Policy Briefs

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

Higher Stock Buyback Tax Would Raise Billions by Tightening Loophole for the Wealthy

February 13, 2023 • By Joe Hughes

A higher excise tax rate on buybacks is completely reasonable. Quadrupling the rate, as the President proposes, would raise more revenue and cut into the tax advantage buybacks have over dividends. When a company uses their cash holdings to repurchase their own stock, it is an admission that they have few productive investment opportunities. The public does have productive uses for the tax revenue like infrastructure and schools that create value for the entire economy.

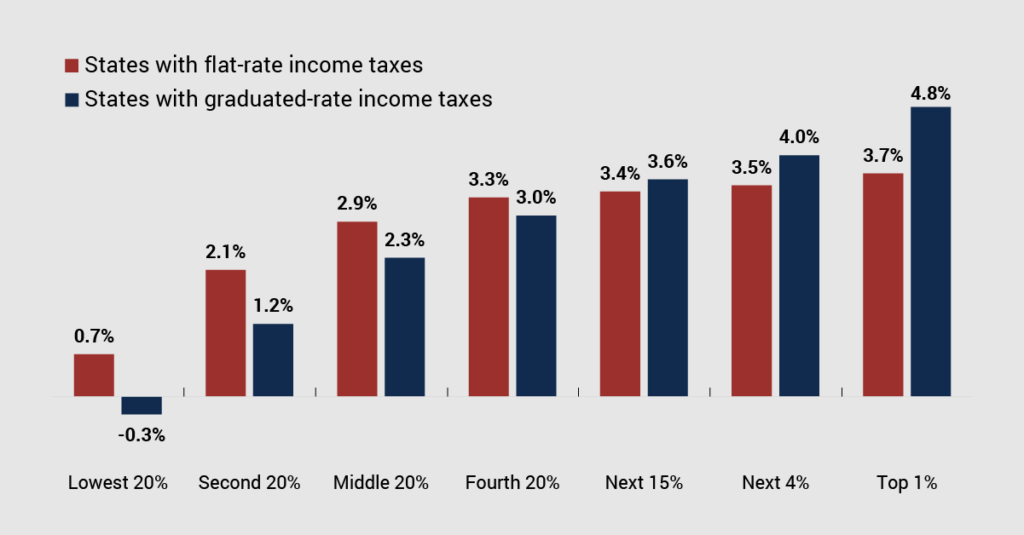

Flat taxes have some surface appeal but come with significant disadvantages. Critically, a flat tax guarantees that wealthy families’ total state and local tax bill will be a lower share of their income than that paid by families of more modest means.

Twenty-Three Corporations Saved $50 Billion So Far Under Trump Tax Law’s “Bonus Depreciation” that Many Lawmakers Want to Extend

November 10, 2022 • By Matthew Gardner, Steve Wamhoff

Nearly two dozen of America’s largest corporations together received roughly $50 billion in tax breaks from 2018 through 2021 under a Trump tax law provision that many lawmakers now want to extend. Corporate lobbyists are even asking Congress to extend this “accelerated depreciation” tax break as part of a possible year-end tax bill.

How the Inflation Reduction Act’s Tax Reforms Can Help Close the Racial Wealth Gap

September 20, 2022 • By Brakeyshia Samms, Joe Hughes

Lawmakers have many opportunities to pass reforms that will make our tax code fairer and further reduce racial inequity in our economy. The Inflation Reduction Act is a great step forward; better taxing wealth and income from wealth and expanding targeted refundable tax credits would build on this progress.

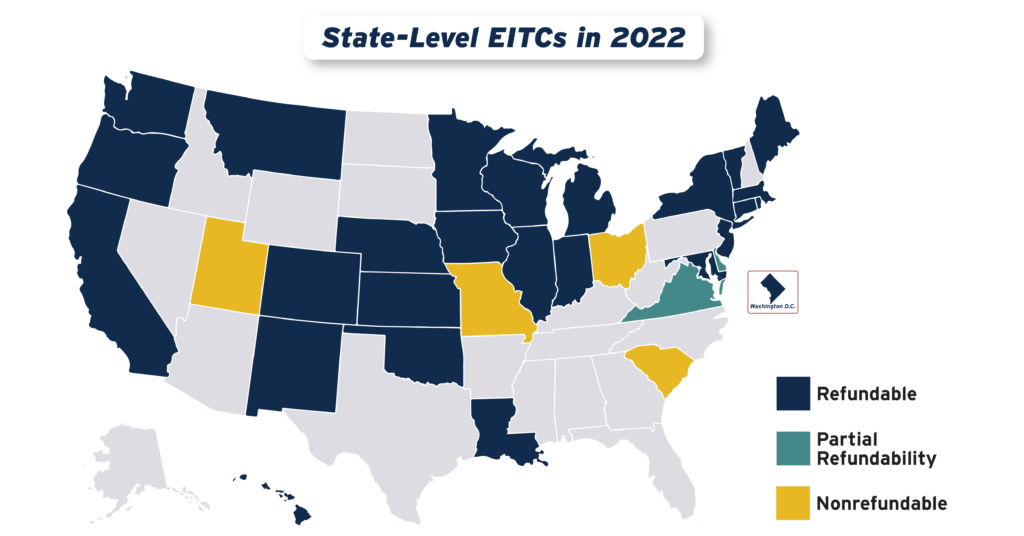

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

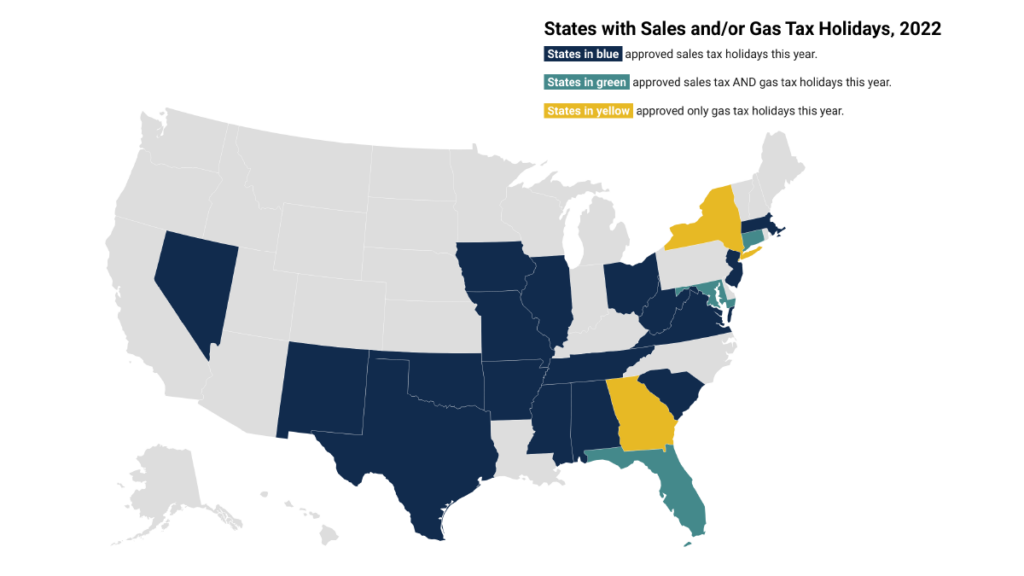

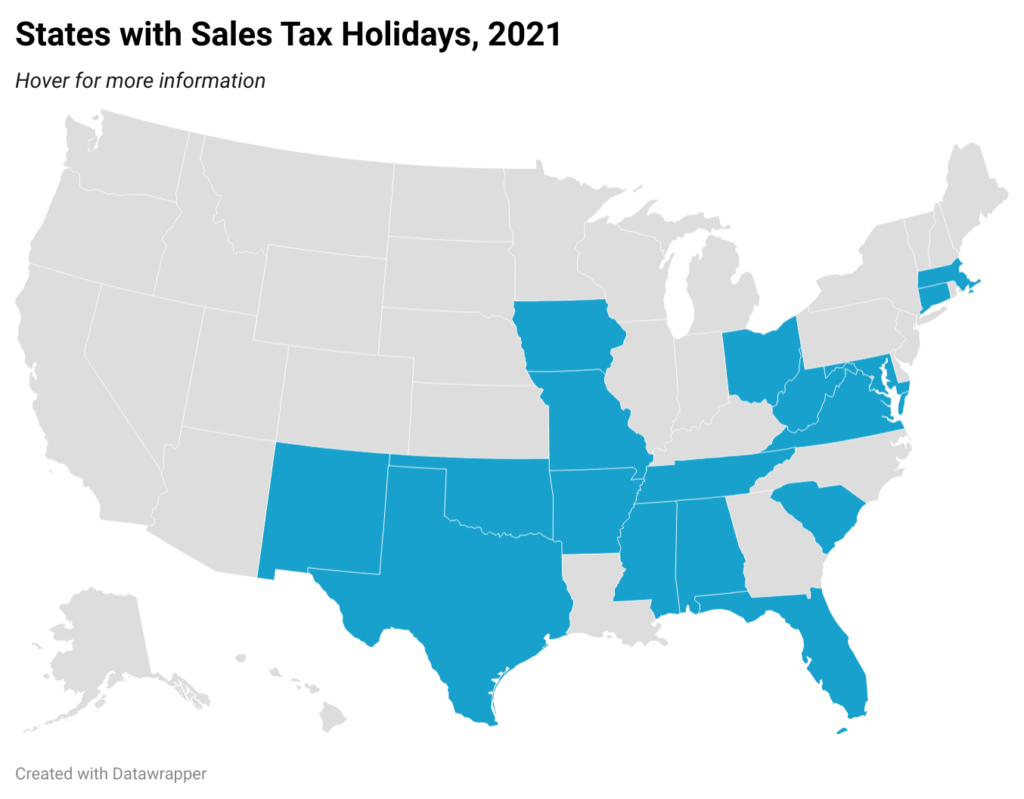

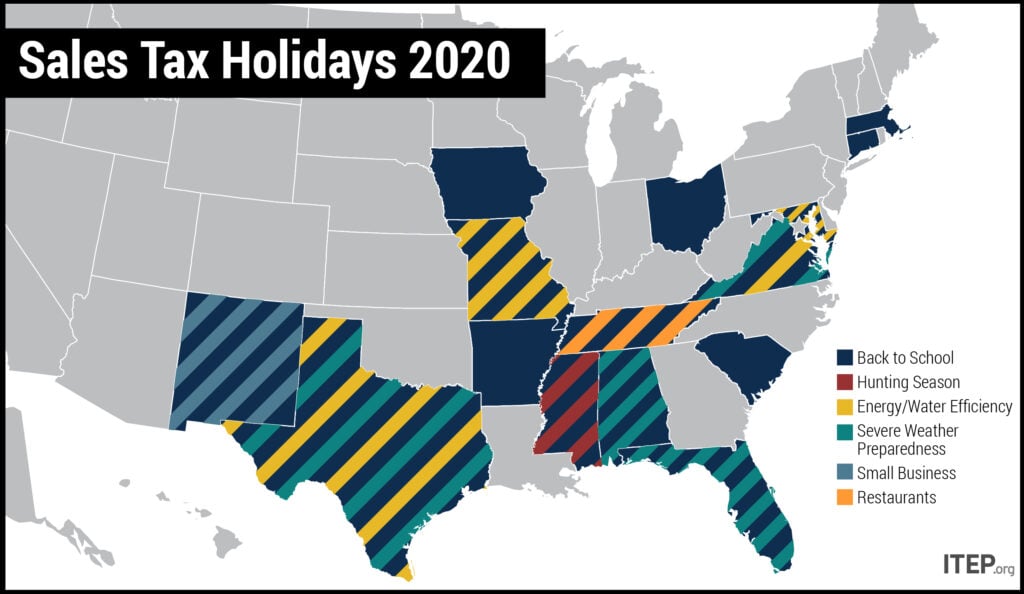

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

President Biden’s American Families Plan (AFP) would use personal income tax increases on very well-off individuals to finance investments in people—in childcare, education, higher education, reducing child poverty, and other related measures. The following analyses provide more information about the revenue proposals in the AFP.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

Investment Income and Racial Inequality

October 14, 2021 • By Emma Sifre, ITEP Staff, Joe Hughes

Congress has a historic opportunity to fix the way the preferential treatment of investment income widens the racial wealth gap and to strive toward a racially equitable tax code.

The One Thing Missing From the Qualified Business Income Deduction Conversation: Racial Equity

August 25, 2021 • By Marco Guzman

When crafting tax policy, lawmakers and bill authors often work backward, using a patchwork of changes to help achieve their stated goal. One important consideration that is routinely left out is what impact the change will have on racial equity. Such is the case with the qualified business income deduction, which is helping to further enrich wealthy business owners, the overwhelming majority of whom are white. At present, white Americans own 88 percent of private business wealth despite making up only 60 percent of the population. Meanwhile, Black and Hispanic families confronting much higher barriers to entrepreneurship each own less…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

ITIN Filer Data Gap: How Changing Laws, Lack of Data Disaggregation Limit Inclusive Tax Policy

June 17, 2021 • By Emma Sifre

Like U.S. citizens, noncitizens who live, work, or invest in the United States must file local, state and federal taxes. But in order to file personal income taxes, they must first be issued a processing number called an Individual Taxpayer Identification Number (ITIN) by the IRS. These numbers are issued to both legal permanent residents and nonresidents who are not eligible for Social Security numbers. ITINs do not imply immigration status, nor can they be used for immigration enforcement purposes, but they can be used to create burdensome barriers that make it difficult for ITIN holders to file taxes and…

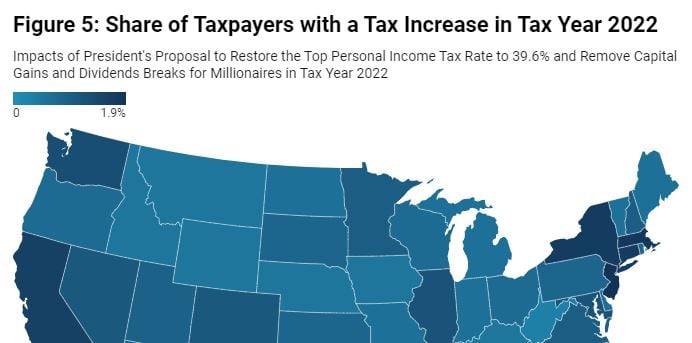

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

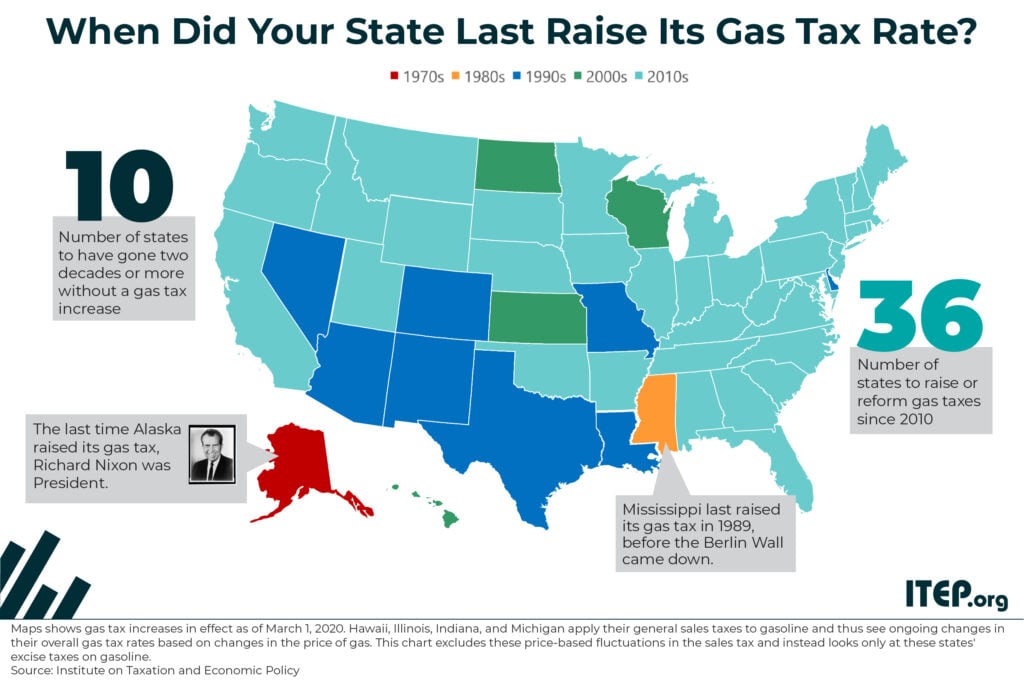

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

ANALYSIS: Cash and Tax Provisions in Biden’s Economic Recovery Plan

January 15, 2021 • By Steve Wamhoff

The $1.9 trillion economic recovery plan, known as the American Rescue Plan, announced by President-elect Biden contains, among other provisions, expanded cash payments and changes to the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC).

State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms

September 25, 2020 • By Marco Guzman

The federal tax system and every state treat income from capital gains more favorably than income from work. Preferential capital gains tax treatment includes exclusions and seldom-discussed provisions like deferral and stepped-up basis, as well as more direct tax subsidies for profits realized from local investments and, in some instances, from investments around the world. This policy brief explains state capital gains taxation, examines the flaws in state capital gains tax breaks, and proposes reform options that will help make state tax systems more progressive and more equitable.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

Racial justice requires tax justice. Economic justice requires tax justice. Climate and health justice require, yes, tax justice.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

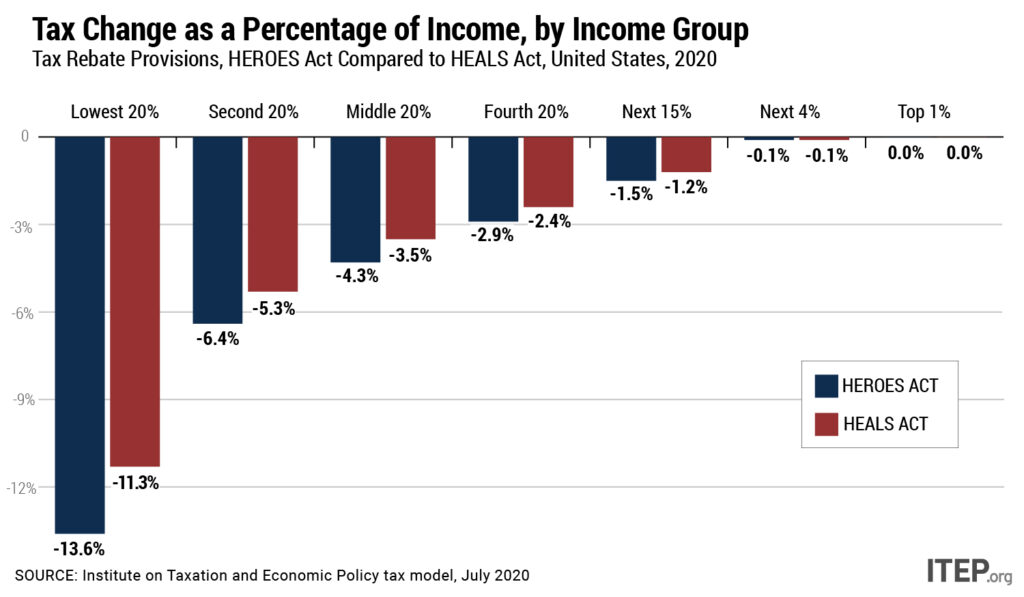

New Analysis Compares HEROES Act and HEALS Act, Disaggregates Data by Race and Income

July 28, 2020 • By ITEP Staff, Jessica Schieder, Meg Wiehe, Steve Wamhoff

The Health, Economic Assistance, Liability Protection and Schools (HEALS) Act released by Senate Republicans Monday includes a tax rebate that is slightly more generous than the one provided under the March CARES Act, but fails to correct most of the earlier act’s problems. House Democrats addressed these shortcomings in the May HEROES Act, a better starting place for negotiations over the next round of COVID-19 relief. ITEP has analyzed both acts to provide a detailed comparison of how the tax rebate provisions would affect families across the income spectrum and by race. Both measures would provide cash payments to a…

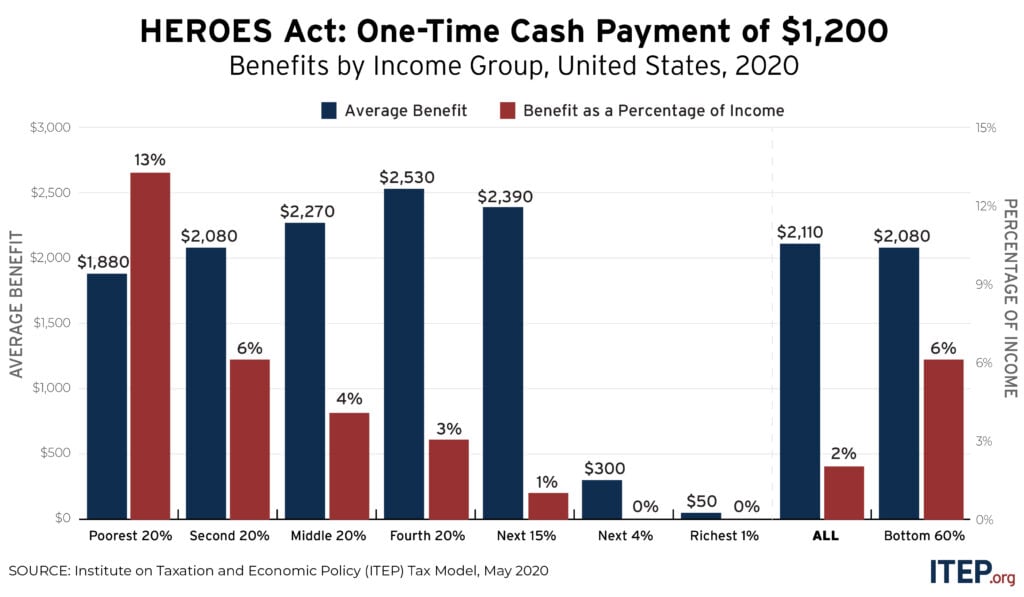

Major Cash Payment and Tax Provisions in the HEROES Act

May 15, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The major provisions for cash payments and tax changes in the House Democrats’ Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act would provide nearly $600 billion to individuals and households and average benefits of more than $3,000 to families in all but the highest income levels.