Reports

Harris-Sanders-Markey Cash Payment Proposal Would Dwarf Checks Sent Under the CARES Act

May 8, 2020 • By Steve Wamhoff

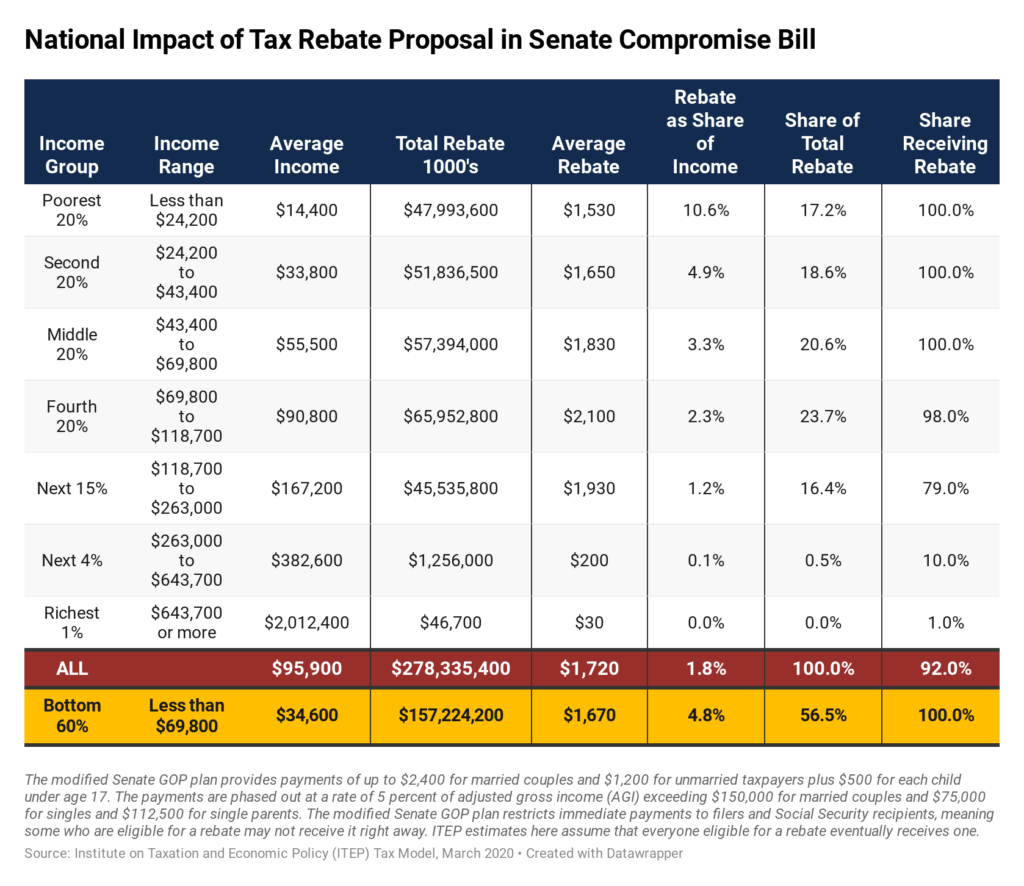

Sens. Kamala Harris, Bernie Sanders and Edward Markey released a proposal to provide a monthly payment of $2,000 for each member of a household (including up to three dependents), with benefits phased out at income levels starting at $200,000 for married couples. The proposal is partly a response to concerns that one-time cash payments under the CARES Act, which amount to $1,200 ($2,400 for married couples) and $500 for each child under age 17, are not sufficient to help families make ends meet or boost the economy.

State Options to Shore up Revenues and Improve Tax Codes amid Pandemic

April 15, 2020 • By Dylan Grundman O'Neill, Meg Wiehe

The COVID-19 pandemic is an extraordinarily challenging time, as we see harm and struggle affecting the vast majority of our families, businesses, public services, and economic sectors. No one will be unaffected by the crisis, and everyone has a stake in the recovery and faces tough decisions. In the world of state fiscal policy, where revenue shortfalls are likely to be far bigger than can be filled by the initial $150 billion in federal aid or absorbed through funding cuts without causing major harm, tax increases must be among those decisions. Even with more federal support, states will need home-grown…

Data available for download Congress passed and the president signed a $2 trillion plan that includes $150 billion in fiscal aid to states, $150 billion in health care spending, large expansions of unemployment compensation and more. These measures are clearly needed as the economy teeters on the brink. Though the bill improves on flaws in […]

President Trump has proposed to eliminate payroll taxes that fund Social Security and Medicare through the end of the year. ITEP estimates that this would cost $843 billion and 65 percent of the benefits would go to the richest 20 percent of taxpayers, as illustrated in the table below.

Expanding State EITCs: Age Enhancements and a Credit Increase for Workers without Children in the Home

February 18, 2020 • By Aidan Davis

For 45 years, the federal Earned Income Tax Credit (EITC) has benefited low- and moderate-income workers. Yet, throughout its history, the EITC has provided little or no benefit to workers without children in the home—a group that includes noncustodial parents whose children live the majority of the year with another parent.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

Mayor Pete Buttigieg's proposal An Economic Agenda for American Families: Empowering Working and Middle Class Americans to Thrive would expand the Earned Income Tax Credit (EITC) as modeled by the Working Families Tax Relief Act.

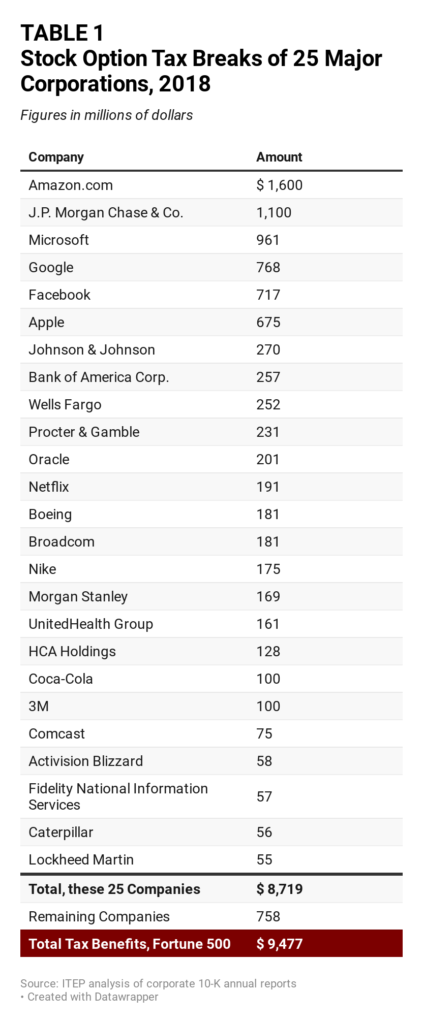

Corporate Tax Avoidance in the First Year of the Trump Tax Law

December 16, 2019 • By ITEP Staff, Lorena Roque, Matthew Gardner, Steve Wamhoff

Profitable Fortune 500 companies avoided $73.9 billion in taxes under the first year of the Trump-GOP tax law. The study includes financial filings by 379 Fortune 500 companies that were profitable in 2018; it excludes companies that reported a loss.

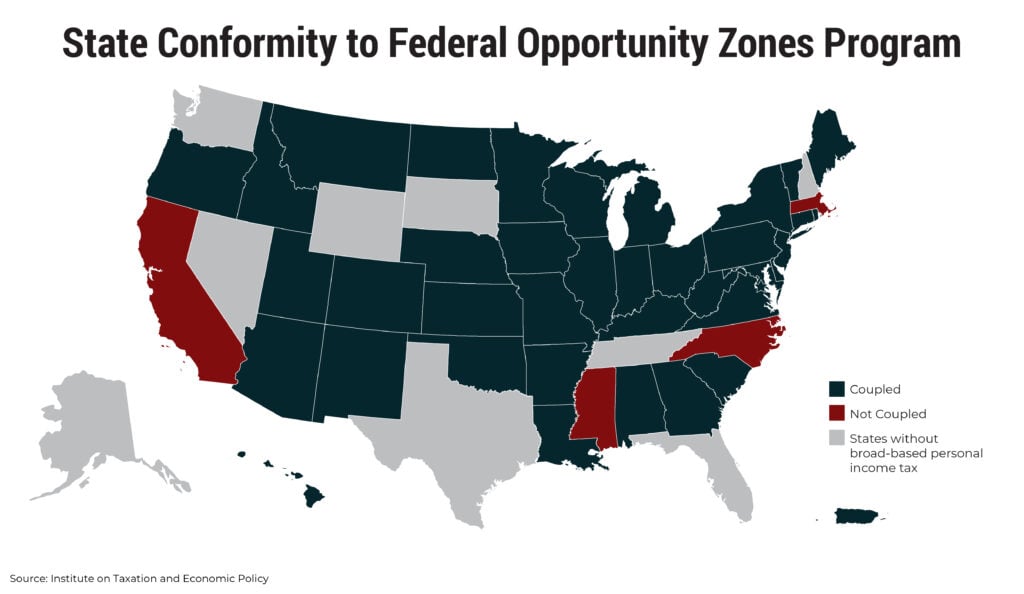

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

Understanding the full tax consequences of cannabis legalization requires evaluating not only the excise taxes proposed in most legalization bills, but also the effects on the federal income tax liability of cannabis businesses.

Benefits of a Financial Transaction Tax

October 28, 2019 • By Jessica Schieder, Lorena Roque, Steve Wamhoff

A financial transaction tax (FTT) has the potential to curb inequality, reduce market inefficiencies, and raise hundreds of billions of dollars in revenue over the next decade. Presidential candidates have proposed using an FTT to fund expanding Medicare, education, child care, and investments in children’s health. Any of these public investments would be progressive, narrowing resource gaps between the most vulnerable families and the most fortunate.

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

The Working Families First Credit proposal would increase the CTC from $2,000 to $3,000 and remove the limits on refundability that prevent many lower-income families from receiving the entire credit and expand the EITC by increasing the rate at which earnings are credited and it would provide a larger increase for childless workers. View the distributional analysis.

Promoting Greater Economic Security Through A Chicago Earned Income Tax Credit: Analyses of Six Policy Design Options

September 12, 2019 • By Lisa Christensen Gee

A new report reveals that a city-level, Chicago Earned Income Tax Credit would boost the economic security of 546,000 to 1 million of the city’s working families. ITEP produced a cost and distributional analysis of six EITC policy designs, which outlines the average after-tax income boost for families at varying income levels. The most generous policy option would increase after-tax income for more than 1 million working families with an average benefit, depending on income, ranging from $898 to $1,426 per year.

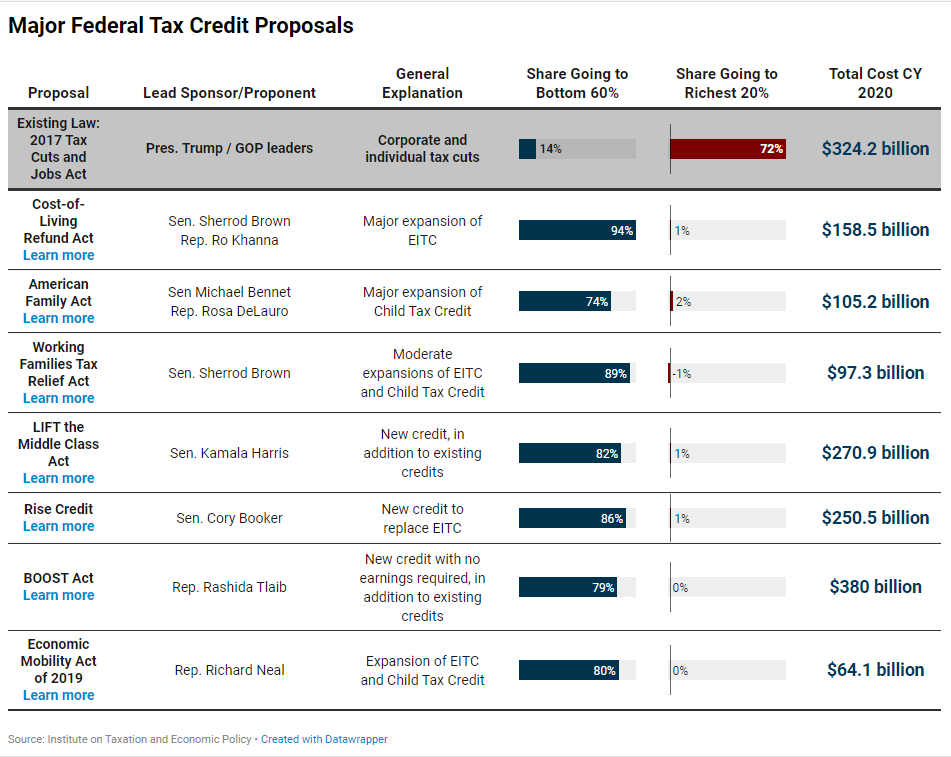

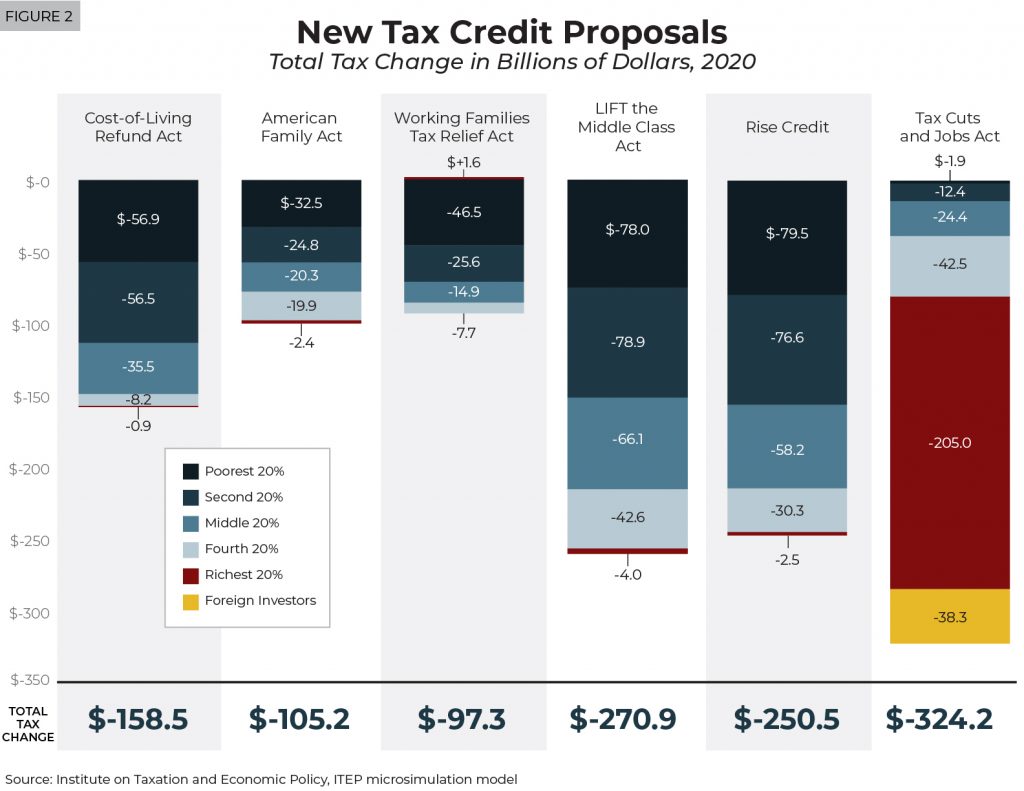

In 2019, several federal lawmakers have introduced tax credit proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all build off the success of the EITC and CTC and target their benefits to families in the bottom 60 percent of the income distribution who have an annual household income of $70,000 or less.

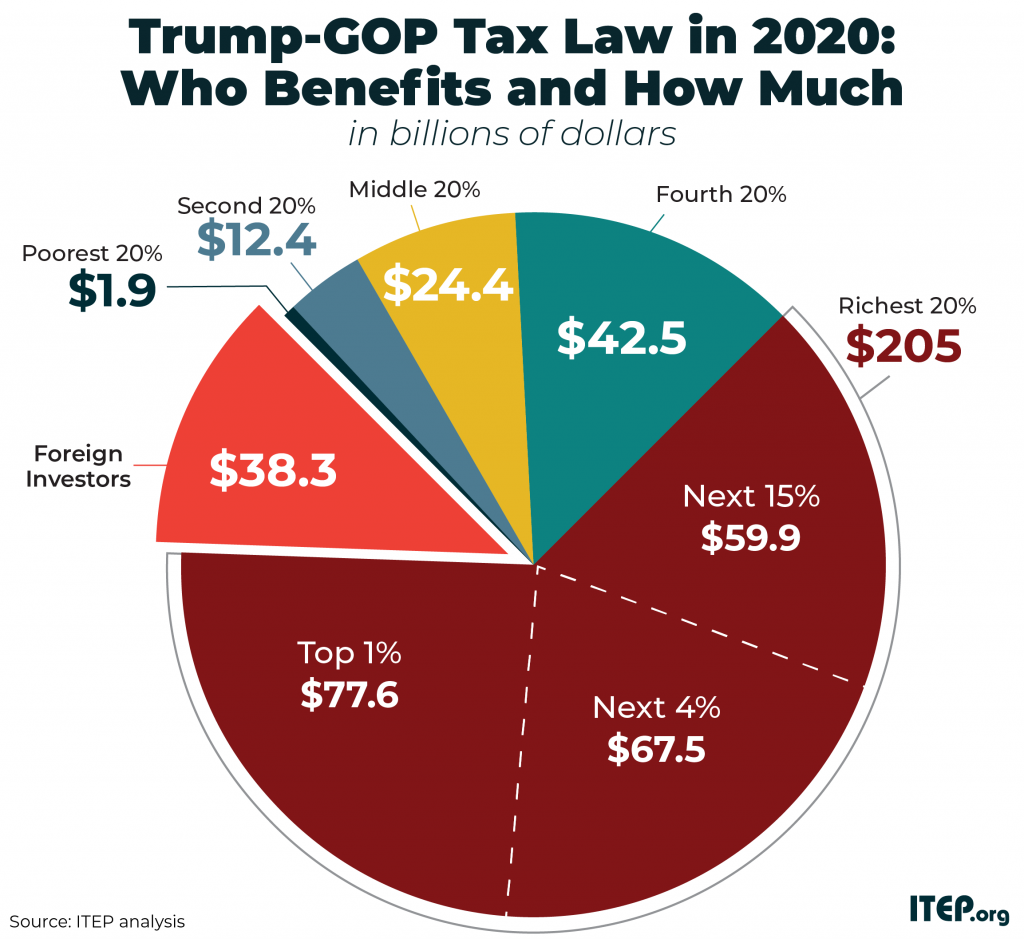

The Tax Cuts and Jobs Act (TCJA), signed into law by President Trump at the end of 2017, includes provisions that dramatically cut taxes and provisions that offset a fraction of the revenue loss by eliminating or limiting certain tax breaks. This page includes estimates of TCJA’s impacts in 2020.

In December 2017, federal lawmakers hastily enacted the Tax Cuts and Jobs Act. So rushed was its passage that provisions of the legislative text were scrawled in the margins. Scroll through this timeline for an in-depth look at the Tax Cuts and Jobs Act and the impact since its passage.

The BOOST Act would provide a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be in addition to existing tax credits. Income limits would prevent well-off households from receiving the credit. Unlike other refundable tax credit proposals, the BOOST Act would not be limited to people with earnings or people with children.

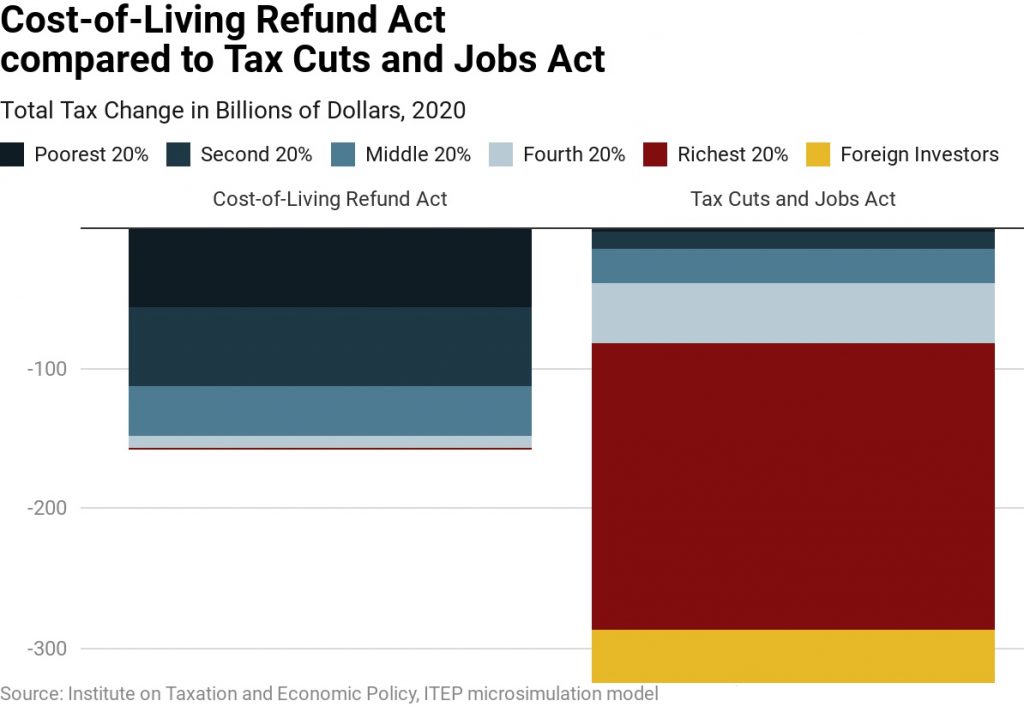

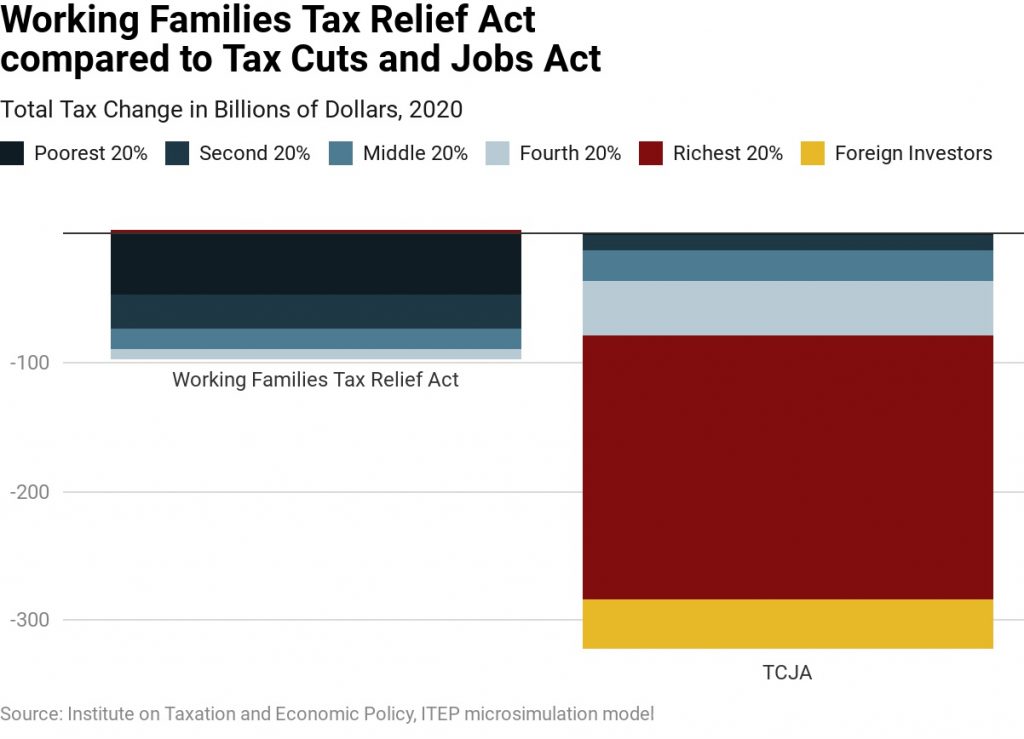

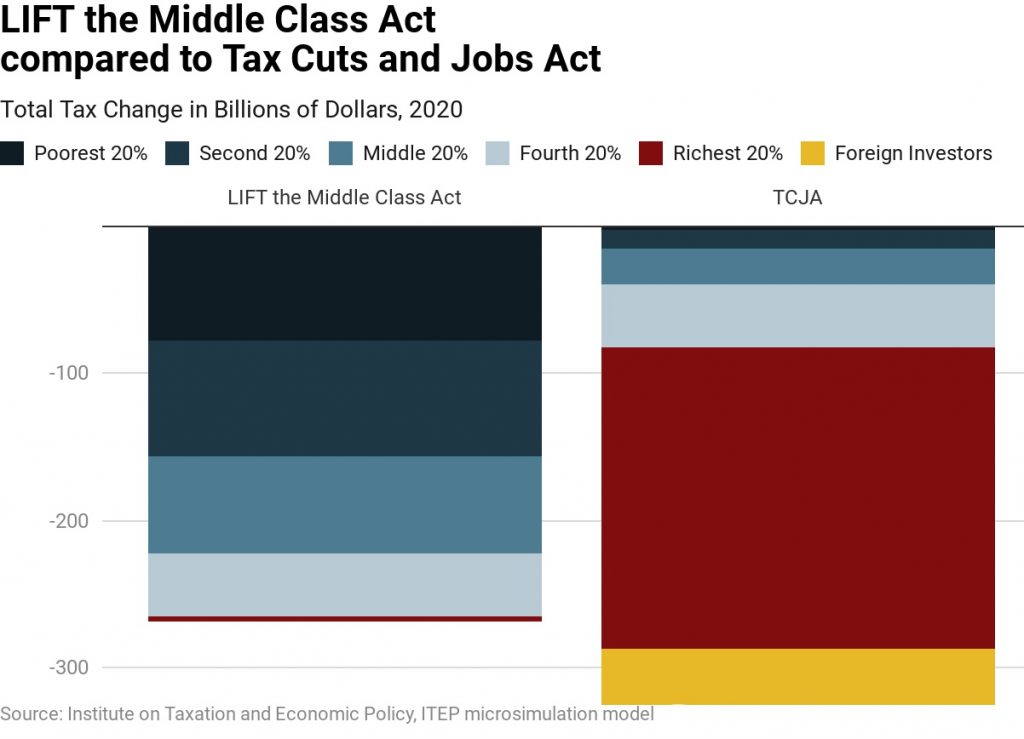

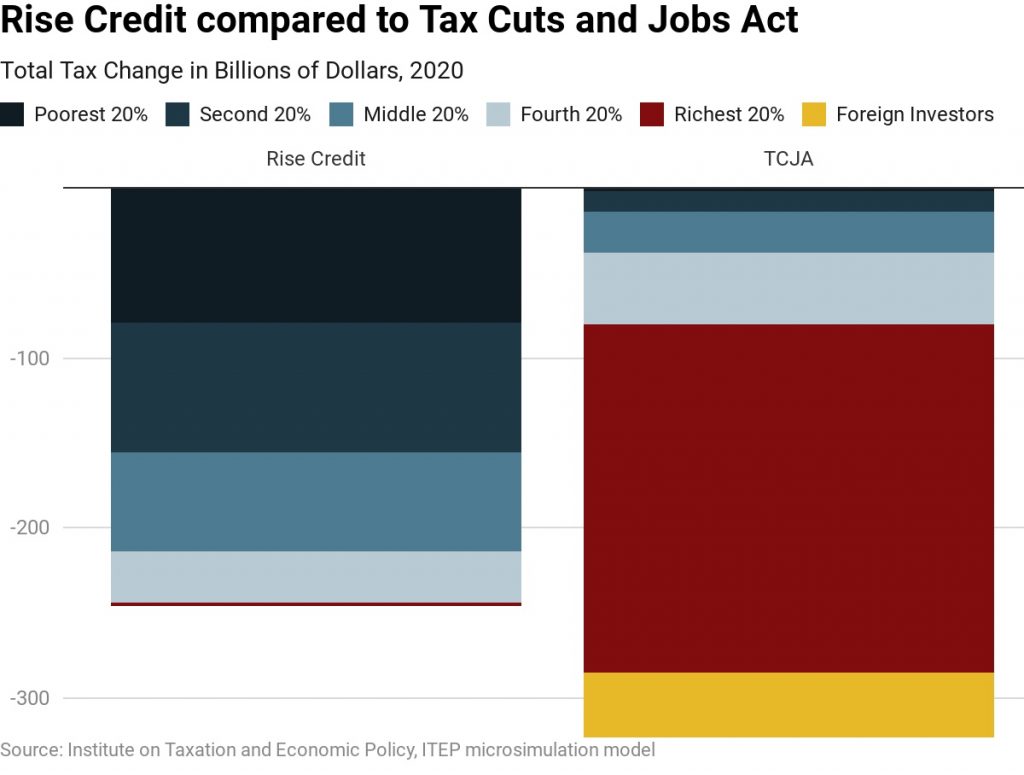

Federal lawmakers have recently announced at least five proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all would primarily benefit taxpayers who received only a small share of benefits from the Tax Cuts and Jobs Act.

The Cost-of-Living Refund Act would expand the Earned Income Tax Credit (EITC) for low- and moderate-income working people. The maximum EITC would nearly double for working families with children. Working people without children would receive an EITC that is nearly six times the size of the small EITC that they are allowed under current law.

The American Family Act would expand the Child Tax Credit (CTC) for low- and middle-income families. The CTC would increase from $2,000 under current law to $3,000 for each child age six and older and to $3,600 for each child younger than age six. The proposal removes limits on the refundable part of the credit so that low- and moderate-income families with children could receive the entire credit.

The Working Families Tax Relief Act would expand the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for low- and middle-income families.

The LIFT (Livable Incomes for Families Today) the Middle Class Act would create a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be an addition to existing tax credits. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less. Income limits would prevent well-off households from receiving the credit.

The Rise Credit would replace the existing EITC. In most cases, the Rise Credit would be $4,000 for single people and $8,000 for married couples. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less.