Offshore Tax Avoidance

New Income Tax Disclosure Rules Mean Halliburton Can No Longer Conceal Its Offshore Tax Avoidance

March 2, 2026 • By Matthew Gardner

The company’s latest annual report throws the doors wide open once again on Halliburton’s penchant for offshoring its profits to tax havens, thanks to terrific new disclosure rules introduced by an obscure but vital agency, the Financial Accounting Standards Board (FASB).

Yum! Brands’ Recipe for Tax Avoidance: Trump Tax Cuts with a Dash of Malta

February 24, 2026 • By Matthew Gardner

the fast-food multinational that owns KFC, Taco Bell, and Pizza Hut reported this week that it made $1 billion of pretax profits in the U.S. last year—and didn’t pay a dime of federal income taxes on those profits.

State-by-State Estimates of the First Year of Trump’s Tax Policies: All But the Richest Americans Face Higher Taxes

February 23, 2026 • By Steve Wamhoff, Michael Ettlinger

As a result of the tax policies approved by President Trump and the Republican majority in Congress, all but the richest Americans are paying higher taxes on average in 2026 than they did last year.

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

February 19, 2026 • By ITEP Staff

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS workforce by 25 percent), and a rewritten federal tax code sends states scrambling to decide what changes they might want to make in their own codes.

NCTI is an Important Part of the Federal Corporate Tax. States Should Adopt It Too.

February 12, 2026 • By Carl Davis

Including NCTI in state corporate tax law is an effective way to neutralize much of the tax avoidance that occurs when multinational companies artificially shift their profits into overseas tax havens.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

10 Reasons Why the U.S. Should Reform Its Corporate Income Tax

December 17, 2025 • By Steve Wamhoff

The U.S. needs a tax code that is more progressive and that raises more revenue than the one we have now. An important way to achieve this is to reform the taxation of business profits. These four key policy reforms would greatly strengthen the corporate tax system: Eliminating or restricting special breaks and loopholes that […]

Tax Haven Data Demonstrate Need for Global Minimum Tax Despite Opposition from Trump Administration

December 10, 2025 • By Steve Wamhoff

American corporations use accounting gimmicks to make profits appear to be earned in tax havens. This widespread problem could be fixed by Congress enacting legislation to implement a minimum tax on corporations that meets the standards of the global minimum tax that other countries have begun to implement.

Congressional Republicans Ignore Tariffs and Instead Talk Up Their Corporate Tax Cuts

December 4, 2025 • By Steve Wamhoff

Instead of discussing President Trump's deeply unpopular tariff policies, House Republicans are making misleading and untrue claims about their tax cuts.

America Has Left the Building: U.S. Loses from Our Global Tax Policy Choices, Others Could Gain

May 5, 2025 • By Amy Hanauer

Countries that once looked to the U.S. for direction on tax policy have concluded they need to form alliances without us. If so, it will often be to the benefit of other people around the globe and to the deficit of U.S. communities.

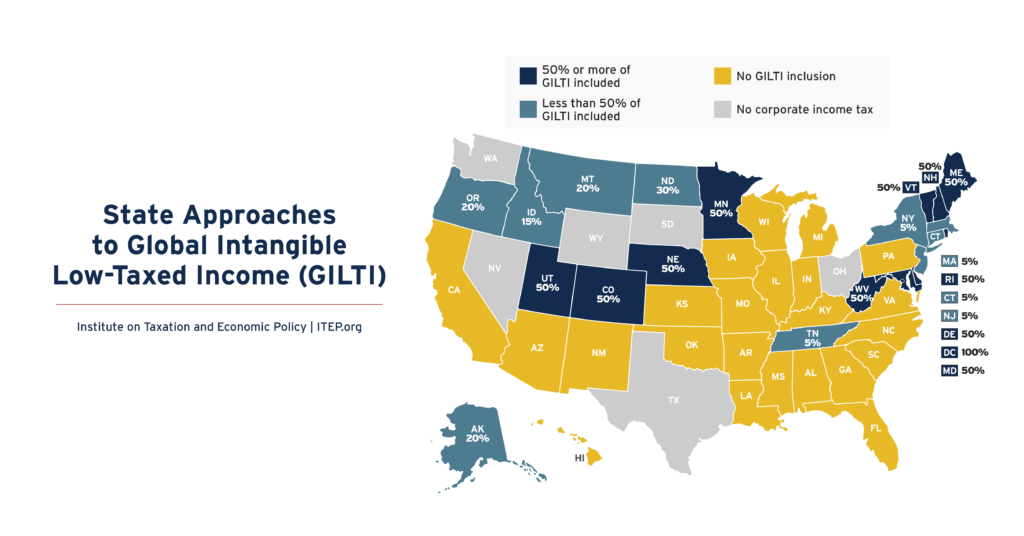

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

Ongoing Use of Offshore Tax Havens Demonstrates the Need for the Global Minimum Tax

January 17, 2024 • By Steve Wamhoff

Key Findings To avoid taxation, American corporations use accounting gimmicks that make profits appear to be earned in foreign jurisdictions which tax corporate profits very lightly or not at all. In 2020, American corporations claimed profits in 15 of these jurisdictions that were often far too high to be possible. For example, in four jurisdictions […]

Minnesota Poised to Enact Landmark Loophole-Closing Corporate Tax Reforms

May 7, 2023 • By Matthew Gardner

With Minnesota poised to enact worldwide combined reporting of corporate income taxes, business lobbyists are pulling out all the stops to make state lawmakers believe the apocalypse is upon them.

The No Tax Breaks for Outsourcing Act Is Needed More than Ever

February 14, 2023 • By Steve Wamhoff

The new corporate minimum tax enacted as part of last year’s Inflation Reduction Act will address some of the worst corporate tax dodging, but what else is needed? A group of Democrats have answered this question with the No Tax Breaks for Outsourcing Act.

Trade Deals Aren’t Enough: Fixing the Tax Code to Bring American Jobs Back

July 16, 2020 • By Amy Hanauer

We all need the public sector to protect public health, keep us safe, educate our children, and much more. Companies, particularly multinational corporations, could not function without the legal, infrastructure, financial, regulatory, health, and transportation resources that the government provides.

Why Today’s Congressional Hearing on “The Disappearing Corporate Income Tax” Is Imperative

February 11, 2020 • By Steve Wamhoff

The United States is collecting a historically low level of tax revenue from corporations. In 2018, corporate tax revenue as a share of gross domestic product (the nation’s economic output) dipped to 1 percent and reached just 1.1 percent in 2019. The only other times in the last 40 years that tax collections were this […]

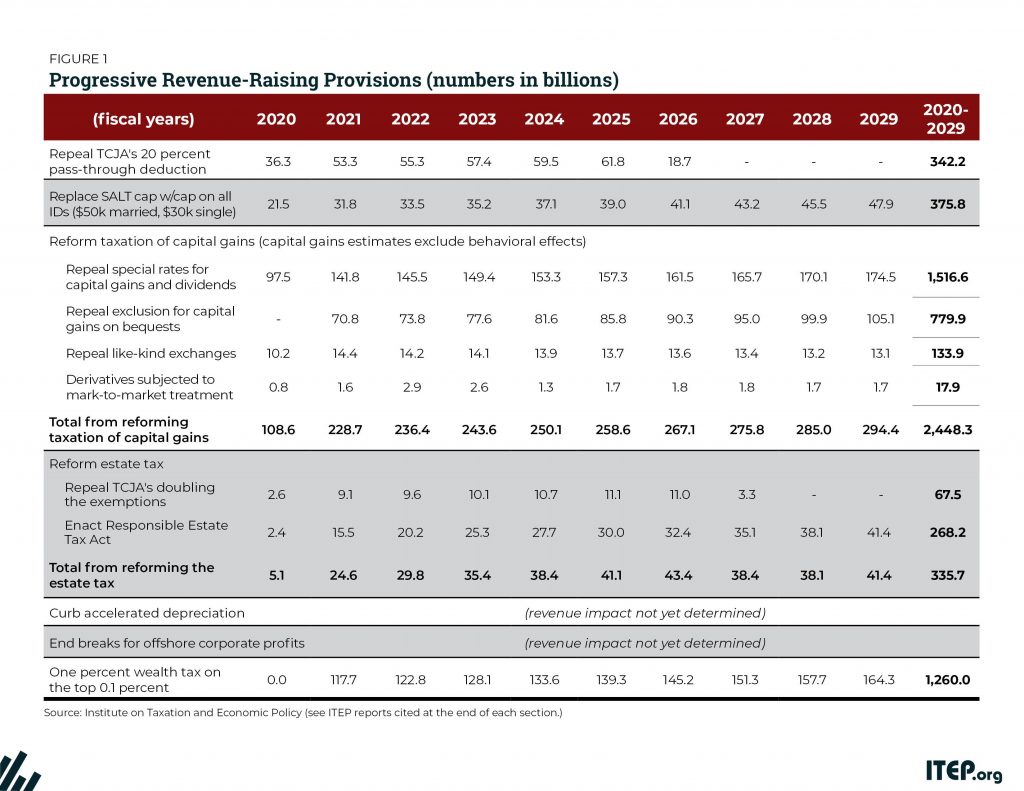

America has long needed a more equitable tax code that raises enough revenue to invest in building shared prosperity. The Tax Cuts and Jobs Act (TCJA), enacted at the end of 2017, moved the federal tax code in the opposite direction, reducing revenue by $1.9 trillion over a decade, opening new loopholes, and providing its most significant benefits to the well-off. The law cut taxes on the wealthy directly by reducing their personal income taxes and estate taxes, and indirectly by reducing corporate taxes.

New Legislation Aims to Change Tax Law Provisions That Incentivize Outsourcing

November 29, 2018 • By Richard Phillips

Sen. Amy Klobuchar (D-MN) and several Senate co-sponsors this week introduced the Removing Incentives for Outsourcing Act, which curbs harmful new incentives created by the Tax Cuts and Jobs Act (TCJA) that encourage companies like GM to move their profits and operations offshore.

New Report Finds Tax Transparency Is Not Just Ethical: It Has a Real Fiscal Impact

November 5, 2018 • By Monica Miller

A new report by Hubertus Wolff and Michael Overesch finds that public country-by-country reporting (CBCR) can have a significant fiscal impact. In fact, the report shows that new CBCR rules applied to European banks appear to have substantially increased the tax rates paid by banks that engage in tax-haven activities. This means that CBCR may not just improve the integrity of the tax system and provide critical information so investors can gauge investment risks, but may also have a much more immediate impact on curbing tax avoidance.

Post-TCJA, International Corporate Tax System Still Leaking Hundreds of Billions in Profits

November 5, 2018 • By Richard Phillips

A recently released working paper from Kimberley Clausing of Reed College finds that U.S. corporations will avoid taxes on nearly $300 billion in offshore profits every year for the foreseeable future. The paper provides an informative new look into the level of offshore tax avoidance before and after the Tax Cuts and Jobs Act (TCJA). While advocates of the TCJA claimed the tax law would end tax haven abuse through lowering the statutory rate and other measures, Clausing’s analysis shows that the TCJA will still allow the vast majority of offshore tax avoidance to remain intact.

New Study Confirms Offshore Earnings are Flowing into Stock Buybacks, Not Jobs and Investments

September 7, 2018 • By Richard Phillips

A new study by the Federal Reserve found that the evidence so far suggests that the new repatriation tax break has resulted in a surge in stock buybacks and little discernable impact in investment by its biggest beneficiaries, just as critics predicted.

How should lawmakers fix the system? A new ITEP report breaks down how the international corporate tax code under the TCJA works, and how lawmakers can fix it. The report lays out three key principles for reform: equalize the rates, eliminate inversions, and create transparency.

Understanding and Fixing the New International Corporate Tax System

July 17, 2018 • By Richard Phillips

The Tax Cuts and Jobs Act (TCJA) radically changed the international tax system. It slashed taxes on corporate income, both domestic and foreign. It encouraged U.S. multinational corporations to shift jobs, profits, and tangible property abroad, and keep intangibles home. This report describes the new international tax system—and its many gaps—and also provides a road map for how to fix these gaps and surveys recent legislative approaches.

New Legislation Would Close Significant Offshore Loopholes in the Tax Cuts and Jobs Act

June 6, 2018 • By Richard Phillips

One simple rule should drive the nation’s international tax policies: tax the offshore profits of American companies the same way their domestic profits are taxed. The latest legislation to approach that ideal is the Per-Country Minimum Act (H.R. 6015), from Rep. Peter DeFazio (D-OR). The DeFazio bill closes the loophole that allows corporations to use foreign tax credits to shelter profits in tax havens from U.S. taxes. No other bill addresses this.

New Legislation Would End Tax Incentives to Move Jobs and Profits Offshore

May 24, 2018 • By Richard Phillips

New legislation introduced today, the No Tax Breaks for Outsourcing Act, by Rep. Lloyd Doggett (D-TX) and Sen. Sheldon Whitehouse (D-RI) would help repair the damage to the international tax code wrought by the new Trump-GOP tax law and move toward a system where U.S. corporations can’t reap tax benefits from shifting jobs and profits offshore.