Blog

1298 posts

Attacks on Voting Rights, Secret Tax-Cut Negotiations in Arizona Reflect Broader Trend to Undermine Democracy

May 13, 2021 • By Carl Davis, ITEP Staff, Jenice Robinson

The onslaught of news about multiple states introducing or passing legislation to make it harder to vote is a clear signal that our democracy is in crisis. Decades of policymaking and judicial rulings have created a system in which the voices of the wealthy and powerful have more weight, and some lawmakers are determined to further rig the system and keep it that way.

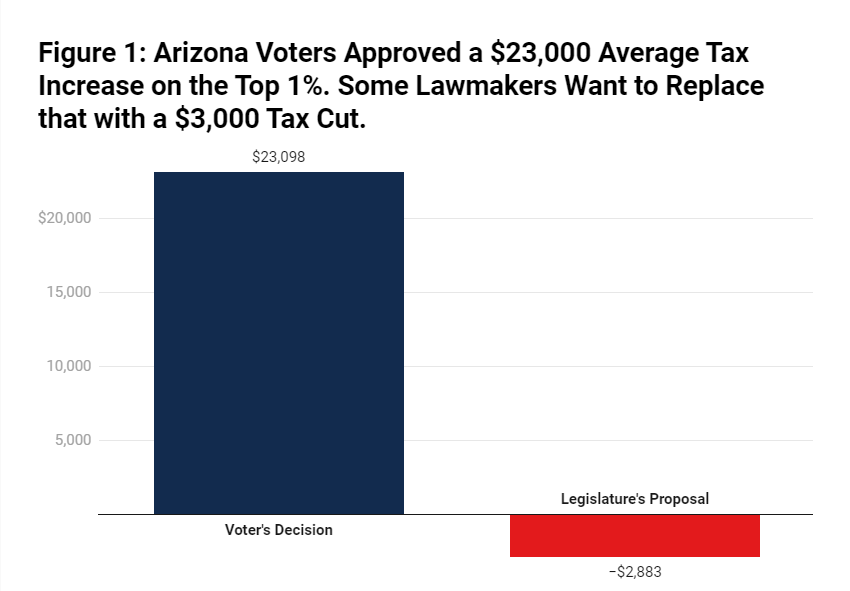

Arizonans Voted to Tax the Rich. Now Lawmakers Want to Undo Most of That.

May 12, 2021 • By Carl Davis

In 2018, Arizona teachers took part in a national wave of teacher walkouts, protesting inadequate education funding and some of the lowest teacher pay in the nation—direct results of the state’s penchant for deep tax cuts and its decision to levy some of the lowest tax rates in the country on high-income families.

This week’s state fiscal news brings a reminder that even though advocates for great economic and racial justice have won some major progressive victories recently, anti-tax zealots have been hard at work too. Lawmakers advanced or enacted troubling regressive tax cuts or shifts in Idaho, Kansas, and Montana, and are actively debating them in Iowa, […]

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

Gentrification and the Property Tax: How Circuit Breakers Can Help

April 27, 2021 • By David Crawford

Property tax circuit breakers are effective because they provide property tax relief to families whose property taxes surpass a certain percentage of their income. If a family in a gentrifying area sees their property tax bill (or their rent) surge to an unaffordable level, a circuit breaker credit kicks in to offer relief. This targeted approach assists low- and middle-income families without significantly reducing overall tax revenue.

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Inclusive Child Tax Credit Reform Would Restore Benefit to 1 Million Young ‘Dreamers’

April 27, 2021 • By Marco Guzman

As the Biden administration maps out the next steps in America’s response to the coronavirus pandemic—through what is now being called the American Families Plan—it should make sure a proposed expansion of the Child Tax Credit (CTC) includes undocumented children who have largely been left out of federal relief packages this past year. Prior to 2017 Tax Cut and Jobs Act, all children regardless of their immigration status received the credit as long as their parents met the income eligibility requirements. This change essentially excluded around 1 million children and their families.

Sometimes a good idea takes a while. Alvin Schorr, who would have turned 100 this month, helped draft a 1972 bill “to provide for a system of children’s allowances.” He continued to push (in a 1977 congressional testimony and in a 1983 New York Times op-ed) for a refundable tax credit for all families and a children’s allowance, among other laudable ideas. A half-century later, these ideas—which many others have championed—are becoming reality.

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

Young workers are confronting a harsh economic reality filled with student loan debt and far too few good-paying jobs. The pandemic reinforced this group’s long history of not receiving proper benefits, such as health insurance, from their employers. They also are often overlooked when it comes to policies that promote economic wellbeing. The federal Earned Income Tax Credit (EITC), for example, is a glowing success story. It lifted 5.8 million people out of poverty in 2018, including 3 million children. But a key shortcoming of the federal EITC: working adults without children in the home receive little to no benefit.

SALT Cap Repeal Would Worsen Racial Income and Wealth Divides

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A bipartisan group of 32 House lawmakers banded together to form the “SALT Caucus,” demanding elimination of the SALT cap. None of their arguments in favor of repeal change the fact that it would primarily benefit the rich and, according to new research, exacerbate racial income and wealth disparities.

Nike’s Tax Avoidance Response Does not Dispute It Paid $0 in Federal Income Tax

April 19, 2021 • By Matthew Gardner

It was (allegedly) P.T. Barnum who first said “there’s no such thing as bad publicity.” But the public relations professionals at the Nike Corporation clearly disagree with this maxim. Last week, after multiple media outlets, including the New York Times, wrote about ITEP’s conclusion that Nike avoided federal corporate income taxes under the Trump tax law, the company contacted these news organizations to… change the subject.

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

What to Expect from Biden and Congressional Democrats on Tax Increases for Individuals

April 8, 2021 • By Steve Wamhoff

The Biden administration has already provided details on its corporate tax proposals and in the next couple of weeks is expected to propose tax changes for individuals. Meanwhile, congressional Democrats have some ideas of their own. What should we expect?

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

State Rundown 4/1: Most States Resisting Foolish Tax Cut Games That Tear Revenues Apart

April 1, 2021 • By ITEP Staff

Supporters of tax fairness and adequate funding for public needs are hoping West Virginia’s income tax elimination effort turns out to be a prank, but most states are not fooling around with such harmful policies this year. For example...

The corporate tax plan put forth on Wednesday by President Joe Biden to offset the cost of his infrastructure priorities would be the most significant corporate tax reform in a generation if enacted.

A New Look at Taxes and Race at the State and Local Levels

March 31, 2021 • By Carl Davis, ITEP Staff, Meg Wiehe

A new ITEP report reveals how different taxes have very different impacts on racial equity and unveils data for two states showcasing the consequences of their contrasting tax policy choices. In short, we find that income taxes can help narrow the racial income and wealth divides while sales taxes generally make those divides worse.

The Biden administration has made clear that its top priorities include a major recovery package with critical investments to boost the nation’s economy and tax increases for corporations and the wealthy. Adequately funding the IRS must be part of that agenda. It seems every week, a new study, data set or research-driven commentary reveals how […]

Looking at the Tax Code Through A Race Equity Lens Presents a Strong Case for Reforms

March 25, 2021 • By Carl Davis

An important new book from Professor Dorothy Brown at Emory University offers a timely look at the federal tax code through the lens of racial equity. The Whiteness of Wealth: How the Tax System Impoverishes Black Americans—And How Can We Fix It uses a mix of data, legal scholarship, interviews, and personal stories to tear […]

We all need the things that the public sector provides. When corporate taxes go unpaid, the American people have less for the things that would help our communities. That means less repair of our failing infrastructure, less investment in greening our economy, less funding to help young people attend college.

It was a relatively quiet week in state fiscal policy, likely partly due to states waiting for federal guidance on some of the details in the American Rescue Plan. As they await those details, lawmakers in Mississippi and West Virginia continue to wrangle over whether to recklessly eliminate their income taxes, while leaders in states including Connecticut and New York considered more productive and progressive reforms. And in the meantime, groundbreaking work on the intersection of race and tax policy is now available.

Zoom Video Communications, the company providing a platform used by remote workers and school children across the country during the pandemic, saw its profits increase by more than 4,000 percent last year but paid no federal corporate income tax on those profits.

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

Trickle-Down Myths Swamp Tax Policy Debates in Mississippi and West Virginia

March 15, 2021 • By Aidan Davis

Recent proposals in both Mississippi and West Virginia seek to pare back, and ultimately eliminate, each state’s income tax while shifting the responsibility of funding services even more onto low- and middle-income taxpayers through increased consumption taxes. The states are moving forward with this tax experiment even though a similar experiment notoriously and immediately sent Kansas into a financial tailspin.