Virginia

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

NC Teachers’ March on Raleigh and the Tax Cuts that Led Them There

May 15, 2018 • By Aidan Davis

Once again, public school teachers are taking a stand for education and against irresponsible, top-heavy tax cuts that deprive states of the revenue they need to sufficiently fund public services, including education.

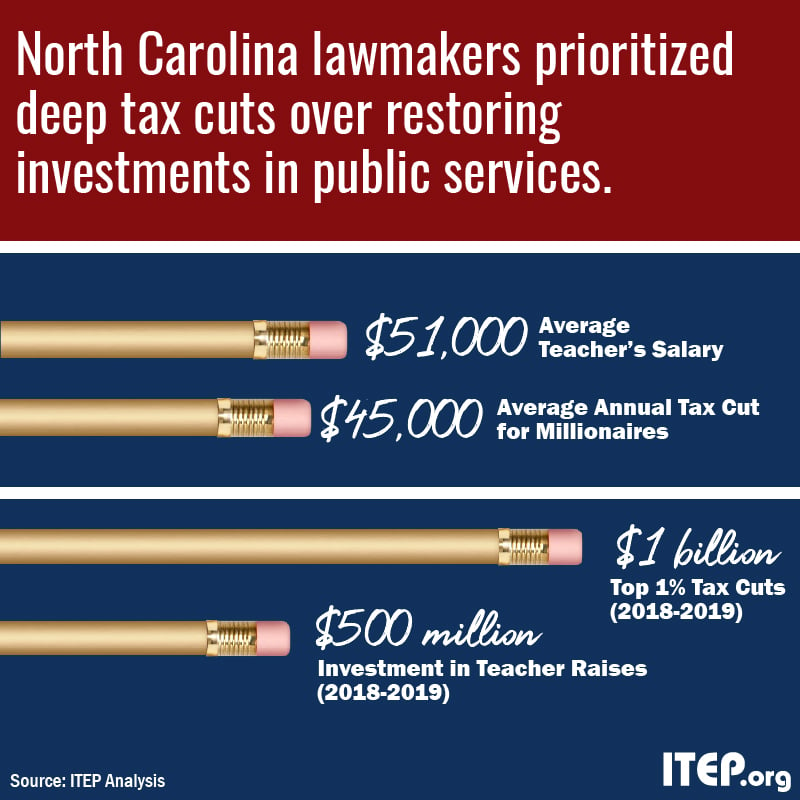

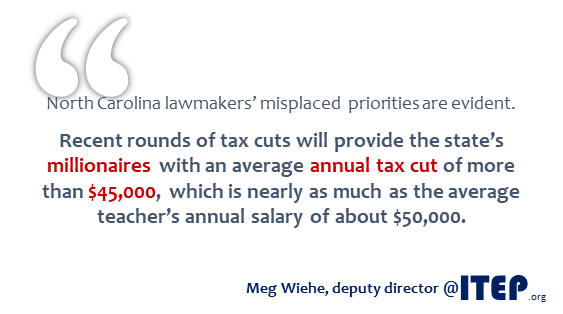

Millionaires Average Annual Tax Cut in North Carolina Is Comparable to Average Teacher’s Salary

May 11, 2018 • By Meg Wiehe

North Carolina lawmakers' misplaced priorities are evident: The recent rounds of tax cuts will provide the state’s millionaires with an average annual tax break of more than $45,000, which is nearly as much as the average teacher’s annual salary of about $50,000.

Business Insider: The Trump Org Just Quietly Announced It Is Collecting Sales Tax in a New State

May 4, 2018

New York’s addition to the list of states where TrumpStore.com collects sales tax, which previously included Louisiana, Florida, and Virginia, was first spotted Thursday by the Institute on Taxation and Economic Policy, a nonpartisan think tank. “Refusing to collect sales tax in New York was a risky move, and it’s not surprising that they’ve reversed course,” […]

Politico Morning Tax: Yeah, That’s a Nexus

May 4, 2018

The Trump Store has started collecting sales tax on online purchases from customers in New York, a state where it most certainly seemed to have the physical presence required for collection — a Manhattan flagship store. The liberal Institute on Taxation and Economic Policy noted that update on the store’s website. In all, the store […]

State Rundown 5/3: Progressive Revenue Solutions to Fiscal Woes Gaining Traction

May 3, 2018 • By ITEP Staff

This week, Arizona teachers continued to strike over pay issues and advocates unveiled a progressive revenue solution they hope to put before voters, while a progressive income tax also gained support as part of a resolution to Illinois's budget troubles. Iowa and Missouri legislators continued to try to push through unsustainable tax cuts before their sessions end. And Minnesota and South Carolina focused on responding to the federal tax-cut bill.

Bloomberg BNA: Higher Gas Prices May Mean Paying States More in Taxes

May 1, 2018

As a result, a few states will see revenue gains from higher prices because their tax rates are tied to the price of fuel, rather than its volume, Carl Davis, research director for the left-leaning Institute on Taxation and Economic Policy, told Bloomberg Tax. Those states include California, Connecticut, Kentucky, Maryland, Nebraska, New Jersey, New […]

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

CNBC: Trump Organization’s Online Store Adds Virginia to Short List of States Collecting Tax on Its Sales, Bringing Total to 3

April 9, 2018

“You have Trump Tower New York and the Trump Store in Trump Tower pointing people to the site, essentially being salespeople,” Carl Davis, research director of the nonpartisan Institute on Taxation and Economic Policy, told CNBC. A spokesman for the New York Department of Taxation and Finance said secrecy laws prevent it from commenting on […]

Is the Trump Organization’s Sales Tax Avoidance More Aggressive Than Amazon’s?

April 6, 2018 • By Carl Davis

In recent weeks, President Trump has been raking Amazon over the coals for failing to collect state and local sales taxes on many of the company’s sales—a criticism that has some merit. But a new story first reported by James Kosur at RedStateDisaster, and then picked up today by the Wall Street Journal, provides fascinating insight into the sales tax collection habits of the Trump Organization’s “official retail website,” TrumpStore.com.

Trends We’re Watching in 2018, Part 4: Tax Cuts & Tax Shifts

April 4, 2018 • By Lisa Christensen Gee

While a lot of tax activities in the states this year have focused on figuring out the impact of federal tax changes on states' bottom lines and residents, there also have been unrelated efforts to cut state taxes or shift from personal income taxes to more regressive sales taxes.

Cities Fail to Disclose Tax Incentives in Bids for Amazon’s HQ2

April 3, 2018 • By Guest Blogger

The Amazon HQ2 project would be the biggest in U.S. history as measured in projected jobs, yet little is known about the incentives cities have offered Amazon to lure its second headquarters. This lack of disclosure prevents public participation in the deal, including raising important questions about whether tax incentives that cities are offering are in the best short- and long-term interest of their residents. This is the main finding of Public Auction, Private Dealings: Will Amazon’s HQ2 Veer to Secrecy Create A Missed Opportunity for Inclusive, Accountable Development?, a Good Jobs First study released today.

Teachers’ Strikes Are Emblematic of Larger Tax Challenges for States

March 30, 2018 • By Meg Wiehe

As other researchers as well as journalists have noted, teachers striking or threatening to strike over low wages and overall lack of investment isn’t simply a narrative about schools and public workers’ pay. It is illustrative of a broader conflict over tax laws and how states and local jurisdictions fund critical public services that range from K-12 education, public safety, roads and bridges, health care, parks, to higher education.

State Rundown 3/30: Several Major Tax Debates Will March on into April

March 30, 2018 • By ITEP Staff

This week, after the recent teacher strike in West Virginia, teacher pay crises brought on by years of irresponsible tax cuts also made headlines in Arizona and Oklahoma. Maine and New York lawmakers continue to hash out how they will respond to the federal tax bill. And their counterparts in Missouri and Nebraska attempt to push forward their tax cutting agendas.

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

State Rundown 3/22: Some Spring State Tax Debates in Full Bloom, Others Just Now Surfacing

March 22, 2018 • By ITEP Staff

The onset of spring this week proved to be fertile ground for state fiscal policy debates. A teacher strike came to an end in West Virginia as another seems ready to begin in Oklahoma. Budgets were finalized in Florida, West Virginia, and Wyoming, are set to awaken from hibernation in Missouri and Virginia, and are being hotly debated in several other states. Meanwhile Idaho, Iowa, Maryland, and Minnesota continued to grapple with implications of the federal tax-cut bill. And our What We're Reading section includes coverage of how states are attempting to further public priorities by taxing carbon, online gambling,…

Trends We’re Watching in 2018, Part 2: State Revenue Shortfalls and the Impact on Education and Other Services

March 12, 2018 • By Aidan Davis

Many states struggle with a need for revenue, yet their lawmakers show little will to raise taxes to fund public services. Revenue shortfalls can prove to be a moving target. Some states with expected shortfalls are now seeing rosier forecasts. But as estimates come in above or below projections, states continue to grapple with how and whether to raise the revenue necessary to adequately fund key programs. Here are a few trends that are leading to less than cushy state coffers this year.

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

This Valentine's week finds California, Georgia, Missouri, New York, Oregon, and other states flirting with the idea of coupling to various components of the federal tax-cut bill. Meanwhile, lawmakers seeking revenue solutions to budget shortfalls in Alaska, Oklahoma, and Wyoming saw their advances spurned, and anti-tax advocates in many states have been getting mixed responses to their tax-cut proposals. And be sure to check out our "what we're reading" section to see how states are getting no love in recent federal budget developments.

State Rundown 1/31: Low-Income Families’ Taxes Getting Some Much-Needed Attention

January 31, 2018 • By ITEP Staff

This week was promising for advocates of Earned Income Tax Credits (EITCs) and other tax breaks for workers and their families, which are making headway in Alabama, Maine, Massachusetts, Missouri, Utah, and Wisconsin. The week also saw the unveiling of a tax cut plan in Missouri, a budget-balancing tax increase package in Oklahoma, the end of an unproductive film tax credit in West Virginia, and a very busy week for tax policy in Utah.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…