Wisconsin

Urban Milwaukee: Labor Leaders Slam Trump for Betraying Working People

July 14, 2020

By Democratic Party of Wisconsin The tax law Trump pushed through was a boon for large corporations, including those in Wisconsin like Kimberly Clark, that used the handout to shutter their facilities, issue stock buybacks, and lay off workers instead of creating jobs and increasing wages. Read more

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

Intended Consequences: Deliberate Disinvestment Caused Florida’s Unemployment Disaster

May 4, 2020 • By Stephanie Clegg

Florida politicians deliberately rigged the unemployment system after the Great Recession to avoid raising taxes on businesses. Now, in a pandemic, some out-of-work residents are left waiting more than six weeks for unemployment benefits while more than 280,000 others have been inexplicably denied. What’s happening in Florida underscores deeper challenges with systems that should help those in need, but instead are designed to fail them.

State Rundown 4/15: Tax Day Delayed but Other Important Work Accelerated

April 15, 2020 • By ITEP Staff

April 15 is traditionally the day federal and state income taxes are due, but like so much else, Tax Day is on hold for the time being. Meanwhile the pandemic’s disastrous and uneven effects on communities and shared institutions are decidedly not suspended. But nor are the efforts of individuals, advocates, and policymakers to develop solutions to respond to the immediate crisis while also building better systems going forward. ITEP’s recommendations for state tax policy responses are now available here, and this week’s Rundown includes experiences and perspectives on paths forward from around the country.

State Rundown 4/9: Pandemic’s Fiscal Effects Slowly Coming into Focus

April 9, 2020 • By ITEP Staff

The COVID-19 pandemic continued this week to wreak havoc on lives and communities around the world. The fiscal fallout of the virus in the states is growing as well, and beginning this week to come into sharper focus. This week’s Rundown brings together what we know of that slowly clarifying picture and how states are responding so far.

State Rundown 4/3: States Welcome Federal Aid, Seek Further Solutions

April 3, 2020 • By ITEP Staff

States and families got good news this week as Congress came together to pass major aid to help during the COVID-19 coronavirus pandemic. But that bright spot came amid an onslaught of very difficult news about the public health crisis and the economic and fiscal fallout accompanying it. This week’s Rundown brings you the latest on these developments and state and local responses to them.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

This weekend’s Leap Day should be a welcome extra day for state lawmakers, advocates, and observers who care about tax and budget policy, as there is an overflow of proposals and information to digest. Most importantly, as emphasized in our “What We’re Reading” section, there are never enough days in a month to do justice to the importance of Black History Month and Black Futures Month. In state-specific debates, Oregon and Washington leaders are hoping to take a leap forward in raising funds for homelessness and housing affordability measures. Lawmakers in West Virginia and Wisconsin could use a day to…

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

ITEP Testimony In Support of H.B. 222 Income Tax Rates – Capital Gains Income & H.B. 256 Maryland Estate Tax – Unified Credit

February 12, 2020 • By Kamolika Das

Read as PDF Testimony of Kamolika Das, State Policy Analyst, Institute on Taxation and Economic Policy Submitted to: Ways and Means Committee, Maryland General Assembly Thank you for this opportunity to submit testimony. My name is Kamolika Das, and I represent the Institute on Taxation and Economic Policy (ITEP), a non-profit, non-partisan research organization that […]

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

Amy Hanauer

January 7, 2020 • By ITEP Staff

Amy Hanauer provides vision and leadership to bring accurate research and data to tax policy conversations. As Director, Amy raises resources, guides strategy, and works with the board and staff to make ITEP a critical part of the policy discussion around a stronger tax code. She brings nearly 30 years of experience working to create economic policy that advances social justice.

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

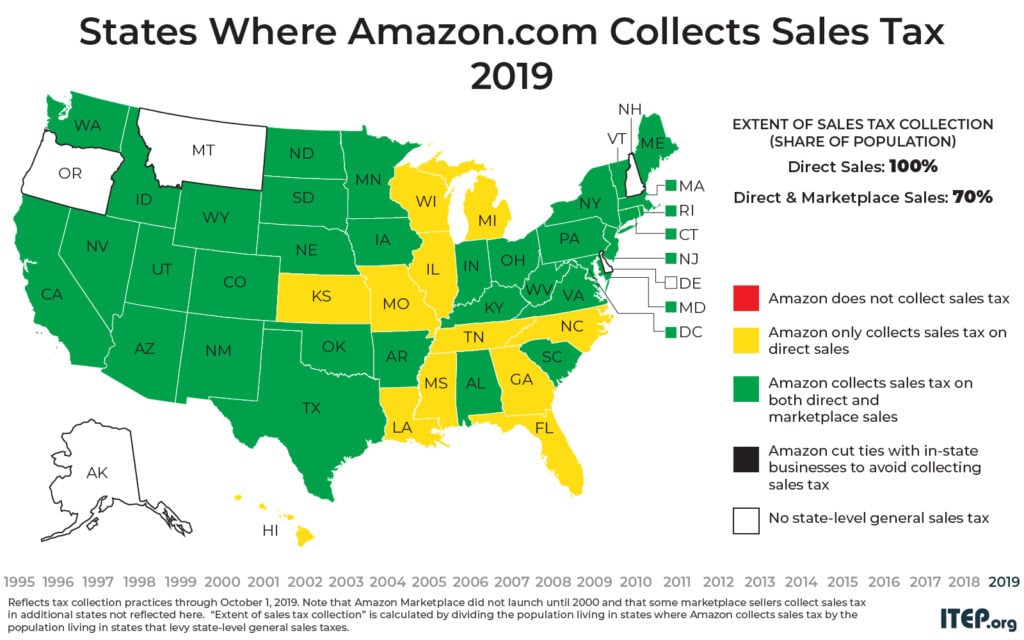

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

Amy Hanauer Appointed as Executive Director of ITEP-CTJ

November 5, 2019 • By ITEP Staff

Institute on Taxation and Economic Policy (ITEP) and Citizens for Tax Justice (CTJ) Boards of Directors announced today the appointment of Amy Hanauer as Executive Director to lead the organizations’ tax justice work. Hanauer, founder of Policy Matters Ohio, will assume responsibilities mid-January 2020, joined by long-time ITEP-CTJ team member Meg Wiehe in her expanded role as Deputy Executive Director. Together the pair will lead the organizations in transforming tax policies to better meet the country’s needs.

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

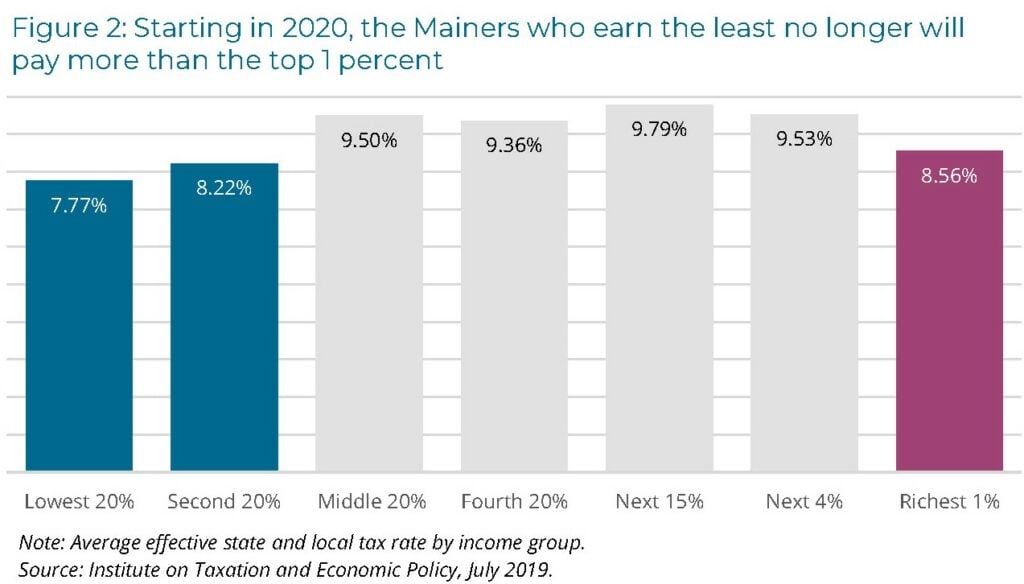

Lawmakers in Maine this year took bold steps toward making the state’s tax system fairer. Their actions demonstrate that political will can dramatically alter state tax policy landscape to improve economic well-being for low-income families while also ensuring the wealthy pay a fairer share.

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…