Blog - Federal Policy

525 posts

It doesn’t matter if someone with a family income of $800,000 per year thinks they aren’t rich because they can’t quit their jobs and retire to a luxury home on the beach in Malibu. They can call themselves what they want. The point is that they are richer than 99 percent of the population and can afford to pay more.

The IRS Direct File pilot is currently open to eligible taxpayers here. Millions of American families have now received their W-2s for 2023, signaling the start to a new tax filing season. The IRS has set January 29 as the first date that people can file their tax returns for the previous year, and the […]

Everything You Need to Know About Proposals to Better Tax Billionaires

December 21, 2023 • By Steve Wamhoff

Tax policy may not be on the minds of most Americans during the final weeks of 2023, but billionaires with an eye on their own tax bills have been riveted by developments in D.C.

With the Moore vs. United States Case, the Supreme Court Could Unleash Chaos on Our Tax System

December 1, 2023 • By Steve Wamhoff

On Tuesday, the U.S. Supreme Court will begin hearing oral arguments in Moore vs. United States, which could become the most important tax case in a century. A broad ruling could destabilize our tax system, enrich many profitable corporations, and widen existing economic and racial inequalities.

The Latest Convoluted Arguments in Favor of Rich People Not Paying Taxes

November 13, 2023 • By Steve Wamhoff

Two Senate hearings last week focused on how the richest Americans are avoiding and evading taxes in ways that ordinary Americans could hardly imagine. All the experts brought in to testify seemed to agree that the House GOP’s recent tactic of “paying for” a spending proposal by cutting IRS funding makes no sense because it […]

Year-End Tax Package Must Prioritize Children and Families Over Corporations and Private Equity

November 8, 2023 • By Joe Hughes

While Congress considers extending expired tax provisions, it should first and foremost focus on expanding the Child Tax Credit, a policy with a proven track record of helping families and children.

Workers of all races and ethnicities are confronting a tax code that puts them at a disadvantage relative to those with immense wealth, and people of color and women are among those most likely to be negatively impacted by this injustice.

Free Tax Filing Option from the IRS Would Benefit People of Color, Contrary to Corporate Warnings

October 30, 2023 • By Brakeyshia Samms

There's a patchwork of programs and preparers for people of color to turn to when filing taxes, and most come from corporations that profit from providing a service that the government could provide more effectively and efficiently for free. The Direct File program can change that and is a great step forward in the IRS’ work addressing racism in the tax code.

On Corporate Tax Avoidance, Critics Take Aim at ITEP – and Miss

October 25, 2023 • By Matthew Gardner, Steve Wamhoff

In identifying companies that avoid taxes, ITEP presented evidence that our federal corporate income tax was not working the way most Americans think it should work. The public and lawmakers paid attention, including President Biden who then made the case that this demonstrated the need for reform. As a result, Congress enacted the corporate minimum tax, to make the tax system a bit closer to what most Americans want it to be. If you look closely at this, you might just see an example of democracy working.

Intuit Receives Millions in Federal Subsidies While Arguing IRS Direct File Would Be Too Costly

October 24, 2023 • By Joe Hughes, Spandan Marasini

The tax preparation industry has for years lobbied to prevent the IRS from providing a tool that would allow Americans to file their taxes online for free. Recent public disclosures from Intuit, the maker of TurboTax and the leader of the pack, show that tax breaks the company claims for doing “research” might be larger […]

Large and Growing Tax Gap Underscores the Need to Adequately Fund the IRS

October 17, 2023 • By Jon Whiten

New figures released show the difference between what Americans paid and owed in taxes grew to $688 billion in 2021, a significant jump from previous estimates. This new data underscores that last year’s boost to IRS funding under the Inflation Reduction Act was absolutely necessary and should be protected by lawmakers.

The Moore Case Before the U.S. Supreme Court Could Widen the Racial Wealth Gap

October 17, 2023 • By Brakeyshia Samms, Moore v. United States

Moore v. United States, already a cause for concern for tax lawyers, could create more barriers for racial equity advocates working to reverse the economic plight of many households of color.

The Campaign by Democratic Former Officials to Stop Taxes on the Wealthy

October 6, 2023 • By Steve Wamhoff

One of the most attention-grabbing anti-tax campaigns at work today is called SAFE, which stands for Saving America’s Family Enterprises. But it might as well mean Saving Aristocrats From Everything given the outfit’s knack for opposing any national proposal to limit special tax advantages that only the wealthy enjoy. The basic approach of SAFE is […]

Last year, Congress reversed decades of funding cuts to the IRS to help the agency improve taxpayer services and crack down on wealthy tax cheats through the Inflation Reduction Act. The IRS adopted their assignment, and this past tax filing season was a marked improvement from the year before – both for the agency and […]

Government Shutdown is Rooted in Hypocrisy, Dysfunction, and, As Always, Tax Cuts for the Rich

September 27, 2023 • By Joe Hughes

The priorities in this shutdown drama couldn’t be clearer. House Republicans once again threaten the financial security of the millions of Americans to exact cuts to programs like Head Start, the Social Security Administration, and the EPA – all while seeking unaffordable tax cuts for multinational corporations, the wealthy, and foreign investors.

Moore Case Could Enrich Tax-Avoiding Multinational Corporations – and the SCOTUS Justices Who Own Their Stock

September 27, 2023 • By Matthew Gardner

The Moore v. United States case that will soon be heard by the U.S. Supreme Court could jeopardize at least $270 billion if SCOTUS finds the entire transition tax to be unconstitutional. The decision could also invalidate other important parts of the current tax system while preempting progressive wealth tax proposals. Such an outcome would represent one of the costliest—and most ethically questionable - Supreme Court decisions in U.S. history.

Kyrsten Sinema’s Latest Fight to Protect Tax Breaks for Private Equity

September 15, 2023 • By Steve Wamhoff

Sen. Sinema's bill to stop a seemingly arcane business tax increase that was enacted as part of the 2017 Trump tax law would be hugely beneficial to the private equity industry.

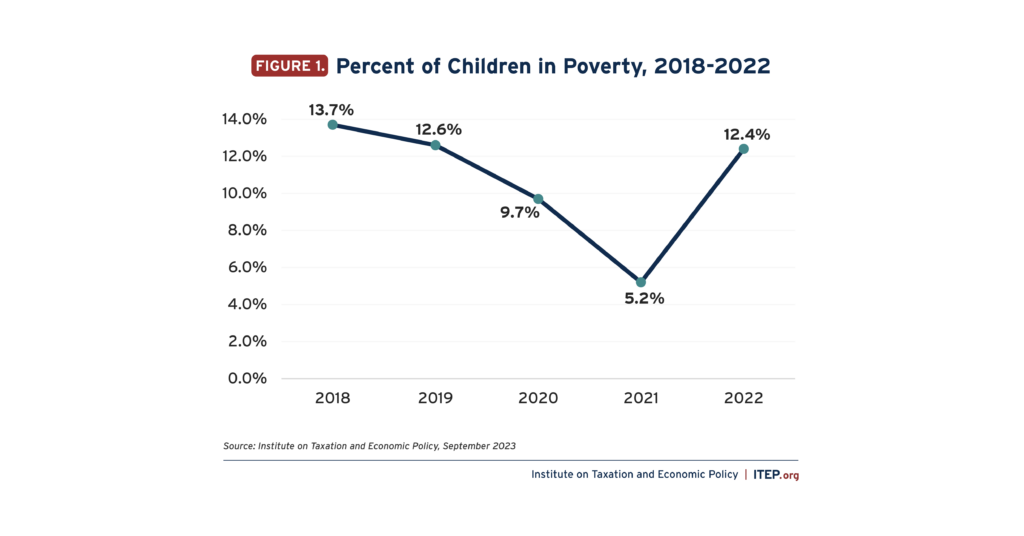

Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in Child Poverty

September 12, 2023 • By Joe Hughes

The new Census data should provide both concern and optimism for lawmakers. The steep rise in child poverty is an inexcusable tragedy. But it shows that child poverty is avoidable when Congress makes the decision to make tax policy for those who need the hand up rather than for the rich and powerful.

How to Better Tax the Rich Men North (and South) of Richmond

September 7, 2023 • By Amy Hanauer

When you examine tax policy through the lens of how much working (and poor) people are taxed compared to rich men north (and south) of Richmond, it’s hard not to take Oliver Anthony's runaway hit as a jumping off point to amplify some important facts.

The Innovative Non-Tax Tax Parts of the Inflation Reduction Act

August 23, 2023 • By Michael Ettlinger

In the year since Congress enacted the Inflation Reduction Act (IRA), ITEP has written extensively on the law’s provisions to increase tax fairness and raise revenue for public investments. The IRA, however, also includes tax provisions that serve purposes other than ensuring that we raise adequate revenue and that we do so in a fair […]

Celebrating One Year Since the Landmark Inflation Reduction Act

August 14, 2023 • By Joe Hughes

The Inflation Reduction Act was a course correction from decades of tax cuts that primarily went to the richest Americans and left the rest of us with budget shortfalls that conservative lawmakers now seek to plug with cuts to Social Security and Medicare. For the first time in generations we are finally asking those who have benefited the most from our economy to contribute back.

Congressional Republicans Distort a New Report on the Global Minimum Tax

June 22, 2023 • By Steve Wamhoff

The notion that we are better off allowing our corporations to pretend their profits are earned in the Cayman Islands or Ireland simply defies logic and the facts. There is no scenario in which the U.S. would be better by ditching the international agreement that the government already negotiated.

Debt-Limit Deal’s Provision to Let Tax Cheats Off the Hook Will Increase the Deficit

June 1, 2023 • By Jon Whiten

The latest debt-limit bill in Congress includes a provision to claw back important IRS funding meant to crack down on wealthy tax cheats. This cut in funding would actually increase the deficit while continuing the rig the system in favor of the most well-off.

Congress Should Consider Attaching Work Requirements to the Biggest Tax Break for the Rich

May 25, 2023 • By Steve Wamhoff

Instead of focusing on low-income people who are already mostly employed or facing significant barriers to employment, lawmakers who want to encourage labor force participation should revisit existing tax breaks subsidizing wealthy individuals who live off their assets rather than work.

The House’s Debt Ceiling Smoke Screen: The GOP Budget Plan Gives Cover for Tax Cuts for the Rich

May 9, 2023 • By Joe Hughes

While it isn’t reasonable in the first place for Congress to debate whether it will pay the bills it has already incurred, some of the same lawmakers who are holding the economy hostage to exact budget cuts have decided to make the conversation even more irrational by proposing to increase deficits with tax cuts that enrich the already rich.