American Rescue Plan

What We Can Learn Today from the American Rescue Plan – and Sen. Rick Scott’s Proposed Tax Increases

March 11, 2022 • By Steve Wamhoff

The success of the American Rescue Plan Act is worth revisiting today. Instead of pursuing Sen. Rick Scott’s agenda of making life more difficult for those already working the hardest, Congress should extend or make permanent some of the beneficial policies in ARPA.

It’s become popular to urge people to imagine a better world. But on tax policy, the last year gives us ample evidence that lets us move far beyond imagining.

More Than One in Three Young Workers Would Benefit from EITC Reforms in Build Back Better Plan

February 8, 2022 • By Aidan Davis

Although the EITC expansion did not receive as much attention as the expanded Child Tax Credit, a new ITEP report shows the positive impact of allowing young workers without children in the home to maintain access to one of the nation’s most significant and effective anti-poverty programs.

Experts Weigh in on the Payoffs of Advanced Child Tax Credit Payments

July 15, 2021 • By Jenice Robinson

During a Tuesday webinar (The Child Tax Credit in Practice: What We Know about the Payoffs of Payments) hosted by ITEP and the Economic Security Project, panelists explained why the expanded Child Tax Credit is a transformative policy that should be extended beyond 2021. They highlighted tax policy and anti-poverty research and discussed lessons learned from demonstration projects that have provided a guaranteed income to low-income families.

In Drive to Cut Taxes, States Blow an Opportunity to Invest in Underfunded Services

July 7, 2021 • By Marco Guzman

Many states find themselves in a peculiar fiscal situation right now: federal pandemic relief money has been dispersed to states and revenue projections have exceeded expectations set during the pandemic. Meanwhile, more and more workers are returning to jobs as vaccines roll out and typical economic activity resumes. Some states, however, have decided to squander their unexpected fiscal strength on tax cuts.

On July 15, the U.S. Treasury will begin mailing monthly checks to families with children who are eligible for the Child Tax Credit. Previously, the maximum credit was $2,000 per child, but for 2021, President Biden’s American Rescue Plan broadened the credit to $3,600 for each child under six and $3,000 for children over six. The expansion also made eligible children whose parents' incomes were too low to qualify for the previous credit, both addressing a fundamental policy flaw and taking a significant step to reduce child poverty. This is the first time that the federal government is sending advanced…

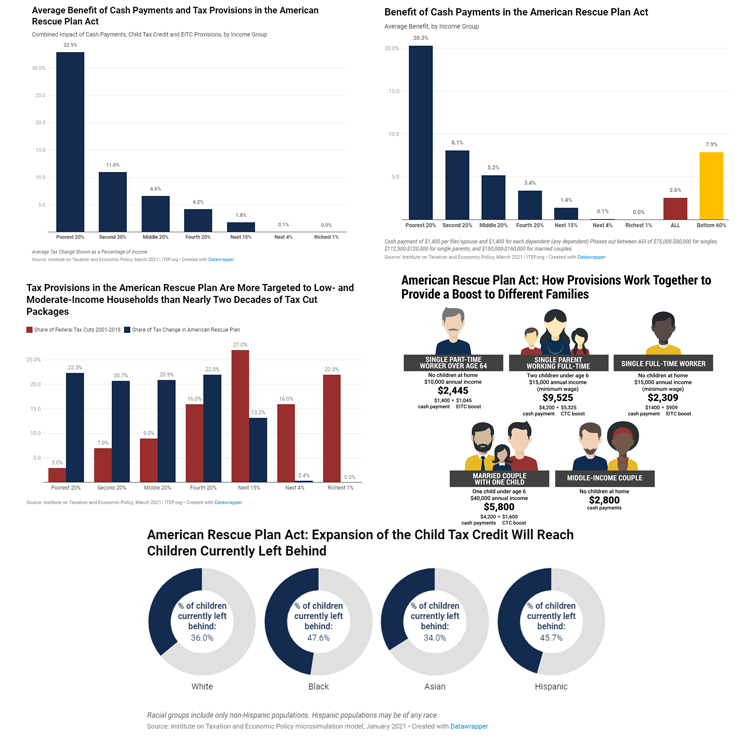

Targeted Relief and the American Rescue Plan in Five Charts

March 10, 2021 • By Stephanie Clegg

The American Rescue Plan Act is unique in that it employs the tax code to deliver relief to those struggling most. These five charts provide a glimpse of how the plan helps families across the income spectrum and also targets economic relief to low- and moderate-income families in the form of cash payments and expansions to the Child Tax Credit and Earned Income Tax Credit.

American Rescue Plan Uses Government Muscle to Tackle Big Economic Problems

March 10, 2021 • By Amy Hanauer

Media contact Following is a statement by Amy Hanauer, executive director of The Institute on Taxation and Economic Policy, regarding the American Rescue Plan, which has cleared both houses of Congress and President Biden is expected to sign. “The American Rescue Plan is a monumental first step toward President Joe Biden’s pledge to build back […]

Estimates of Cash Payment and Tax Credit Provisions in American Rescue Plan

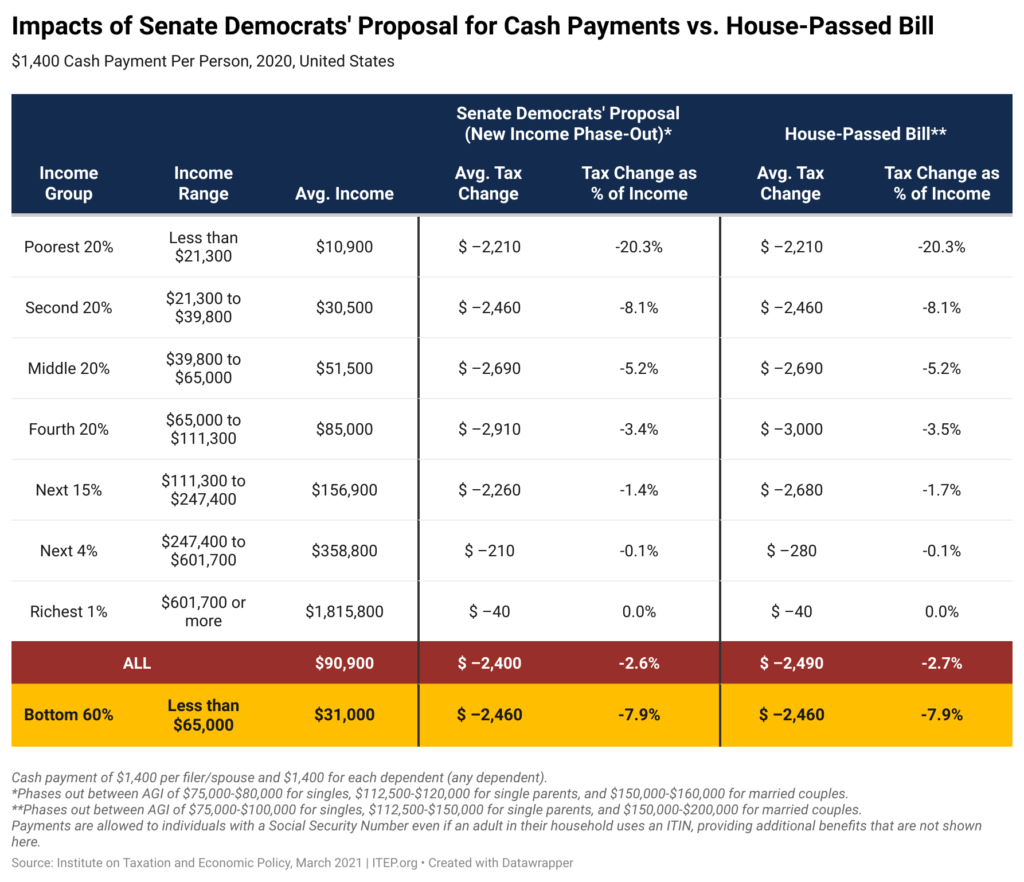

March 7, 2021 • By Steve Wamhoff

Update: On March 10, the House passed the Senate version of the COVID relief bill, called the American Rescue Plan Act, and sent it to President Biden for his signature. This means that the Senate version of the bill described herein is the final legislation enacted into law.

As the Senate takes up the COVID relief bill passed by the House last week, Senate Democrats have proposed to lower the income level at which the $1,400 cash payments would be phased out. New estimates from ITEP demonstrate that, for most people, the change would make no difference.

Senators and representatives can look to recent history—the 2007-2009 recession—for lessons on how to best address the current economic crisis. If we do too little, the economy will stay weak much longer, hurting all of us.

President Biden’s Child Tax Credit Proposal Could Right a Historical Wrong

February 2, 2021 • By ITEP Staff, Jenice Robinson, Meg Wiehe

Many 1990s policies were grounded in harmful, erroneous ideas such as financial struggles are due to personal shortcomings and less government is better. Lawmakers didn’t apply these ideas consistently, however. For example, there was no drive to reduce corporate welfare even as policymakers slashed the safety net and disinvested in lower-income communities. So, it’s not surprising that a bipartisan group of lawmakers concluded during that era that the CTC was an appropriate vehicle to give higher-income households a tax break while leaving out poor children.

ANALYSIS: Cash and Tax Provisions in Biden’s Economic Recovery Plan

January 15, 2021 • By Steve Wamhoff

The $1.9 trillion economic recovery plan, known as the American Rescue Plan, announced by President-elect Biden contains, among other provisions, expanded cash payments and changes to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).