Capital Gains

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

His 900-word New York Times op-ed identifies some sensible federal tax reform ideas that would create a fairer, more sustainable tax system.

Shelter Skelter: How the Educational Choice for Children Act Would Use Tax Avoidance to Fuel School Privatization

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would ostensibly provide a tax break on charitable donations to organizations that give out private K-12 school vouchers. Most of the so-called “contributions,” however, would be made by wealthy people solely for the tax savings, as those savings would typically be larger than their contributions.

A Revenue Impact Analysis of the Educational Choice for Children Act of 2025

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would provide donors to nonprofit groups that distribute private K-12 school vouchers with a dollar-for-dollar federal tax credit in exchange for their contributions. In total, the ECCA would reduce federal and state tax revenues by $10.6 billion in 2026 and by $136.3 billion over the next 10 years. Federal tax revenues would decline by $134 billion over 10 years while state revenues would decline by $2.3 billion.

On Election Day, Voters Across the Country Chose to Invest in Their States & Communities

November 19, 2024 • By Kamolika Das

On election day, voters across the country — in states red and blue and communities rural and urban — approved a wide range of state and local ballot measures on taxation and public investment. The success of these measures clearly shows that voters are willing to invest in public priorities that feel tangible and close to home.

Everything You Need to Know About Proposals to Better Tax Billionaires

December 21, 2023 • By Steve Wamhoff

Tax policy may not be on the minds of most Americans during the final weeks of 2023, but billionaires with an eye on their own tax bills have been riveted by developments in D.C.

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

December 7, 2023 • By Steve Wamhoff

The federal estate tax has reached historic lows. In 2019, only 8 of every 10,000 people who died left an estate large enough to trigger the tax. Legislative changes under presidents of both parties have increased the basic exemption from the estate tax over the past 20 years. This has cut the share of adults leaving behind taxable estates down from more than 2 percent to well under 1 percent.

The Latest Convoluted Arguments in Favor of Rich People Not Paying Taxes

November 13, 2023 • By Steve Wamhoff

Two Senate hearings last week focused on how the richest Americans are avoiding and evading taxes in ways that ordinary Americans could hardly imagine. All the experts brought in to testify seemed to agree that the House GOP’s recent tactic of “paying for” a spending proposal by cutting IRS funding makes no sense because it […]

Workers of all races and ethnicities are confronting a tax code that puts them at a disadvantage relative to those with immense wealth, and people of color and women are among those most likely to be negatively impacted by this injustice.

The Campaign by Democratic Former Officials to Stop Taxes on the Wealthy

October 6, 2023 • By Steve Wamhoff

One of the most attention-grabbing anti-tax campaigns at work today is called SAFE, which stands for Saving America’s Family Enterprises. But it might as well mean Saving Aristocrats From Everything given the outfit’s knack for opposing any national proposal to limit special tax advantages that only the wealthy enjoy. The basic approach of SAFE is […]

Congress Should Consider Attaching Work Requirements to the Biggest Tax Break for the Rich

May 25, 2023 • By Steve Wamhoff

Instead of focusing on low-income people who are already mostly employed or facing significant barriers to employment, lawmakers who want to encourage labor force participation should revisit existing tax breaks subsidizing wealthy individuals who live off their assets rather than work.

At nearly every turn, Oregon’s tax policies widen inequality; as a result, the top 1 percent pay less state and local taxes as a share of income than the poorest residents. Taxing capital gains at the local level is an important and exciting move in the other direction – to tax income from wealth and use it to address crucial needs.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

As one of the most prosperous countries in human history, we have enough resources for our collective needs. By better taxing corporations and the wealthiest, we can generate revenue to improve family security, strengthen our communities, and reduce the debt too.

Politifalse: A Fact-Checker Does Biden an Injustice on Taxes Paid by Billionaires

March 9, 2023 • By Michael Ettlinger

Most Americans pay more in Social Security and Medicare payroll taxes than they pay in federal personal income tax. So just looking at the personal income tax for comparison misses most of the taxes middle-income Americans pay. That is not true for billionaires because a much, much smaller proportion of their income is subject to the federal payroll taxes.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2023 Budget Plan

April 26, 2022 • By Steve Wamhoff

President Biden's latest budget plan includes proposals that would raise $2.5 trillion in new revenue. While many of these reforms appeared in his previous budget, some of them are brand new, such as his proposal to prevent basis-shifting in partnerships and his Billionaires Minimum Income Tax.

Biden’s Proposals Would Fix a Tax Code that Coddles Billionaires

April 21, 2022 • By Steve Wamhoff

Billionaires can afford to pay a larger share of their income in taxes than teachers, nurses and firefighters. But our tax code often allows them to pay less, as demonstrated by the latest expose from reporters at ProPublica using IRS data. According to their calculations, Betsy DeVos, the Education Secretary under former President Donald Trump, […]

President Biden’s Proposed Billionaires’ Minimum Income Tax Would Ensure the Wealthiest Pay a Reasonable Amount of Income Tax

April 6, 2022 • By Steve Wamhoff

The Billionaires’ Minimum Income Tax included in President Biden's budget plan would limit an unfair tax break for capital gains income and complement proposals the president has offered previously to limit other tax breaks for capital gains.

Frequently Asked Questions and Concerns About the President Billionaires’ Minimum Income Tax

April 6, 2022 • By Steve Wamhoff

Find the answers to some frequently asked questions about President Biden's Billionaires’ Minimum Income Tax, which would limit very wealthy individuals’ ability to put off paying income taxes on capital gains until they sell assets.

Limiting Tax Breaks for Capital Gains Would Mitigate the Racial Wealth Gap

October 14, 2021 • By Joe Hughes

The racial wealth and income gaps are the results of centuries of government policies favoring the accumulation of wealth among white communities while marginalizing communities of color. Policy solutions that are race-forward, meaning they remedy past and ongoing racial inequities, can also address broader social inequities.

The Billionaires’ Income Tax Is the Latest Proposal to Reform How We Tax Capital Gains

September 28, 2021 • By Steve Wamhoff

When people first hear about proposals to tax unrealized capital gains, they often ask, “Is this income, and if so, should we tax it?” The answers to those questions are “yes” and “yes, when we are talking about the very rich.”

Reforming Federal Capital Gains Taxes Would Benefit States, Too

September 28, 2021 • By Carl Davis

Congress’s action or inaction on federal tax changes under consideration in the Build Back Better plan could have important implications for states on many fronts. One critical area of note is at the foundation of income tax law: setting the definition of income that most states will use in administering their own income taxes.

It’s Not About Farms: Don’t Let Lies Crush Biden’s Tax Plan

September 2, 2021 • By Steve Wamhoff

Several former Democratic members of Congress have joined a campaign to misrepresent President Biden’s proposal to close a huge tax loophole for wealthy people with capital gains. This proposed reform is the cornerstone of the president’s tax plan. If lawmakers fall for the lies, Biden's plan will collapse. Instead, they should do what is both popular and fair: enact the plan intact so that millionaires and billionaires no longer escape the federal income tax.

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

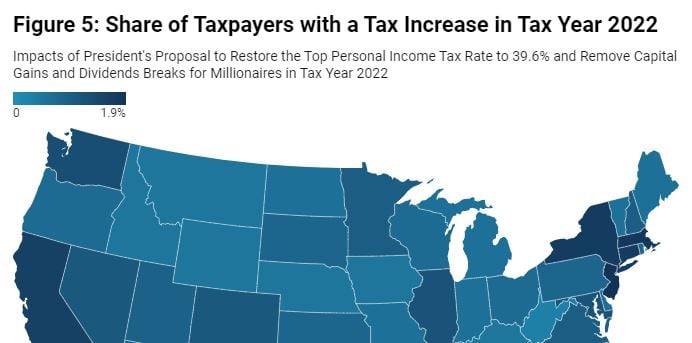

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.