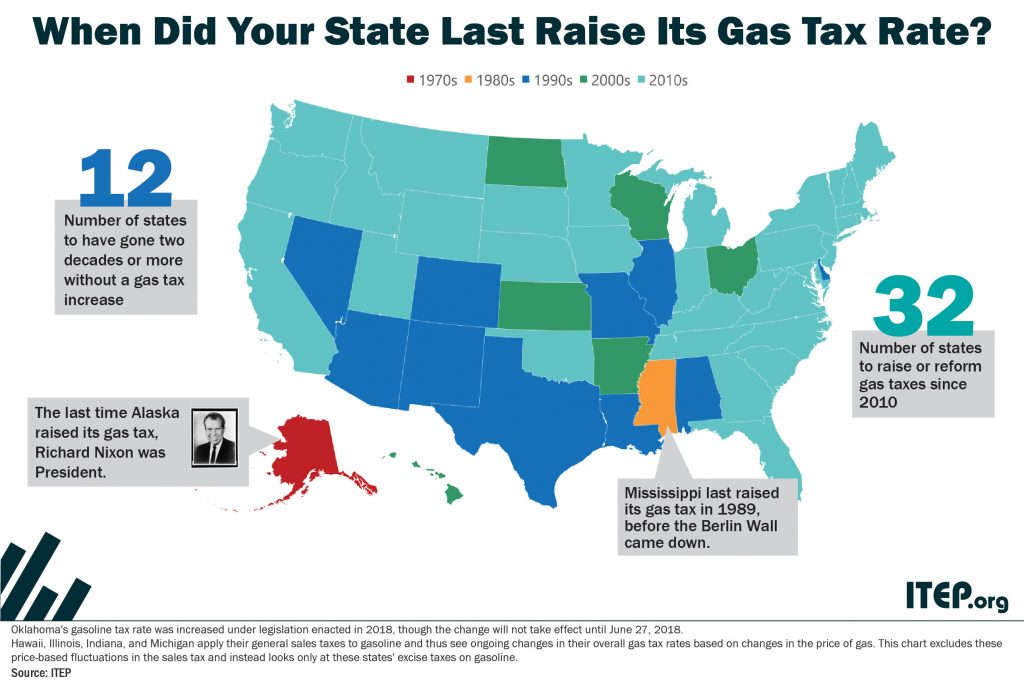

- ALABAMA lawmakers are showing support for a gas tax increase this year, Gov. Kay Ivey is on board as well, and local jurisdictions are already discussing how the revenue should be distributed. That’s an early start for a legislative session that begins in March — or a very late start for a tax that hasn’t been updated since 1992, depending on how you look at it.

- ARKANSAS residents started 2019 with a drop in the sales tax rate on food and a rate cut for taxpayers with under $21,000 in taxable income (enacted in prior years). With enough legislative support, Gov. Asa Hutchinson hopes to end the year having passed a tax cut for the highest income earners in the state, consolidating three tax tables into one and bringing the top rate down to 5.9 from 6.9 percent.

- COLORADO lawmakers plan to tackle the state’s education funding system to more equitably distribute funds to less well-off school districts.

- DISTRICT OF COLUMBIA Mayor Muriel Bowser says legislation to legalize and tax retail cannabis will be introduced soon.

- DELAWARE leaders will have a budget buffer to work with this year, perhaps allowing them to revisit last year’s income tax strengthening proposals to add a bracket for high-income households and make the state EITC refundable.

- FLORIDA legislators will consider exempting diapers from sales taxes this year.

- A long-expired high-tech tax credit in HAWAII continues to cost taxpayers millions (including $16.3 million in 2016) even after its 2009 elimination.

- IDAHO’S Governor-elect Brad Little is already walking back plans to repeal the state’s 6 percent sales tax on groceries. Although Little and many legislators would like to exclude groceries from the sales tax base, the state is up against additional funding pressures, including Medicaid expansion, increasing teachers’ salaries, and lower than expected revenues.

- Health advocates and the chamber of commerce in INDIANA are arguing for a cigarette tax increase. Gov. Eric Holcomb is not yet convinced.

- After passing a bizarre set of income tax cuts in response to the federal tax bill last year, IOWA lawmakers are now expected to turn their attention to property taxes.

- Among many issues lawmakers will take up this year in MARYLAND are whether and how to fund the $4 billion of education improvements recently recommended by an education reform commission, and whether to legalize and tax retail cannabis.

- Taxes are among the top legislative issues to be considered by a new cast of lawmakers in MINNESOTA this session, with lawmakers expected to address infrastructure funding, the expiring medical provider tax, and allocation of a $1.5 billion surplus.

- A $1.50-per-pack cigarette tax increase has been proposed in MISSISSIPPI.

- A MONTANA lawmaker started the session with a bill proposing a tax shift from several sources of property tax revenue to a 5 percent sales tax. Some localities have also been pushing for a local sales tax option. And the governor’s proposed budget includes increases to several excise taxes including tobacco, liquor, and rental cars.

- As they have the last several years, NEBRASKA lawmakers will attempt to reduce property taxes despite several obstacles such as growing school funding needs, rural-urban disagreements, and Gov. Pete Ricketts’s fixation on income tax cuts for the wealthy. This year they’ll be having these debates while also needing to fund and implement voter-approved Medicaid expansion. They may also consider a panel’s recommendation to end the state’s largest business tax subsidy program.

- NEW JERSEY lawmakers and Gov. Phil Murphy made some notable improvements to their tax code last year, including a mega-millionaires tax and enhanced credits for low- and middle-income families, but there remains room for improvement in the tax code and the state’s fiscal situation. They will pick up many of the same tax debates as they seek further progress this year.

- A new Senate Committee in NEW YORK will focus on the impact of the 2017 federal tax law on New York State and alternative options for revenue raising.

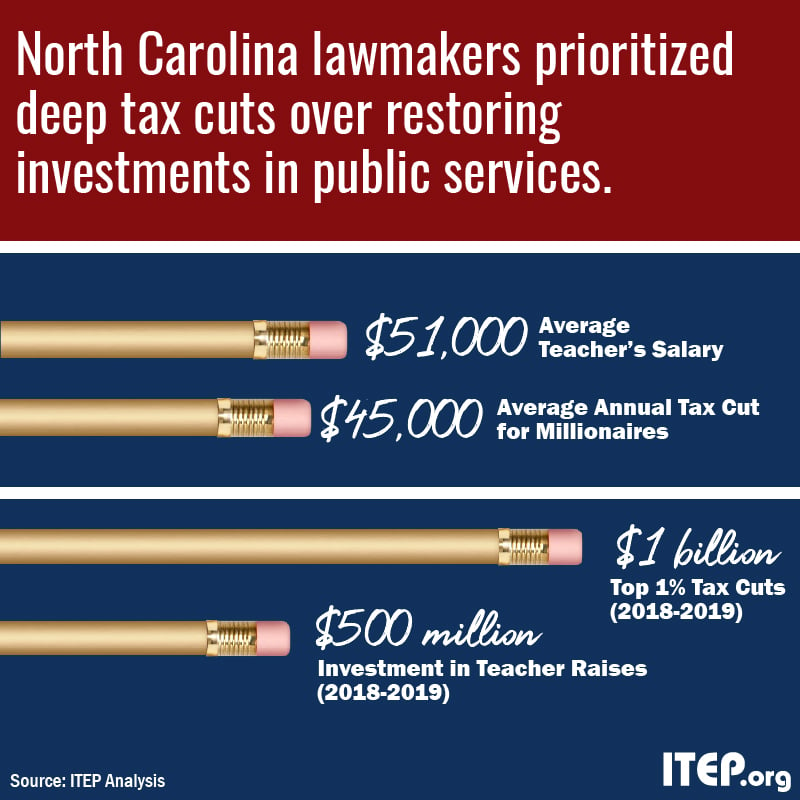

- NORTH CAROLINA kicked off 2019 with the final phase of its 2013 tax overhaul. The state’s personal income tax rate dropped from 5.499 to 5.25 percent and the corporate income tax rate from 3 to 2.5 percent. The fully phased-in tax package prioritized cuts to the tune of $3.5 billion annually over investment in schools and other public services.

- An influential NORTH DAKOTA legislator is proposing to eliminate the one significant progressive component of the state’s tax code by completely replacing the state’s income tax with revenue from a “Legacy Fund” funded by oil and gas revenues.

- OHIO unveiled a payment portal called OhioCrypto, which allows companies to remit their taxes using cryptocurrency. Overstock has announced that it will pay part of its Ohio state business tax using the new technology.

- SOUTH CAROLINA lawmakers have major education funding needs to address this year, and luckily will have a significant budget surplus to put toward those needs—assuming they resist the temptation to fritter the money away on regressive income tax cuts.

- TENNESSEE’s Sycamore Institute warns that without boosting its reserves, the state might not be able to weather the next economic recession without slashing services or raising taxes.

- TEXAS lawmakers are looking to their first legislative session since 2017 to address school financing, property taxes, and online sales tax collection. Gov. Greg Abbott would like to cap property taxes so that “property rich” school districts won’t have to contribute as much to “property poor” districts in recapture payments. Other options for additional school funding include increased state contributions, establishing a personal income tax, and increasing the gas tax.

- UTAH Gary Hebert plans for the state to address sales tax reform this year, proposing that the state expand its sales tax base to include services in order to bring down the general sales tax rate.

- A newly formed commission in VERMONT will review the state’s tax system and recommend reforms, with particular focus on the state’s education funding system. A report is expected to be presented to lawmakers before the 2021 legislative session.

- Despite revenue needs—apparent through the teachers’ strike last year—WEST VIRGINIA lawmakers plan to introduce bills that would cut revenues by phasing out a tax on business equipment and inventory and eliminating the state’s tax on Social Security benefits. The state’s Gov. Jim Justice gave his State of the State address last night where he promised funding increases but echoed the Legislature’s sentiment for no new revenue and a commitment to tax cuts.

- WYOMING lawmakers are seeking to increase education funding by raising the property tax which is currently funded primarily by minerals. Also, a proposed bill would create a statewide lodging tax and a separate tourism account, removing the state’s tourism office from the general fund.

What We’re Reading

- How are states and localities impacted by the shutdown of the federal government? Governing has the story here, Stateline takes a look here, and Route Fifty weighs in here.

- PBS previews the issues state lawmakers will face in 2019 here, Governing does so here, and Route Fifty looks at 2019 through the lens of governors’ budget proposals here.

- A new paper in the Northwestern University Law Review gives careful academic treatment to the question of whether tampons and other menstrual products should be subject to sales taxes.

- The “dark store” approach through which big-box retailers have been challenging assessments to reduce their property tax contributions has become so widespread the New York Times wrote about it recently.

- Route Fifty has an update on how states are taking advantage of newly-legal sports betting.

- Route Fifty also picks up a Pew report on how health care benefits for retired public employees are affecting states’ bottom lines.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.