Georgia

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

February 19, 2026 • By ITEP Staff

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS workforce by 25 percent), and a rewritten federal tax code sends states scrambling to decide what changes they might want to make in their own codes.

Education Week: How Do Schools Solve a Problem Like Property Taxes?

February 19, 2026

As tax season dawns, backlash to a nationwide surge in property-tax bills is spurring states to double down on proposals to diminish one of the main revenue sources for school districts. At least 10 states are pitching the end of one of schools’ chief revenue sources. Read more.

State Rundown 2/11: This Valentine’s Day, Conscious Decoupling Is Our Love Language

February 11, 2026 • By ITEP Staff

While some may be excited for a romantic Valentine’s Day this weekend, many state lawmakers are breaking up and decoupling from recent federal tax changes that are poised to leave states with revenue shortfalls – much like a bad date who forgets their wallet and asks you to pick up the tab.

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

Georgia Budget & Policy Institute: Overview of Georgia’s Budget for Amended Fiscal Year 2026 and the Full 2027 Fiscal Year

January 26, 2026

Between Gov. Brian P. Kemp’s first full fiscal year (FY) budget as governor and his eighth and final budget for FY 2027, state spending has increased by nearly $11 billion to $38.5 billion. Governor Kemp’s AFY 2026 and FY 2027 budget proposals recognize that Georgia can use its historic level of resources to fill long-awaited […]

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities

January 21, 2026 • By Kamolika Das

2025 saw an intensification of state and local tax fights across the country, as well as growing experimentation with local-option taxes, levies, fees, and tourism taxes aimed at keeping budgets afloat while also navigating political constraints imposed by state legislatures.

Associated Press: Georgia Republicans Move to Scrap State Income Tax by 2032 Despite Concerns

January 8, 2026

Eliminating state income taxes sounds great to many voters, but Republicans backing the push in multiple states still face questions about whether such big tax cuts can be made without raising other taxes or sharply cutting state funding for education, health care and other services. Read more.

State Rundown 1/7: New Year, New Opportunities for Progressive Revenue

January 7, 2026 • By ITEP Staff

As we kick off a new year, several states are facing revenue shortfalls. Some lawmakers are approaching the challenge with sustainable and equitable solutions.

Not-So-Free Kick: How the 2026 FIFA World Cup Will Cost Cities Millions

December 5, 2025 • By Page Gray

FIFA demanded sales tax breaks on World Cup Tickets. That means millions in lost revenue for host cities already shouldering the costs on providing infrastructure, security and logistics.

State Rundown 11/24: States Say ‘No Thank You’ to Federal Tax Cuts Reducing State Revenue

November 24, 2025 • By ITEP Staff

Lawmakers in two more states have wisely said “no thank you” to federal tax cuts that would have flowed through to their state tax codes and undermined funding for their priorities

Georgia Budget and Policy Institute: Breaking the Bank: Eliminating the State Income Tax Harms Most Georgians and Increases the Cost of Living

November 17, 2025

Eliminating Georgia’s income tax would represent the largest transfer of wealth from working and middle-class families to high income individuals and corporations in state history. Doing so would dramatically push Georgia’s budget out of balance, given that the income tax has been the state’s single largest source of revenue since 1982. Read more.

Vacancy taxes will not single-handedly solve problems in cities, but they are worth considering to address housing shortages, land use, and building thriving communities.

State Tax Dollars Shouldn’t Subsidize Federal Opportunity Zones

November 12, 2025 • By Eli Byerly-Duke

The Opportunity Zones program benefits wealthy investors more than it benefits disadvantaged communities.

The 5 Biggest State Tax Cuts for Millionaires this Year

October 16, 2025 • By Dylan Grundman O'Neill, Aidan Davis

Some states continue to hand out huge tax cuts to millionaires. The five largest tax cuts this year will cost states a total of $2.2 billion per year once fully implemented.

The Potential of Local Child Tax Credits to Reduce Child Poverty

October 8, 2025 • By Kamolika Das, Aidan Davis, Galen Hendricks, Rita Jefferson

Local governments have a critical role to play in reducing child poverty. Local Child Tax Credits could provide large tax cuts to families at the bottom of the income scale, lessening the overall regressivity of state and local tax systems.

Quite Some BS: Expanded ‘QSBS’ Giveaway in Trump Tax Law Threatens State Revenues and Enriches the Wealthy

October 2, 2025 • By Sarah Austin, Nick Johnson

States should decouple from the federal Qualified Small Business Stock (QSBS) exemption.

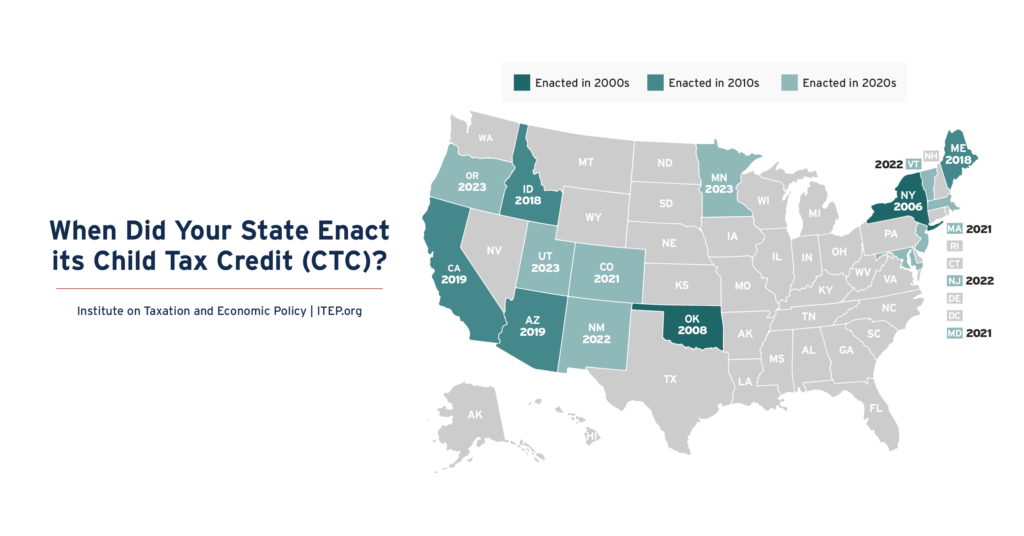

State Child Tax Credits Boosted Financial Security for Families and Children in 2025

September 11, 2025 • By Neva Butkus

Child Tax Credits (CTCs) are effective tools to bolster the economic security of low- and middle-income families and position the next generation for success.

State Rundown 9/4: Colorado Tackles Offshore Corporate Tax Avoidance, Paves Way for State Conformity Best Practices

September 4, 2025 • By ITEP Staff

Despite an increasingly bleak state revenue outlook, state lawmakers across the country continue to prioritize regressive tax cuts.

AP News: Georgia Republicans, Against Backdrop of 2026 Election, Push to Eliminate State Income Tax

August 20, 2025

As the 2026 election looms, Georgia Republicans seeking higher office met Tuesday to begin exploring plans to eliminate the state’s personal income tax.

As states prepare for the revenue loss and disruption resulting from the federal tax bill, tax policy is being considered in legislatures across the country.

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.