Tax Reform Options and Challenges

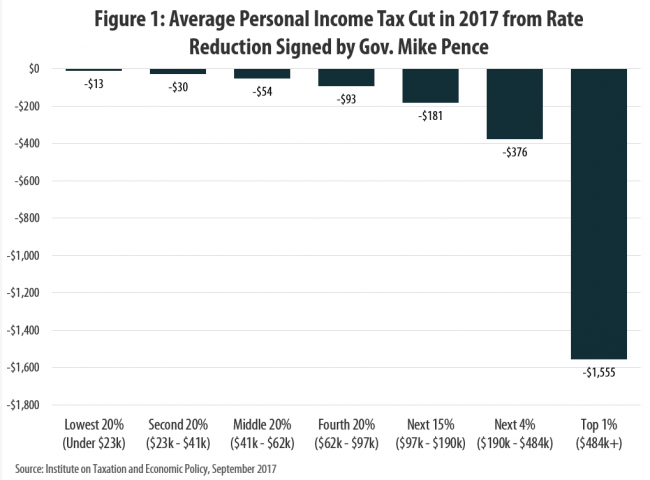

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

Trump Proposals Would Reduce the Share of Taxes Paid by the Richest 1%, Raise It for Everyone Else

September 13, 2017 • By Steve Wamhoff

The tax proposals released by the Trump Administration in April would reduce the share of total federal, state and local taxes paid by America’s richest 1 percent while increasing the share paid by all other income groups. This clearly indicates that the tax system would be less progressive under the president’s approach.

Arkansas Advocates for Children and Families: The Trump Tax Plan: What Would It Mean for Arkansas?

September 5, 2017

Who benefits and who loses under the Trump tax plan? An analysis by the Institute on Taxation and Economic Policy (ITEP) estimates that Arkansas would fare worse under the plan compared to other states. Relative to our share of the U.S. population, we would be one of the 12 states receiving the lowest share of the total Trump tax cut.

New Mexico Voices for Children: The Trump Tax Plan Isn’t ‘Reform.’ Here’s Why:

September 1, 2017

In April the Trump administration released a sketchy outline of their half-baked ideas for tax changes. An analysis by the Washington, D.C.-based Institute for Taxation and Economic Policy (ITEP) of that back-of-the-envelope ‘plan’ found that nearly half (48 percent) of Trump’s proposed tax cuts would go to millionaires. Millionaires make up only 0.5 percent of the U.S. population.

Trump (Sort of) Used Our Data on Corporate Tax Avoidance, But He Missed the Point

August 31, 2017 • By Matthew Gardner

On Wednesday, reporters waiting to write about President Trump’s much-ballyhooed tax reform speech in Missouri received a fact sheet from the White House informing them that, “Fortune 500 corporations are holding more than $2.6 trillion in profits offshore to avoid $767 billion in Federal taxes, according to the Institute on Taxation and Economic Policy.”

New Mexico Voices for Children: Trump Tax Plan Does Little for NM’s Middle Class

August 31, 2017

Average New Mexicans would not benefit much from President Trump’s tax reform proposal, which would give the biggest tax breaks to New Mexico’s millionaires. That’s according to a report released recently by the Institute on Taxation and Economic Policy (ITEP).

Maryland Center on Economic Policy: Trump Tax Framework Would Give Away Trillions in Tax Breaks to Millionaires

August 24, 2017

The Trump administration and congressional leaders are gearing up to overhaul the federal tax code this fall. While many of the details remain fuzzy, one thing is clear: the administration’s top priority is to hand out big tax breaks to millionaires.

GOP Leaders Tout Corporate Tax Cuts at Boeing and AT&T, Companies that Already Have Single-Digit Tax Rates

August 23, 2017 • By Matthew Gardner

House Speaker Paul Ryan plans to visit a Boeing factory in Washington State tomorrow to promote the GOP’s ideas for tax reform, which include a deep cut in the corporate tax rate, while House Ways and Means Chairman Kevin Brady is bringing the same message today to employees of AT&T in Dallas. What is unclear is how much lower taxes for these companies can possibly go.

Maine Center for Economic Policy: Maine Millionaires Primary Recipients of Proposed Trump Tax Breaks

August 17, 2017

New analysis from the Institute on Taxation and Economic Policy (ITEP) shows Maine’s millionaires would get an average tax cut of $135,220 under President Trump’s proposed tax plan. Maine millionaires represent only 0.3 percent of all Maine households, yet would receive more than a quarter of all tax breaks.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

Art Laffer and Stephen Moore’s Misleading Case for the Trump Tax Cuts

July 28, 2017 • By Nick Buffie

Art Laffer and Stephen Moore recently penned an op-ed in the Wall Street Journal in which they called on state and local policymakers to support the Trump tax cuts. They claimed that the Trump plan would provide a significant boost to state and local tax revenues, thereby allowing states with large budget deficits to “regain fiscal health.” State and local lawmakers should not be fooled by these claims. The reality is that Trump’s tax cuts are more likely to worsen state and local fiscal health than improve it.

GOP Leaders in Congress and the White House Set Out Goals for Tax Reform that Their Plans Fail to Meet

July 27, 2017 • By Alan Essig

Today Republican leaders in Congress and officials from the White House released a joint statement on tax reform, claiming that “the single most important action we can take to grow our economy and help the middle class get ahead is to fix our broken tax code for families, small business, and American job creators competing at home and around the globe.” Unfortunately, the proposals they have put forward so far do not address any such goals.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

Florida Policy Institute: The Growing Divide: Federal Tax Plan Would Give Massive Tax Cuts to Wealthy Floridians as the Poorest Americans Continue to Struggle

July 21, 2017

The federal tax plan broadly outlined by the current administration would do very little to create opportunities for Floridians struggling to make ends meet. Instead, the tax plan would provide massive tax cuts for Florida’s highest income earners, accordingly to a recent report by the Institute on Taxation and Economic Policy (ITEP). Broadly outlined, the plan is likely to make an already unfair tax system that favors the wealthy even worse.

New Jersey Policy Perspectives: Trump Tax Plan: A Boon for the Wealthiest New Jerseyans

July 21, 2017

A federal tax package based on President Trump’s April outline would fail to deliver on its promise of mostly helping the middle class, instead showering most of its help to the richest 1 percent, according to a new 50-state analysis from the Institute on Taxation and Economic Policy released today.

Hope Policy Institute: Mississippi’s Wealthiest Get the Most Benefit under New Federal Tax Cut Proposal

July 21, 2017

New research from the Institute on Taxation and Economic Policy (ITEP) looks at the potential effects of a tax cut proposal from the Trump Administration on families in the 50 states. The tax cut proposal would reduce the tax rate on corporate income from 35 percent to 15 percent, would repeal the estate tax, replace the current income tax brackets with three brackets at 10 percent, 25 percent, and 35 percent, eliminate most itemized deductions, except charitable giving and home mortgage interest, and create a new tax credit for childcare expenses, among other things.

Kentucky Center for Economic Policy: Trump Tax Plan Would Be a Windfall for Only the Wealthiest Kentuckians

July 21, 2017

The wealthiest Kentuckians would be winners from the $4.8 trillion in federal tax cuts President Donald Trump has proposed, as shown by a new report from the Institute on Taxation and Economic Policy (ITEP). But as a poor state the tax cuts — coupled as they are with huge federal budget cuts to programs and […]

West Virginia Center on Budget & Policy: New Report Shows Trump Tax Plan Benefits Wealthy, Fails to Help Middle Class

July 20, 2017

A new analysis from the Institute on Taxation and Economic Policy reveals a federal tax reform plan based on President Trump’s April outline would fail to deliver on its promise of largely helping middle-class taxpayers, showering 61.4 percent of the total tax cut on the richest 1 percent nationwide. In West Virginia, the top 1 percent of the state’s residents would receive an average tax cut of $51,600 compared with an average tax cut of $720 for the bottom 60 percent of taxpayers in the state.

Economic Progress Institute: Trump Tax Plan Would Mostly Benefit Wealthiest Rhode Island Taxpayers

July 20, 2017

A new analysis from the Institute on Taxation and Economic Policy reveals a federal tax reform plan based on President Trump’s April outline would fail to deliver on its promise of largely helping middle-class taxpayers, showering 61.4 percent of the total tax cut on the richest 1 percent nationwide. In Rhode Island, the top 1 percent of the state’s residents would receive an average tax cut of $86,610 compared with an average tax cut of just $430 for the bottom 60 percent of taxpayers in the state.

Maine Center for Economic Policy: Trump Tax Plan Would Give Richest Maine Taxpayers an Average $53,000 Tax Cut and Trigger Deep Cuts to Federal Dollars for Maine

July 20, 2017

A new analysis from the Institute on Taxation and Economic Policy reveals a federal tax reform plan based on President Trump’s April outline would fail to deliver on its promise of helping middle-class taxpayers, showering three out of every five dollars of the total tax cut on the richest 1 percent nationwide. In Maine, the top 1 percent of the state’s residents would receive an average tax cut of $53,000 compared with an average tax cut of $400 for the bottom 60 percent of taxpayers in the state.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

This letter outlines ITEP’s two broad objectives for meaningful federal tax reform and discusses six recommendations that would achieve them.

What do terrorists, opioid and human traffickers, corrupt government officials and tax evaders have in common? They all depend on the secrecy provided by anonymous shell corporations to allow them to finance and profit from their crimes. Momentum is building in the House and Senate to pass legislation that would strike against illicit finance in the United States and around the world by bringing an end to the anonymity provided by U.S. incorporation.

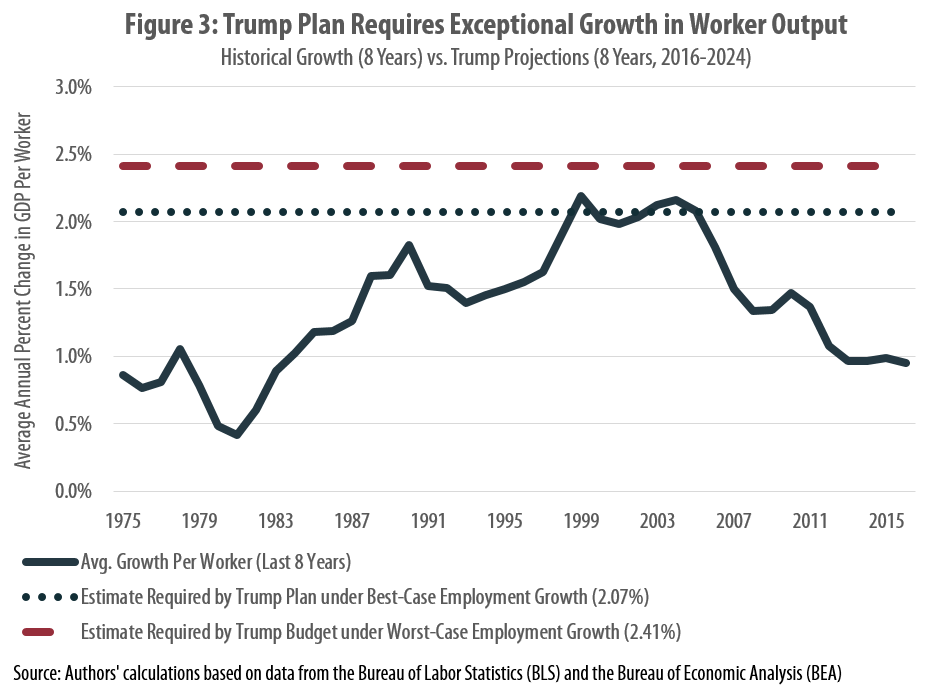

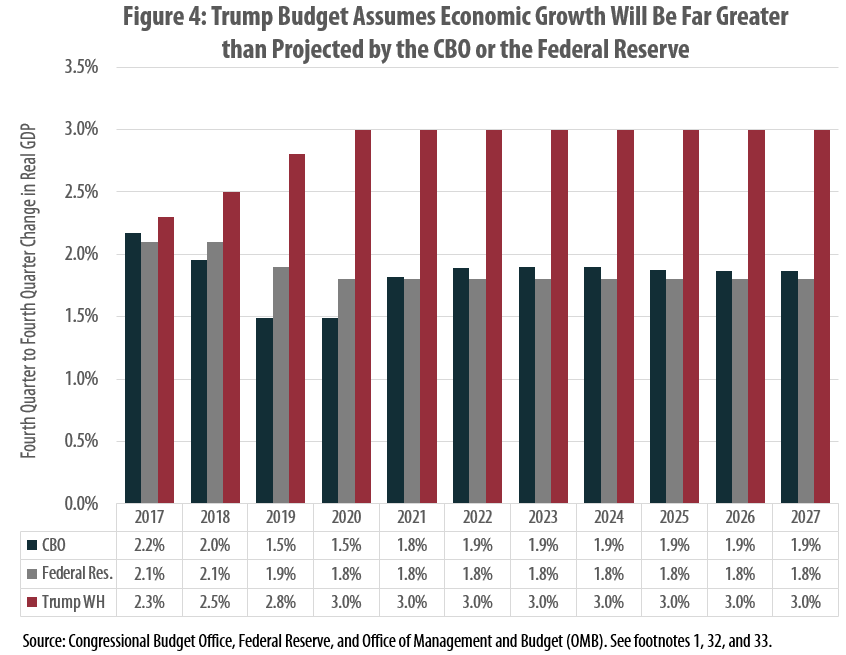

Trump Budget Uses Unrealistic Economic Forecast to Tee Up Tax Cuts

June 29, 2017 • By Carl Davis

The Trump Administration recently released its proposed budget for Fiscal Year 2018. The administration claims that its proposals would reduce the deficit in nearly every year over the next decade before eventually achieving a balanced budget in 2027, but the assumptions it uses to reach this conclusion are deeply flawed. This report explains these flaws and their consequences for the debate over major federal tax changes.

The GOP Health Plan Cuts Medicaid to Lower Taxes for the Richest 3 Percent

June 16, 2017 • By Alan Essig

The bill passed by the House of Representatives last month to repeal the Affordable Care Act (ACA) is the most unpopular legislation in decades. Lawmakers should reverse course and take the necessary time to put together legislation that would preserve or, better yet, improve access to health care. But this isn’t likely to happen because at its core, the American Health Care Act isn’t truly health care reform. It is tax cuts that disproportionately benefit the rich shrouded in legislative provisions that would weaken the existing health care law.

In addition to distributional analyses of existing and proposed tax law, ITEP provides policy recommendations for lawmakers to build a more equitable tax code, from progressive revenue-raising options to corporate tax reform to establishing a model for a wealth tax.