Corporate Tax Watch

The Walt Disney Corporation announced this week that in the wake of the new tax bill’s passage, it will spend $125 million on one-time bonuses and $50 million on an education program for some employees, all in 2018. This $175 million spending commitment is notable for two reasons: it’s temporary, and it’s a drop in the bucket for a company that’s likely to see annual tax savings of $1.2 billion a year and has already committed to a $50 billion-plus corporate acquisition of 21st Century Fox’s assets.

Olympics-like Bidding for Amazon’s HQ2 Is a PR Stunt Meant to Extract Tax Subsidies

January 19, 2018 • By Guest Blogger

By Greg LeRoy Amazon.com’s announcement of a 20-site “short list” for its second headquarters, or “HQ2” location, is provoking a public backlash that could reshape how economic development is done in the United States. In one sense, Amazon is continuing to behave as predicted, staging a public-relations stunt apparently to extract the largest possible subsidies […]

Apple Gambled on Congressional Spinelessness on Tax Policy— and Won

January 18, 2018 • By Matthew Gardner

Now, Apple Inc. would like the American public to know that it has “a deep sense of responsibility to give back to our country” a small fraction of its multi-billion-dollar tax cut haul. However, the company’s splashy press release is devoid of any specifics on the jobs it will create as a result of the tax bill. Like other corporate announcements, the company’s recent proclamation of newfound patriotism should be viewed as a public relations ploy designed to convince a skeptical public that working families will see some trickle-down benefit from this historic corporate giveaway.

Walmart’s Minimum Wage Hike: Did the Tax System Make Them Do It?

January 12, 2018 • By Matthew Gardner

The Walmart corporation announced this week that it will increase its minimum wage to $11 an hour, in a move that the company attributed to the major corporate tax cut signed into law by President Trump last month. The $300 million the company will spend on the wage boost is just a fraction of the more than $2 billion a year ITEP estimates Walmart could net from the corporate tax rate cuts that took effect January 1—but even so, the company felt the need to make the wage boost more affordable by simultaneously closing 63 Sam’s Club stores and laying…

Corporate America, You Just Got a $650 Billion Tax Cut! What Are You Going to Do Next?

December 22, 2017 • By Matthew Gardner

While many Fortune 500 CEO’s likely had to restrain themselves from preemptively shouting “we’re going to Disneyland” in an homage to the Disney Corporation’s trademark ad spot involving the winner of each year’s Super Bowl, it’s pretty understandable that several of them—including known tax avoiders AT&T, Boeing, Comcast and Wells Fargo—would preemptively make grandiose promises that they will reserve part of their tax cuts for the little people who made it all possible.

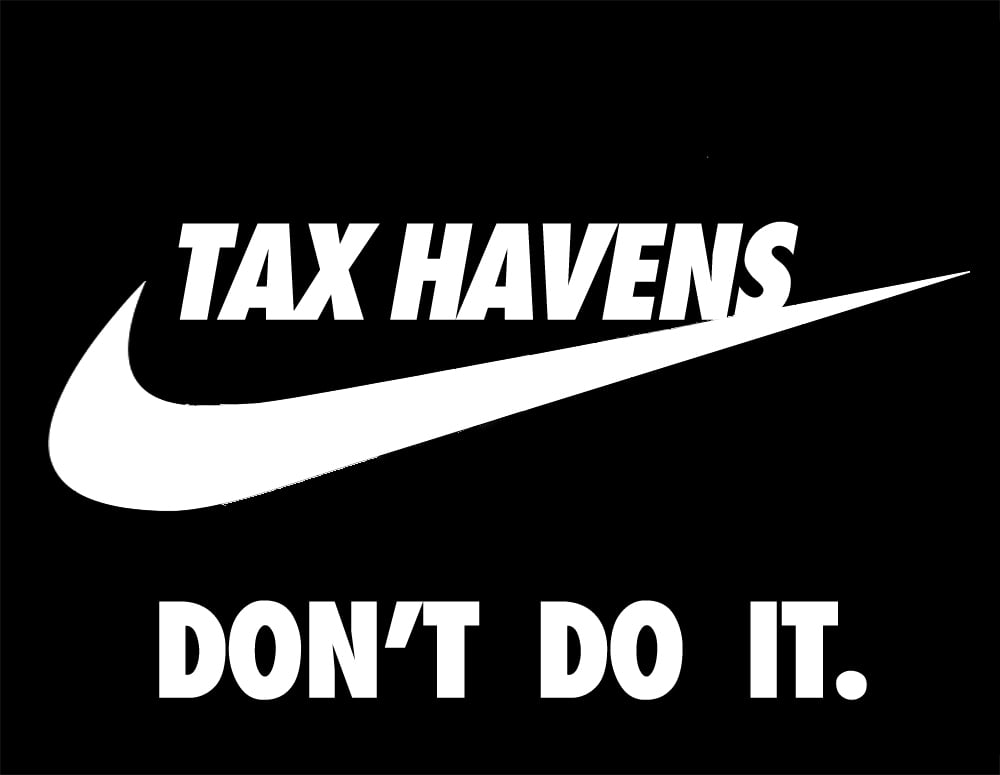

Nike earned more than $10 billion in U.S. profits from 2008 to 2015 but only paid 18.6 percent in U.S. federal taxes during this time. This is just over half of the official U.S. corporate tax rate of 35 percent.

Since Facebook became a public company, its annual revenues have increased by 250 percent from around $8 billion in 2013 to nearly $28 billion last year. In the same time period, the company’s before-tax profits shot up four-and-a-half fold to $12.5 billion. But in this time it has also managed to avoid billions of dollars in U.S. taxes.

Apple is the most valuable public company of all time with a market value of more than $800 billion. Last year, it cleared $45.7 billion[iii] in profits after taxes, making it the most profitable company in the Fortune 500 for the third straight year.

The Manufacturing Deduction Is a Case Study in Tax Policy Gone Wrong

October 30, 2017 • By Richard Phillips

When you think of manufacturing, what comes to mind? According to the U.S. Congress, manufacturing may include things like the production of wrestling-rated films, assembling bouquets of flowers and even slicing cheesecake. These unusual definitions of manufacturing come from the domestic production activities deduction (better known as the manufacturing deduction), a tax break Congress created to encourage manufacturing in the United States.

The Domestic Production Activities Deduction: Costly, Complex and Ineffective

October 26, 2017 • By Richard Phillips

When the Domestic Production Activities Deduction (DPAD) became law in 2004, proponents described it as a way to help American companies manufacture in the United States and export products abroad. In recent years, the DPAD has grown into one of the largest corporate tax expenditures, with an estimated cost of more than $15 billion in 2016 and $174 billion over the next 10 years.

The Corporate Tax Code is in Dire Shape, But Trump-GOP Plan Would Make It Worse

October 18, 2017 • By Richard Phillips

Just how bad has the corporate tax code gotten? The newest edition of Offshore Shell Games, a joint report by the Institute on Taxation and Economic Policy (ITEP) and U.S. PIRG, outlines the massive scale of the offshore tax avoidance undertaken by U.S. multinationals. It’s well known that Fortune 500 companies have accumulated a stash of $2.6 trillion in earnings offshore, which has allowed them to avoid an estimated $752 billion in taxes.

This study explores how in 2016 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country’s biggest corporations benefit the most from offshore tax avoidance schemes.

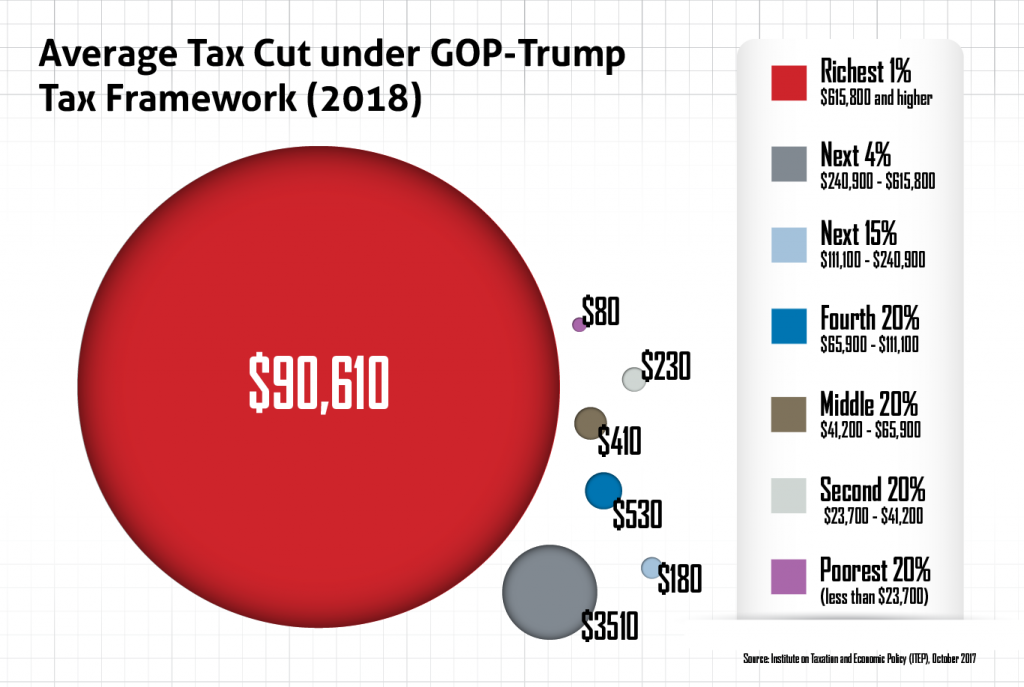

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

Fact Sheet: The Consequences of Adopting a Territorial Tax System

September 18, 2017 • By Steve Wamhoff

President Trump and Republican leaders in Congress have proposed a “territorial” tax system, which would allow American corporations to pay no U.S. taxes on most profits they book offshore. This would worsen the already substantial problem of corporate tax avoidance and result in more jobs and investment leaving the U.S. Lawmakers should know some key facts about the territorial approach.

Turning Loopholes into Black Holes: Trump’s Territorial Tax Proposal Would Increase Corporate Tax Avoidance

September 6, 2017 • By Matthew Gardner, Steve Wamhoff

The problem of offshore tax avoidance by American corporations could grow much worse under President Donald Trump’s proposal to adopt a “territorial” tax system, which would exempt the offshore profits of American corporations from U.S. taxes. This change would increase the already substantial benefits American corporations obtain when they use accounting gimmicks to make their profits appear to be earned in a foreign country that has no corporate income tax or has one that is extremely low or easy to avoid.

GOP Leaders Tout Corporate Tax Cuts at Boeing and AT&T, Companies that Already Have Single-Digit Tax Rates

August 23, 2017 • By Matthew Gardner

House Speaker Paul Ryan plans to visit a Boeing factory in Washington State tomorrow to promote the GOP’s ideas for tax reform, which include a deep cut in the corporate tax rate, while House Ways and Means Chairman Kevin Brady is bringing the same message today to employees of AT&T in Dallas. What is unclear is how much lower taxes for these companies can possibly go.

Today, the economic climate is starkly different, but it seems GOP leaders are relying on messaging and luck to push through the biggest tax package since 1986. The White House, Republican leaders and anti-tax advocates all have been toeing the same erroneous line: their plans to cut individual and corporate taxes will benefit middle class families and grow the economy. This is, of course, baloney.

How to Think About the Problem of Corporate Offshore Cash: Lessons from Microsoft

August 4, 2017 • By Matthew Gardner

For a corporation with deeply American roots, Microsoft seems remarkably unable to turn a profit here. Against all odds, the Redmond, Washington-based company continues to claim that virtually all its earnings are in foreign countries. Microsoft’s latest annual report, released earlier this week, shows that over the past two years, the company enjoyed worldwide income of almost $43 billion. It claims to have earned just 0.3 percent of that—$128 million—in the United States.

Trump Administration May Make Corporate Inversions Great Again

August 4, 2017 • By Richard Phillips

During the presidential campaign, Donald Trump called out companies engaging in corporate inversions saying that one proposed inversion was “disgusting” and that “politicians should be ashamed” for allowing it to happen. Despite this rhetoric, the Trump Administration is considering rolling back critical anti-inversion rules as part of its broad regulatory review of recently issued Treasury Department regulations.

Reviving U.S. Manufacturing, One Cheesecake Factory at a Time

July 27, 2017 • By Matthew Gardner

In the latest example of how the tax code has been abused and distorted, the Cheesecake Factory is claiming the manufacturing tax deduction, apparently for manufacturing cheesecakes, burgers, and other treats.

Tax Avoidance: Nike “Just Did It” Again, Moving $1.5 Billion Offshore Last Year

July 21, 2017 • By Matthew Gardner

The Nike Corporation’s annual financial disclosure of income tax payments is always notable for two recurring trends: the Oregon-based company’s steady shifting of profits into offshore tax havens, and Nike’s apparent effort to conceal how it’s achieving this tax avoidance. This year’s report, released earlier this week, is no exception.

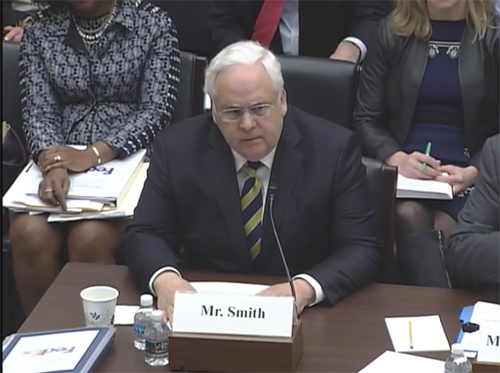

FedEx Pays Just 7.5% of Its Profits in Taxes While Pushing for a Lower Corporate Tax Rate

July 18, 2017 • By Matthew Gardner

The latest annual financial report released by shipping giant FedEx is yet another reminder that where you stand often depends on where you sit. The report shows that last year FedEx paid a 7.5 percent federal income tax rate on nearly $3.6 billion of U.S. pretax income and this low rate is due in part to accelerated depreciation, a provision in the tax code that allows the company to write off capital investments faster than they wear out. It’s not surprising, then, that FedEx’s leadership is currently promoting a tax plan that would drop the company’s statutory tax rate even…

Rather than being known for its pioneering pharmaceuticals, Mylan is increasingly becoming infamous for its pioneering tax avoidance strategies. In 2015, Mylan used an inversion to claim that it is now based in the Netherlands for tax purposes. It is a Dutch company only on paper because ownership of the company was mostly unchanged and it continues to operate largely out of the United States. This maneuver has allowed the company to avoid millions in taxes on its earnings in the U.S. and abroad. But that’s not the end of Mylan’s innovation when it comes to tax planning. A new…

Speaker Ryan’s “Bold Agenda” for the Country Boils Down to Tax Breaks for the Wealthy

June 20, 2017 • By Alan Essig

Speaker Paul Ryan today correctly outlined some of working people’s concerns, including the desire for more good jobs and access to the training required to secure those jobs. But his bottom line policy prescriptions for addressing the concerns of working people are the same old trickle-down economic policies that time after time have proven to primarily benefit the wealthy.