Blog - SALT Deduction

9 posts

Latest Proposal from Senate Democrats Would Bar the Rich from SALT Cap Relief

December 7, 2021 • By Steve Wamhoff

Richest taxpayers would receive $0 benefit under new compromise compared with 51 percent of the benefit of House-passed SALT provision DOWNLOAD NATIONAL AND STATE-BY-STATE ESTIMATES In the latest chapter of the saga over SALT, some Senate Democrats are discussing a new compromise that would amend the House-passed provision providing relief from the SALT cap to […]

Senators Menendez and Sanders Show the Way Forward on the SALT Cap

November 3, 2021 • By Steve Wamhoff

Amending the Build Back Better bill to fully repeal the SALT cap would mean that the richest 1 percent could pay less in personal income taxes than they do now, which goes against everything President Biden has said for the past year as he promoted this legislation.

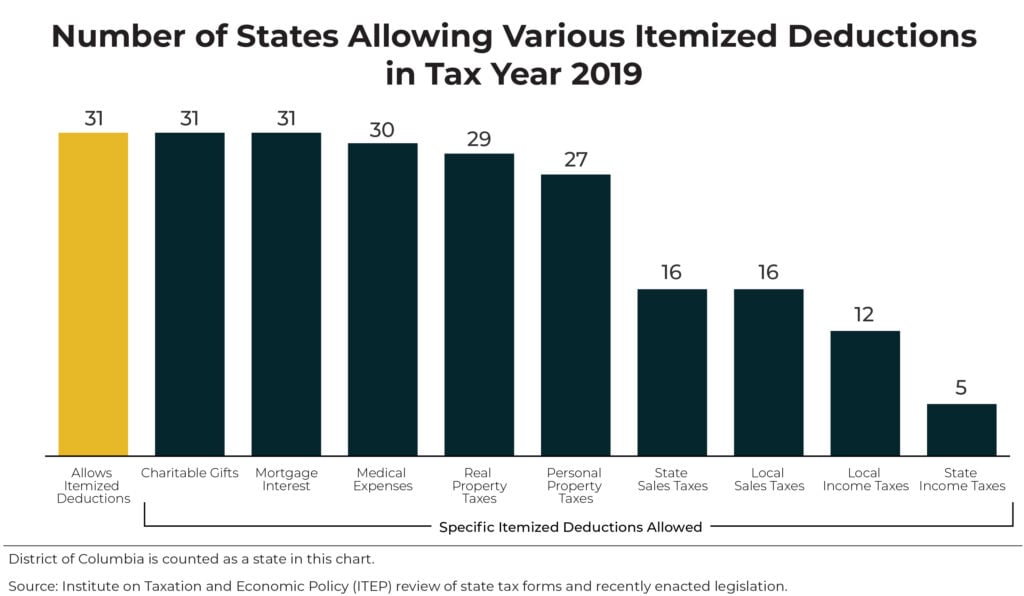

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

A new IRS proposal could once again allow wealthy business owners to use state charitable tax credits–including tax credits for donating to support private and religious K-12 schools–to dodge the federal government’s $10,000 cap on state and local tax (SALT) deductions.

IRS’s SALT Workaround Regulations Should be Strengthened, Not Rejected

August 13, 2019 • By Carl Davis

Lawmakers are seeking to achieve a backdoor repeal of the $10,000 cap on deductions for state and local taxes paid (SALT) by invalidating recent IRS regulations that cracked down on schemes that let taxpayers dodge the cap. If successful, their efforts would drain tens of billions of dollars from federal coffers each year, with the vast majority of the benefits going to the nation’s wealthiest families.

The SALT Cap Isn’t Harming State and Local Revenues. Myths About It May Be.

June 24, 2019 • By Carl Davis

A House Ways and Means subcommittee hearing on Tuesday will explore a highly controversial provision of the Tax Cuts and Jobs Act (TCJA) that prevents individuals and families from writing off more than $10,000 in state and local tax (SALT) payments on their federal tax forms each year. The focus of the hearing will be whether the cap negatively affects state and local revenue streams that fund schools, firefighters, and other services. There are at least three ways this could happen though only one of those is plausible, and it’s not the one that the organizers of this hearing likely…

New SALT Workaround Regulations Narrow a Tax Shelter, but Work Remains to Close it Entirely

June 11, 2019 • By Carl Davis

Today the Internal Revenue Service (IRS) released its final regulations cracking down on a tax shelter long favored by private and religious K-12 schools, and more recently adopted by some “blue state” lawmakers in the wake of the 2017 Trump tax cut. The regulations come more than a year after the IRS first announced the […]

After states implemented laws that allow taxpayers to circumvent the new $10,000 cap on deductions for state and local taxes (SALT), the IRS has proposed regulations to address this practice. It’s a safe bet the IRS will try to crack down on the newest policies that provide tax credits for donations to public education and other public services, but it remains to be seen whether new regulations will put an end to a longer-running practice of exploiting tax loopholes in some states that allow public money to be funneled to private schools.

What to Watch for When the IRS Releases Its SALT Workaround Regulations

April 1, 2019 • By Carl Davis

The Treasury Department and IRS last summer proposed regulations that would make it more difficult for taxpayers to avoid the $10,000 cap on deductions for state and local taxes (SALT). Now, likely days away from the unveiling of the final version of IRS regulations on SALT cap workarounds, Carl Davis recaps the finer points ITEP will be watching for when the regulations become public.