Corporate Tax Watch

Corporate tax avoidance boosts companies’ bottom lines, and this benefits the owners of corporate stocks, which are mostly concentrated in the hands of the well-off. The cost of corporate tax dodging is borne by everyone, in several different ways.

More of the Same: Corporate Tax Avoidance Hasn’t Changed Much Under Trump-GOP Tax Law

December 16, 2019 • By Matthew Gardner

A new report from ITEP released today shows that, based on the first year of financial reports released by companies operating under the new tax law, tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect.

Fortune 500 Companies Avoided $73.9 Billion in Tax Under First Year of Trump Tax Law

December 16, 2019 • By Matthew Gardner

A comprehensive examination of Fortune 500 companies’ financial filings in 2018, the first year of the Tax Cuts and Jobs Act, finds that the law did nothing to curb corporate tax avoidance, with 91 companies paying $0 in taxes on U.S. income in 2018 and profitable companies overall paying a collective effective tax rate of 11.3 percent, which is barely more than half the 21 percent rate established by the tax law, the Institute on Taxation and Economic Policy (ITEP) said today.

Corporate Tax Avoidance in the First Year of the Trump Tax Law

December 16, 2019 • By ITEP Staff, Lorena Roque, Matthew Gardner, Steve Wamhoff

Profitable Fortune 500 companies avoided $73.9 billion in taxes under the first year of the Trump-GOP tax law. The study includes financial filings by 379 Fortune 500 companies that were profitable in 2018; it excludes companies that reported a loss.

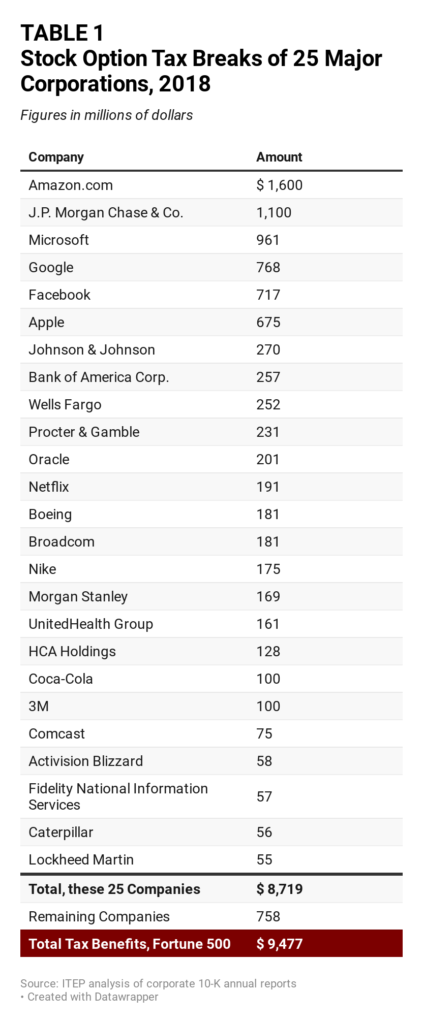

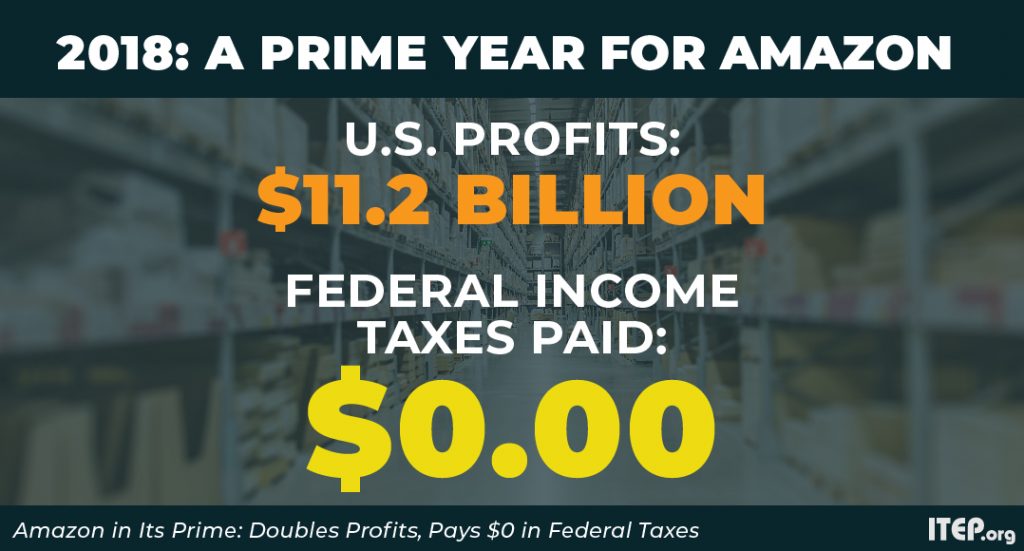

Earlier this year, Amazon and Netflix made headlines when ITEP reported findings that these and at least 58 other companies paid no federal income taxes in 2018. One of the tax breaks they use to manage this feat is related to stock options. Some companies saved hundreds of millions, and in some cases more than a billion dollars, in taxes in 2018 alone with this break. It’s time for Congress to eliminate the stock options tax dodge.

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

House Passes Landmark Bipartisan Bill to Crack Down on Shell Companies Used for Tax Evasion and Other Crimes

October 24, 2019 • By Steve Wamhoff

On Tuesday night, 25 Republicans joined nearly all the chamber’s Democrats to approve the Corporate Transparency Act, a bill that would require those creating a company to report its owners to the federal government. The White House expressed support but called for the House and Senate to work on certain details, creating the possibility that the measure could be enacted.

Depreciation Tax Breaks Are a Problem that Deserves More Attention

October 18, 2019 • By Steve Wamhoff

Sen. Bernie Sanders’ recently released corporate tax plan would shut down the major breaks and loopholes that allow corporations to dodge taxes. The reforms in his plan that are most likely to get attention are proposals to shut down offshore tax dodging, as ITEP has long called for.

Business Roundtable’s Newfound Devotion to Corporate Responsibility Doesn’t Include Paying Taxes

August 20, 2019 • By Matthew Gardner

If you squint really hard, the Business Roundtable’s newly declared fondness for “supporting the communities in which we work” could be read as an acknowledgment of the need for a tax system that can pay for needed services. But it’s not.

One Tax System for Most Americans, and a Second System for the Wealthiest

August 16, 2019 • By Matthew Gardner

Last year, the Walton family's fortune grew by $100 million a day. This level of wealth is particularly obscene in the context of the Walmart Corporation’s dark store strategy. The company works nationwide to reduce its property tax assessments, which, when successful, deprives local communities of revenue necessary to fund education, libraries, parks, public health and other services.

Taxing Offshore Profits and Domestic Profits Equally Could Curb Corporate Tax Dodging

August 9, 2019 • By Steve Wamhoff

In recent days, presidential candidates Sen. Kamala Harris and New York Mayor Bill DeBlasio have called for taxing corporate profits the same whether they are earned in the United States or abroad. These calls echo the position of Sen. Bernie Sanders, who has long had a proposal along these lines. As ITEP has explained, correcting […]

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

Things Get Worse for Uber: Ride-Sharing Giant’s Taxes Under Scrutiny

June 4, 2019 • By Matthew Gardner

Since Uber’s much-hyped initial public offering last month, the news has been relentlessly bad for the scandal-plagued ride-sharing company. The company’s share price has fallen by 8 percent from its initial $45, meaning that billions of dollars of the company’s apparent value have vanished. This week the news got a little worse: Uber is under […]

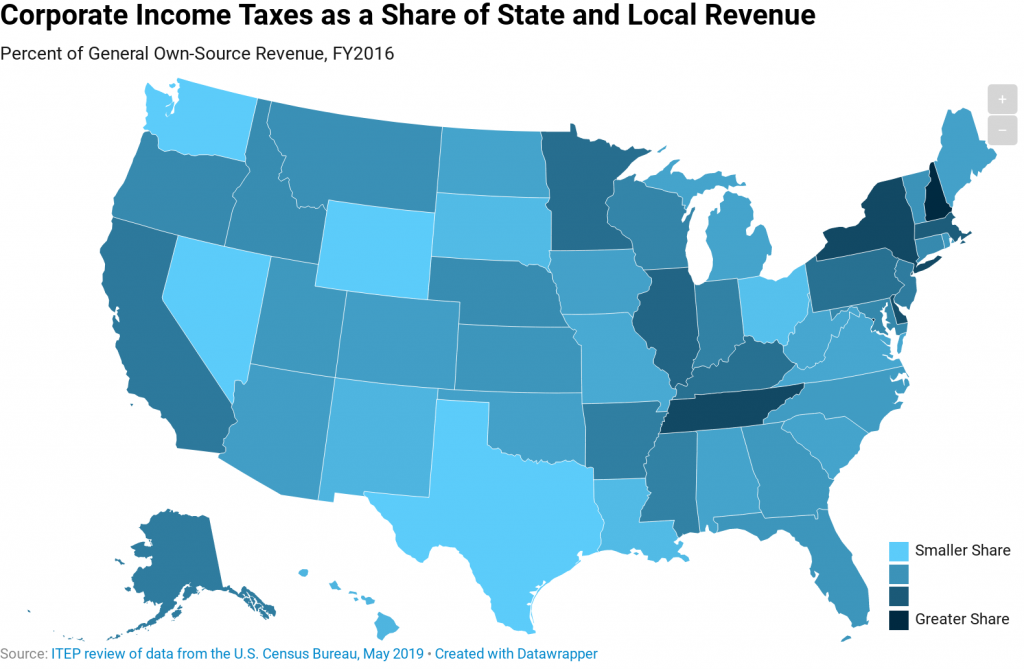

Corporate income taxes are an important source of revenue for state governments and ensure that profitable corporations benefiting from public services pay toward the maintenance of those services.

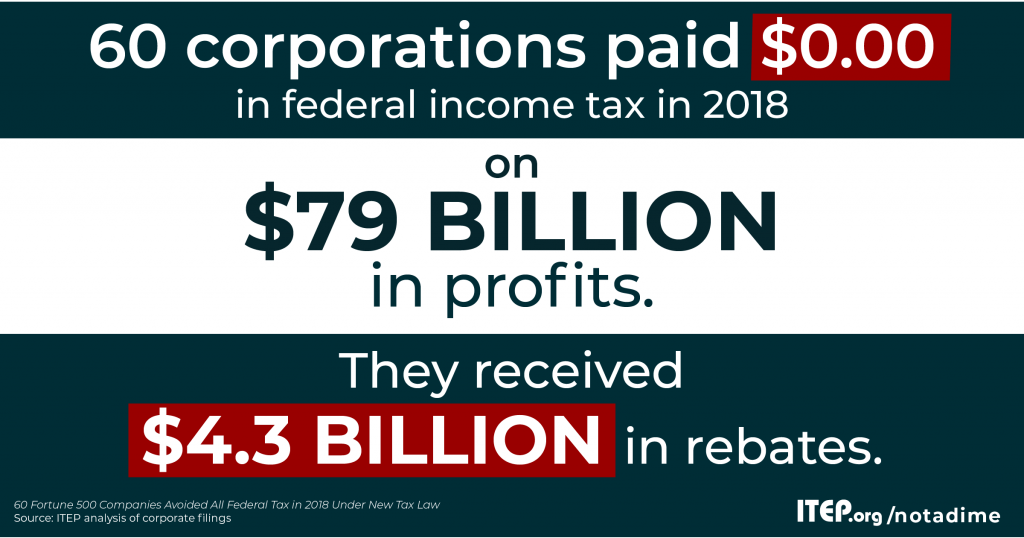

$4.3 Billion in Rebates, Zero-Tax Bill for 60 Profitable Corps Directly Related to Loopholes

April 12, 2019 • By Matthew Gardner

Meet the new corporate tax system, same as the old corporate tax system. That’s the inescapable conclusion of a new ITEP report assessing the taxpaying behavior of America’s most profitable corporations. The report, Corporate Tax Avoidance Remains Rampant Under New Law, released earlier this week, finds that 60 Fortune 500 corporations disclose paying zero in federal income taxes in 2018 despite enjoying large profits.

Corporate Tax Avoidance Remains Rampant Under New Tax Law

April 11, 2019 • By Lorena Roque, Matthew Gardner, Steve Wamhoff

For decades, profitable Fortune 500 companies have been able to manipulate the tax system to avoid paying even a dime in tax on billions of dollars in U.S. profits. This ITEP report provides the first comprehensive look at how the new corporate tax laws that took effect after the passage of the 2017 Tax Cuts and Jobs Act affects the scale of corporate tax avoidance.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

February 13, 2019 • By Matthew Gardner

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.

Netflix Posted Biggest-Ever Profit in 2018 and Paid $0 in Taxes

February 5, 2019 • By Matthew Gardner

The popular video streaming service Netflix posted its largest-ever U.S. profit in 2018—$845 million—on which it didn’t pay a dime in federal or state income taxes. In fact, the company reported a $22 million federal income tax rebate.

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Morgan Stanley Report Confirms Tax Cut Promises Made Are Promises Unkept

December 7, 2018 • By Matthew Gardner

Almost a year after lawmakers hastily enacted the Tax Cuts and Jobs Act, evidence continues to mount that it is providing far more tax cuts than jobs. A new Morgan Stanley report estimates that U.S. companies repatriated between $50 billion and $100 billion of offshore cash in the third quarter of 2018. This means companies […]

New ITEP Report on Depreciation Breaks: The Most Important Tax Giveaway that People Don’t Know About

November 19, 2018 • By Steve Wamhoff

Many Americans sense that the tax code is riddled with unnecessary and costly breaks for big business, but if asked to name one, few would reply “accelerated depreciation.” While they may seem arcane, tax breaks like “full expensing” and other types of accelerated depreciation are among the central problems in our tax code. A new report from ITEP makes the case that any serious tax reform would repeal or sharply curb these provisions.

15 Companies Report an Average 10.4 Percentage Point Drop in Effective Tax Rates Since 2017

November 13, 2018 • By ITEP Staff

Comparing the year’s first three quarterly filings of 2018 with those of 2017, we find that 15 of the largest Fortune 500 companies reported worldwide effective income tax rates declining by an average of 10.4 percentage points and by as much as 16 percentage points. In total these companies owed $22.3 billion less in taxes than they would have under their 2017 effective rates, saving an average of $1.5 billion each.

Amazon HQ2 Finalists Should Disclose the Financial Incentives They Promised

November 6, 2018 • By Guest Blogger

The Crystal City and Long Island City subsidy offers are among the many Amazon HQ2 bids that remain completely hidden. Citizens have no idea what their elected officials have promised to a company headed by the richest person on earth.