California

Fifteen (of Many) Reasons We Need Real Corporate Tax Reform

April 11, 2018 • By Matthew Gardner

This ITEP report examines a diverse group of 15 corporations’ federal income tax disclosures for tax year 2017, the last year before the recently enacted tax law took effect, to shed light on the widespread nature of corporate tax avoidance. As a group, these companies paid no federal income tax on $24 billion in profits in 2017, and they paid almost no federal income tax on $120 billion in profits over the past five years. All but one received federal tax rebates in 2017, and almost all paid exceedingly low rates over five years.

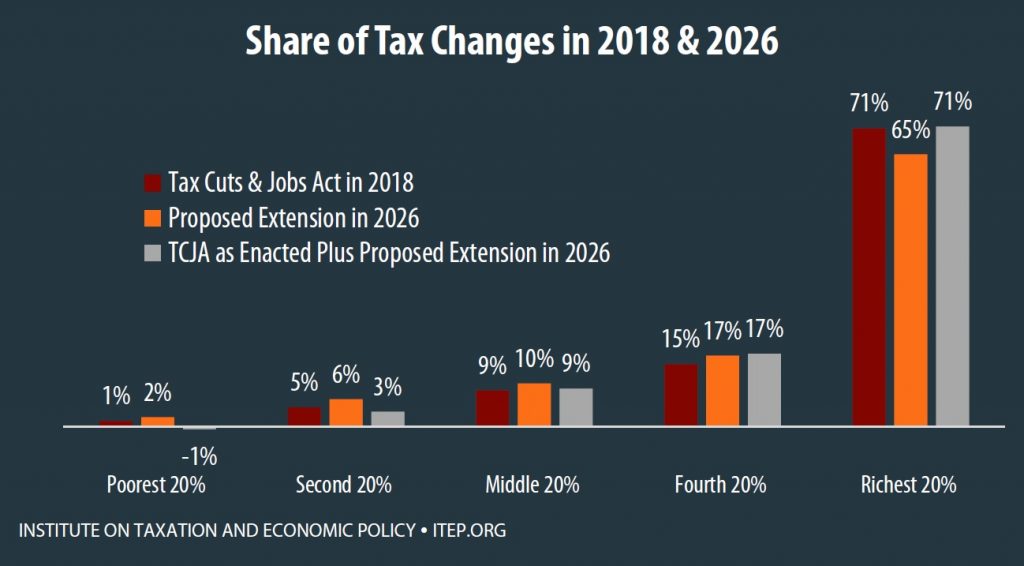

Extensions of the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By Matthew Gardner, Steve Wamhoff

This analysis finds that extending the temporary tax provisions in 2026 would not be aimed at helping the middle-class any more than TCJA as enacted helps the middle-class in 2018.

Is the Trump Organization’s Sales Tax Avoidance More Aggressive Than Amazon’s?

April 6, 2018 • By Carl Davis

In recent weeks, President Trump has been raking Amazon over the coals for failing to collect state and local sales taxes on many of the company’s sales—a criticism that has some merit. But a new story first reported by James Kosur at RedStateDisaster, and then picked up today by the Wall Street Journal, provides fascinating insight into the sales tax collection habits of the Trump Organization’s “official retail website,” TrumpStore.com.

State Rundown 3/30: Several Major Tax Debates Will March on into April

March 30, 2018 • By ITEP Staff

This week, after the recent teacher strike in West Virginia, teacher pay crises brought on by years of irresponsible tax cuts also made headlines in Arizona and Oklahoma. Maine and New York lawmakers continue to hash out how they will respond to the federal tax bill. And their counterparts in Missouri and Nebraska attempt to push forward their tax cutting agendas.

New York Times: The Facts Behind Trump’s Tweet on Amazon, Taxes and the Postal Service

March 30, 2018

Mr. Trump has made similar claims before about Amazon’s tax payments, both as president and a private citizen. After he mentioned it in August 2017, The New York Times reported: If Mr. Trump’s point was that Amazon did not collect sales taxes — which are owed by the purchaser and collected by the retailer — […]

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

With many state legislative sessions about halfway through, the ripple effects of the federal tax-cut bill took a back seat this week as states focused their energies on their own tax and budget issues. Major proposals were released in Nebraska and New Jersey, one advanced in Missouri, and debates wrapped up in Florida, Utah, and Washington. Oklahoma and Vermont are considering ways to improve education funding, while California, New York, and Vermont look to require more of their most fortunate residents. And check in on "what we're reading" for resources on the online sales tax debate, the role of property…

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

Five Ways States Can Recoup Corporations’ Massive Federal Tax Giveaway

March 2, 2018 • By Aidan Davis

Corporate America is doing alright. Corporate profits soared last year, and 2018 has already brought a major windfall in the form of the Trump-GOP tax law, which dramatically cut the federal corporate tax rate from 35 percent to 21 percent and shifted to a territorial tax system, giving income earned offshore by U.S. companies a free pass by no longer making it subject to U.S. taxes.

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

This Valentine's week finds California, Georgia, Missouri, New York, Oregon, and other states flirting with the idea of coupling to various components of the federal tax-cut bill. Meanwhile, lawmakers seeking revenue solutions to budget shortfalls in Alaska, Oklahoma, and Wyoming saw their advances spurned, and anti-tax advocates in many states have been getting mixed responses to their tax-cut proposals. And be sure to check out our "what we're reading" section to see how states are getting no love in recent federal budget developments.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

Dallas Morning News: Look out N.Y., L.A. and Chicago: The New Tax Law Makes Dallas even stronger

February 2, 2018

Most of the individual and family savings from tax reform are going to high earners. In Texas, three-quarters of the upside will be claimed by taxpayers earning over $106,000, according to the Institute on Taxation and Economic Policy, a “nonprofit, nonpartisan” research firm in Washington. To offset those gains — and the hit on the […]

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

States’ attempts to work around the new federal tax law and ensure their residents continue to maximally benefit from state and local tax (SALT) deductions have been in the news since the beginning of the year. At a panel discussion for tax professionals in Washington Thursday, Thomas West, tax legislative counsel at the Treasury Department, cast doubt on proposed work-around schemes that would convert state income tax payments into “charitable contributions.”

State Rundown 1/25: States Begin Tax Debates while Still Racing to Understand Federal Bill

January 25, 2018 • By ITEP Staff

State legislative sessions are in full swing this week as states grapple with revenue shortfalls and the ramifications of the federal tax cut bill. Lawmakers in Alaska and Louisiana, for example, are debating how to handle their revenue shortfalls, and a tax cut proposal in Idaho has been received tepidly. And be sure to peruse our "What We're Reading" section for helpful perspectives on how states are affected by the federal tax cut bill.

Repealing, or Working Around, the Cap on State and Local Tax Deductions Would Make the Trump-GOP Tax Law Even More Unfair

January 17, 2018 • By Steve Wamhoff

A bipartisan proposal in Congress to eliminate the new $10,000 cap on federal deductions for state and local taxes (SALT) would cost more than $86 billion in 2019 alone and two-thirds of the benefits would go to the richest 1 percent of households. Unfortunately, “work around” proposals in some states to allow their residents to avoid the new federal cap would likely have the same regressive effect on the overall tax code.

Last week, a federal court judge in California ruled that the Trump administration cannot end DACA (Deferred Action for Childhood Arrivals) while the case works its way through the courts. Although this is reassuring news for the roughly 685,000 young people currently enrolled or seeking renewals for their DACA status it does not extend protections to new applicants, and it does not lessen the need for congressional action to protect Dreamers.

New York Magazine: California, New Jersey, and New York Designing Workarounds to Blunt GOP Tax Bill Impact

January 12, 2018

In a memo released in 2011, the Internal Revenue Service gave its blessing for taxpayers to claim federal deductions on those gifts. The combination of a 100 percent state-tax credit and a federal deduction actually makes the gifts profitable for some donors, said Carl Davis, research director for the Institute on Taxation and Economic Policy. […]

State Rundown 1/12: Tax Cut Tunnel Vision Threatens to Bore State Budget Holes Even Deeper

January 12, 2018 • By ITEP Staff

As states continue to sift through wreckage of the federal tax cut bill to try to determine how they will be affected, two things should be clear to everyone: the richest people in every state just got a massive federal tax cut, and federal funding for shared priorities like education and health care is certain to continue to decline. State leaders who care about those priorities should consider asking those wealthy beneficiaries of the federal cuts to pay more to the state in order to minimize the damage of the looming federal funding cuts, but so far policymakers in Idaho,…

State Rundown 1/4: Will States Show Resolve in a Challenging Year?

January 4, 2018 • By ITEP Staff

This week marks the beginning of what is bound to be a wild year for state tax and budget debates. Essentially every state is already working to sort through the complicated ramifications of the federal tax cuts passed in December, including Kansas, Michigan, Montana, and New Jersey highlighted below. These and other states will have important decisions to make about how to incorporate, reject, or mitigate various aspects of the new federal law, and will need considerable resolve to improve state tax policy to be more fair and more adequate – even as federal taxes become less so.

Select state coverage of ITEP’s analyses of Republican tax Plans

January 1, 2018

Burlington County Times: Will Phil Murphy raise NJ’s taxes (and 4 other political questions for .. Kaplan Herald: This chart exhibits how the GOP tax plan will hit your pockets Wiscnews: Tax cuts increase inequity Patch.com: MacArthur Touts Tax Reform; Will It Help NJ As Much As He Says? NJ.com: Long lines spring up as […]

These have been dark days for those who care about tax justice and public investments, but with the Winter Solstice this week and many states diving into their legislative sessions in January, longer days (and long work days) are soon to come! Governors and legislators are already proposing or hinting at their 2018 tax and budget plans in Alaska, California, Iowa, Maryland, and Washington. And transportation investments are getting strong support in Missouri, Oregon, and Virginia.